Question 1

Define the concept of Market Making in your own words

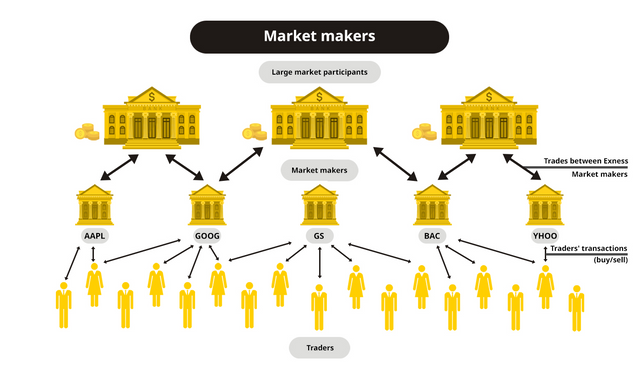

In this chapter, I will be talking about the concept of Market Making. This is a term that defines an individual who actively states the two sides of a market; thus, he provides bids and also asks prices with regards to the market size in a particular security.

Also, another thing about market makers is that they provide liquidity in the market as well as depth so as to earn some sort of profit from the difference that comes from the bid and ask price which could also be known as the spread.

Moreover, trades are sometimes made by market makers and such trades made in their accounts are termed the principal trades.

Key Points About a market Maker

A market maker can be someone who is a participant of an exchange organization dealing in the buying and selling of securities in their own accounts.

As I mentioned, they provide liquidity as well as depth whiles they earn profit from bi and ask price.

Upon the risk involved, they are compensated for holding assets as a result of the decline in the value of the bid and ask.

Question2

Explain the psychology behind Market Maker. (Screenshot Required)

Basically, the main motive of market makers is to make sure there is a presence of liquidity in the market as they have to regulate their prices for selling and buying crypto assets.

So, what happens is that the bid price which is the buy is mostly a little lower compared to the selling price and also the asking price which is, of course, the sell is regulated above the buying price.

This is done since this organization involved in this kind of activities also need to make some kind of profits in other to get going their affairs. Liquidity is not just their main aim but to also get some sort of profit in whatever they are doing.

How Do Market Makers Earn a Profit?

In order to earn some profit, Market Makers does this through the spread between the bid and ask price. We know that they bear so much risk since they are covering designated security which probably could drop in price at any point in time. So let's say the profit is made by some kind of compensation that is given to them for the risk taken in holding the assets.

Let’s look at this scenario here.

Assuming, an investor sees that, Samsung has a bid price of $60 and an asking price of $60.10. This simply means that the market maker purchased the Samsung shares for $60 and selling them at a price of $60.10, so he will be getting a profit of $0.10. This is how they earn profit

Alternatively,

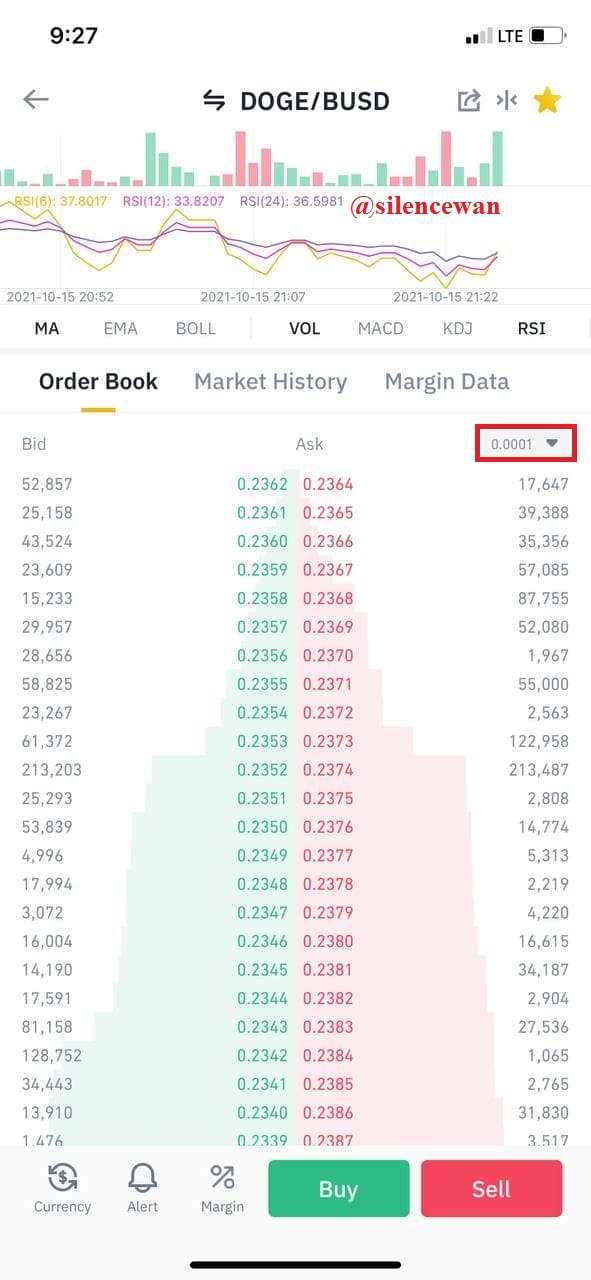

The chart above is a DOGEBUSD chart on which I made this analysis. So in other to obtain the profit I spoke about. This is what Market Makers do.

They find the difference between these two. Thus, they bid and ask before they can now find or calculate it from the amount a user or trader is buying.

Let’s look at this scenario to get a better understanding of what I am trying to explain.

For instance, in the chart above, we can see the bid price and also the asking price. Now the difference between these two is $0.0001 as stated in the chart above.

So, assuming there is a transaction worth about $ 28,000, then the profit that would be earned by the market makers is calculated for us

0.01 x 28,000 = 28

So that would be like $28 and that is the profit that is made by the market makers for rendering such service. Though it said they provide liquidity. But of course, profit-making is also a factor.

Question 3

Explain the benefits of Market Maker Concept?

In this chapter, I would be explaining the benefits of the concept of the Market Maker.

The first benefit I would like to talk about is that, quite apart from improving the services of liquidity of stocks available in the market, market makers also enhance or increase volumes of the shares that are traded.

Another benefit is that the stock exchange performs well by beating the time taken for execution of an order as well as the cost of transaction required during the trading process of the stock

Also, the increments in the price of crypto assets are another benefit of Market makers. We know liquidity in the market is controlled by market makers which also controls the spread in the market. So basically, prices of assets can increase if they decide on moderating the bid and the asking price of the assets.

Additionally, there is a reduction in volatility as resources are pumped into the market. So it is a benefit since they are able to reduce price volatilities.

Lastly, we all know that immediately we see an asset increasing in price, then there is an increase in the number of investors. So another benefit is that it also makes an increase in the number of investors available in the market.

Question 4

Explain the disadvantages of Market Maker Concept?

Disadvantages of Market Marker Concept

The first disadvantage I would mention is that, Market Makers can give outbid or ask prices that are worse than what you could have gotten from another market maker since they control the spread.

Another disadvantage I would like to talk is that they may wait until when they want to invest and that is when they provide liquidity and once, they claim their investment they stop which is also a major disadvantage. So basically, they provide short-term liquidity which is not better enough.

Also, there are cases where investors sell their assets as a result of losing much, this is so because market makers offer false signals in the market sometimes which is unhealthy for investors.

Lastly, since they work under no regulation, they can regulate the prices in any direction they need it which is also a major disadvantage to the investor.

Question 5

Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

In this chapter, I will be dealing with the RSI (Relative Strength Index) and then the EMA (Exponential Moving Average).

Relative Strength Index (RSI)

This indicator works under the principle of momentum. So, it is a Momentum Indicator as it's used in technical analysis to measure magnitude in the price change of an asset in other to control overbought and oversold situations in the price of an asset.

The indicator is marked twice, and this is a 70% mark and that if the 30% market. Where 70% signifies an overbought in the price of an asset and also 30% signifies an oversold in the price of an asset.

So, using this indicator in your trades, you will know when to release your asset and when to invest because of the price changes. Based on this, market makers can always capitalize on the movement of the signals to in providing liquidity for their investment.

Let’s see how this can be done in the following charts below.

You can clearly see I have made indications for my overbought and that of the oversold. Now what happens is that, based on the chart, traders at this level will feel that there might be a trend reversal cause market makers might regulate liquidity to favor their investment in a sense that, traders will feel that the price might fall, but instead it probably might go above the anticipated price with the presence of the Market makers.

So looking at this, Market Makers sometimes cause harm to traders to cause they sometimes pump in or regulate this liquidity in their favor by giving out false or fake signals in the market which really makes traders think the opposite.

Exponential Moving Average (EMA)

This indicator is a technical indicator focused on tracking the prices of an investment. EMA is just another type of Weighted Moving Average but this rather gives more value to weighting to recent price data in the market. There are two lines involved in this indicator where we have the shorter line and that of the long line.

A cross that occurs in the shorter line above that of the longer one is termed as a bullish trend, so this means that there are more buys in the market since the price of the asset is going upwards and when the longer line crosses the shorter line, the chart is seen to be a bearish trend and, in this case, it signifies more sells in the market as the price of the asset is seen going down. No one will want to make loses

Let’s see how this can be done in the following charts below.

Through the chart you have seen how a death cross is gotten and a golden cross. These are just technical terms; we could also say bullish and bearish trend trends or crosses.

From the above charts, these crosses may have an impact negatively on traders since false signals may be seen in the price of the assets. This is to the advantage of the Market Makers since they are those the capitalize on the price by providing liquidity to make a profit.

CONCLUSION

The idea of Market Makes paves way for a smooth trade in the market with regards to traders and the Market Markers themselves though sometimes there are a lot of challenges with regards to how liquidity flows. But we know they are also into making a profit.

Quite apart from that, it a great idea and I want to say I really enjoyed making my research across the topic. It was a great experience with you professor @reddileep

Thank you for reading my post.....!!!!