Hello everyone, I will be talking about trading cryptocurrencies.

Before I proceed, I will list the questions I will be answering below.

QUESTIONS

1 • Explain the following stating its advantages and disadvantages:

-Spot trading

-Margin trading

-Futures trading

2 (a) Explain the different types of orders in trading.

(b) How can a trader manage risk using an OCO order? (technical example needed).

3(a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

(4) Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

(i)Why you chose the crypto asset?

(ii)Why you chose the indicator and how it suits your trading style.

(iii)Indicate the exit orders. (Screenshots required).

(1) EXPLAIN THE FOLLOWING STATING ITS ADVANTAGES AND DISADVANTAGES:

- SPOT TRADING

- MARGIN TRADING

- FUTURE TRADING

SPOT TRADING

Spot trading is a type of trading that involves buying and selling cryptocurrency at the current price of the cryptocurrency.

This should be the best type of trading for beginners in cryptocurrency trading.

ADVANTAGES OF SPOT TRADING

You can hold your coin as long as you wish. Even if it goes down below your capital, you can hold it until it appreciates.

There is no minimum capital required in the spot market. You can hold any amount of any coin of your choice.

Traders are not open to face liquidation in the spot market. No matter how bad the bearish market is, investors can’t face liquidation. They can decide to hold their asset until the market becomes bullish.

DISADVANTAGES OF SPOT TRADING

In the spot market, investors do not benefit anything when the market is bearish unlike the future market.

Most times, in spot trading, traders lack planning.

In spot trading, because of the volatility trades are prone to the risk of purchasing a cryptocurrency at an inflated price.

The spot market lacks flexibility in terms of timing.

MARGIN TRADING

Margin trading involves borrowing capital for trading which makes you have more capital for trading.

There is not much difference between margin trading and futures trading. Traders are given leverages. You can purchase a very large quantity of an asset with just a little of your capital.

ADVANTAGES OF MARGIN TRADING

In margin trading, traders have the power to make a very big profit with just a little very attractive capital.

In margin trading, trading is flexible, unlike spot trading.

DISADVANTAGES OF MARGIN TRADING

Margin trading is not meant for those going into trading newly. It’s requires very experienced traders.

In margin trading, traders are open to big risks.

A trader can make a very huge loss or even loss all his/her money including capital if the market goes against him/her.

Borrowing isn’t free. You pay an amount of interest which depends on the amount you borrowed.

In margin trading, traders are prone to what is called a margin call.

A margin call happens when the fund in your account falls below the requirements of the broker margin requirements.

FUTURE TRADING

Futures trading involves buying and selling assets at a future price. It’s meant for well-experienced traders. A beginner in trading that goes into the future is prone to lose all his/her funds in few minutes.

In future trading, traders don’t purchase assets at their real price but instead, they purchase assets at a predicted future price.

ADVANTAGES OF FUTURE TRADING

In future trading, traders are given the opportunity to take advantage of the up and down movement of price in the market.

Traders are given leverage which allows them to use just a little amount of their capital to purchase a large number of assets.

In future trading, Even when the market is bearish, traders are still allowed to make profits from the bearish market.

In future trading, through scalping, you can make a huge profit in a short period.

DISADVANTAGES OF FUTURE TRADING

The fact that I’m future trading, you don’t purchase the real price of the assets but the future price is very risky.

The leverage is very dangerous.

You can even lose all your fund in a very short period.

Before I explain the different types of orders in trading, I will firstly, explain what order means in trading.

ORDER IN TRADING

Order in trading are instructions given to a broker or brokerage to sell or buy an asset on behalf of a trader.

They are different types of orders. An order a trader use depends on what the trader thinks about the asset he/she wants to buy or sell.

Now, I will go into explaining the different types of orders in trading.

DIFFERENT TYPES OF ORDERS IN TRADING

MARKET ORDER

A market order is a type of order whereby a trader buys or sells assets immediately. It executes at the current market price of that asset.

LIMIT ORDER

In this type of order, a trader sets his/her trade to be executed at a specific price. It can be a sell or buy.

STOP LIMIT ORDER

Stop limit order is a type of pending other that triggers the limit order. when a trader sets a stop-limit order, when it hits the stop price, it automatically places a limit order.

OCO ORDER

The OCO is an abbreviation that stands for “One cancel the other”. In OCO orders, traders can open two different orders at the same time.

An OCO order is best used when a trader is confused about the direction the market will go when it hits its resistance or support.

In the OCO order, when the limit price or stop price is reached, the other will be automatically canceled. As the name implies “one cancels the other”

Take profit order

Take profit order is an order which is used to execute a trade automatically when the trade is on a particular profit.

A trader sets a particular profit price whereby the trade will automatically close when it gets to that price.

STOPLOSS ORDER

Stoploss order is a type of order a trader sets to automatically close a trade when making a loss.

A trader sets a particular price whereby the trade will automatically close when he/she is making a loss in other to avoid further losses.

It helps to prevent your account from a margin call.

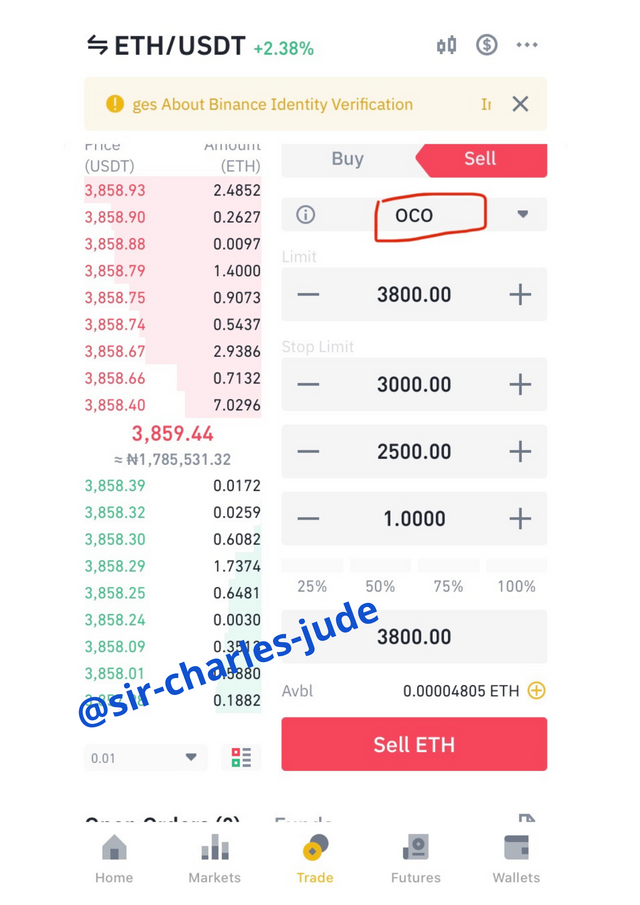

(b) HOW CAN A TRADER MANAGE RISK USING AN OCO ORDER? (TECHNICAL EXAMPLE NEEDED).

“One cancels the other” is a very good type of order used for trading.

OCO allows traders to avoid a suspected risk in the movement of an asset in the sense that it opens two different orders at the same time whereby when one order is reached, the other order will be canceled.

When the price limit is reached, the stop price will be canceled or when the stop price is reached, the price limit will be canceled.

Below, I will show you an example using ETH/USDT pair.

Screenshot got from my Binance app

As you can see in the image above. I set a limit order to sell ETH at $3.8k and a stop-limit order to sell ETH at $2.5k when the price hit $3k.

3(a) OPEN A LIMIT ORDER ON ANY CRYPTO ASSET WITH A MINIMUM OF 5 USDT AND EXPLAIN THE STEPS FOLLOWED. (SCREENSHOT NEEDED FROM ANY CRYPTOCURRENCY EXCHANGE).

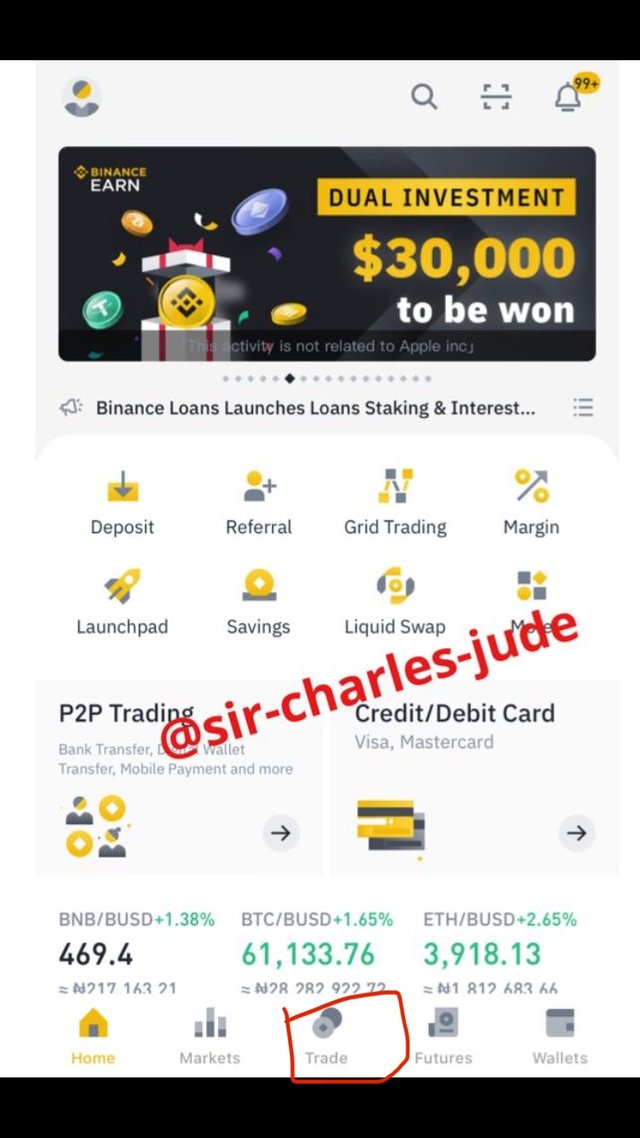

Step 1

You log in to your Binance app and click on trade.

Screenshot got from my binance app

Step 2

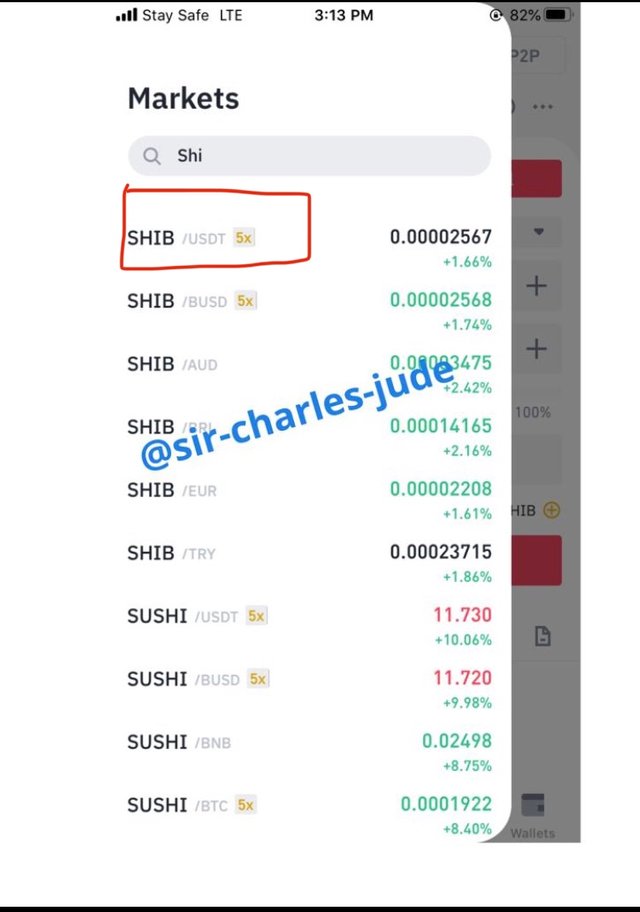

After clicking on trade, You will be directed to the spot trade. Then you click the pairs at the top so you can choose the pair you want to trade on.

Screenshot got from my binance app

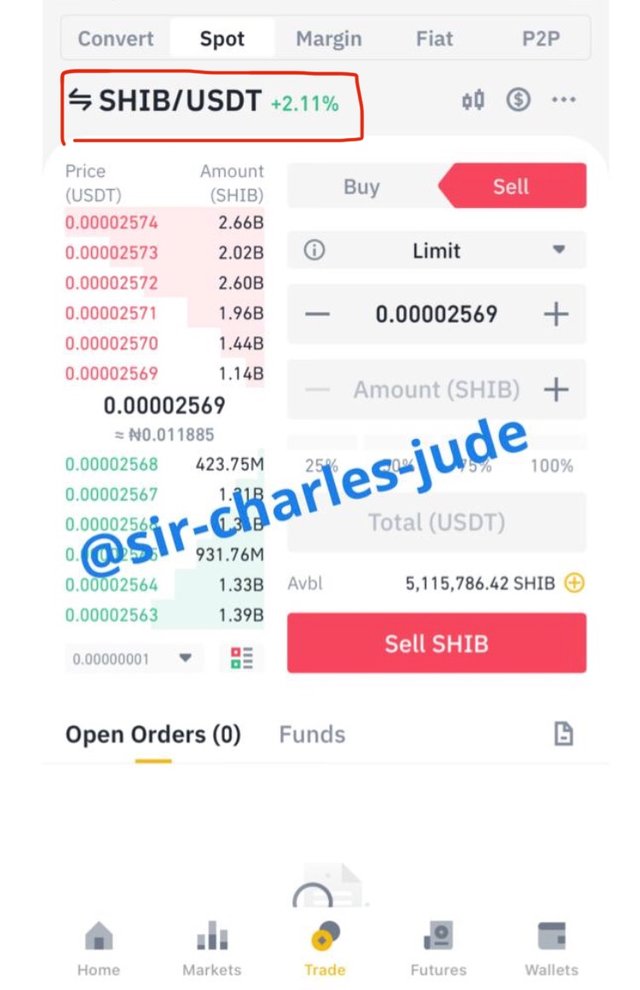

Step 3

It will show you a list of different pairs then you select the one you want. I selected to trade on SHIB/USDT pair.

Screenshot got from my binance app

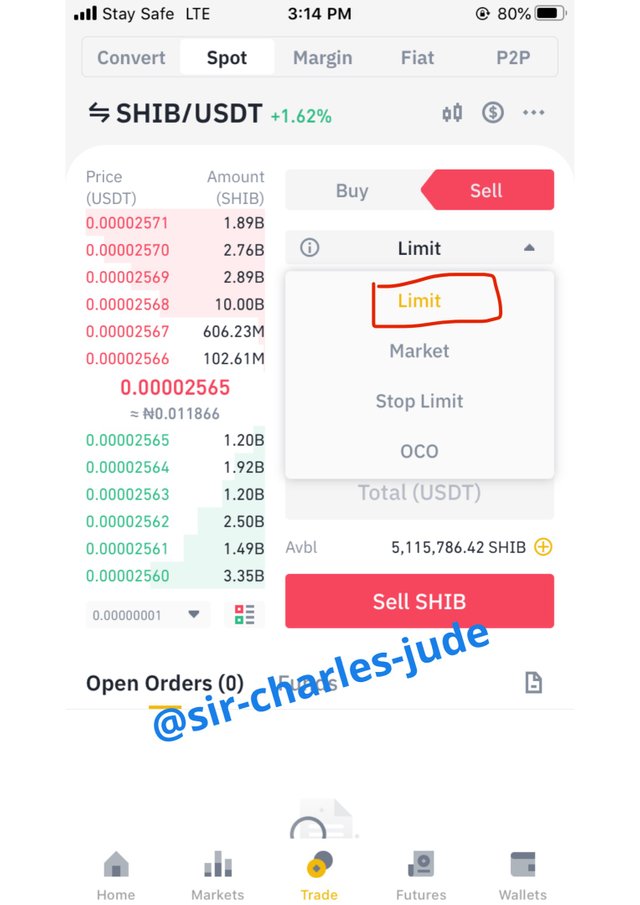

Step 4

After selecting the pair you want to trade on, you will be taken to a page then you select limit.

Screenshot got from my binance app

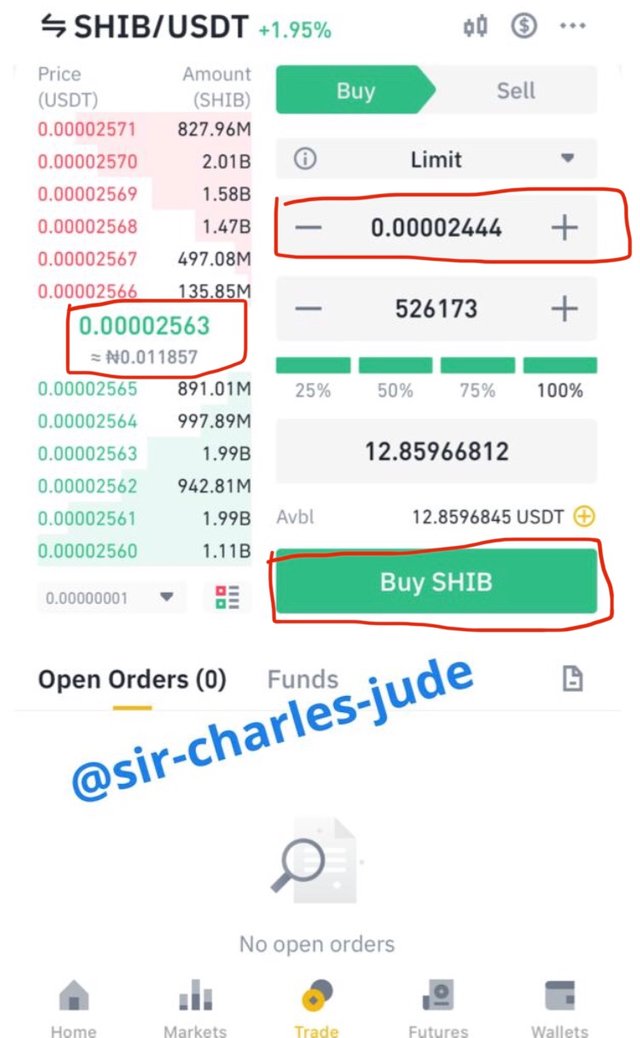

Step 5

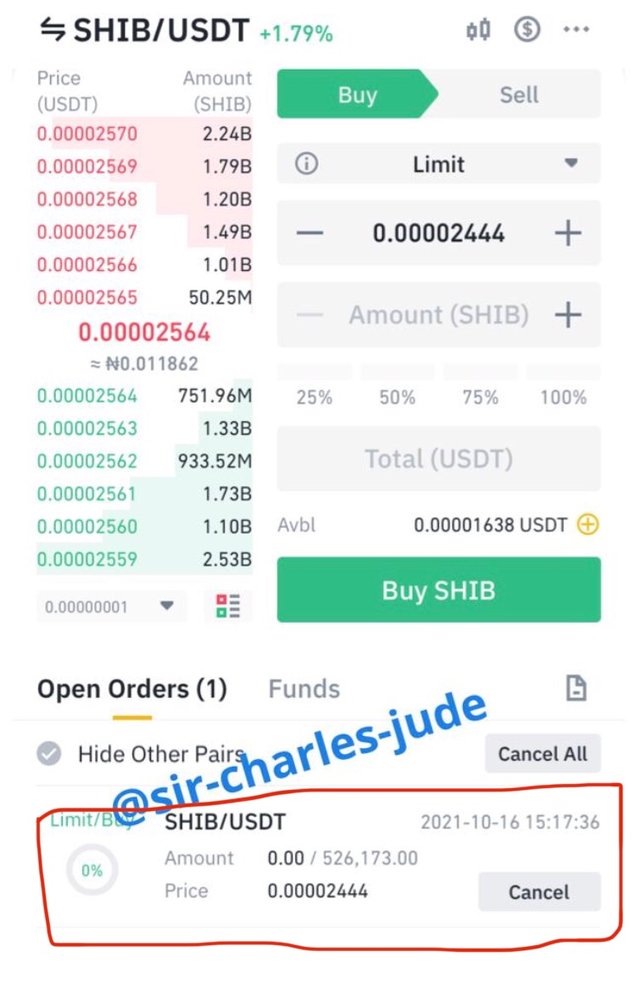

Then you set your limit order. I set my limit order at 0.00002444 while the current market order price is 0.00002563. Then you click on buy to open the order.

Screenshot got from my binance app

The order will be pending until it gets to the limit order price I set before the trade will be executed.

(4) USING A DEMO ACCOUNT OF ANY TRADING PLATFORM, CARRY OUT A TECHNICAL ANALYSIS USING ANY INDICATOR AND OPEN A BUY/SELL POSITION ON ANY CRYPTO ASSET.

On my trading view app, I placed a buy for BTC/USDT.

Screenshot from my TradingView app

With the help of the moving average indicator which was indicating an uptrend, I place a buy order when it was 60874.76.

(i) WHY YOU CHOOSE THE CRYPTO ASSET

I choose to trade on BTC/USDT because of the way BTC has been moving in a bullish direction for some days now. I feel this pair will be a good pair for traders to trade on now. Some weeks ago, BTC was around $51k but currently, BTC is over $60k

(ii) WHY YOU CHOOSE THE INDICATOR AND HOW IT SUITS YOUR TRADING STYLE

I choose to use the moving average indicator because I wanted to know the trend and the moving average indicator helps to show the trend direction in the market.

(iii) INDICATE THE EXIT ORDERS

Exist orders are also very necessary. They help in managing risks in trading.

I set two different exit orders which are “take profit” and “stop loss"

I set take profit at 87000 and stop loss at 50000.

Screenshot from my TradingView app

CONCLUSION

Trading cryptocurrency is a very big advancement in the world today. Also, when trading cryptocurrency, one should always know the best type of order to use in his/her trade which depends on the condition of the market.

Thanks to professor @reminiscence01 for the wonderful lecture. I learned so many new things.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @sir-charles-jude, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit