image created on Canva

Greetings to everyone here in steemit, hope we are all having a wonderful festive period. I am here again for another homework, which the lecture was taken by our wonderful professor @lenonmc21 title Trading Strategy with Price Action and the Engulfing Candle Pattern. and below is my homework post, you can join me to study as well from the homework page. as I begin I wish you a happy reading.

Question 1- Do you say in your own words that you understand about the Trading Strategy with "Price Action and the Enveloping Candlestick Pattern", also describe each step to be able to execute it (Place at least 2 examples in clear crypto assets and with your charts mandatorily)?

The word Trading Strategy with Price Action and the Enveloping Candlestick Pattern is said to be a method/strategy which is used in placing an order, be it a sell or a buy order in the market by the use of the price action and also with the help of the engulfing candle pattern. this method/strategy is basically on the price action due to the carrying out of this method/strategy demand that the price create clear and clean movement. which is, the price in question is expected to have a better and clearer trend in other for the strategy to be used in providing an accurate result.

In a nutshell Trading Strategy with Price Action and the Enveloping Candlestick Pattern entails the noticing of a clear and clean direction of a particular trend movement to a specific position and stops to wait for a counter-motion to the new dominating trend movement. and after this must have taken place then on that account a trader is well promised that the current trend movement is near to take another form then he/he will have to wait for an accurate chance to take an advantage entry in the market. also in the current dimension, the price is creating, we await for the liquidation gathering of the price near the current trend and at this point, the Engulfing candlestick pattern is applied. here the pattern is being used as an entry area, so typically it is said to be the area we ought to watch out for in other to make an entry.

Bear in mind that the carrying out of this particular method/strategy request more and not just a time frame. but be that as it may, a less time frame within the range of 15-50 minutes is used to carry out an execution of this strategy and which gives a better return. now let us go straight to the business of the day, subsequently, I will be elaborating few steps on how to carry out trade strategy alongside price action and also the engulfing candle pattern.

Now the steps are as follows.

1- First we ought to get a clear Chart with a reoccurring trend: The first and number one thing to do is to get a clear chart with a reoccurring market trend which occurs periodically in other to carry out the trading strategy alongside the price action and engulfing candlestick pattern because we know that the price ought to create a clearer trend movement in the market in other to carry out such strategy. and also we ought to be assured of an accurate reoccurring of the price either in a retracement movement or an impellent movement and if not so, we should not relate it to the strategy. that is if a trend movement is not in alignment with the above mentioned then it is not be taken into account because the main aim of the method/strategy is to achieve a price action that is clear and clean.

Now in a situation like this, a period of 15min timing is advised in other to look for a spotless and accurate reoccurring price action. this is necessary and must be accomplished for the success of applying this strategy as seen in the below image.

image from Tradeview

2- to Identify a solid Movement that is contrary to the new direction: The next step is to be able to identify a solid movement that contradicts the new trend movement which has been formed already in the first step. having a solid movement near the contrary direction of the prevailing trend insinuates that many individuals investing are in the market already and are also much set to push the price to a different position. and as such thought must be made by us alongside with them and keep get set for the trade opportunity by this.

And also having this solid price movement which is already contrary to the prevailed trend, there should be a minimum of three candlesticks which must be found in the current direction indicating an outgoing trend as seen below.

image from Tradeview

3- Locate a break in the price as well as the engulfing candlestick pattern: This is another step, it entails the identification of a break in price after which we have recognized a solid movement, it is a retracement of a solid impellent in price which is going to be in line with the past dominated trend. and in such a situation, it is a bullish retracement and it is seen below.

image from Tradeview

Here we made use of the bullish engulfing candlestick, almost entirely as we have seen the last trend is bearish also the opposite trend is bullish, in such case we wait for the price to the pattern of the candlestick to be created after the strong move of bearish retracement. and note that the previous bearish candlestick must be enclosed by the new candlestick pattern. the engulfing bullish candlestick is seen in the above image which is indicated by a black vertical line.

4- Make a change of the chart to 5 minutes to search for an entry: As soon as we make a change of the chart to s minutes, we then search for a vivid and clearer break from the zone which is marked already by the engulfing candle on the15 minute chart, but a thing which can take place is that when the chart is been changed from 15 minutes to 5 minutes, then the area is broken already, and in such situation we await in other for the price to bounce back to the area and be refused by it, which is, we again await in other for the price retracement and as soon as a red candle is sent to us and the begins to pull back, we then make our entry quickly. we also place a Stop Loss a little higher than the previous retracement and also at the last support we can identify, we place our Take Profit. and in this situation it supports it on account of the entry is towards the downside as seen below.

image from Tradeview

So to round up the task above below is also an example to clarify the question.

This is the first step as seen below

image from Tradeview

This is the second step as seen below

image from Tradeview

This is the third step as seen below

image from Tradeview

This is the fourth step as seen below

image from Tradeview

Explain in your own words the interpretation that should be given to a big strong movement in the market. What does the price tell us when it happens?

At the period in which the price is in the range of making higher lows as well as higher highs alongside a clearer reoccurring that signifies the notion that the price is bullish, also it arrives at a particular spot that price is unable to make an all-high which is higher than the last all-high rather, it creates a solid movement in the opposite direction, this denotes that the current trend will take a new turn in the market.

This strong large movement is also known as the footprints of whales, many people who invest and also various institutions are involved in the market since they are the reason for the strong large movement occurring in the market. they often employ a lot of cash into the market to take advantage of the minor individual who is trading.

A large strong movement signifies that the whales are in the market, which implies that big individuals who are the major investors are pumping money in the market during a certain timeframe. and if the new dominating trend movement is bullish and the strong movement is moving towards the opposite position, then it might imply a reversal dominant trend movement. but on the contrary when the trend movement is bearish, then the strong large movement which opposite this trend may be signifying a reversal towards the upside.

note that, as soon as we notice a large strong movement is taking place in the market, then it implies that the new trend alongside the price has changed and also the new trend is about to change in no time.

Explain the trading entry and exit criteria for the buy and sell positions of the Price Action trading strategy and the Enveloping Candlestick Pattern on any cryptocurrency of your choice (Share your screenshots taking into account a good risk-profit ratio)?

To execute the entry and exit criteria for our buy and sell positions of the Price Action trading strategy and the Enveloping Candlestick pattern is quite easy when the terms am about to mention through the following steps below are dully observed.

Step 1- Ensure that the price is in a clearer trend as well as having a neat impulse and pullback alongside an agreement in price harmonic movement, which implies that the price may be seen in either a sharp upward trend or a sharp downward trend. and it must be fulfilled.

image from Tradeview

image from Tradeview

Step 2- After a clear trend in a strong movement is established, we have to bear in mind that, a minimum of three[3] solid candlesticks with a well-developed shape in the opposite spot of the dominating trend. after which we then search for the engulfing candle towards the pullback of the strong movement made. the pullback and the last dominating trend must be in the same direction, unless this is achieved we can not make an entry or exit so we then need to search for another favorable circumstance in the market. the solid appearance of the candlesticks is so vital as they indicate the footprint of the whales in the market and as such signifies that a change is about to occur in the market trend.

image from Tradeview

image from Tradeview

Step 3- Also bear in mind that the engulfing candle is the candle that makes the envelope candle. after knowing this then, the next thing is the identification of such candle in the duration of 15min then make use of a horizontal line to mark up the above as well as the below area of this envelope. and that is said to be our point of focus, after that we then make a change of our chart to a period of 5 minutes. after this change and we still notice that the zone is yet to break, we will have to wait for a clearer break alongside strong energy in other to make our entry. and after changing the time and noticing that the zone has broken, and now before we make an entry we will wait for the price to retrace back to the zone.

image from Tradeview

image from Tradeview

Step 4- Immediately after the engulfing candle marked with the horizontal line is broken within the period of 15 mins, we then make an entry, note that the stop loss should be beneath the bullish, and the take profit is expected to be at the closest resistance should in case of any eventuality of a strong movement against the last bullish trend movement, in the period of 5 minutes the stop loss is expected to be high above the bearish candlestick and also the take profit is expected to be at the last resistance and support. after that is done in other to checkmate either the support or the resistance, we have to make a change in time to the period of 15 minutes or above that. and know that a minimum of 1:2 risk-reward ratio must be our targeted profit.

image from Tradeview

Make 2 entries (one bullish and one bearish), using the trading strategy with "Price Action and the Enveloping Candlestick Pattern. These entries must be made in a demo account, keep in mind that it is not enough just to place the images of the execution, you must place additional images to observe the development of these operations to be able to be evaluated correctly and see if they understood the strategy.

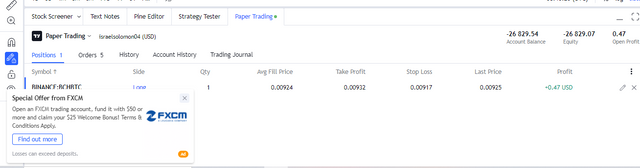

Now I will be making both entries with my Paper Trading account, so I will be making my buy and sell entries.

I will be making use of BCHBTC to carry out this practice.

From the chart below we can all see that the digital currency was having a downtrend, which was making lower lows and low highs, and as such will be a bearish structure that is made. and we can see that the currency made a break from the moving trend but with a strong force, and as seen again a motion with 3 candles which has been noticed, and the motion is to the opposite position of the moving trend and it is going to be my affirmation of the price action strategy with the engulfing candle next step.

image from Tradeview

The next thing to do is to await the price downtrend correction again and as such I will await for the engulfing candle which envelopes the last candle that was formed, so I also went ahead to mark up the end of the candle with a horizontal line and also as seen I mark it with a vertical line as well to mark out the engulfing candle.

image from Tradeview

As confirmed in the image below, I started making a profit within a short while, it reaches my stop loss with the use of the prince action strategy and the engulfing candle pattern, and as we all can see the trade shows that I am gaining profit, and it is still running.

image from Tradeview

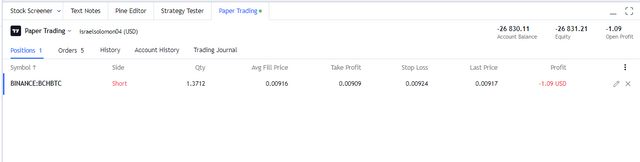

Now for the Sell entry I will be using the BCHBTC to explain the subsequent steps

image from Tradeview

As seen from the above image that the price of the currency was in an uptrend momentum, but I saw that the price was retracted by a minimum of 3 candlesticks were creating a fall in price and also a big candlestick was formed then I figured it out that I have to wait for an upward correction in other for a bearish engulfing candle to be formed and by then I can make my entry into a limited time.

image from Tradeview

So on getting to the 5-minute timeframe, a breakout was yet to happen in the engulfing candle area which has been identified but in a while, it got broken and I made my sell entry, also placed the stop loss at the last all-high spot of the last retracement and as well as my take profit which was having 1:2 ratio.

And as it was, the trade also gave a negative response as the trade execution was arriving at the stop loss resulting in a loss in the trade with the price action strategy which was next to the engulfing candle, and as we can see it is still running.

image from Tradeview

Conclusion

This wonderful strategy has taught me many things, it teaches me to be more patient enough in other to get an accurate outcome using the Trading Strategy with Price Action and the Engulfing Candle Pattern the reason is due to the much time it requires for the development of price and takes note of all requirements and procedures in other for the transaction to stay put.

All thanks to Professor @lenonmc21 for this wonderful teaching. Have a great New Year Ahead.