Hello everyone, today, I will be talking about capital management and trading plan. I appreciate the effort professor @ @lenonmc21 put in explaining the course. I was very enlightened.

QUESTION 1

Define and Explain in detail in your own words, what is a "Trading Plan"?

Before I define and explain the trading plan, I will like to talk about the meaning of the word Trading and the word Plan.

Trading

Trading is one of the very common things in the world today.

Trading simply means buying and selling of assets it is also the act of exchanging an asset for another asset. The most important aim in trading is to make profits.

Plan

Planning simply means an act of making proper arrangements for something to avoid anything going wrong.

Having talked about the meaning of trading and the meaning of plan, now I will go into defining and explaining the trading plan.

Trading plan

A cryptocurrency market is a place where people make profits and also make losses. Due to the volatility of the crypto market, If a trader lacks a good trading plan, he/she is likely to lose all his/her capital.

A trading plan is an act of making proper arrangements on how to go about your trades in other to manage your risks.

A trading plan helps a trader to minimize his/her loss.

A trader should set some amount of his/her capital that he/she is willing to lose by setting an in a trade by setting a Stop Loss and also an amount he/she is willing to make for profit in a trade by setting a Take Profit.

This is why market orders are very important in a trading plan.

For example, a trader enters the market with a capital of $500, he/she can set a Stop loss at $400 and a Take profit at $900.

QUESTION 2

Explain in your own words why it is essential in this profession to have a "Trading Plan"?

As we all know about the volatility of the crypto market, a trader should be very careful in making decisions. A trading plan must be needed because it will help a trader to know when to exit the market to avoid losses.

We all know that greed is very hard to control in trading. Most people lose money in trading not because they don’t know how to trade but because of greed. They can’t be satisfied with the profit they made and this is because they lack a good trading plan.

Due to the lack of a proper trading plan, Some traders can use fundamental analysis without Knowing that technical analysis can make the market go in a different direction.

A trader should be very disciplined enough to follow his/her trading plan. A trading plan will help will a trader to overcome greed by setting a Take profit.

When a trader goes into the market without a trading plan, the trader is very likely to lose his/her money instantly because of how volatile the market can be.

QUESTION 3

Explain and define in detail each of the fundamental elements of a "Trading Plan"

Firstly, I will be listing the four fundamental elements of a Trading Plan;

• Trading psychology

• Capital management

• Planning and control

• Risk management

Trading psychology

This trading element is all about emotions. There are so much emotions involved in trading. An example of such emotions is the Revenge trading.

Revenge trading is a situation whereby a trader doesn’t want to leave the market with a loss so he/she goes back into the market to make profits to recover the loss he/she made this is wrong and can also lead to more losses.

Capital Management

It will be a very bad experience if a trader loses a high percentage of his/her capital or even all his capital in a trade but with the use of capital management, such can be avoided.

Capital management means setting out a percentage of your capital you are willing to risk on a trade. This can be done by setting a stop loss.

For example; a trader enters the market with a capital of $200. Him/she should risk just 1% of the capital by setting a stop loss to avoid losing a high percentage of his/her capital.

Planning and control

Profit is the aim of trading. All traders want to make profits and also grow their capital.

Planning and control mean the act of growing your capital as you continue trading and this can be done by managing your risk very well.

For example; The first day, a trader went into the market with a capital of $500 he set 1% as his risk management which is $5 and he made a profit of $20, now making his capital $520.

The next day, he goes into the market with $520 which is higher than the capital of the previous day. He set out 1% for risk management which is $5.2 which is higher than the amount of the risk management the previous day thereby increasing his/her risk management.

He/she keeps moving with the same plan and keeps making a profit and increasing his/her capital.

Risk Management

Risk management involves decisions. Deciding when to leave the market and how to leave the market. Deciding whether to leave the market with a loss or leave the market with profit.

For example; I plan on making 7 trades for the day, I decide how many trades I will make a profit before I end to trade for the day or how many trades I will make a loss before I end to trade for the day.

PRACTICAL QUESTION

Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your examples and your images to make a said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

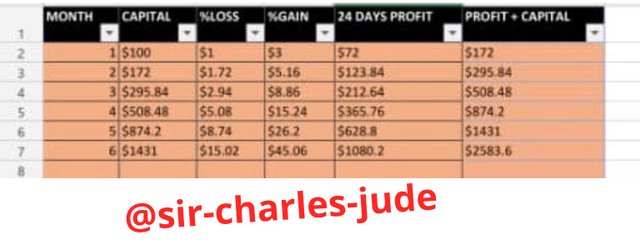

Screenshot got from my excel app

I have to be in a very good state of mind before going into a trade.

I don’t use borrowed funds for trading because it’s very risky.

I always make sure I’m not under pressure before going into a trade.

Column 1

Column 1 contains the month which is 1 to 6 months.

Column 2

Column 2 contains the capitals I used in the different months.

Column 3

Column 3 contains the percentage of my loss in the different months which is 1% of my capital.

Column 4

This column contains the percentage of the profit I made in the different months.

Column 5

This column contains the profit I made in 24 hours. This is calculated by adding the profit I made daily on my capital.

Column 6

Column 6 contains the sum of profit I made for the month with the capital I had for the month.

CONCLUSION

A trading plan is very important for crypto traders.

If a trader goes into the market without a trading plan, he/she is likely to lose all his/her money.

Thanks to professor @lenonmc21 for the wonderful lecture. I learned a lot of things.

Hello @lenonmc21 this post has not been marked yet.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit