Hey guys,

Welcome to the first week of the season 6 SteemitCryptoAcademy lecture by Professor @abdu.navi03

Without wasting much of our time, let me quickly proceed with the given tasks.

QUESTION 1

The cryptocurrency market is volatile and trading is very risky due to its volatility.

This has led to the development of various methods of analysis that will aid traders in identifying possible future price behavior.

Technical analysis is a method of analysis that involves the consideration of old market data in the speculation of possible future price behavior.

There are two methods of technical analysis which are Price action technique and The use of indicators.

The price action technique which can be regarded as the basics of technical analysis is simply the interpretation of market action basically by analyzing price charts without the application of technical indicators.

The application of indicators is essential in making apparent price behaviors that might sometimes be confusing or rather impossible to identify by merely based on the use of price action technique.

This application of indicators in making apparent price behavior and direction is what has led to the development of median indicators.

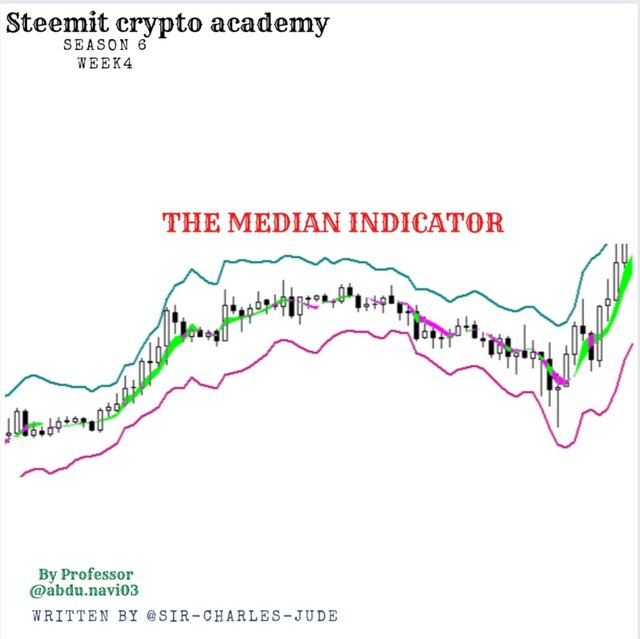

The Median indicator is a trend-based indicator that aids traders in identifying proper trend directions and measures volatility levels.

It does this by using the Average True Range (ATR) in showing the median value of price over a given length of the price chart.

The ATR is seen to be plotted above and below the median line with the median line indicating bullish and bearish trends with a change of color from purple to green for bearish and bullish price trends respectively.

The distance of the ATR from the Median line indicates a level of market volatility as it tends to be wider when the volatility is higher and thinner when the volatility is low.

QUESTION 2

Indicators are usually made up of mathematical calculations of price information such as its opening point, closing point, highs, and lows as well as previous data points.

Just as previously stated, the Median indicator makes use of the ATR in identifying the lower and upper bands which are located above and below the middle band.

Some of its parameters include;

Median length: Number of data points (This is 3 by default)

ATR: Number of periods (This is 14 by default)

ATR Multiplier: Multiplication of ATR in upper and lower band formation. ( 2 by default).

Upper band: Median length + 2ATR

Lower band: Median length - 2ATR

- Screenshot

QUESTION 3

The Midian indicator is an indicator that is primarily used in identifying trend directions.

In other to identify an uptrend using the median indicator, we wait to observe a color change usually from Purple to green although this color can be uttered to suit a trader's choice.

- Screenshot

From the above screenshot, we will see a change from purple to green color which indicates a bearish to a bullish price reversal.

A trader who is trading using the Median indicator is expected to only take a buy position during the formation of this green color in other to avoid trading against the trend which can result in massive loss.

QUESTION 4

Identifying a downtrend using the Median indicator is quite simple as it only involves the spotting of the median line when it crosses below the EMA of the same length.

This is much easier as it involves a color change from green to purple thereby making obvious the change in trend direction.

- Screenshot

The above screenshot shows a bullish to bearish trend reversal as indicated by a change from green to purple color which therefore makes apparent the actual trend direction.

This color change aids a trader in the proper identification of price direction which in turn helps to avoid counter trading (trading against the trend).

QUESTION 5

Fakeouts otherwise known as fake signals are common in the market as no indicator is always 100 percent accurate.

This fact is what makes the combination of indicators advisable during trading in other to filter out false signals.

- Screenshot

From the above screenshot, we will see the median indicator signaling a bearish-to-bullish trend while the stochastic indicator is at the overbought region signaling a bullish-to-bearish reversal.

In cases like this, the two indicators should be in confluence (produce the same signal) in other to minimize the chances of falling for fake signal.

QUESTION 6

- LONG TRADE

I will be performing this task using the ETH|USDT pair on a trading view.

The analysis was performed using a combination of the median indicator and RSI indicator with the RSI serving as a signal filter.

From the analysis above, the median line was found to be crossing above the EMA of the same length thereby showing a green color which indicates a bullish movement.

After observing the Median indicator, the applied RSI Indicator was also found to be crossing above its mid-point thereby indicating a bullish movement.

After observing the above confluence, I took a buy other in other to trade in the direction of the trend.

- After analysis

- SHORT TRADE

I will be performing a short trade on ADA|USDT pair on trading view.

The trade analysis will be performed using a combination of Median indicators alongside RSI indicators.

The Median indicator will be serving to identify trend direction while the RSI which is a volatility-based indicator will help to provide confluence thereby serving as a signal filter.

- Screenshot

From the above screenshot, we will observe the formation of a purple color which indicates a bullish to a bearish trend reversal.

At the same time, the RSI indicator is observed to be at the overbought region which indicates a bearish-to-bullish trend reversal.

Observing the above confluence between the median indicator and the RSI, I took a sell position.

- After analysis.

CONCLUSION

The Median indicator is a trend-based indicator that is used in identifying price direction.

It comprises a median line, an upper band, and a lower band. When the median line crosses above the EMA, it indicates a bullish trend with a color change (green). When it crosses below the EMA, it indicates a bearish trend with a color change of purple.

In as much as this indicator is effective, the fact s remains that no indicator is 100 percent efficient therefore it is best combined with other technical analysis tools in other to maximize profit and minimize loss.