Hello guys,

Today I want to participate in the assignment task given by the professor @reddileep after his lecture on Cryptocurrency Triangular Arbitrage. Have fun as you read through my blog.

Today I want to participate in the assignment task given by the professor @reddileep after his lecture on Cryptocurrency Triangular Arbitrage. Have fun as you read through my blog.

1- Define Arbitrage Trading in your own words.

Arbitrage trading is a type of trading that the traders involve spot a significant difference in price of an asset between two exchange and then make use of the opportunity by buying in the exchange with low price and then selling in the exchange with a higher price. This type of trading is a short term trade and for that reason it is always recommended that we use a huge amount of capital. The idea behind this type of trade is simply to buy asset at lower price and sell at higher price.

The Arbitrage trading is no doubt a trading strategy with little or no risk attach to it. This is so because you have to take into consideration the price difference in the two exchanges and then know where to buy and also where to sell to make your profit. If for instance you as a trader spot a less risk involve in you trade, it is advisable to invest huge amount of money in the trade as it will fetch you more profit within a blink of an eye.

This act is mostly done by traders who operates two or more exchanges. They monitor the price of an asset in one exchange and then compare it with the price of same asset in another exchange. For instance if I want to trade on Steem, I happen to operate two different exchange wallet say Binance and Roqqu. I will consider the price of Steem in Binance and then consider the price on Roqqu and then decide where to buy and where to sell to earn a little profit at the end.

2- Make your research and define the types of Arbitrage (Define at least 3 Arbitrage types)

Exchange Arbitrage:- The exchange arbitrage is a type of arbitrage that is seen as a result of the difference in prices of an asset between two different exchanges. We know that every exchange platform offers different price rate and that leads to the variation in the price of assets. Let's consider the example between two different exchanges I.e Binance and Roqqu. The price of STEEM in Binance as at the time of performing this task is #235.13 whereas the price of the same STEEM in Roqqu at that same time is #287.01, so this implies that the price is higher in Roqqu than in Binance.

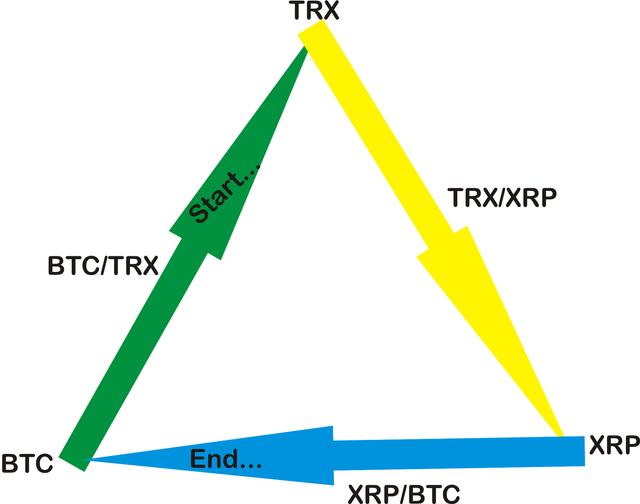

Triangular Arbitrage:- The Triangular arbitrage is a type of trading strategy that involves three different coins or asset to be traded simultaneously within an exchange platform this is as a result of the difference in prices of the asset within the said exchange platform. The sole purpose of these type of arbitrage trading is to get back the first asset you traded with profit at the end.

Example I want to trade BTC, TRX and XRP. I sold BTC to get TRX then I sold my TRX to get XRP and finally I sold my XRP to get back the BTC I initially have. This is a clear example of how the triangular arbitrage works.

Merger Arbitrage:- This is a type of arbitrage that is done during a company merging acquisition. Due to uncertainty that surrounds a company during acquisition, the company are usually valued so low hence traders at this point get shares in the company and bear the riskso that when everything works well at the end they all will become big persons in the company.

3- Explain the Triangular Arbitrage strategy in your own words. (You should demonstrate it through your illustration)

The Triangular arbitrage is a type of trading strategy that involves three different coins or asset to be traded simultaneously within an exchange platform this is as a result of the difference in prices of the asset within the said exchange platform. The sole purpose of these type of arbitrage trading is to get back the first asset you traded with profit at the end.

Example I want to trade BTC, TRX and XRP. I sold BTC to get TRX then I sold my TRX to get XRP and finally I sold my XRP to get back the BTC I initially have. This is a clear example of how the triangular arbitrage works.

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing arbitrage strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

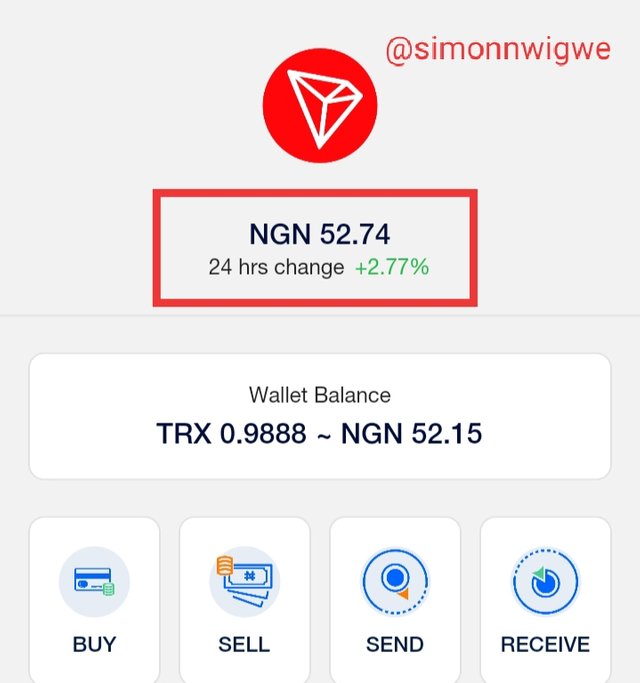

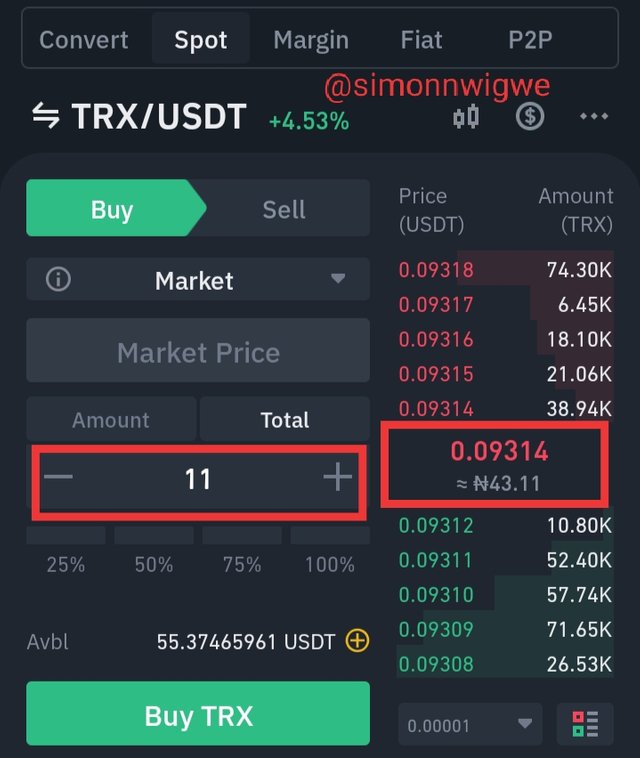

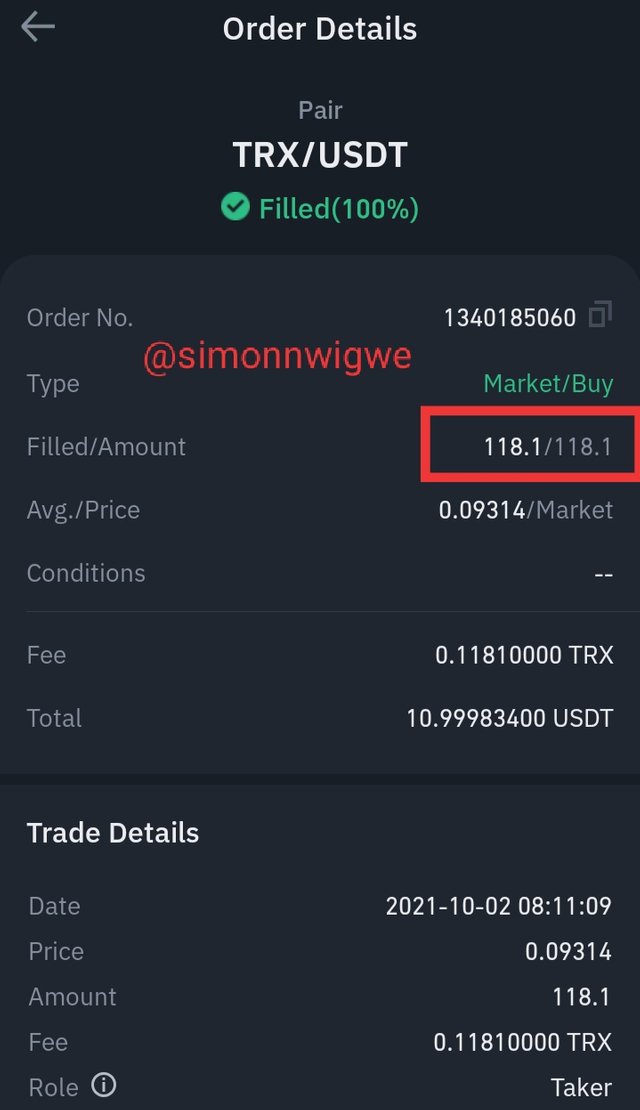

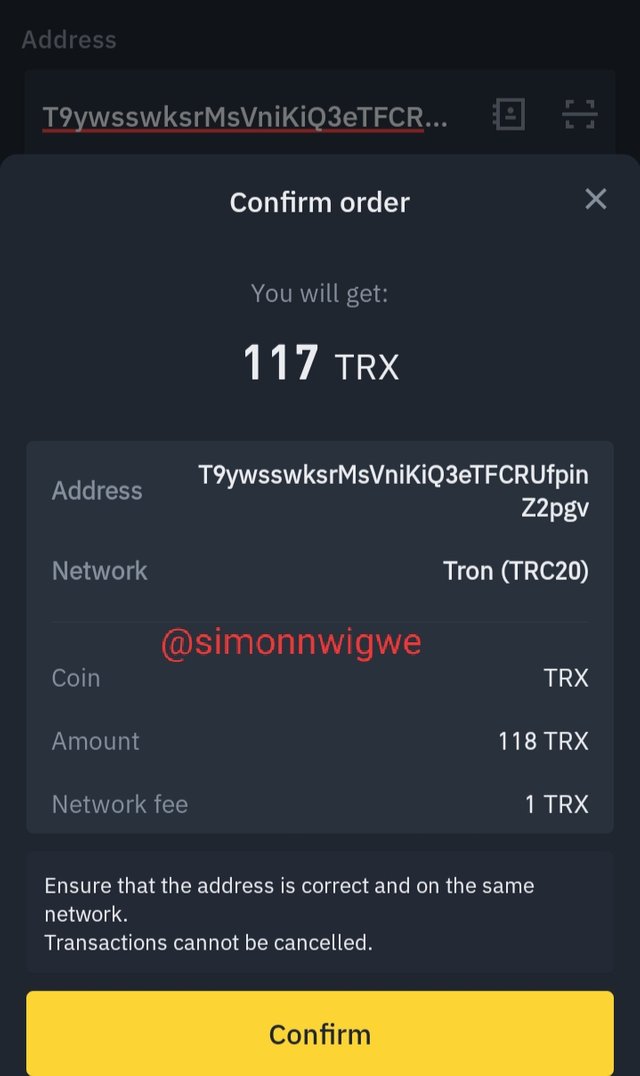

I will be using Roqqu and Binance exchange platform to perform this transaction. I traded TRX in this task. On Roqqu 1TRX = #52.74 and in Binance 1TRX = #43.11. I bought TRX worth 11USDT from Binance which is equivalent to 118TRX. See screenshots below.

Roqqu

Binance

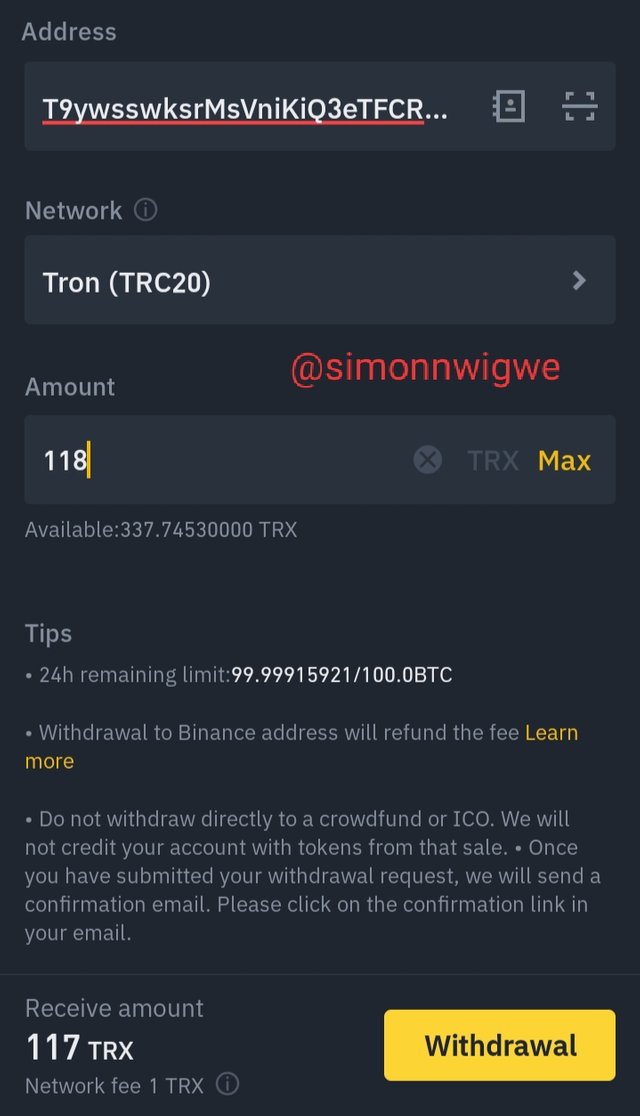

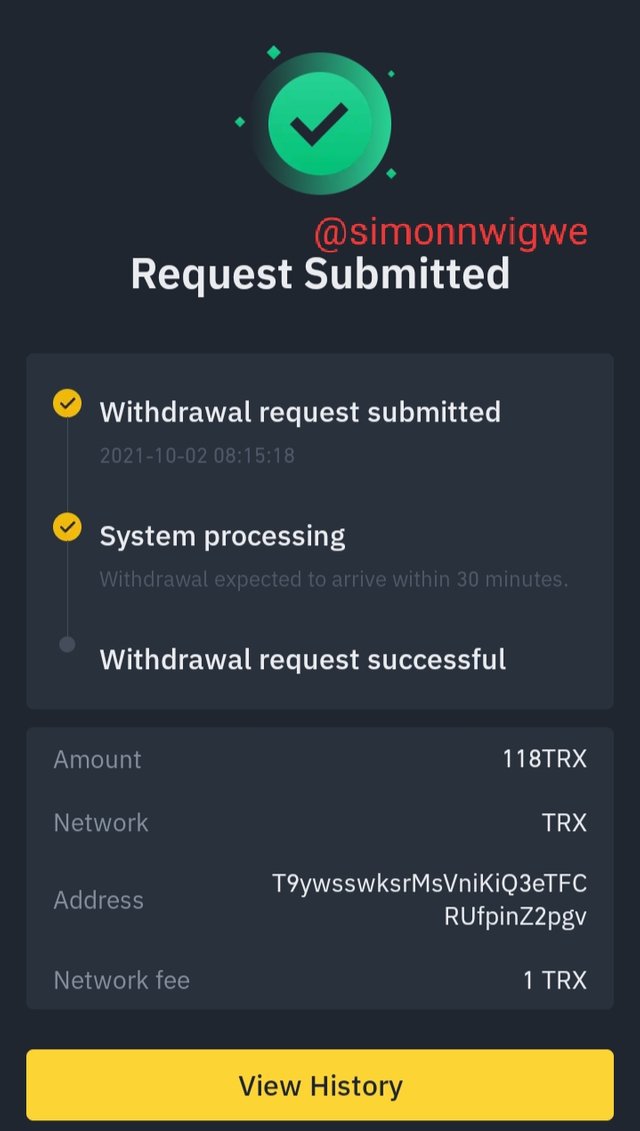

The next thing I did was to withdraw the TRX to my Roqqu wallet. See the screenshots below on the process I used in carrying it out.

The exchange arbitrage profit gain is seen below

Binance total for the amount of TRX

43.11 * 118 = #5,086.98

Roqqu total for the amount of hive

52.74 * 118 = #6,223.98

The difference is given as

6,223.98 - 5,086.98 = #1,136.34

Therefore exchange profit = #1,136.34

5- Invest at least $15 worth of a coin in a verified exchange and then demonstrate the Triangular Arbitrage strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing cryptocurrency triangular arbitrage strategy, you should provide screenshots of each transaction)

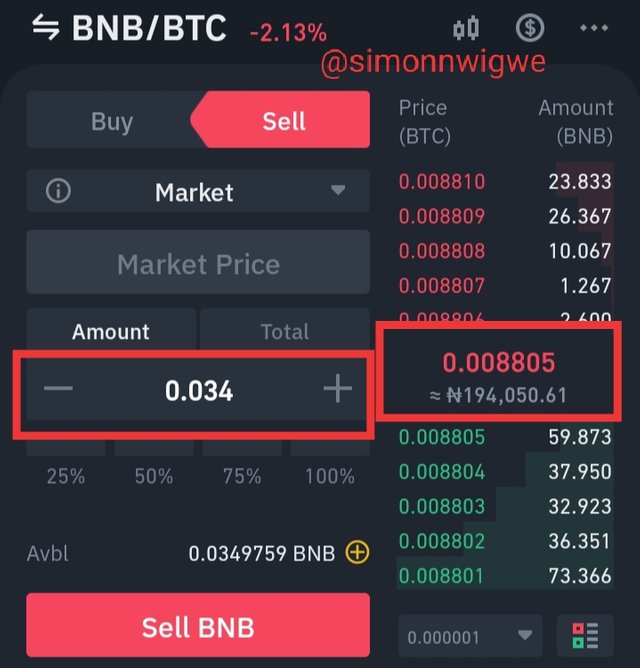

My Binance verified account is what I will be using to perform the said transaction. The three crypto asset I selected are BNB, BTC and ETH.

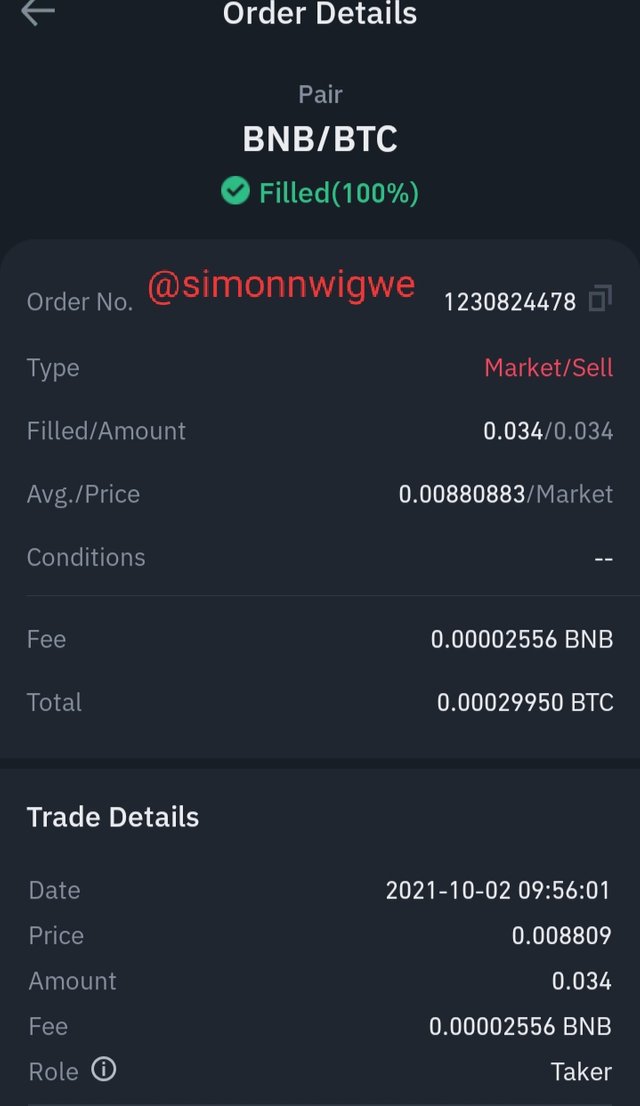

First I sold 0.034 BNB to get about 0.00029950 BTC at the BNB/BTC exchange rate of 0.008805. See screenshots below.

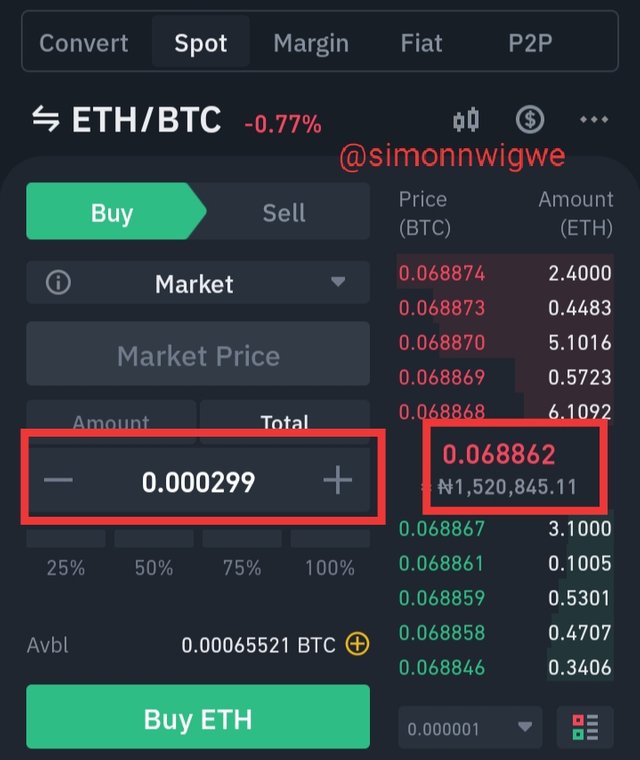

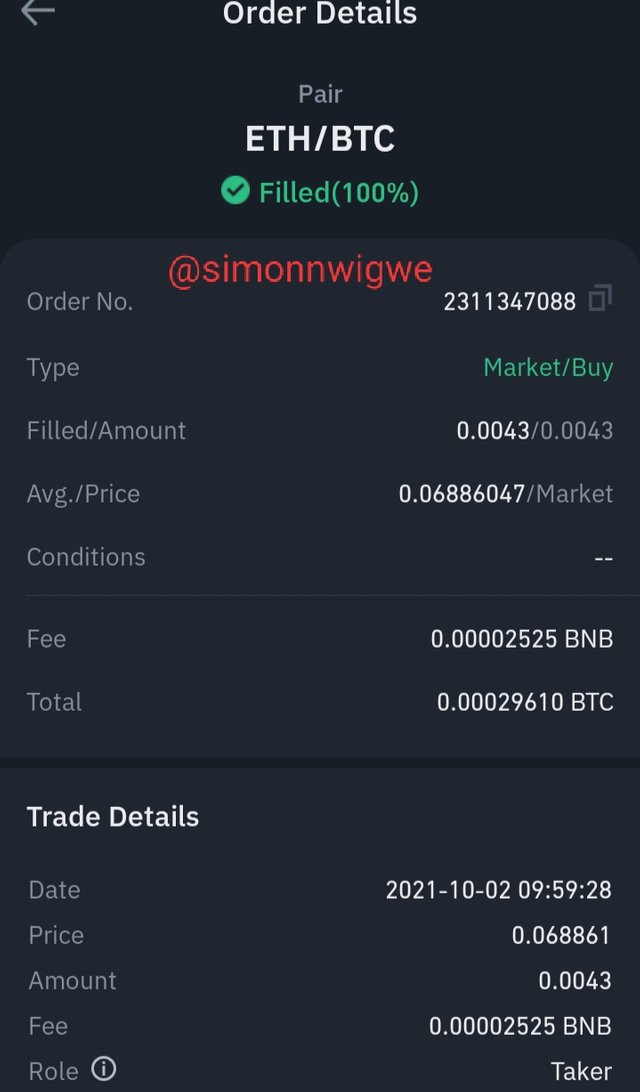

After that I proceeded to purchase ETH by selling the BTC. I sold 0.00029950 BTC to purchase ETH at the ETH/BTC exchange rate of 0.068862, See screenshots below.

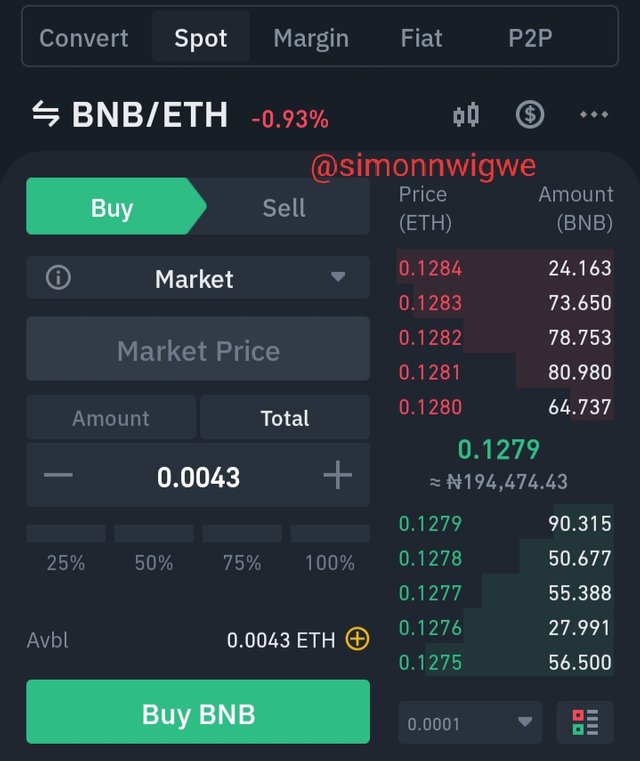

To complete the transaction, I sold the ETH to get back my BNB. The exchange rate of the pair of BNB/ETH is 0.1279. See screenshots below.

Though the transaction was not completed because the quantity of ETH required for the transaction is about 0.005 but I am having less due to the amount I used in trading. Though an interest was made.

6- Explain the advantages and disadvantages of the triangular arbitrage method in your own words.

- This method of trading adds liquidity to the market

- Does not require any technical knowledge or skills before you can carry out the trade

- Low or no risk is involve

- No delay in transaction as the transaction is carried out almost immediately.

- Due to market volatility, the trader may loss some valuable amount of resources

- Price slippage is another factor that can affect the triangular arbitrage and hence the profit may be affected.

The arbitrage trade as we can see is a very fast trading strategy that traders can utilize the opportunity presented to them and then make a very high profit within the shortest possible time. This strategy can enable traders make profit without any technical analysis. Thank you so much professor @reddileep for such an insightful lecture.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit