Greetings, everyone.

I am participating in the Steemit Crypto Academy Contest Season 5 Week 6 - My cryptocurrency portfolio. A decent crypto portfolio can be profitable for you. You have to always learn to manage your portfolio. Otherwise, you can put your funds at risk. I have some knowledge about the cryptocurrency portfolio and I am going to share my thoughts with you.

Explain in your own words what a cryptocurrency portfolio is

Nowadays people love to invest in cryptocurrency. Beginner or Experienced, every trader needs to understand the cryptocurrency portfolio.

A cryptocurrency portfolio is a scenario of our total investment in digital currency or cryptocurrency. The Crypto portfolio represents our total investment in crypto assets like Bitcoin, Steem, Ethereum etc including NFTs.

A Verity of assets can be included in our portfolio. A Crypto portfolio is a manifestation of the crypto that we own or that we purchased. If I have three different cryptocurrencies in my wallet it means my portfolio is built with three crypto assets. If I spent 10 dollars on three cryptos, it means I have a portfolio of 30 Dollars. A Crypto portfolio indicates the total value or percentage of our investment.

Do you prefer a diversified portfolio or a concentrated portfolio? Explain each one.

I prefer a diversified portfolio rather than a concentrated portfolio.

Diversified portfolio- A diversified portfolio defines a portfolio belonging to different coins like Bitcoin, Steem, Trx, Dot, Gala etc.

Concentrated portfolio- On the other hand, when an investor concentrates on a particular crypto and holds the asset in his portfolio that defines as a concentrated portfolio. A concentrated portfolio has little or no diversification.

I prefer a diversified portfolio because this kind of portfolio can help us to limit the risk and reduce the volatility. This kind of approach allows us to manipulate the risk of our assets. There should be allocations for various assets so that we do not overlook a massive loss.

Cryptocurrency trading is so profitable but it is too risky also. Suppose, I have allocated my funds for just one asset. Though I can manage the asset easily, but It can cost a massive loss also. Because I have put all of my funds into a single project, if the project fails, I will lose all the money in a single investment. The recent crash of Terra luna and FTX reminds us how risky it is to put our all money into a single project.

Diversification of a portfolio is focused on different projects and if a project fails other can recover the loss for me. So I love diversified portfolios. A diversified portfolio can be built with crypto from different industries like web3, metaverse, smart contracts etc.

In your portfolio do you have any crypto assets in Hodl?

We hold our crypto for the long term or we don't sell our crypto when the market goes down. Hodl (Hold On For Dear life) is a strategy to hold assets with a long-term vision.

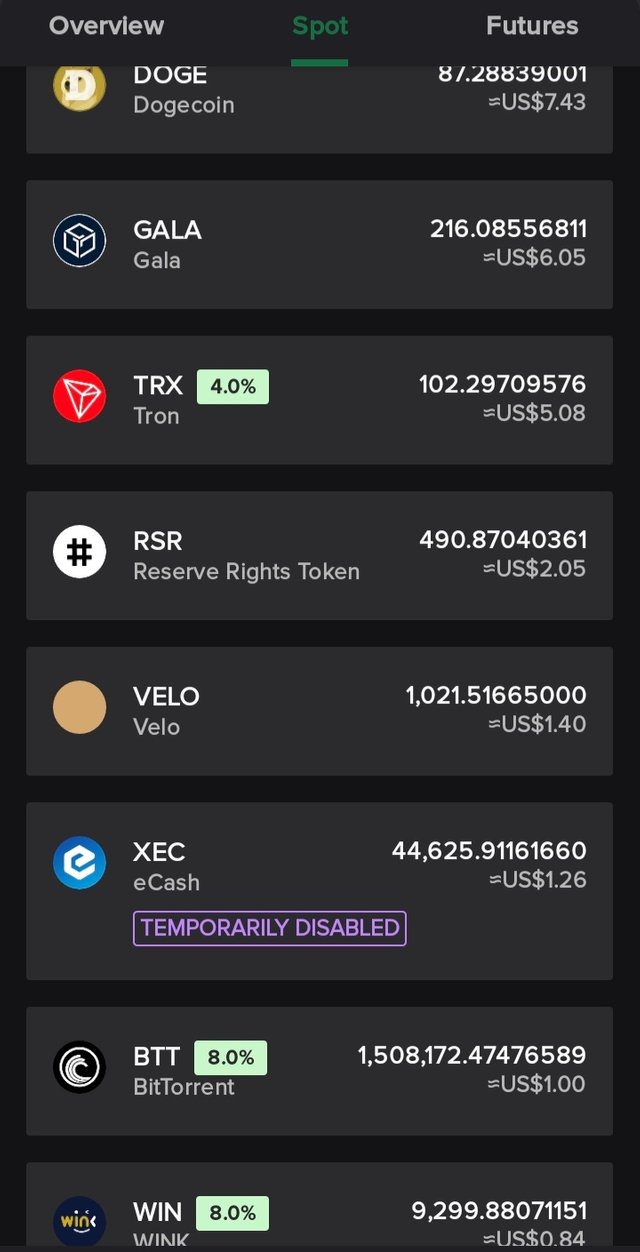

A crypto asset can give us a good profit when we hold it for a long term that's the theme of HODL. I have several crypto assets in Hodl. I have a little investment in some cryptocurrency. Here is the screenshot of my holding asstes on poloniex-

|

|---|

Explain what is Holder in cryptocurrencies.

Those who own crypto assets and hold the asset in their portfolio rather than going for trade are considered holders of cryptocurrencies.

Cryptocurrency holders don't trade always with their assets. Whether the crypto price goes down they don't sell their asset and hold the asset until they recover the loss. Crypto holders are good investors in crypto.

In your portfolio, you have some crypto assets in Staking.

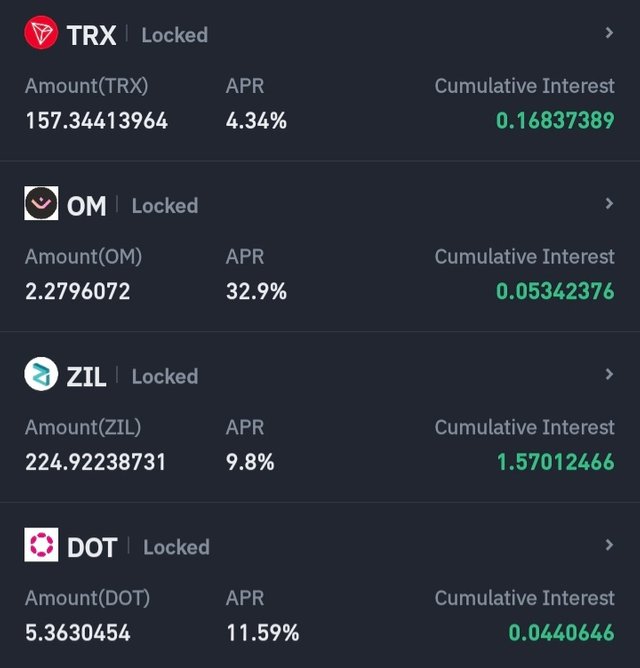

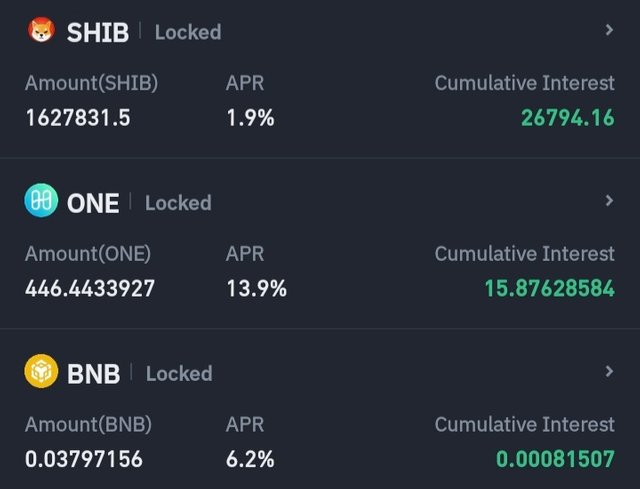

In my portfolio, I staked some of my crypto assets. I staked those cryptos because the crypto market is trembling in the bearish zone. Moreover, I am targeting a price range for my assets.

I will wait and not sell my crypto until I achieve my target. When I hold my crypto asset it will remain in a dead state. I can put them in work through staking. Staking provides me with the opportunity to earn from the asset I staked.

|  |

|---|

Explain what is Staking in cryptocurrencies.

Staking is a way to put our assets to work and earn rewards without selling them. Through the staking process, we can help to maintain the security and efficiency of the blockchain network. We earn the rewards for contributing to the blockchain.

Some cryptocurrency use staking to verify their transaction and provide rewards who locked their crypto in staking. Staking doesn't associate with all cryptocurrencies. For staking, you need to own crypto that follows the proof-of-stake model.

You can stake your crypto to earn rewards. In some cases, you have to wait for a certain period for using your crypto but the asset will be in your possession and you can trade them after the staking period.

Which do you prefer Hodl or Staking?

Hodl or staking can be a decent strategy if you can apply them by measuring the risk. In the bearish market scenario, Hodl and staking both seem to be profitable for the investors.

Hodl is the process to hold a crypto asset for a long time. Buying the coins at a low cost and holding them for a long to get a good profit, that's the motive here.

Staking means locking the crypto for a certain period and earning interest for that. Staking is the way to earn rewards with our crypto by putting them to work. The reward is destributed base on the staked amount of our crypto.

I prefer staking. In my opinion, Staking is more profitable and better than Hodl. We can easily put our crypto to work and earn rewards from that. Though there is some risk of locking the assets for a certain period.

But it's also a task to observe the market and taking risks. When you invest in cryptos with a long-term vision it's better to go with staking. Or if you are willing to sell crypto in the targeted zone then you have to buy the tokens or coins at a low cost and hold them.

The Bearish market exists for a long time. Then there is nothing to do with our assets. At that moment Staking allows us to earn something with our assets. So I chose locked staking rather than just holding my assets.

But you have to make your research to choose which is profitable for you. Which is a more productive strategy that depends on the market situation.

Conclusion: Crypto lovers must know about managing their portfolios while investing in crypto. Always try to invest in the bear season, try to diversify your portfolio and book the profit in Bullrun. That's a simple strategy we can follow. Happy trading!!!

I am inviting my friends @toufiq777, @pea07, @shamimhossain & @arjinarahman to take part in the contest.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

En estos momentos bajistas, es bueno invertir en las criptomonedas que conocemos, en esas que sabemos que van a subir en cualquier momento.

Apostar es una buena forma de ahorro, mis TRX los coloco en Staking y voy generando pequeños intereses, es mejor apostar que dejarlos en Hold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will also try to stake my trx. Thank you for visiting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When someone pursues or joins crypto, they have to learn a lot about crypto. For me crypto is complicated, and every day we have to learn about crypto. Because crypto knowledge is endless to learn. I also share posts about portfolios, if you have time please take a look and I'm very happy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah we have to learn everyday in crypto. I will try to comment in your post also.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow you havig good collection of coins in your portfolio,thats cool.

Yes Diversified portfolio give better results for holders.

Nice Entry from you. Take care of you my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for your nice comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have written well @sohanurrahman about the said topic, you prefer staking because this process allows your crypto to work for you and earn passive income. There is always an interest associated with staking of tokens. You have also given a financial advice to traders to buy during bearish season and sell when the market is bullish to maximize profit. I wish you success in this contest my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it has been observed that staking also helps secure the network and if you have a lot of tokens, then your contribution is worth more. stakers get paid their percentage of the fees that were collected on all transactions that took place while they were securing the network.

Thanks for sharing friend, and goodluck in this contest. #steem-on.

I will appreciate if you equally engage on Mine

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit