Hello everyone, welcome to the steemit crypto academy season 4 homework post.

Firstly, I would like to thank our noble Professor @awesononso for all his awesome contributions to our community. Thank you, Professor.

QUESTION 1

Define the Order Book and explain its components with Screenshots from Binance.

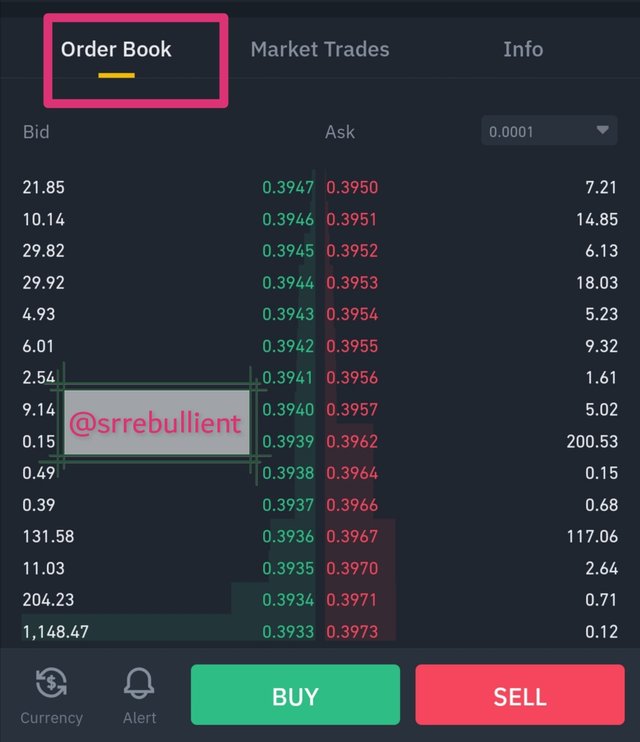

The order book is a serial arrangement of all open market orders of an asset. Its made up of the bid and ask orders, orderly arranged according to the order price with the highest price at the topmost and the lowest at the bottom.

Order book of Sol/BNB pair on binance

The order book is made of two sides which are the ask and bid sides.

The price located at the left-hand side is the bid order which shows all the current open buy orders of that particular asset.

The side on the right-hand corner is seen as the ask order which shows all the current open ask orders of that particular asset.

This overall open order helps in determining various activities of the asset which include liquidity level, the support, and resistant level, and the potential price movement of the asset.

QUESTION 1b

- explain its components with Screenshots from Binance

The order book in made up of some components which includes;

- BUY ORDERS

- SELL ORDERS

- ORDER HISTORY

The buy order is an order to buy an asset at a particular price. This is done with the mind that the price of the asset will increase above the price at which the buy order is initiated.

The various buy orders of a particular asset are arranged serially according to the difference in price with the highest price above and the lowest below.

BTC/USDT pair on binance

The sell order is similar but opposite to the buy order. It is an order to sell an asset at a particular price. This is also done with the mind that the price of the asset will decrease below the price at which the sell order is initiated.

The various sell orders of a particular asset are arranged serially according to the difference in price with the lowest price above and the highest below.

BTC/USDT pair on binance

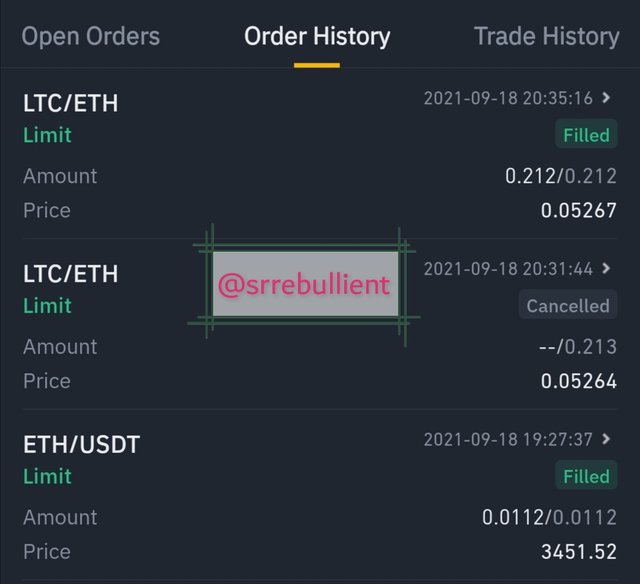

Order history is the total record of a trader's transactions.

It holds details of both succesful and cancelled orders. It also contains the date and time of various transactions.

My binance order history

QUESTION 2

Who are Market Makers and Market Takers?

Market makers are traders who provide liquidity on the market by adding their own buy and sell limit orders on the exchange market.

According to investopedia, the term market maker refers to a firm or individual who actively quotes two-sided markets in a particular security, providing bids and offers (known as asks) along with the market size of each.

Due to their preferred price level, market makers do not have their orders specified at the current market price.

Opposite to the market makers is the market takers.

Market takers are traders who don't have any say on an exchange market limit orders making them buy and sell at the ask and bid price of the market respectively.

According to Investopedia, A price-taker is an individual or company that must accept prevailing prices in a market, lacking the market share to influence the market price on its own.

Market takers are liquidity seekers where as market makers provide liquidity by creating a tight bid-ask spread.

QUESTION 3

What is a Market Order and a Limit order?

MARKET ORDER

A market order is simply an order that can be initiated on the market at any market price.

It is the type of market order initiated by market takers.

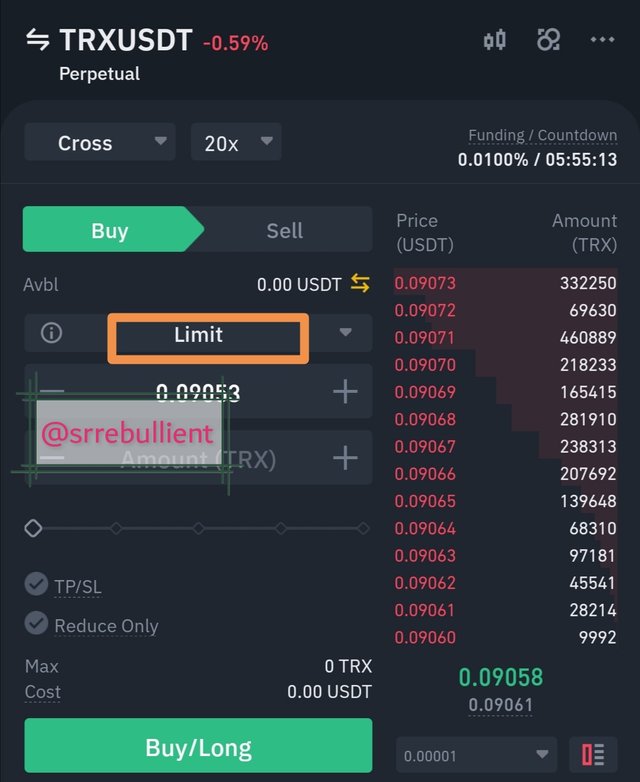

Binance TRX/USDT order

LIMIT ORDER

This is the type of order initiated by market markers. Unlike the market order, a limit order is a price fixed for a particular amount of an asset to be bought or sold.

QUESTION 4

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market

The fact that market makers initiate fixed pending orders using limit order creates liquidity for market takers.

Market takers in turn earn via the difference between the bid-ask prices created by their trades.

source

Market makers creates liquidity on an asset by opening orders while market takers fill up the open orders created by market markers.

The high liquidity created by market makers makes conversion of the cryptocurrency to fiat easier and faster.

The faster rate of converstion aid market takers is securing more profits.

QUESTION 5a

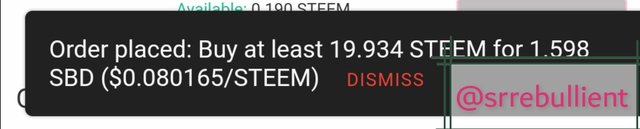

Place an order of at least 1 SBD for Steem on the Steemit Market place by accepting the Lowest ask. Was it instant? Why?

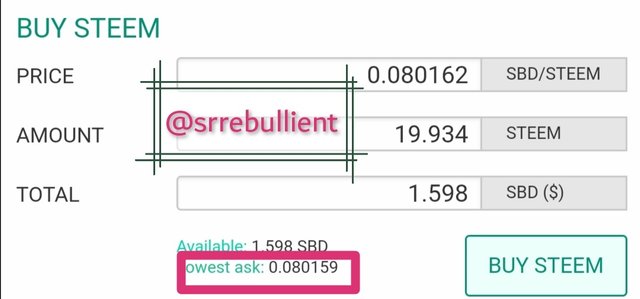

I will be placing the order with 1.598SBD.

STEP 1

Steemit market place

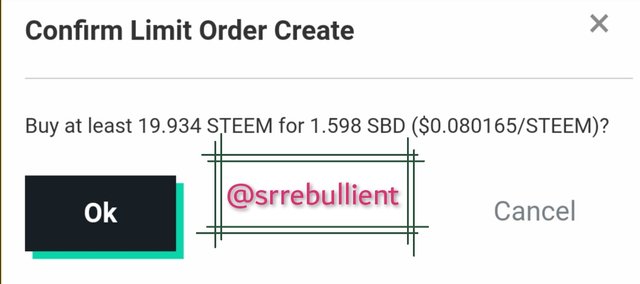

STEP 2

Press OK to proceed

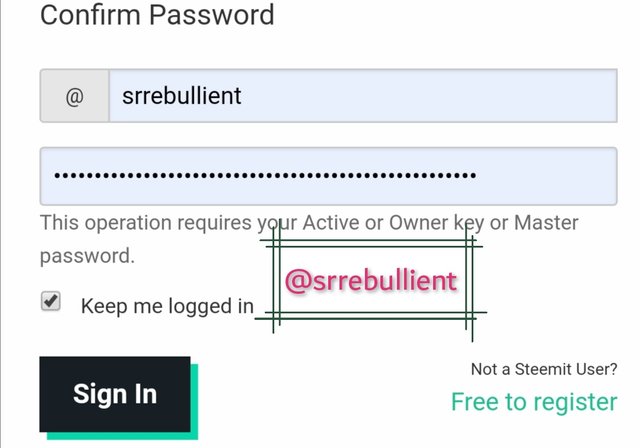

STEP 3

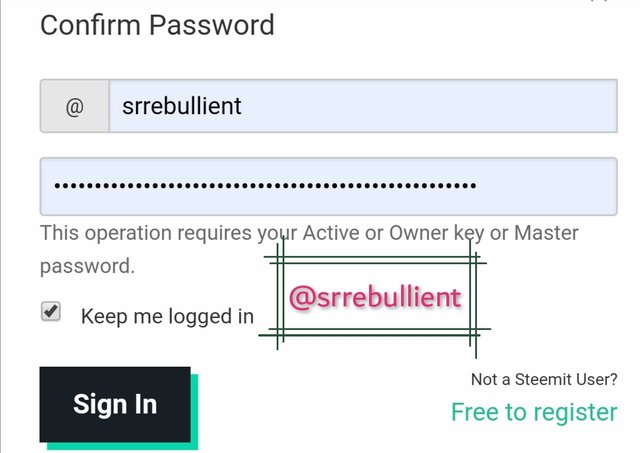

Sign in and confirm password to execute transaction

STEP 4

Transaction executed

- WAS IT INSTANT AND WHY?

The trade was instant because I took the position of a market taker by accepting the current bid price of the market.

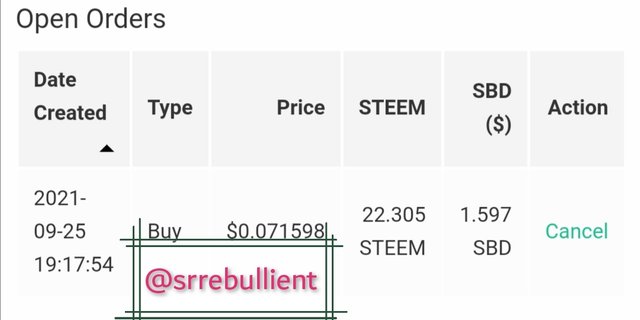

QUESTION 5b

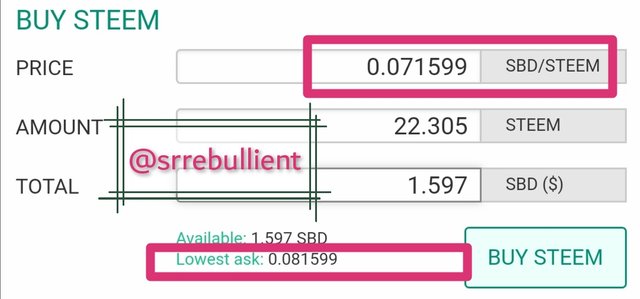

- changing the lowest ask. Explain what happens.(Make sure you are logged in to your wallet).

- STEP 1

change the lowest ask

- STEP 2

Press Ok

- STEP 3

confirm password by clicking on sign in

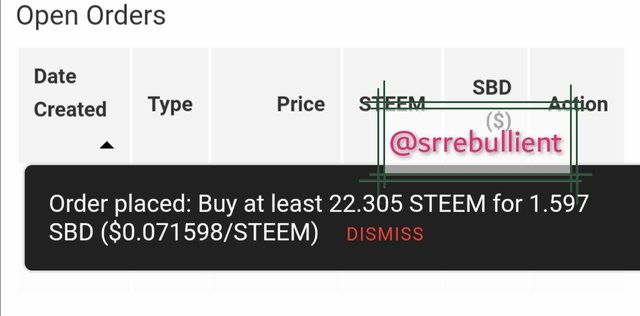

- STEP 4

Order created

- STEP 5

Order in open orders

The trade is not instant because I took the position of a market maker. The order was initiated below the lowest ask price so it will remain pending until the price of the asset goes down to the point that the minimum asks price will be at least 0.071598 before it will be completed.

As it stands now, the order can still be cancelled in other to get back my asset capital.

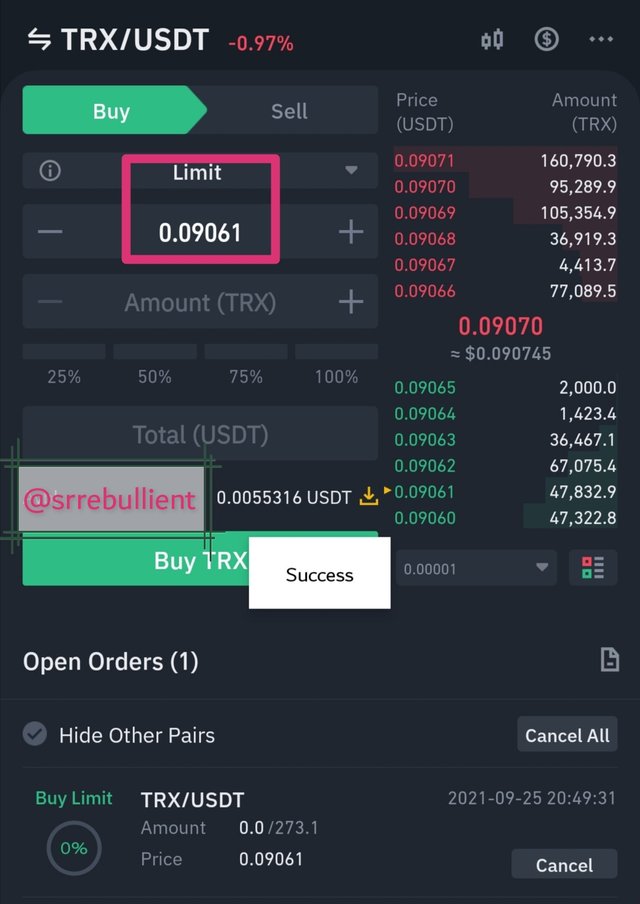

QUESTION 6

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

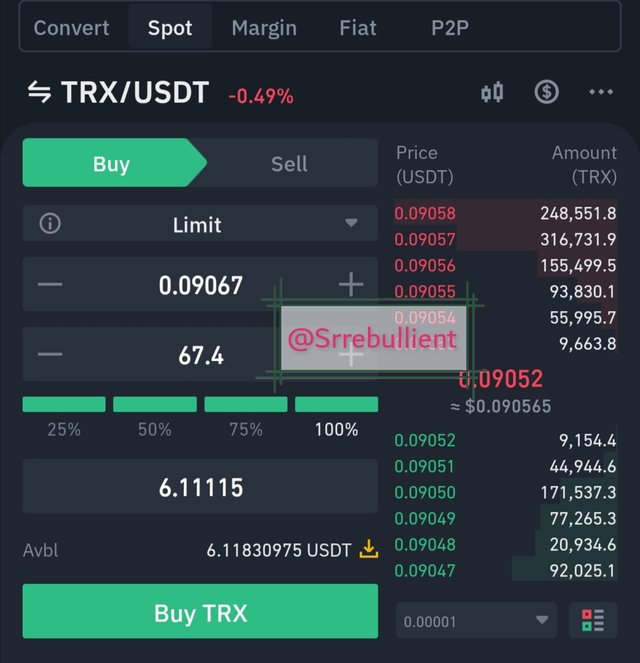

On binance, choose TRX|USDT pair on the spot market.

Open the pair and click on buy in other to buy TRX with USDT.

The limit order is slightly below the market price of TRX due to its volatility which means that the order will remain pending until the price of TRX falls to the limit order. This eventually adds liquidity to the market.

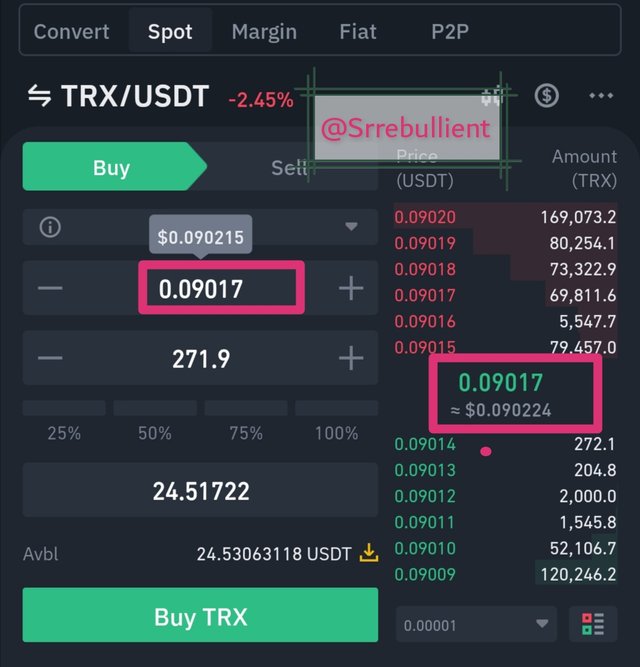

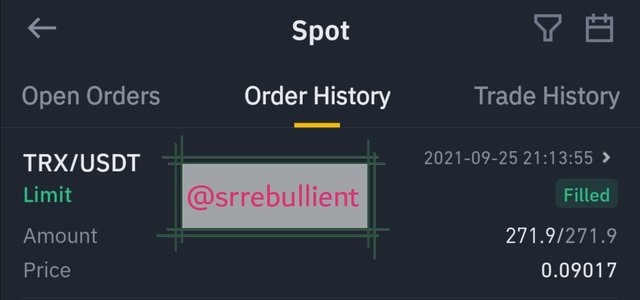

QUESTION 7

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

On binance, choose TRX|USDT pair on the spot market.

Open the pair and click on buy in other to buy TRX with USDT.

The fact that market makers are liquidity providers by playing orders at a fixed price regardless of the market price.

As a market taker, the impact of my order in the market is that it fills up the orders created by market makers.

Market takers also pay high fees during order execution.

Screenshot of the completed order

QUESTION 8a

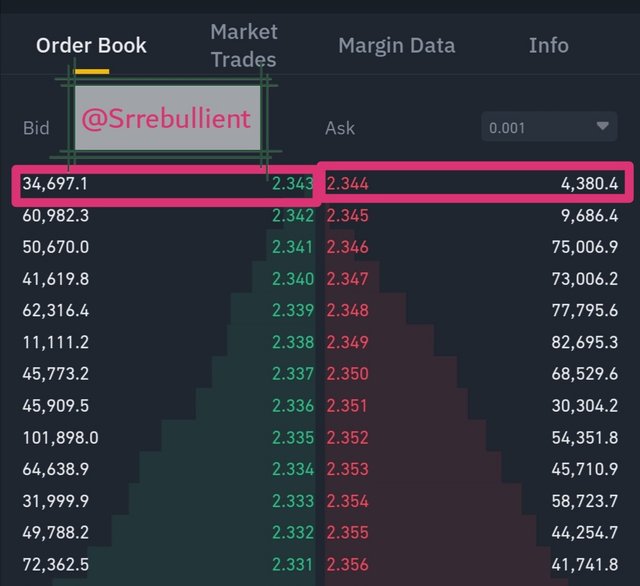

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

screenshot of the orderbook of Ada|Usdt

- Calculate the Bid-Ask

Highest bid = 2.343

Lowest ask = 2.344

The bid-ask price =(Lowest ask price - Highest bid price)

=>(2.344 - 2.343)

Therefore Bid-ask price =0.001.

- Calculate the Mid-Market Price

Mid-Market Price = (Highest bid Price + Lowest ask Price)/2

Highest bid price=2.343

Lowest ask price=2.344

Mid-market price = (2.343 + 2.344)/2

=>(4.687)/2

Therefore the Mid-market price = 2.3435

I just noticed with this calculation that the mid-market price is almost equivalent to the market price of $Ada.

CONCLUSION

The order book is a serial arrangement of all open orders of an asset. It comprises all the current bids and asks prices at that particular time. The majority of the open orders are executed by market makers which helps in providing liquidity to the market. The market takers fill in the open orders created by market makers and this creates a mutual relationship between them. The order book containing the bid-ask prices also helps a trader in determining the possible price movement of an asset by observing the difference in the bid and ask prices.

Thanks for reading.

Special regards to Professor @Awesononso for this awesome lecture.

.png)