Spot Trading

The spot trading is usually the easiest and simplest type of trading where new users or beginners can take part in without any challenges,When we talk about the spot trading it is a type of trading where by a user is capable of keeping his or her assest by a method of purchasing at a very low cost,Usually the owner of the assest keeps on waiting for their assest to rise in price and they sell at a very good rate than the normal price they bought their assest in order to gain a lot of profit which we term a spot price.In most time we have this type of trade to be risk-free as compared to the other types of trading.

Now let say I purchase 70 TRX at a very low rate of $10,So in someday later the TRX was increased in price where 70 TRX was to be purchase at a rate of $20 at that moment,So I decided to sell my TRX,With this I have been able to make a prosperous spot trading which I was able to make a profit of $10.

ADVANTAGES.

With the spot trading it is very less to risk in loosing profit.

With the spot trading it is not compulsory to have much capitals before you can start trading,Even users with small capitals can also start to trade.

All new user to this type of trading can easily operate as compared to the other type of trading.

DISADVANTAGES

With the spot trading for a user to make profit he must be able to wait until their assests increase in price to sell and make enough profit.

With the spot trading whenever there is a dip in price of an assest not every user is capable of selling out their assset since this could be incline to create harm.

Margin Trading

This is a type of trading whereby a trader is having the opportunity to open a trade more than the actual money he or she is having,With the help of margin trading all traders are able to take money from the third parties,Different trader and other exchange plafform.With this the trader are able to get enough with the small amount they have,When their forecast move in a good way,Also they might loss whenever their forecast does not go in a good way.

Let assume a trader is having $100 in his account and he was able to open a trade of $200 that is using the leverage of 2X.

ADVANTAGES.

With this type of trading all trader has the opportunity to get loan from the third parties,Other traders and exchange plafform,In order to purchase enough assests.

With this type of trading it helps traders to get enough profit from their little funds whenever their forecast goes right.

With the help of the margin trade,All traders with less capital are also allowed to trade at the high leverages to help them get enough profit.

DISADVANTAGES.

With the margin trading it need traders with more encounter,Not everyone can trade using the margin trading especially a starter.

With the margin trading,Traders are expose to a very high risk,When traders forecast don’t go well they might lose all their funds or profits.

All traders must have enough funds put aside,Let’s say for instance,Each time the users trading do not go to their liking as predicted.

Future Trading

This is a type of trading which is usually not approved by users who are new to the trading market,In most time traders with a high knowledge about the trading are approved to use the future trading.With the future trading it always deal with a prediction by a trader,Now from the prediction of the traders he might either gain or loss profits this depends on the predictions of the traders.With the future trading it helps a trader to check either to set a purchase or sell order due to the prediction on the market direction.For an investor or trader to make enough profit or lose this is going to rely on the correctness prediction made on market by the trader.

ADVANTAGES.

With the future trading users are having a very high possibility of making a vast profit.

With the help of future trading it allows users to forecast the future cost of an assests.

With the future trading users can make a vast profit depending on the leverage whenever their prediction goes to their liking or choice.

DISADVANTAGES.

Only traders with high experience can use the future trading not for beginners.

For an investors to use the future trading it needs a vast sum up of money to begin this type of trading.

With the future trading all users are related to a very high risk.

Market Order

This a type of order which usually deals with when a trader set an order to buy or sell an assest at the new price on market.With the market order trader do accept every price offered.When an order is placed it is carried out very fast since it rely on the new price on market at the moment.Market takers are the name we usually give to those using this type of market orders on market.

Everyone can testify to the current exchange rate has increased in value.first I used to buy 20 steem for just 1.5 sbd,For now 1.5 sbd is going to give you 17 steem,With the market order when I place my order anytime I want to purchase a steem wheather the exchange rate is higher or not my order will just be carried out in the shortest time,That is I do accept every amount of steem they are going to give me.

Limit Order

Limit order is a type of order that do not carried out,Till it gets to the actual price the trader placed in the order,Whenever a trader wants to place a sell order,The order can be placed at a high rate so that the order will be able to carried out when the price is able to reach the price placed,Also whenever a trader wants to place a buy order,The order can be placed at a low rate so that the order will be able to carried out anytime the price is dropped to the price placed.

Let assume I want to buy a 20 steem but it will cost me 2 sbd,But I want to buy the 20 steem at a low rate of 1.5 sbd,With this am going to place a limit order,So whenever the rate to buy 20 steem at a cost of 2 sbd drop to a cost of 1.5 sbd,My order will then be carried out.

Stop-limit Order

This is a type of order which is a pending order and it is made up of the stop and limit order.For this type of pending order it usually carried out when the order is able to extend to the stop price,This is going to make the limit order of a trader to be set.

OCO

This is a type of order whereby two dissimilar order are been set down,With this one of the order is surely going to perform first,Making the other one to stop,So as the name signify ONE CANCEL OTHER (OCO).For this type of order it usually helping investors or traders to escape a high risk of losing assest or profit.

Let assume I decided to purchase an asset so I then placed my stop and limit order,With this whenever the limit order is carried out first the stop order is going to be cut off same as whenever the stop order is carried out first the limit order is going to be cut off.

2.b)How can a trader manage risk using an OCO order? (technical example needed).

For a trader to manage a risk utilizing the OCO is very easy,When traders use the OCO in their trading it is very difficult for them to lose their profit or assest,Because with the OCO we have two orders at the same time,That is the limit order and stop limit order.Whenever the basic of the stop limit order is encounter,The stop order will be cut off,Same as whenever the stop order is encounter the stop limit order will also be cut off.For a trader to reduce a risk of loosing their assest there is a need to placed a stop loss order whenever their forecast do not go to their liking.

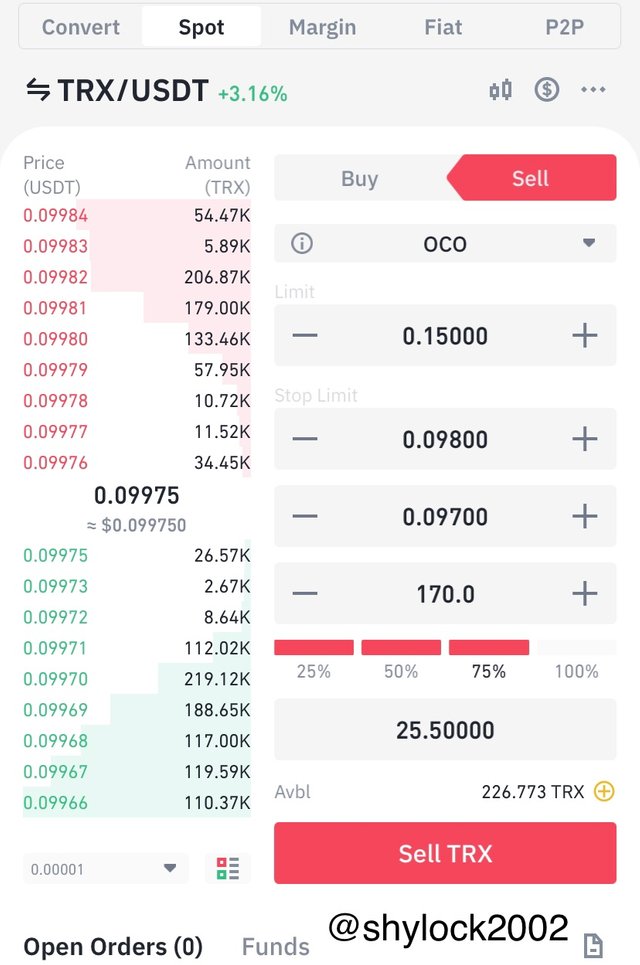

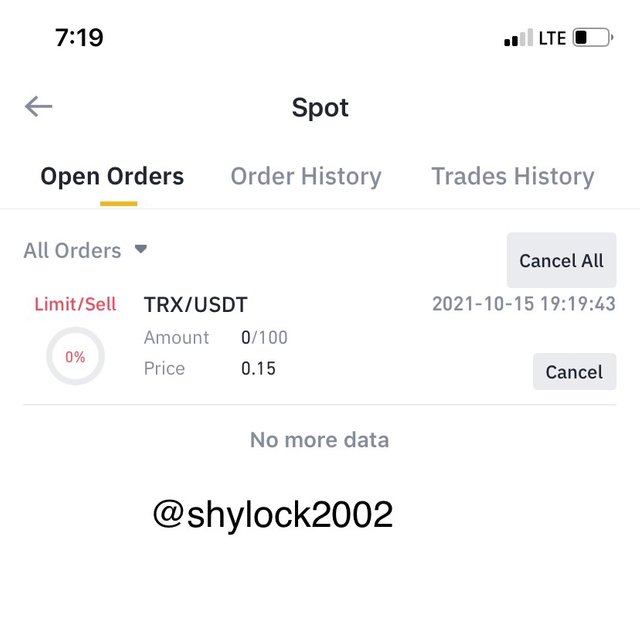

From the picture above I was able to place a limit order to sell my TRX at rate of 0.15000,I was also able to place a stop limit to sell my TRX at a rate of 0.09700,Whenever the stop price reaches 0.09800.

Exit Orders

This is type of orders which has been separated into two types that is the stop loss order and take profit order.

STOP LOSS ORDER

With this type of order it is usually used by traders to quit the trading whenever the trade is not going to their liking as forecasted.Whenever a trader wants to start. trading he or she have his own prediction that is for the market trend to be in bullish season to make enough profit,Whenever the prediction don’t go to their liking and when the market prediction moves to a bearish season,Traders can make use of the stop loss order to quit the trading to escape loosing of profit.

TAKE PROFIT ORDER

This is a type of order usually used by traders or investors to quit the trading whenever the trading is going in their liking as predicted,In most time whenever a trader enters the market he or she has his own extent of making profit,When they get to their extent of profit they need,They can quit the trade and get their profit.

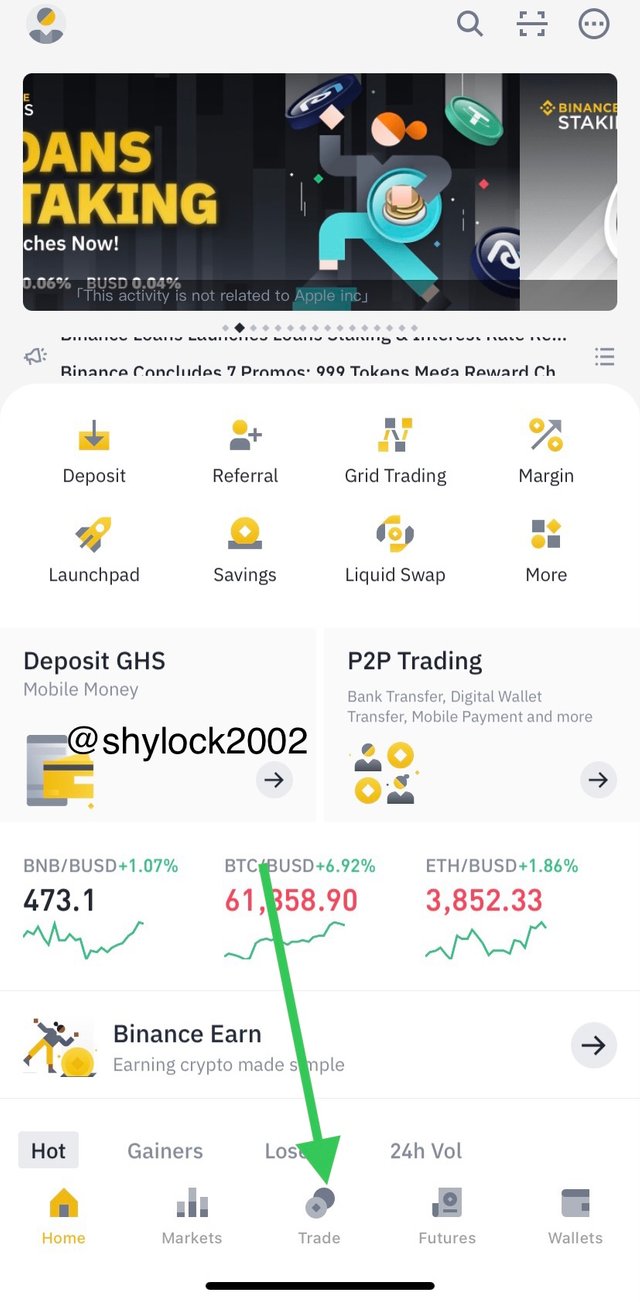

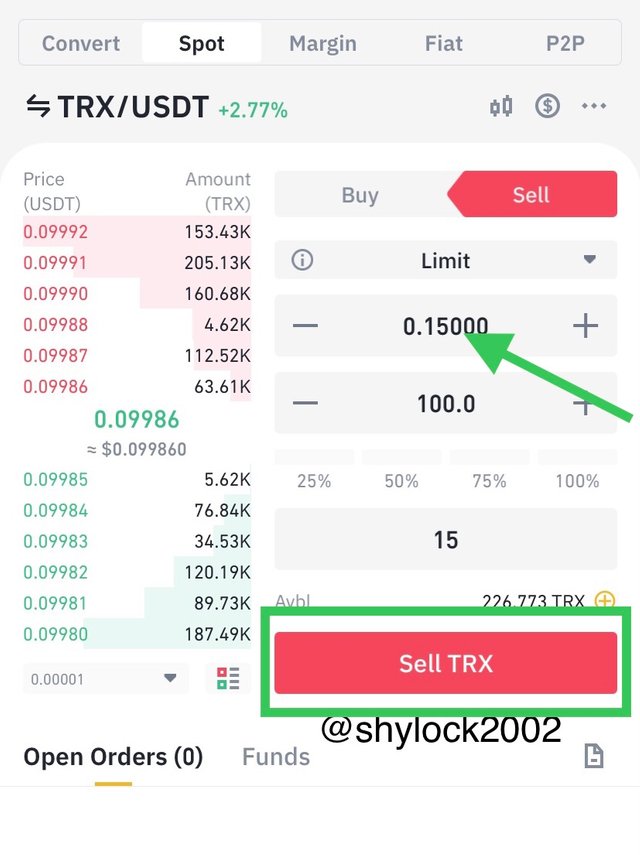

- You first need to open your BINANCE and locate trade.

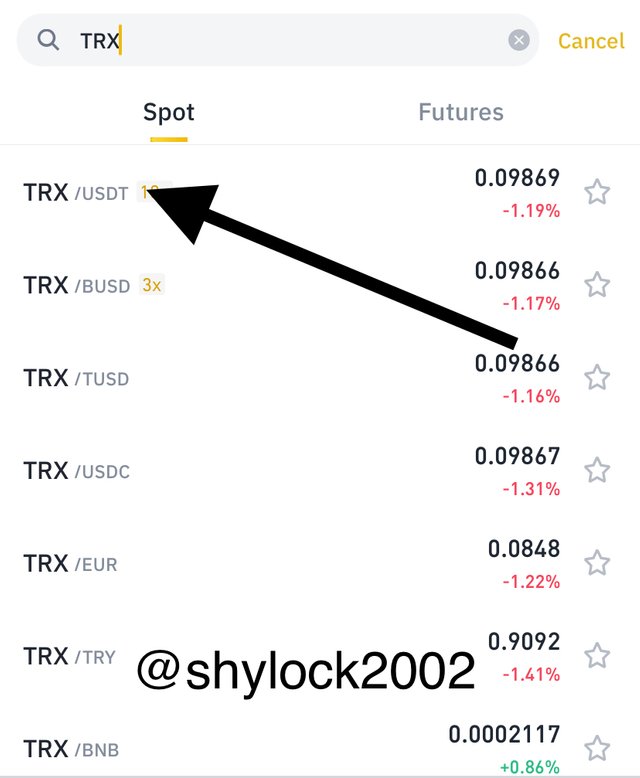

- After locating your trading and clicking on it,You would then select your pair of cryptocurrency,For this task I decided to pick TRXUDST.

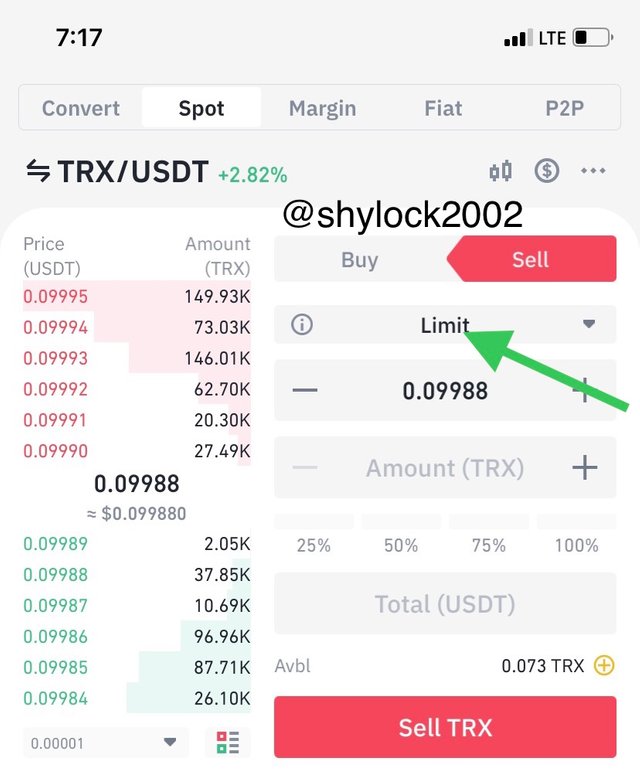

- I also decided to pick a limit order,That is the type of trade I wished to get going.

- I then selected my limit order that I wish to set my order,Now I put down the amount of TRX am willing to sell.

- I then click on the sell TRX for my order to be placed.

- My order has been successfully created.

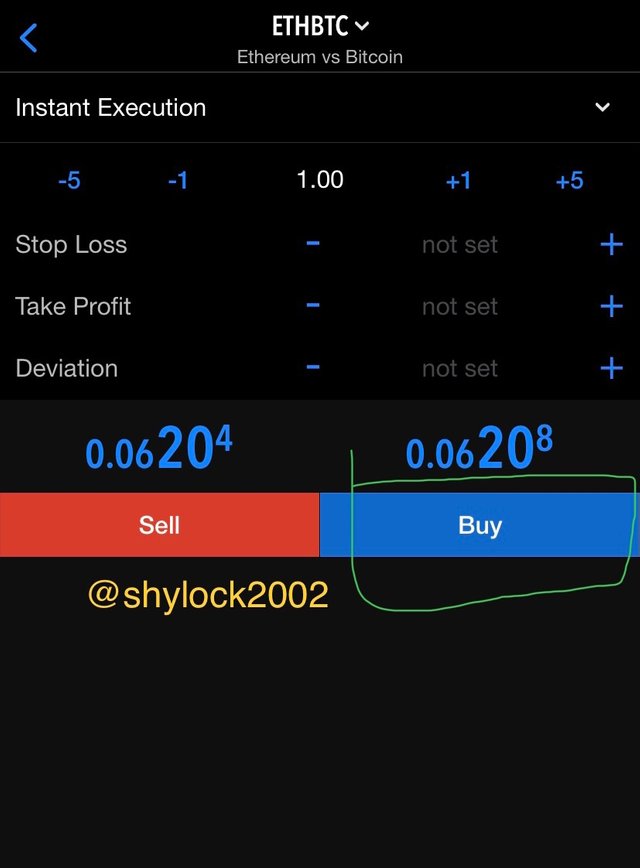

Performing my task I decided to use the indicator we called the RSI indicator on my TradingView.The current time I performed this home work the trend on market was a bearish trend.

After making my technical analysis I opened a buy trade using the MetaTrader 5.

THE MAIN REASON WHY I DECIDED TO PICK THE ETHBTC

The reasons why I decided to go for Bitcoin is because as we all the Bitcoin happens to be mother to all the crypto currencies on market and also the first cryptocurrency created,As we speak Bitcoin is really increasing in price after there was a dip,Now at a rate of $60,604 that was the price on market as the time I performed this task.

Also the reason why I decided to go for the ETH because it is one of the good assests on market which is also getting the attention and increasing it value on market.Since the market trend is in bearish as I was performing my task after I purchase this assest,Am going to place a sell order anytime the market goes to a bullish trend am really going to get enough profit when sell my asset because I bought it a low rate and am selling it a high rate.

There are a lot of indicators on market but I decided to go for the RSI indicator because it help traders like beginners to have a good recognition or understanding of the market trend,Also the RSI always signify all traders the oversold and overbought,Also their chart analysis is very simple and fast to explain as compared to the other indicators,Anytime a trader uses the RSI it help the trader to know the market trend before he or she start the trading.The time I analyzed my chart it was in a bearish trend and I was able to notice with the help of the RSI indicator.

CONCLUSION

A very big thanks to our noble professor @reminiscence01 for such a wonderful lesson,The lesson was very educative.

Hello @shylock2002, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit