Define the following Trading terminologies;

- BUY STOP

When it comes to the buy stop,They are usually the orders we set whenever the market moves up.And our desire of financial investment after affecting it will still carry on it up trend,and this will make us gain.With the buy stop we must always used in purchasing but can’t be used in selling.

With the buy stop it is already made automatic to perform a task and has been set in the exchange to find out the right time we can put the market as stated by our examining.

- SELL STOP

When it comes to the sell stop,It is usually a type of awaiting order,Which the trader set an order to sell an assest at a very cheap price than the new price,Occasionally alike to the buy stop.In most of the time is purposely used to place a loss maximum on an sure purchase.

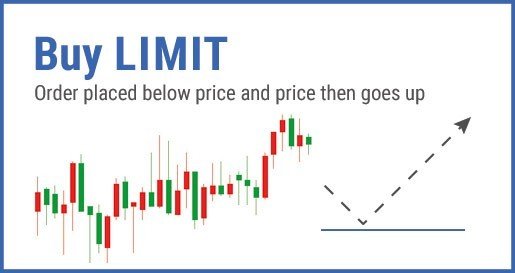

- BUY LIMIT

When it comes to the buy limit,It is usually the storyline when a seller place a price an assest where he will be ready to sell in a specific time.With the buy limit a traders cannot sell the assest above the original limit set already.Whenever a trader place a sure limit to herself,Up to the price moves to it limit the sell place in the order will not be carry out.Formerly when the price is all right with the limit of sellers the will be able to carry out.

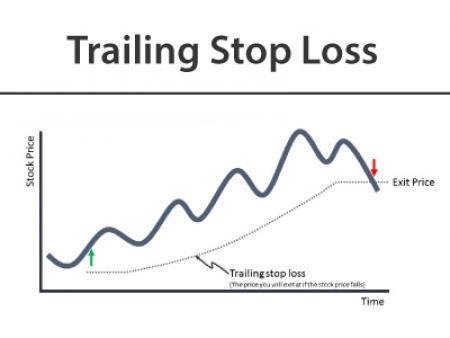

- TRAILING STOP LOSS

When it comes to the trailing stop loss,It is usually a type of order whereby a trader set an order of a sure proportion which makes it dissimilar from the new price on market.Traders are very protected when trading on the trailing stop loss.It is very superior over a systematic stop loss.Whenever the price goes in your liking but later turns,Your stop loss will come after the liking price change,Making it goes in a different direction.

- MARGIN CALL

When it comes to the margin call,It is usually a warning that the brokers gives to all it traders to make sure they top up their account.In most cases the investor may have their usual amount in their account,But because of lessen prices of the assest,this will cause low money they can use for trading.

With the margin call is it purposely for investors or traders to put down much money into their account.Usually when a trader gets a margin call it simply means he or she need to deposit to top up the account.

Practically demonstrate your understanding of Risk management in Trading.

RISK MANAGEMENT.

Is simply another way to acknowledge and take control of the risks of loosing your assests which may or can occur in trading market.Usually traders or investors bring in risk management to help them mange their loss and profit.Risk management is not purposely used in preventing all risk management of loosing assests but rather use to reduce the risk of loosing.Once a traders insist of making profit he or she must take the advantage to manage the risks or reward ratio of their assests.

In most time traders loses their assest because of carelessness to set a stop loss.Every trader is recommended to place a stop loss and pull a profit with a caution assessment.

- Setting a plan

Whenever a trade is plan,It will help examine if the negotiator is satisfy for a recurrent trades.

- stop loss

Placing a stop loss in a monetary investment in trading is really helping traders to run and direct their endanger in their trading.It is also their way out master plan usually used by traders to choose out a trade moves in opposition to their order.

- using a percentage rule

This is also another useful skill used by investors or traders to control their finance.This is usually built on the individual outlook on their endanger.

- using the risk per day

This is also another useful skill used by traders.It is usually the total endanger an investor or trader is always prepared to pull in some of the trade every day.

Demonstration of Risk management Using Moving Averages Trading strategy

I would like to talk a little of moving average before I get to the main question on board.

MOVING AVERAGE:Is one of the popular and successful indicator purposely used in monetary trading to check the trend of an assest

,That is being a bullish or bearish trend.Its another function is that they are also used for controlling risk management.

Now let’s get to the main question.

You first need to click on this link to launch your trading view.

After your trading view is launch,You will then look at the top left corner to locate your setting icon.I will be showing screenshot below.

After locating your setting icon,You then click on it,to locate your chart.I will be showing screenshot below

After clicking on it my chart was successfully launched.I will be showing screenshot

I will look at the top of my chart to locate my Fx(indicator and strategies).I will be showing screenshot below

After clicking on the Fx,I searched for moving average in the search box.I will be showing screenshot

After clicking on the moving average,It was successful added to my chart.I will be showing screenshot below.

After it was added to my chart,I decided to change the length to 200.

To perform this,You need to tap on the moving average on the chart,A pop up menu will appear and click on the setting icon.After putting your own length.I put 200 and I click ok to add to your chart.i will be showing screenshot below

I also decided to add another indicator called the exponential moving average.

I also used the same procedure for applying my moving average.

So I locate my fx on top of my chart and I click on it.

After clicking on the Fx, I then search for exponential moving average in the search box.I will be showing screenshot below.

After clicking on it,It was successfully added to my chart.I will be showing screenshot below

In the exponential moving average I also changed the length to 200.

To perform this,You need to tap on the exponential moving average on the chart,A pop up menu will appear and click on the setting icon.After putting your own length.I put 200 and I click ok to add to your chart.i will be showing screenshot below

Now we have the two indicators successfully added to my chart.We have the yellow color to be the exponential moving average and white color to be the moving average.I will be showing screenshot

From the screenshot above you all can see the exponential moving average and the moving average.The two indicators was able to join together.When ever the two moving average crosses there is a chance of making profit.Moving average can also help a trader to gain profit from the trading,This making it as one of the skillful uses of the risk management.

CONCLUSION

I would like to thank prof @yohan2on once again for such a wonderful lesson,I have really learn a lot about this trading especially the risk management,Since I would start trading soon I have been able to get more ideas about trading,So I who know what to do next if I want to start my trading,Indeed it a great lesson.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

I found trouble understanding your work. Too many typing errors and Trading terminologies were not clearly defined. You have to do more research to clearly understand the concepts so that you gain confidence to explain Risk management in a clear and much better way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit