Image edited by canva

Hello everyone, welcome to the steemit crypto academy season 4 homework post.

First of all, I would like to appreciate our awesome Professor @reminiscence01 for all his commendable contributions to our community. Thank you.

QUESTION 1

Explain Leading and Lagging indicators in detail. Also, give examples of each of them.b) With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question 1a.Do this for both leading and lagging indicators.

LEADING INDICATORS

.png)

Leading indicators are indicators that aid traders in determining the potential price movement of an asset. It makes use of the formal price information in predicting the future price of an asset. Leading indicators tend to provide traders with maximum profit a change in price movement can give because it signals traders on the possibility of a change in price direction before the actual change. This indicator achieves this majorly by identifying the overbought and oversold regions of an asset. Nevertheless, these types of indicators are not 100 percent accurate as certain factors such as price manipulation, false breakouts, fake reversal, and several other factors can mislead traders into believing that there's a real potential change in price direction. Therefore, in other to minimize the chances of falling for the above deceptions, other technical analysis tools are used alongside a particular leading indicator.

SOME EXAMPLES OF LEADING INDICATORS

- Fibonacci retracements

- Donchian channel

- key levels of support and resistance

- Stochastic

- RSI.

Fibonacci retracement:

This type of leading indicator predicts future levels of support and resistance. It is made up of significant numbers that often occur naturally and in finance.

Donchain channel:

This type of leading indicator is used to calculate the highest high and the lowest low in a particular period which in turn predicts the possible breakout or reversal of a trend.

Key level of support and resistance:

This level is determined when the price hits a particular zone multiple times without breaking it. Reaching this zone again, a trader can easily predict a price reversal.

Stochastic:

This is a momentum-based indicator that signals traders on overbought and oversold regions. This often shows where a trend might end.

Reletive strength index (RSI):

This type of leading indicator also signals a trader when an asset is being overbought or sold which in turn signals a possible pullback.

The leading indicator favors scalpers and short-term traders as they tend to maximize profits even if the new trend is short-lived.

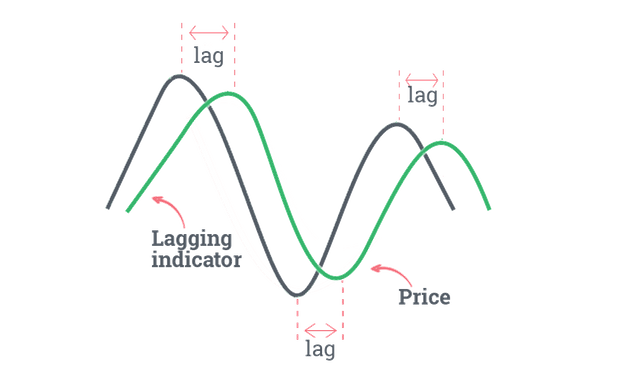

LAGGING INDICATORS

Lagging indicators are indicators which signals an already existing trend. Lagging indicators allows the price to first confirm its direction before signalling a trader making it not susceptible to feakouts or manipulations.

Nevertheless, it doesn't give traders the chance to make maximum profit out of a new price direction due to its late signal. Traders who rely on lagging indicators are often not scalpers and short term traders as price movement here are often confirmed before being signaled to make it riskier for scalpers and short term traders because they will have to make use of a wide stop-loss and wide stop-loss isn't favorable to scalpers as most scalpers are small capital traders. Not all trends are long-lived and this fact is another problem with lagging indicator for the fact that it can lead a trader into an already weak trend which is at its point of reversal.

This is why lagging indicators are best used with other technical analysis tools in other to minimize loss.

SOME EXAMPLES OF LAGGING INDICATORS

1.Simple moving average (SMA)

2.Bollinger Bands

3.Parabolic SAR

4.VWAP

5.MACD

Simple Moving Average (SMA):

A moving average is an indicator that majorly focuses on the actual price direction. It does this by neglecting some minor price fluctuations. Its slight delay in following price moving makes it a lagging indicator.

Bollinger bands:

These are trend-based indicators that aid in determining high and low on a financial market chart. They are used in the measurement of market volatility and in determining overbought and oversold regions.

Parabolic Sar:

A parabolic SAR is a lagging indicator that is most useful in a trending market. It is mostly used to determine when a price direction is changing.

Volume Weighted Average Price (VWAP):

This type of lagging indicator shows the average of various closing prices at a certain period. It makes periods with higher volumes clearer.

Moving Average Convergence Divergence (MACD):

This type of moving average indicator is used in identifying the nature of a new trend. It is mostly used alongside support and resistance area in other to properly identify when a new trend is likely to be formed.

From what I have observed so far, Lagging indicators are mostly trend-based indicators whereas leading indicators are mostly momentum-based indicators.

QUESTION 1b

With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question 1a.Do this for both leading and lagging indicators.

LEADING INDICATOR

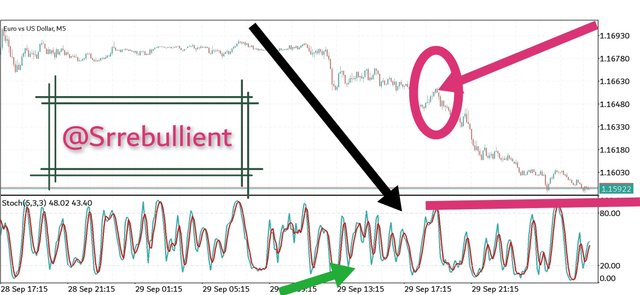

From my examples above on leading indicators, I will be picking stochastic indicator.

- STOCHASTIC

Just like we already know, stochastic indicator is a momentum based indicator which signals traders on overbought and oversold regions. This often shows where a trend might end. It makes use of support and resistance levels.

screenshot from my MT5 app

From the chart above, the black arrow is pointing at the overbought price line. Once a price of an asset rises above the line, the asset is considered as being overbought and a price reversal is expected.

The green arrow on the other hand is pointing at the oversold price line. Once the price over an asset drops below the line, the asset is considered as oversold and an upward price reversal is expected.

Looking at the main chart, the circled region shows the effect of an overbought asset on price direction at that particular period. After the asset was overbought, its upward price movement as at that time reversed just as expected.

The pink line which is placed slightly above the oversold line shows the resistance zone and below it shows the support zone.

LAGGING INDICATOR

From my examples above on lagging indicators, I will be picking parabolic sar indicator

- PARABOLIC SAR

A parabolic SAR is a lagging indicator that is most useful in a trending market. It is mostly used to determine when a price direction is changing. This indicator is very much easy to use as its dots clearly show the price direction.

screenshot from my MT5 app

The green dots on the chart identifies an upward and downward trend movement respectively. When the dots are above a trend, it shows that the price is on a downward trend and when the dots are below a trend, it shows that the price is on an upward trend.

QUESTION 2

What are the factors to consider when using an indicator?b) Explain confluence in cryptocurrency trading. Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required).

FACTORS TO CONSIDER WHEN USING AN INDICATOR

- Understanding your trading strategy

- Understand the market trend

- Understand the type of indicator

- Finding confluence

Understanding your trading strategy:

Just like I once mentioned above, the first thing to consider before using an indicator should be the type of trading that works for you. A scalper and a swing trader don't mostly use the same trading strategy as information on the market vary with time. A scalper mostly makes use of leading indicators like RSI and Stochastic due to its fast signal information. This fast signal information helps in decreasing the size of their stop-loss which is very important for a scalper.

Understand the market trend:

Understanding the market trend is a very important factor to consider before using an indicator.

Knowing that there are different kinds of indicators concerning market movement makes understanding market movement important. Indicators such as Volatility based, momentum-based, trend-based, and volume-based all have their various functions and in other to use them more effectively, a trader should be able to understand the market movement. A trending market requires trend-based indicators such as MADC, SMA, etc while a ranging market of sideways trend market requires volatility, momentum, or volume-based indicators such as Stochastic in other to determine the overbought or sold regions.

Understand the type of indicator:

When using an indicator, one must understand it very well before using it. What do I mean by this? A trader who is using MADC and still wants to capture a trend on time will require a leading indicator in other to achieve that. Without proper knowledge of the types of indicators, the above will be difficult to achieve.

Finding confluence:

Confluence is more like reconfirmation of a signal using different technical analysis tools.

For instance, using Stochastic to identify an overbought region, in other to verify this signal, it is required you use an analysis tool capable enough of doing so. Example of such is RSI, Support and resistance levels, etc. So in identifying an overbought and oversold region, RSI is best matched with the Stochastic indicator for more accurate verification.

QUESTION 2b

Explain confluence in cryptocurrency trading. Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required ).

CONFLUENCE

Conflucnce as a word means assemblage, joining of meeting. Just like we have the city where river naija and river benue meet known as confluence town.

In cryptocurrency, the meaning is not different for the fact that it still means a combination of different technical indicators/techniques of similar use in other to verify a signal. This combination makes a trader be more certain of a potential buy or sell signal. Just like using a stochastic indicator to determine an overbought region which is signaling a potential price reversal (downtrend). If the normal support and resistance level technique is analyzed and seen that the price of the asset has reached the resistance zone, a trader is more convinced of the price reversal. The more confluence, the more confident a trader becomes in placing an order.

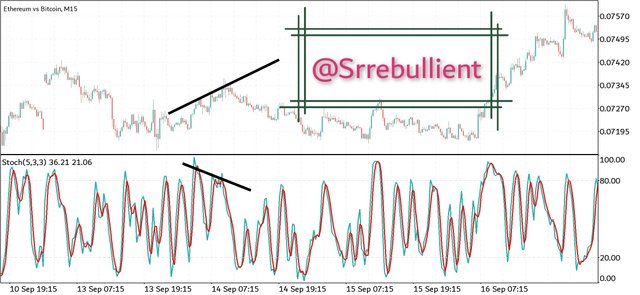

- Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required ).

ETH|BTC pair on MT5 trading app

In the screenshot above, I used a stochastic indicator alongside parabolic SAR with support and resistance technique in analyzing the price movement of Ethereum against BTC in a 15 minutes chart.

MY OBSERVATIONS

- The black arrows are pointing at a resistance zone indicating a possible price reversal.

- The Parabolic SAR dots are currently above the price trend indicating a downward trend.

- The purple arrow pointing at the stochastic indicator shows that the price is almost at the overbought region which is an indication of a possible price reversal.

MY CONCLUSION

With all three indicators pointing towards a downward price movement, I would sell.

ETH|BTC pair from MT5 trading app

From the above, it's much apparent that the price went exactly as I predicted and if I had taken the sell position after my analysis, I would have scalped some nice profits😉.

QUESTION 3

a) Explain how you can filter false signals from an indicator.b) Explain your understanding of divergences and how they can help in making a good trading decision.c) Using relevant screenshots and an indicator of your choice, explain bullish and bearish divergences on any cryptocurrency pair.

HOW TO FILTER FALSE SIGNAL FROM AN INDICATOR

False signals are usually a case with leading indicators as they tend to give out signals before the actual price movement. To filter false signals, a trader has to, first of all, observe the price movement of an asset regardless of the signal given. This helps to confirm that the signal given is correspondent to the price movement of the market.

The screenshot above is an example of a false signal.

In the screenshot above, the stochastic signal indicated an apparent oversold region yet the market price continued in an uptrend movement which means that it is a false signal.

QUESTION 3b

Explain your understanding of divergences and how they can help in making a good trading decision

Divergence occurs when the price of an asset is moving against the indicator.

Just like we have seen above in false indicators, divergence is a justification for the reason above.

We can say that with divergence, there is no such thing as a false signal as it clarifies that and give reasons for price movement against indicators. In other words, we can regard it as a false signal filter.

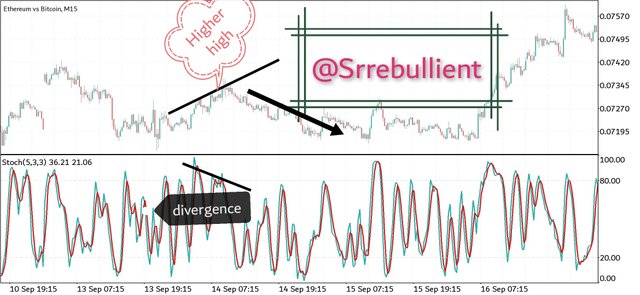

ETH/BTC

The chart above shows a divergence indicating a weak uptrend which resulted in a price reversal.

- HOW DIVERGENCE CAN HELP IN MAKING A GOOD TRADING DECISION

Taking the above example as an instance, a divergence aids traders in identifying weak trends thereby preventing them from jumping into such trends as they are prone to a possible reversal.

Divergence also aid traders in predicting possible proce movements as they point out weak trends which in turn indicates possible price reversal.

QUESTION 3c

Using relevant screenshots and an indicator of your choice, explain bullish and bearish divergences on any cryptocurrency pair

BULLISH DIVERGENCE

Bullish divergence occurs when the price chart is indicating a bearish signal or on a bearish trend whereas the indicator is indicating a signal opposite to that of the chart.

MT5 app

The chart above is a downtrend forming a lower low which is a more bearish signal whereas the divergence is signaling a lower high which is a bullish signal. The reverse of the downward trend is an indication that the trend is already weak as confirmed by the divergence.

BEARISH DIVERGENCE

A bearish divergence occurs when the price chart is indicating a bullish signal or on a bullish trend where as the indicator is showing otherwise.

MT5 app

The chart as seen above is in uptrend movement whereas the divergence is indicating a higher low which stands for a possible price reversal. This divergence signals that the trend is a weak one and it prone to a bearish reversal which indeed happened.

CONCLUSION

Technical indicators are very useful in stock and cryptocurrency trading. A trader should be able to differentiate between different technical analysis tools and know how to use them for more effective results. The leading and lagging indicators work differently in signaling a possible trend formation or price movement and in confirming an already existing trend respectively.

This course by our noble professor @reminiscence01 has indeed widened my knowledge further on the use of technical analysis and in the difference between leading and lagging indicators and their uses and also on the importance of confluence and divergence. All I can say is thank you so much professor @Reminiscence01 for this great lecture.

Hello @srrebullient , I’m glad you participated in the 4th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much professor @reminiscence01 for your encouragement.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit