Homework Question

- What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

- Explain the following Risk Management tools and give an illustrative example of each of them.

- a) 1% Rule.

- b) Risk-reward ratio.

- c) Stoploss and take profit.

- 3.Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

- a) Trend Reversal using Market Structure.

- b) Trend Continuation using Market Structure.

- The following are expected from the trade.

- Explain the trade criteria.

- Explain how much you are risking on the $100 account using the 1% rule.

- Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions.

- Place your stoploss and take profit position using the exit criteria for market structure.

- (Show demo account balance and proof of trade execution)

Introduction

Happy New Year Steemians , I will be responding to Home task given by Professor @reminiscence01's , Thank you for your awesome teaching on ""Risk Management and Trade Criteria"" . below is my home task.

- What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

Risk management is the best way to prepare ahead for eventualities that may set in while trading crypto currency. Due to the volatility of Crypto market risk is inevitable, risk management is the best plan for handling potential threats and then develops structures that can manage risk .Risk management is something which traders need to learn in-order to maximize profit and minimize loss .

Risk management is the process of using trading tools to identify, assess and control threats or risk while trading crypto in order to maximize profit and minimize loss . We have different risk management tools used by crypto traders to manage risk example: stop loss and take profit, deciding the exit criteria etc.

What is the importance of risk management in Crypto Trading

The importance of risk management can never be over emphasized. Any trader that doesn't incorporate risk management skills is at verge of losing everything . below are some importance risk management.

Risk management Skill will traders to minimize loss and maximize profit. Traders can lose all his money if he does not in-cooperate risk management which will guide him while trading.

Risk Management will help boast trader confidence whenever he/she wants to place a trade. Trader will not be having double mind if he wants to place a trade because their is this confidence that comes within when you are on the right track.

Risk management gives the trader to regulate the amount he invest on a trade and gives him the opportunity to be cautious in whatever he is doing and also be consistence .

Risk management gives traders to be organized and give them opportunity to have anything planned out before they execute their trade .

- Explain the following Risk Management tools and give an illustrative example of each of them. (a) 1% Rule. (b) Risk-reward ratio. (c) Stoploss and take profit

Like I said Initially that crypto is very volatile and their is need to in-cooperate risk management in-order to maximize profit and minimize loss below is my explanation on risk management tools.

(a) 1% Rule

1% rule is one of the risk management tool that traders use while trading for optimum risk management. The rule Implies that you are allowed to use only 1% of your trading account to trade. Thus for every entry you are allowed to enter the market with nothing more than 1% of your account.Traders are allowed to risk 1% or at most 3% of his total trading capital. This gives the traders the opportunity not to liquidate the account with one wrong move .

Illustration:

For instance, I have the trading capital is $700 and I want to risk just 1% on every trade . below is the illustration of 1% Rule.

= 1% × $700

= 1/100 × $700

= 0.01 × 700

= $7

The above calculation implies that I will be risking $7 from $700 account. Even if I will be placing trade twice a day I wont be losing much . I will be lose just $14 out of $700. 1% rule helps traders to minimize loss.

(b) Risk to Reward Ratio:

Risk to Reward Ratio is another important tool that can be used to maintain, If a trader don't know how set risk reward ratio properly and the trade might be going well initially, it may reverse and enter loss if proper risk to reward ratio is not set. The recommended Risk reward ration is 1:2 or above.

Illustration:

For example, If a trader is using $7 to trade, then his target profit should be nothing less than $14. Trading with the same amount and risk reward of 1:1 not worth taking and advisable. A trader is expected to gain twice what he invested or risked but when a trader is using 1:2 reward ration is on the right track.

(c) Stop loss and take profit.

Stop loss and take profit is one of the risk management strategy used while trading . The major reason while the exit orders is used is to protect the fund of traders . Stop loss is being used to stop trade whenever a trade is moving in opposite direction against what the trader predicted. When the price of an asset reverse against what the trader predicted, the stop loss order will close the trade . Same goes to take profit order when a trade going in line with what the trader predicted,The take profit order is used to close the trade so as to take profit. Traders use stop loss and take profit order to protect their fund.

Illustration

Now, setting take profit and stop loss depends on the strategy you are using. There are some I which traders use to set stop loss and take profit. Also, We have so many tools in which traders can use but which ever tools a using, the stop loss should not be on a closer range so that trade will not throw traders off balance Same applies to take profit order, take profit is meant to too big because market will not allows be in a bullish trend all the time.

- Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). (a) Trend Reversal using Market Structure. (b) Trend Continuation using Market Structure.

- The following are expected from the trade.

- Explain the trade criteria.

- Explain how much you are risking on the $100 account using the 1% rule.

- Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

- Place your stop loss and take profit position using the exit criteria for market structure.

(a) Trend Reversal using Market Structure.

Entry Criteria

For this question I will be using the chart of ADAUSD. The picture uploaded below is the chart of ADAUSD which have made higher highs and higher lows movement on bullish trend But at some point the price fail to make a new high move after a while the price reversed to the previous low which confirms the break of market structure .

But immediately after the break in the market structure the price made a come back back which broke the low and a resistance was formed .

Source:Trendingview

Exit criteria

For stop loss order:

I placed a stop loss order at $1.582289. The trade order will automatically stop if price hits the stop loss order.For take profit order:

I also set the take profit order. This was set in accordance of risk to reward ratio is 1:2 and above.

Source:Trendingview

Calculating the Risk reward ratio to determine the stop loss and take profit

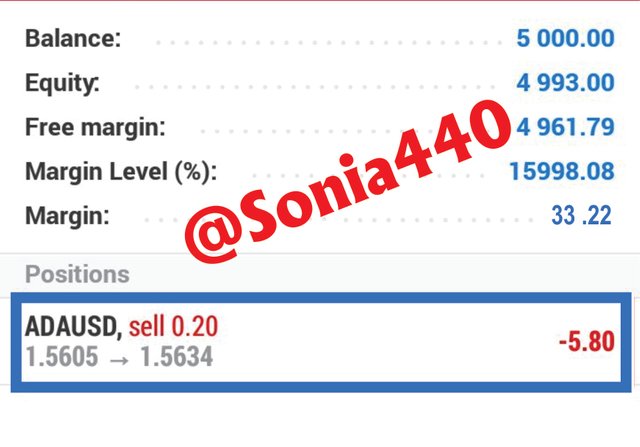

For this,I will be using MT4 to perform the transaction and also demo account of $5, 000 , below is the screenshot.

[Source](Screenshot From MT4 App)

I placed an order order with the following details: Entry price is $1.5604, Stop loss order is $1.5822 and Take profit order is $1.5124.

[Source](Screenshot From MT4 App)

I will be using 1% rule, I have decided to risk 1% of my trading account for every position I take.

1/100 × $5000

0.01 × $5000

= $50

Below is the image of the transaction of ADA/USD .

[Source](Screenshot From MT4 App)

(b) Trend Continuation using Market Structure

- Image uploaded below is the chart of XRPUSD . The, price was making making higher high and higher low movement until it was broke by the previous high , then it made a retest of previous high as shown in the image. Then price moved back up and a buy order was placed.

Source:Trendingview

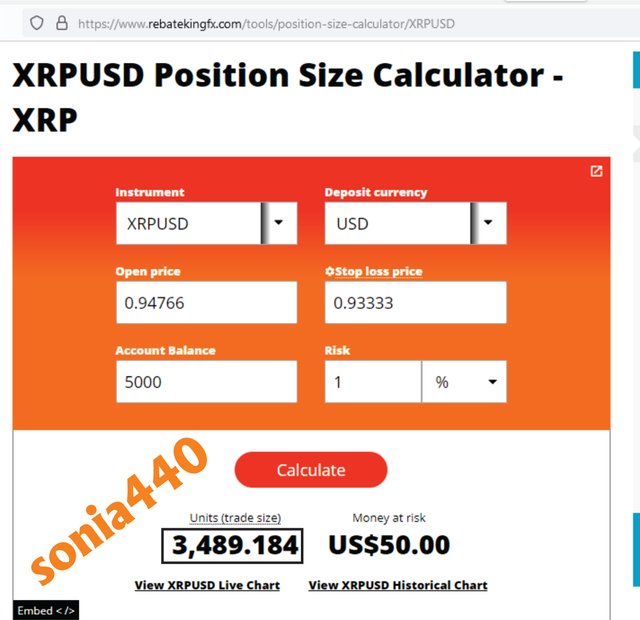

Immediately after a bullish movement , a buy order was placed and the detail is as follows : Entry price is $0.94766, Stop loss is $0.93333 and take profit is set at $0.96799 with the risk to reward ratio at 1:2

Source:Trendingview

I placed a buy order using MT4 app.

[Source](Screenshot From MT4 App)

For the calculation mentioned above.

In the calculation, I filled in the open price ,the stop loss, the account balance, percentage of the risk and I clicked on calculate. The result appeared in unit is 3,489.184 as shown below in the image .

Now to get the lot size:

1 units of XRPUSD = 0.0001

3,489.18 unit = L

L = 3,489.18 x 0.0001 = 0.34

So the lot size to be used is 0.37

Below is the image of the ongoing trade .

[Source](Screenshot From MT4 App)

Conclusion

In this lecture I was able to understand what Risk management. is all about the important and how to use it

Risk management Skill will traders to minimize loss and maximize profit. Traders can lose all his money if he does not in-cooperate risk management which will guide him while trading.

Am Thankful professor Professor @reminiscence01 for this wonderful lecture.

Hello @sonia440 , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit