1.) How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved.

Bitcoin, which is the world's first cryptocurrency has a pre-programmed feature where the block reward halves after every 210,000 blocks mined.

This happens once every four years and the phenomenon is known as halving. In the history of Bitcoin, three halvings have taken place and the Bitcoin algorithm has it that there will be a total of 33 halvings after which the block reward will be less than 1 Satoshi.

The Genesis block which is the first block of Bitcoin Blockchain was mined in the 3rd of January, 2009 by Satoshi Nakamoto and set the initial block reward to be 50BTC.

Bitcoin's first halving occurred in November, 2012 which caused a steady increase in price up to $1,100. Although this didn't last because there was a prolonged fall in price which reduced it to $152 in January, 2015. After about 9months, it began growing again. At this first halve, the Block reward was 25 BTC and about 3600 BTC were created daily.

The second halving happened on the 9th of July, 2016. It was a anticipated by the crypto community and the rise in Bitcoin's renown led to an increase in price towards the end of May. There were ups and downs but the coin developed exponentially and reached its all-time high of $19,700 in December 2017. This in turn led to the emergence of ICO bubble which increased the demand for Bitcoin especially as many ICOs accepted it. At this level, there were about 1,800 BTC created daily with a block reward of 12.5 BTC.

The third halving happened on the 11th of May 2020 when block 630 was mined. Initially, it didn't cause an increase in price especially with the advent of the Coronavirus pandemic which caused the price to collapse. This really makes it difficult to ascertain how much halving is already done into the price. At this stage, 900 BTC are created daily while the Block reward is 6.25 BTC.

The next halving is expected to occur around 2024 when block 840,000 is mined.

Currently, Bitcoin miners receive a block reward of 6.25BTC.

Two Halved Cryptocurrencies

Bitcoin Cash (BCH)

The Bitcoin cash was created in 2017 from the Bitcoin network. It is equally halved every four years after every 210,000 blocks. Presently, it's mining reward is 6.25BCH and it would halve in 2023 where the miner's reward will reduce to 3.125 BCH.

Litecoin (LTC)

Litecoin was introduced in 2011 by a man called Charlie Lee. In August 2015, its first halving occurred which was after 840,000 blocks were created and the miner's reward of 50LTC was halved to 25LTC. It is said that the next halving will happen in August 2023.

2.) What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

Consensus Mechanism also known as consensus algorithm functions in allowing a network of computers otherwise known as distributed systems to work together and stay secure. It is an essential requirement for any Blockchain protocol to function properly. For many years, these mechanisms have been used to agree on the state of the network amongst database nodes, application servers and other enterprise infrastructure. It ensures the security of users of the Blockchain and works to prevent economic attacks such as the 51% attack. There are different kinds of mechanisms and they all are built in different ways to solve the issue of security.

They include proof-of-history (PoH), proof-of-work (PoW), proof-of-stake (PoS), delegated proof-of-stake (DPoS), proof-of-brain (PoB), etc.

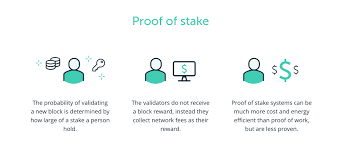

We will be differentiating between Proof-of-work and Proof-of-stake in the following ways:

Method of Work

The first difference between both consensus mechanism is they way they work. PoW is the oldest algorithm which involves adding a group of transactions in a mempool and the transactions have to be verified by miners by solving a cryptograhic puzzle. On the other hand, PoS doesn't rely on mathematical puzzles but chooses validators randomly based on their stake in the network and does not require the creation of any kind of coin.

Use of Energy

Proof-of-work have the leverage of using different kinds of energy such as wind, hydropower and other computational energy whereas proof-of-stake requires specialized hardware and an active internet connection with heavy energy which is quite expensive.

Security

Proof-of-stake which is a new consensus mechanism doesn't put restrictions on forking and users don't have to increase the amount of stakes in validating transactions on different copies of blockchain whereas in Proof-of-work miners must pay rapt attention to the blockchain fork.

Examples of Blockchains that use the proof-of-work (PoW) consensus algorithm are Bitcoin, Litecoin, Ethereum, etc.

Examples of Blockchains that use the proof-of-stake (PoS) consensus algorithm are Cardano, EOSIO, Polkadot, etc.

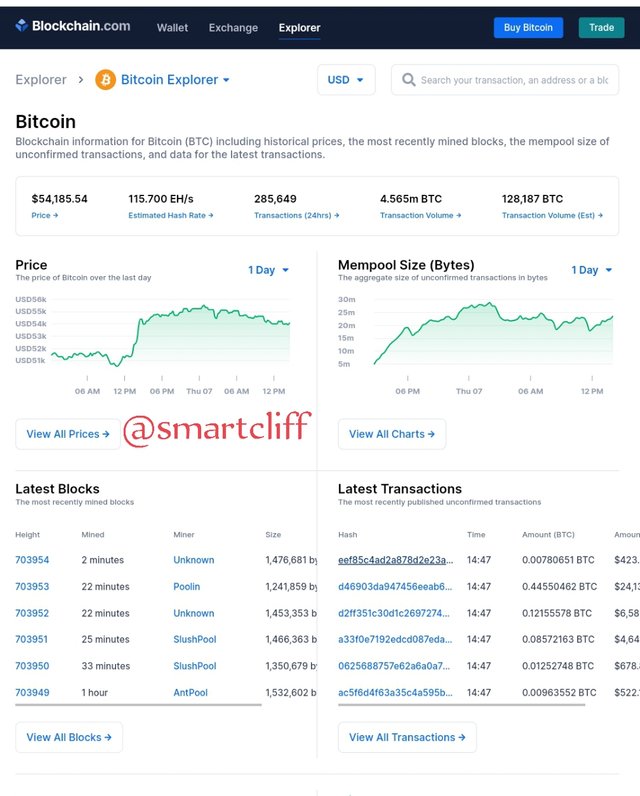

3.) Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

I visited the block explorer website to get information about the lastest Blockchain transaction.

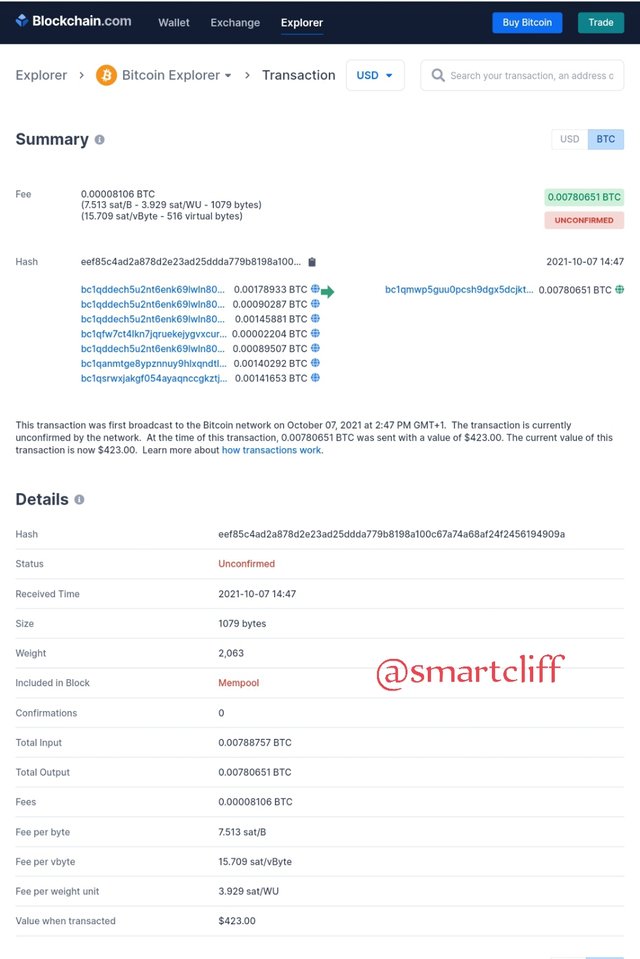

The details of the hash of the latest transaction are as follows:

The hash of the latest transaction is: eef85c4ad2a878d2e23ad25ddda779b8198a100c67a74a68af24f2456194909a

The transaction was included in Block 703955

Total Input is 0.00788757 BTC

Total Output is 0.00780651 BTC

Transaction Fees of 0.00008106 BTC

Value when transacted is $423.00

4.) What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

What is AltCoin Season?

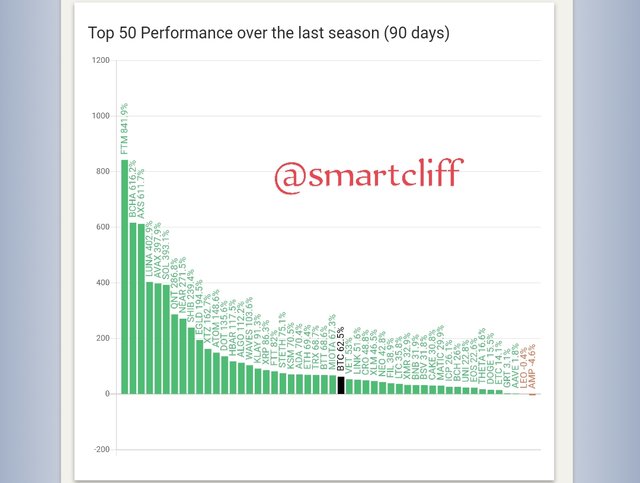

Altcoin season is a timeframe in the crypto ecosystem whereby all crypto assets in the market increase in market value except Bitcoin. This occurs as a result of 40-50% dominance of Bitcoin in the entire market. In this season, Bitcoin losses some of its dominance to coins that perform better. A prime example is the situation where Ethereum increased to a dominance of 20% when Bitcoin's dominance decreased by 40%. Some school of thought have it that if about 75% of the top 50 coins perform better than Bitcoin over the last season which is usually a period of 90 days, then it is an altcoin season.

What Season are we?

To answer that question plainly, I would say NO, we are not currently in altcoin season following the release from Blockchain center's website. Presently, the index of altcoin stands at 53 which invariably means that the index for Bitcoin is 47. However, the altcoin year index stands at 61, hence, the year may likely end with being an altcoin year.

Last altcoin season

The last season of altcoin took place between 25th March, 2021 and 21th June, 2021. The index fluctuated between 73 and 98% and saw peaked on the 18th of May, 2021 setting a new high record of 98%.

Growth of altcoin

According to the data released by Blockchain center's website...

In the last season, there were a couple of altcoins that performed excellently and I'll be talking about my chosen two...BCHA and AXS

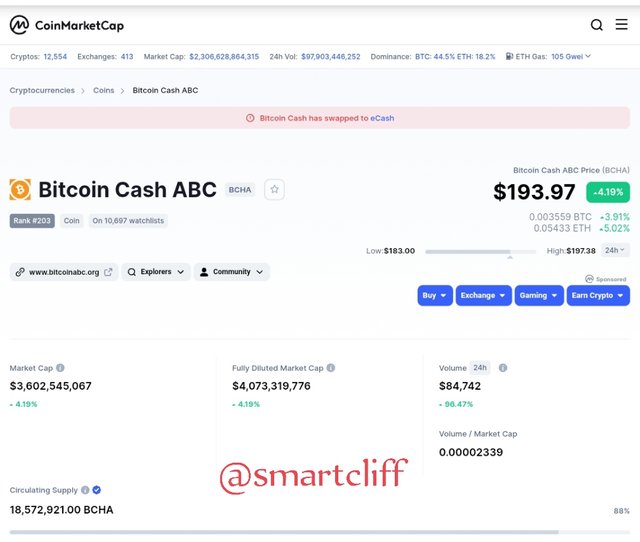

BCHA Token

BCHA is a native token of the Bitcoin Cash ABC which is a Blockchain and cryptocurrency produced on the 15th November, 2020 from the hard forking of Bitcoin. It has grown sporadically between the last season and now. Prior to the altcoin season, the BCHA Token was priced at $33 but after the season, it reached its all-time high of $400 which is about 600% increase.

BCHA has a market capitalization of $3,602,545,067

Fully Diluted Market Cap $4,073,319,776

Volume traded per 24h =$84,742

Price= $193.97

Rank =203

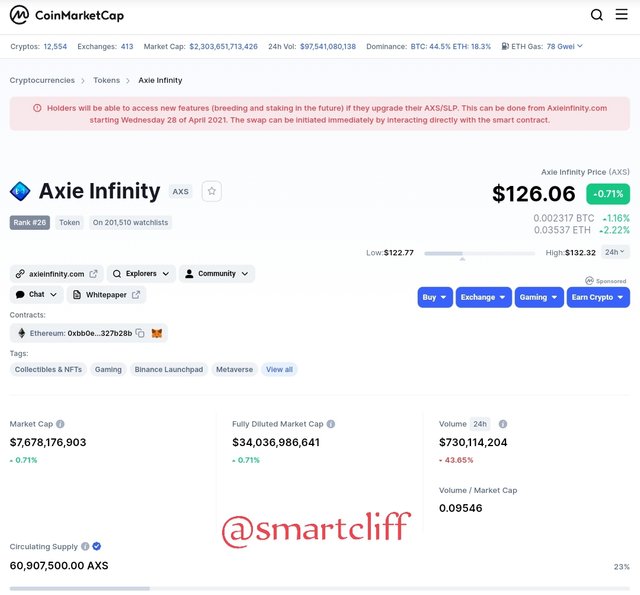

AXS Token

AXS Token is a native token of Axie Infinity which is a Blockchain-based game. Here, in-game characters are purchased, trained and sold for profits. From the last altcoin season, there has been a tremendous growth in the token. Prior to the season, it was priced at about $3 but between the last altcoin season and now, it has reached an all-time high of $155.27 which pegs it at over 900% increase.

AXS has a market capitalization of $7,678,176,903

Fully Diluted Market Cap $34,036,986,641

Volume traded per 24h = $730,114,204

Price =$126.06

Rank =26

5.) Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots.

I am unable to complete this part of the homework because I ran out of time and I had to submit my work before the deadline. My apologies!

6.) Conclusions

The halving of Bitcoin is a pre-programmed feature that reduces the rate of newly created Bitcoins in the form of rewards that the miner's earn for validating transactions. This usually occurs within a period of four years. Similar to Bitcoin, some other cryptocurrencies such as Bitcoin cash and Litecoin have their own halving timeframe and specifications.

Consensus mechanism is a system that harmonizes the works of the distributed systems with a Blockchain. There are different types of consensus algorithm and only Proof-of-work and Proof-of-stake were considered here.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit