A very wonderful thank you to @reddileep and greetings to every one, it was worth the time going through the lecture on the market making concept, it was indeed an expose. I got to learn some new basic contents as regards trading. Below I'll be doing justice to the questions that were asked at the end of the lecture.

Define the concept of Market Making in your own words.

Market making can simply be defined as the process of buying and selling securities through an individual account and ensuring liquidity in the financial market. The term market making just as the name implies is simply the process of making the market.

In the digital market, certain individuals drive this process of market making, this individuals are known as market makers. They do not have an opinion of their own, they simply manipulate the market by offering exchange services based on the bid and ask prices which are often influenced by demand and supply. This concept is known as the bid-ask spread

The market marker make their profit through this process, they can also incur significant losses through this process. Hence the work of market making is indeed a complex one

Explain the psychology behind Market Maker. (Screenshot Required)

Market makers manipulate the market in order to provide liquidity in the financial market. They do this by ensuring that the bid price is always slightly lower than the ask price. Conversely, the ask price is always aimed at being higher than the bid price at any point of the market and on any asset. By doing this, they actually make their gain through this process, i.e through the difference in the bid-ask spread.

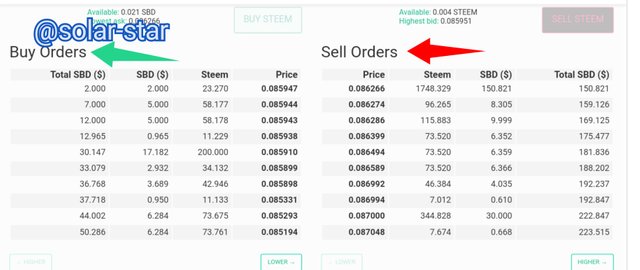

These orders are often reflected in the order book as shown below and they make it in such a way in which the bid price is always higher than the ask price.

However, the market makers can also incur significant losses when the market does'nt go in their favour, these are in rare cases of extreme volatility where the market rapidly shoots up or drops in split seconds. Moreover, immediacy is required in this process as the market trend may tend to swing at any time.

Market makers often finds the edge in every transaction so as to maximize their potential profits and minimize the risks which may arise. However, certain people can also contribute to the work of the market makers, they are those with the big capital. This people can also manipulate the market by withdrawing their huge capital which often leads to a dip in the market and subsequent repurchase during dip thereby making money from other smaller traders.

Explain the benefits of Market Maker Concept?

Market making comes with enormous benefits especially as regards trading, some of it are summarised below;

By providing liquidity

market makers provides liquidity in the financial market by constantly maintaining the edge between the bid and ask price (spread). They do this by making sure that the ask price is always greater than the bid price. By doing this, they help make the market liquid.Reducing price volatility

Market makers help reduce price volatility in the market by accumulating the inventory when liquidity in the market is very high. By doing this, they tend to a balance into the financial market by absorbing the demands at that time.Reduction of slippage

Market makers reduces slippage in the market i.e the difference between the actual price of a trade and the price in which it is executed at. This is most prevalent during the time of volatility in the financial market. However, market making helps reduce this effect.Significant increase in the number of investors

Market makers helps increase the number of investors for a particular asset by increasing the asset value. By doing this, more investors tend to get attracted to the new valued security.

Explain the disadvantages of Market Maker Concept?

Distortion of gullible traders

Market makers are guilty of this particular crime as they exploit on the ignorance of some traders to provide artificial liquidity in the financial market. By doing this, most traders tend to lose their hard earned money when the asset rapidly drops.They manipulate the market to their favour

Most market makers manipulate the market by providing delayed services by actually accumulating the inventory. By doing this, they deprive the trader of the immediacy at which the trade was suppose to scale through. This is always to their favour, as they put in all work to avoid risk.Market makers tend to work negatively against short time traders and most popularly the scalpers who make their profit through very short time trading usually in minutes. This is due to the tight spread often manipulated by the market makers.

Market making concept often deprives small capital traders from making profit as the low spread do not favour small income traders

Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

There are many technical indicators used in the market making concept, some of them includes;

MCAD, moving averages, relative strength index (RSI), TDI etc.

Moving average

This is one of the analystic tools used by crypto traders or financial market analyst to detect the direction of a trend using information and data from previous price movements. Its a lagging indicator in the sense that it trails the current price action to give its signal.

In the photo above, the moving average ( +21 and +55) crossed each other above the chart which normally signifies an intending strong downtrend, but in this case the chart immediately changed position and started spiking which suggests that the smaller traders have been tricked by the market makers into placing sell orders as evident from the chart above.

Bollinger band

Bollinger band is a technical indicator used by crypto traders or market analyst to forcast an intending trend in the market. It was created by John bollinger in 1980, they are veritable tool used in determining overbought and oversold positions in the financial market. The bollinger band tends to constrict when the market get noisy.

In the image above, the price breaks above the the upper band which signifies an overbought position and should be due for a pull down or an intending downtrend per say. However, the price continues to spike suggesting that the market makers have perhaps tricked the gullible traders into making quick sell offs and inevitably falling for the false signal which has been orchestrated by the market makers.

Conclusion

Understanding the concept behind market making is very essential not just only for crypto traders, but also for anyone who has intention of purchasing securities sometimes in the near future. This knowledge will help in understanding the workings of the market and also mitigating risks in the financial market to the bearest minimum. While trading, it is pertinent not to rely on a single indicator for signals as they most time gives out false signals.