Hi guys

This is my last trading post I will be making for the week. This week am still with the Fredquantum-Kouba01 Traders Team which is been supervised by professor @kouba01 and @fredquantum. The trade for today is a pair of QTUM/USDT.

This is my last trading post I will be making for the week. This week am still with the Fredquantum-Kouba01 Traders Team which is been supervised by professor @kouba01 and @fredquantum. The trade for today is a pair of QTUM/USDT.

The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc

The QTUM token is a project that is built using the proof of stake consensus algorithm. The QTUM is a platform and a token at the same time. The QTUM token is built using the bitcoin and ethereum chain and that has made the token to be more stable. Here in this decentralized platform participants have every right to vote for changes of certain things they don't like about the platform.

Currently, because of the fact that the bitcoin and ethereum chain is used basically to built the QTUM platform, most of it's members came from either the ethereum community or the bitcoin community. Another unique future about the QTUM platform is that it is able to execute smart contract project effectively like the ethereum does. The QTUM platform or network also made some significant build up on the Bitcoin UTXO transaction.

When the QTUM token came out, within about 90 minutes, a total of about $10 million of the token was sold which and before the end of the sell of the said token, about $15.7 million was realized for the sell of the QTUM token. From the QTUM whitepaper, the QTUM token is disturbed in this manner, about 51% of the QTUM token was distributed to the public during the crowdfunding process, 49% of the token was left. Among the 49% of the token that was left, 29% was allocated to community whereas the other 20% was given to backers and the development team of the project.

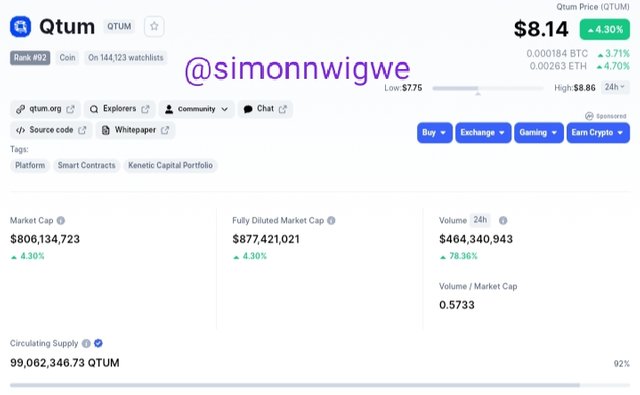

Popular exchanges such as as Binance, Upbit, FMFW.io, HitBTC, Decoin etc are exchanges where the QTUM token can be traded. From coinmarketcap, information about the QTUM token as at the time of carrying this task are as follows.

| Parameter | Value |

|---|---|

| Rank | #92 |

| Price | $8.14 |

| Marketcap | $806,134,723 |

| Volume | $464,340,943 |

| Volume/Marketcap | 0.5733 |

| Circulating Supply | 99,062,346.73 QTUM |

Why am I optimistic on this token today

As a scaple trader, I look forward to seeing opportunity to make my entry. As of today, I saw that the QTUM tokens was given a green light as the price of the asset kept on increasing, since I am a short term traders, I look forward for opportunity to make entry and for that reason I became optimistic about the token at this moment. I want to make a profit and then opt out of the market.

Looking at the chart above, the asset has left it oversold region as indicated by the RSI indicator and moving in an upward direction towards the overbought region. I am certain that the asset will hit the level of overbought as it kept making series of higher high.

Analysis of the Token

Using my Fibonacci retracement tool and the RSI indicator, I performed my analysis using the tradingview.com platform. The chart above shows how the asset is struggling to enter the overbought region after a trend reversal when the price initial hit the region of oversold. The Fibonacci retracement tool I applied on the chart enable me to know how far the price of the asset will retrace back. And also using same idea, I was able to spot how far the price can travel back after the pullback. See screenshot below.

As I observe carefully, I discovered that the asset has not yet enter the overbought section and for that reason I entered my trade at that point. In this section I set my take profit above thee (0) I.e 8.313 retracement level and the stop loss was set below the (1) I.e 8.140 retracement level. See the chart below for my position.

The table below shows the entire details of my trade I.e entry price, stop loss and the take profit level.

| Data | Amount |

|---|---|

| Entry price | 8.252 |

| Take Profit | 8.343 |

| Stop Loss | 8.140 |

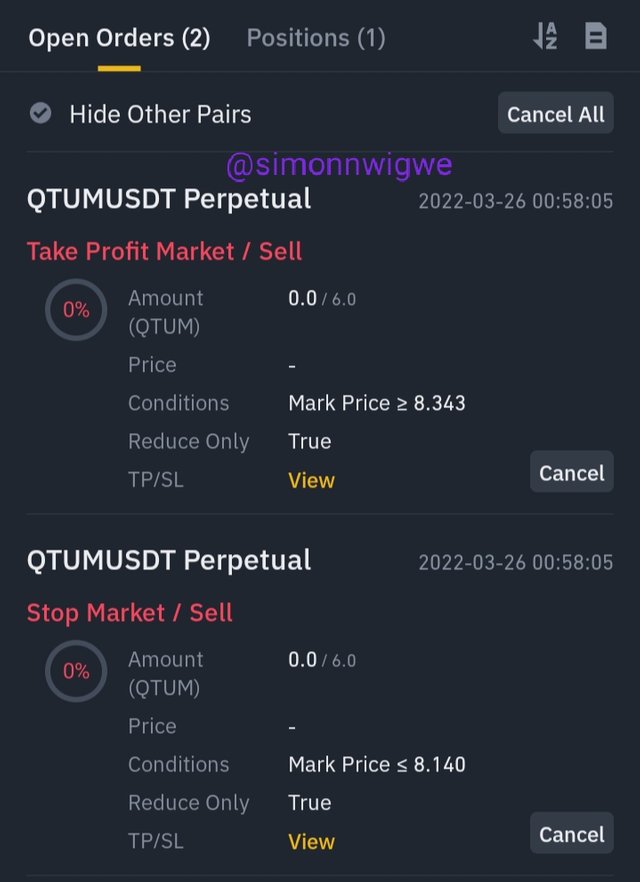

The trade was executed using my verified binance exchange platform. I traded a future trade, using the isolated margin mode and the 20x adjusted leverage. See the screenshot of the position and the open order below.

Source

My position

Source

Open Orders

After about some minutes, the trade executed. The trade broke the level of support where I placed my stoploss. So it terminated exactly at the point I set to stop my loss. The stoploss at this time was filled and the takeprofit expired. The screenshot below shows the details of the trade I carried out.

Source

Order filled

My Plan to hold QTUM long or sell

In my type of trade, once the take profit level or stop loss level is hit, the asset converts back to USDT. So in essence, I do not have plans of holding the said token. For the time being, I intend trading other crypto asset with the little finance I am having on my wallet and after this trading competition, I may decide to continue with the project but for now I am not holding the token. Though I believe that the QTUM asset has a real future rise and for that reason i will try and invest in it.

Would I recommend people to buy QTUM

The QTUM token is a token I want to recommend to other people to buy at this stage when the price is still very much affordable. The token as I have already said has a potential raise and once that raise takes effect the price of the asset might not be too affordable so I recommend that users who have the money now should purchase some of this token and hold. For scaple traders, they can play around it I.e buying and selling it at regular intervals.

Applying the Fibonacci retracement tool on a chart is a strategy on it's own and as such traders who want to use this strategy should apply the Fibonacci retracement correctly on the chart. Price may not always go as we have predicted but more chances of success is given when you apply it correctly.

My gratitude goes to professor @kouba01 for his constant guidance and correction for assignment task given and I look forward to see your feedback on this so that I can better improve the strategy I have learnt.

Cc:

@kouba01

@fredquantum

Written by @simonnwigwe

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit