Anyone acquainted with the term cryptocurrency is likely familiar with Bitcoin. Two engagement challenges have already delved into topics related to bitcoins in Crypto Academy, so I will address the first question directly. I aim to keep this post as straightforward as possible for better understanding. Notably, in the community description, it's mentioned that these challenges aim to increase awareness among the masses, akin to courses.

_20240129_232334_0000.png)

WHAT IS A BITCOIN ETF, AND HOW DOES IT DIFFER FROM OWNING BITCOINS DIRECTLY?

For understanding the concept of ETF (Exchange-Traded Fund), there is need for understanding a little background. Those who are familiar with the concept can can skip it.

Bitcoin is a decentralized cryptocurrency created in 2009 by an individual or group under the pseudonym Satoshi Nakamoto. Operating on a peer-to-peer network, Bitcoin relies on blockchain technology—a distributed and immutable ledger that records all transactions. This decentralized nature eliminates the need for a central authority, such as a government or financial institution.

With a capped supply of 21 million coins, Bitcoin mimics the scarcity of precious metals like gold to prevent inflationary pressures. Mining, the process by which transactions are verified, involves nodes solving complex mathematical problems. In return for their efforts, miners are rewarded with newly created bitcoins. Bitcoin ownership is represented by cryptographic keys stored in wallets. Transactions involve the transfer of ownership recorded on the blockchain.

Despite its pseudonymous nature—transactions are linked to cryptographic addresses rather than personal information—Bitcoin has gained attention for its potential as a store of value and medium of exchange. Its value is known for its volatility, influenced by market demand, regulatory developments, macroeconomic trends, and perceptions of its future utility. The cryptocurrency market, where Bitcoin operates, can be speculative and is subject to regulatory changes.

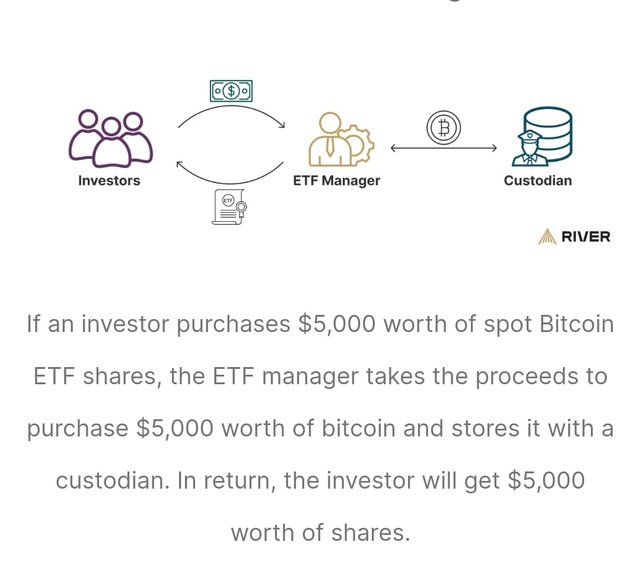

Investors looking to gain exposure to Bitcoin without directly owning the digital currency can utilize Bitcoin ETFs (Exchange-Traded Funds). These financial products allow individuals to invest indirectly in Bitcoin by holding shares in the ETF, representing their exposure to the cryptocurrency's value. These are investment funds you can buy, like purchasing shares in a company. Instead of owning actual Bitcoin, you own shares in this fund, which represent the value of Bitcoin. It's a way to be part of Bitcoin without dealing with all the technical details.

However, It's crucial to consider associated fees and potential differences in performance between the ETF and the actual cryptocurrency market.

As the name implies, ETFs are funds traded on exchanges. It just means these are funds you can trade on the stock exchange. They work like a team of investors putting money together. This team, managed by a Fund Manager, uses that money to buy a mix of different things, like stocks.

Investors receive allocations to units in proportion to their contributions, and each unit has a Net Asset Value (NAV). While this might resemble Mutual Funds, ETFs offer added flexibility – their units can be bought or sold on a stock exchange, similar to regular stocks. This stands in contrast to Mutual Funds, which can only be bought or sold at one price, the end-of-day NAV.

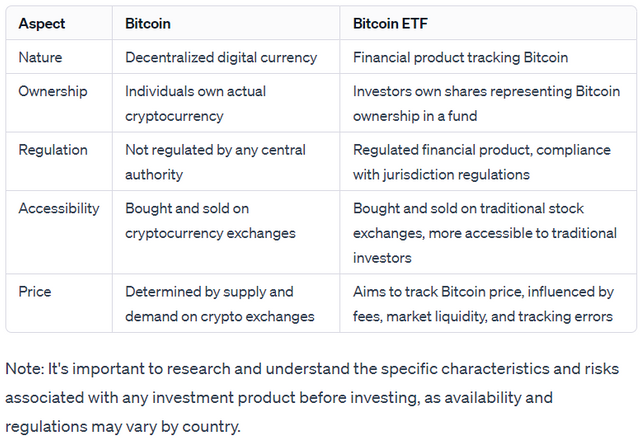

In short, while Bitcoin itself is a digital currency that can be bought and sold on cryptocurrency exchanges, Bitcoin ETFs are financial products that represent ownership in Bitcoin. The main difference lies in the way they are traded and accessed by investors.

if you are an investor, you may consider the following factors while making a decision:

Differences Between Bitcoin and Bitcoin ETF in Tabulated form

HOW CAN THE APPROVAL OF A BITCOIN ETF BY THE COMMISSIONER OF THE AMERICAN STOCK EXCHANGE SEC INFLUENCE THE CRYPTOCURRENCY MARKET? AND WHY DID IT FALL JUST AFTER THIS APPROVAL?

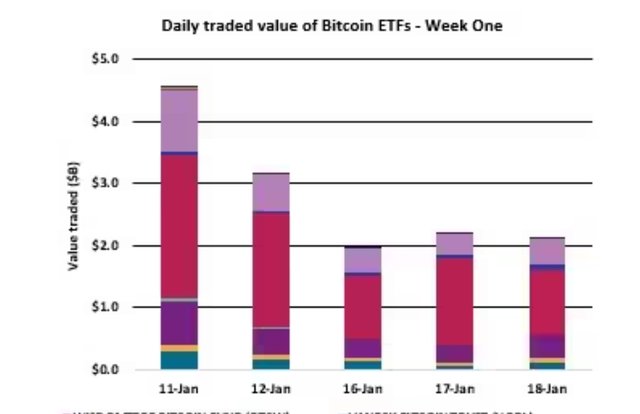

Earlier in January, 2024, The US SEC (U.S. Securities and Exchange) giving the green light to the first U.S. spot Bitcoin ETFs had a big effect on crypto stocks. It brought a wave of enthusiasm and positivity to the market. A lot of stocks linked to crypto saw a good reaction, with trading volumes going up and prices moving. This approval showed that cryptocurrencies are gaining more acceptance and acknowledgment, making investors more confident in the crypto industry as a whole. But remember, the market can change quickly, so it's smart to keep up with the latest news and talk to a financial advisor.

According to a source, the latest news about the approval are:

The US Securities and Exchange Commission (SEC) approved the US-listed Bitcoin exchange traded funds (ETFs). The US SEC has given its nod to 11 applications by BlackRock, Ark Investments, Fidelity, Invesco, VanEck and others to launch ETFs tracking the world's largest and oldest cryptocurrency, ignoring the red flags by officials and investor advocates over the risks associated.

Bitcoin spot ETFs already exist in Canada and Europe, but US SEC's nod open doors for the world's largest capital market. Analysts expect an influx of institutional funds pouring into the crypto space after SEC's approval. Some estimates have predicted a $1 billion inflow into BTC spot ETFs in the next three months and $100 billion by the end of 2024.

The potential "red flags" hinted in the statement might be reason of the fall of price. The concerns could include regulatory oversight issues, insufficient risk disclosures, or a lack of investor protections in the approved US-listed Bitcoin ETFs.

Another source Reuters states that:

WASHINGTON/NEW YORK, Jan 10 (Reuters) - The U.S. securities regulator on Wednesday approved the first U.S.-listed exchange traded funds (ETFs) to track bitcoin, in a watershed for the world's largest cryptocurrency and the broader crypto industry

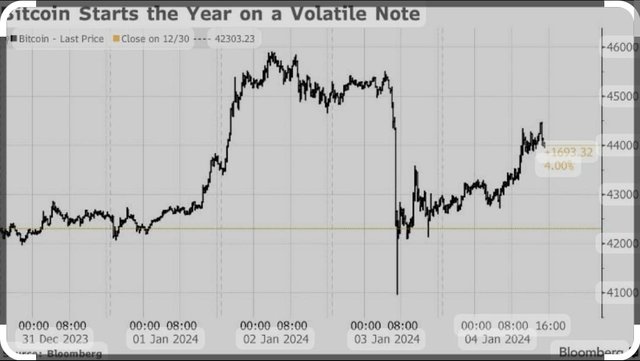

Despite the initial buzz and excitement surrounding its approval, the price of Bitcoin has fallen by over 20 percent since the launch of the first exchange-traded funds in January. Investors seem to be more cautious about directly investing in the token, as speculators assess the potential impact of these products, according to a Bloomberg report

Bitcoin Resumes Ascent With ETF Approval Expectations followed by descent

Hashdex Bitcoin Future ETF (DEFI) one week Stats

According to my understanding, following can be the reasons of descent in Bitcoin price after it saw an ascent following the approval by SEC:

.png)

HOW COULD THE APPROVAL OF A BITCOIN ETF BY A FINANCIAL AUTHORITY SUCH AS THE SEC CONTRIBUTE TO THE LEGITIMACY AND INSTITUTIONAL RECOGNITION OF CRYPTOCURRENCIES?

Based on my exploration of various news sources and crypto-related articles, the following observations have been made:

The evolving world of cryptocurrency eagerly awaited the introduction of a Bitcoin Exchange-Traded Fund (ETF), offering a regulated way for investors to engage with Bitcoin. The journey began with the Winklevoss twins filing the first proposal in 2013, facing years of rejections due to concerns over market manipulation and liquidity. Despite setbacks, ongoing efforts, regulatory advancements, and the emergence of Bitcoin futures ETFs signal growing optimism for eventual approval. This shift in narrative reflects the broader acceptance of cryptocurrencies as a legitimate asset class, attracting both crypto enthusiasts and traditional investors.

A popular name Edul Patel, CEO & Co-founder of Mudrex, asserts; The SEC's approval signals trust in the crypto market's legitimacy and maturity, boosting confidence globally. With global regulatory trends under scrutiny, Indian regulators may adapt their policies or approach to crypto-related financial products. Source

However, according to my understanding the approval of Bitcoin ETFs by SEC doesn't directly impact the legitimacy of other cryptocurrencies. Each cryptocurrency operates independently based on its underlying technology and use case. However, the approval of Bitcoin ETFs can have broader implications and a ripple effect for the overall acceptance and perception of cryptocurrencies in traditional financial markets.

The approval might signal a growing acknowledgment of cryptocurrencies within the mainstream financial system. This increased acceptance could potentially create a more favorable environment for other cryptocurrencies as well. However, regulatory decisions and market dynamics can vary for different cryptocurrencies, so their legitimacy is often determined by factors specific to each individual digital asset.

The overall effects of this approval on some of the cryptocurrencies can be summarized as:

.png)

Note: The actual impact on Ethereum, BNB, and XRP depends on factors such as market dynamics, investor sentiment, and regulatory developments. Cryptocurrency markets are highly volatile and subject to various influences, making it challenging to predict the exact consequences of a bitcoin ETF approval on other cryptocurrencies.

HOW MIGHT THE INTRODUCTION OF AN SEC-APPROVED BITCOIN ETF INTERACT WITH THE DECENTRALIZED GOVERNANCE OF THE STEEM BLOCKCHAIN, AND HOW MIGHT THESE TWO APPROACHES COMPLEMENT OR DIVERGE IN INVESTORS' PERSPECTIVES ON ASSET MANAGEMENT OF DIGITAL ASSETS?

The introduction of an SEC-approved Bitcoin ETF might not have a direct impact on the decentralized governance of the STEEM blockchain. These are separate entities with distinct technologies and purposes. However, the success or failure of the Bitcoin ETF could influence investor sentiment towards digital assets as a whole, potentially affecting investments in blockchain-based projects like STEEM.

ETFs and Steem Blockchain Governance:

Indirect Interaction:

ETFs can indirectly engage with the Steem blockchain governance through investments in cryptocurrencies associated with the Steem ecosystem.

Influential Cryptocurrencies:

If an ETF includes cryptocurrencies like STEEM or SBD (Steem Dollars), the performance of these assets may be influenced by the activities and behavior of investors within the Steem blockchain.

Investors' Actions on Steem Blockchain:

Impact on ETF Performance:

Investors participating in actions on the Steem blockchain, such as voting for witnesses, engaging in governance decisions, or participating in stake-based activities, can impact the overall sentiment and dynamics of the Steem ecosystem.

Affect on Valuation:

The actions of Steem investors may affect the valuation and performance of STEEM-related assets within the ETF.

Limitations of ETF Interaction with Blockchain Governance:

Limited Direct Interaction:

It's crucial to recognize that while ETFs may be influenced by the broader cryptocurrency market, their direct interaction with specific blockchain governance, such as Steem, is constrained.

Diversified Portfolio Focus:

ETFs function as investment vehicles that maintain a diversified portfolio, and their performance is primarily tied to overall market sentiment and the performance of the underlying assets they include.

Broader Market Influence:

ETFs are impacted by general market trends and sentiments rather than direct involvement in the governance decisions of specific blockchain networks.

In summary, these two approaches can be seen:

Investment Choices:

Investors may opt for the ETF for its regulated and mainstream appeal.

Decentralized governance on platforms like STEEM highlights community-driven decision-making.

Diversification and Perspectives:

Platforms like STEEM offer diversified exposure, yield generation, and active governance.

Investor perspectives vary based on risk tolerance, with some favoring ETFs for security and others preferring decentralized assets like STEEM for control and autonomy.

References:

.jpeg)

This post can rightfully be considered a research or scholarly work. It is very thorough and at the same time written in accessible language.

I have been familiar with cryptocurrencies since 2017. Before that I considered them a financial bubble. In fact, cryptocurrencies have not yet managed to firmly establish themselves as a means of payment or securities, so they have not far escaped from the status of a financial bubble.

I have heard a lot about Bitcoin ETF but I only really understood what it is after reading your post. Thank you very much for that. I can't even imagine how much time it takes to process such a large number of sources.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so very much.

I'm not sure about it being a scholarly article but I was very thorough with my research!

Your comment is the payoff for my efforts.

Even if one person was able to grasp half of the things I have written here, I would consider it a success!

Regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In fact, you explained everything very well and I would be grateful if you would continue to write such posts from time to time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love the way you have explained it,, i had no idea about these two but your post helped me understand them … way to go keep on writing the good stuff :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope it was understandable. The world is changing, and cryptocurrencies are the future, so it's a good idea to get acclimatized with these terms and concepts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was attracted to your answer in the last question. For sure investors in ETFs would make the investors have a limited interaction and impact on the Steem block chain.

However, funds owners or managers can directly have an impact in the governance of the Steem blockchain.

Well we will wait to see further impacts on crypto space caused by the BTC ETFapproval. But I believe, it all works for good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for reading it with such attention and such a valuable feedback.

This is my opinion of course.

But let's hope for the best!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Saludos @soulfuldreamer.

Los ETF de BTC en general es por decirlo de alguna manera como una forma de adquirir Bitcoin por inversores que no tienen el conocimiento de manejar una billetera o realizar algún intercambio de Cryptomonedas. Aunque parezca ilógico muchas personas tienen mucho dinero pero carecen de conocimientos.

Los ETF son una excelente oportunidad para que entre muchísimo capital al mercado crypto de inversores no tradicionales.

Éxitos en el desafió.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, the times are changing. Cryptocurrencies are getting more popular, and the SEC's approval of BTC ETFs is, for sure, another milestone achieved. So, fingers crossed for new avenues and ventures in terms of the stock market and investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

Your explanations are so clear that even complex concepts become easy to understand. I really appreciate how you connected the SEC's approval to the broader impacts on the market and the possible reasons for Bitcoin's decline. Your insights on the legitimacy of cryptocurrencies and their various effects are right on the money. And when it comes to the interaction with STEEM's decentralized governance, your thoughtful analysis adds a whole new level of depth. Good luck in the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I never thought a post could be intimidating. There's so much information but you've explained and structured it well like you always do.

I had very basic knowledge of ETFs but your research helped me to get more insights in the topic. Great work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad the post was helpful! If you have any more questions or topics you'd like to explore regarding my article, feel free to ask.

Thank you for your remarks:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With the approval of Bitcoin ETF by SEC Investors are now exposure to the Bitcoin and other cryptocurrencies which means more institutional Investors who can't buy Bitcoin through a crypto exchange will be able to buy from an investment firm using the traditional means which by so doing the crypto market will be stabilize. You have presented good post. Good luck to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for stopping by and your feedback

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM 5

Congratulations! Your comment has been upvoted through steemcurator08.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the support @josepha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post is manually rewarded by the

World of Xpilar Community Curation Trail

STEEM AUTO OPERATED AND MAINTAINED BY XPILAR TEAM

https://steemit.com/~witnesses vote xpilar.witness

"Become successful with @wox-helpfund!"

If you want to know more click on the link

https://steemit.com/@wox-helpfund ❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello dear friend greetings to you, Hope you are having good days there.

You have beautifully describe ETF. Yes ofcourse Bitcoin is a Decentralized Blockchain. In ETF we own BTC, but doesn't completely. We have partial hold on it. It is something very change from direct buying where we have complete hold on BTC. In ETF we just buy shares.

Yes ETF approval by SEC will ofcourse have too good impacts on BTC and crypto market. It will gain the trust of the people and we can see a huge liquidity in Cryptocurrencies. The demand of BTC along with other Aly coins will increases.

If we talk about it effects on Steem governance mechanism, so I think this isn't possible. Steem is managing it's governance according to it's own principles and regulations. I feel Steemit changing it's governance according to it's own interests.

The best post dear, best wishes for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your such thorough remarks.

Really? It is like a huge compliment 🙂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You really made a voluminous post about the concept of the ETF, Bitcoin etf, it application and it adoption on the STEEM Blockchain.

A Bitcoin ETF is a very goof way for investors to invest in the Cryptocurrency where they won't personally own them in a private wallet or so! Despite the good parts of the Exchange Traded Fund in Bitcoin or others, ithas it various pros and cons. One of the major one is the the etfis controlled by a centralized authority which will interfere with the governance of any decentralized exchange like STEEM.

In all, you have fully given yiur best answers to the questions asked.

Thanks for sharing and good luck with the challenge..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the feedback. I tried to cover the topic with as much clarity as I could.

I hope it answers all the questions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@soulfuldreamer Your clear explanations make complex concepts accessible. I appreciate how you connected the SECs approval to broader market impacts and potential reasons for Bitcoin descent. Your insights on the legitimacy of cryptocurrencies and their diverse impacts are spot on. As for the interaction with STEEMs decentralized governance your nuanced analysis adds depth. Best of luck in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your thoughtful feedback! I'm pleased to hear that the connections and insights were valuable to you.

I will be stopping by your article soon with my feedback. I'm sure you have explored the topic in a very thorough way!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Extraordinary post I have never seen the post with this much hardwork your post presentation is so well and I must admir your work how well you have written and I must same that I am you are doing great job or you have some experience that the reason you have given such deep analysis of each and everything best of luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you shanzay.

I hope you were able to grasp what I have tried to convey.

Thanks for the read.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome dear yes sure helpful for me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow my friend you have review all the questions in a very different way and in a very understandable with use of picture and you make the post so clear and with that it's presentation is also so much enhanced very comprehensive explanation you have given and to all the questions

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have talked about limitations of ETF Interaction with Blockchain Governance which I really like as well as you have also talk about some of the investing people perspective and choices at the divergence of two approaches according to the last question I really like your content I wish you good luck in this engagement challenge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings, my astute friend @soulfuldreamer! Your in-depth exploration of Bitcoin ETFs and their intersection with the STEEM blockchain is truly commendable. Your clarity on the SEC approval's impact adds a new dimension. All the best in the contest, success for you! 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Me gustó mucho como abordaste las diferencias comparativas por aspectos entre Bitcoin y Bitcoin ETF, esa tabla está perfecta.

Así mismo explicaste muy bien en una tabla los múltiples factores que alimentaron la caída después de la aprobación del Bitcoin ETF.

Similarmente explicaste en una tabla los distintos elementos de impacto que genera la llegada del Bitcoin ETF entre los que se nombran: incremento de inversionistas, sentimiento positivo del mercado, incremento de la competencia e impacto regulatorio.

Gracias por compartir, saludos y mucho éxitos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for giving our comprehensive understanding about Bitcoin ETF and it's effects at the overall market. I learn a lot from your post I wish you success in your entry

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit