created with canva

Hello everyone, I welcome us once again to the 6th week of season 4 crypto Academy. It is indeed a privilege for me to be taking part in this week's lecture by Professor @reminiscence01. Without wasting much of our time, let me quickly proceed with the given tasks.

QUESTION 1

Explain the following stating its advantages and disadvantages:

- -Spot trading

- -Margin trading

- -Futures trading

SPOT TRADING

Just as the name implies, spot trading is a type of cryptocurrency trading that happens on the spot.

I started my cryptocurrency trading with spot trading on the Binance exchange app. It was so straightforward to use which made me not need any help using it.

Spot trading is a type of cryptocurrency trading that creates a much closer relationship between buyers and sellers as sellers claim ownership of their assets at the spot. Trading on the spot doesn't necessarily need complex indicators as there is no need for complex calculations.

A spot trader doesn't need to worry about liquidation even when the price is going bearish. There is also no such thing as shorting when it comes to sports trading. Spot trading requires patience as profit comes with an increase in asset price which mostly doesn't happen very rapidly also risk in sport trading is very minimal as it comes with a decrease in asset price which also doesn't happen rapidly in most cases unless in the cases of rug pull.

ADVANTAGES OF SPOT TRADING

LOW RISK:

There is very little to no risk on spot trading as the only factor that affects the value of one's assets is the actual value of the asset which most times doesn't go extremely down unless in cases of rug pull.

THE SPEED OF OWNERSHIP:

Asset purchase on the spot account occurs very rapidly and the asset automatically gets moved into the spot wallet.

The speed of transfer of ownership between the seller and buyer on a spot account is what gave it the name "spot"

NO LIQUIDATION:

There is nothing like liquidation during spot trading as the trader's assets are worth their exact price and follow the same price movement in real-time unlike in futures trading.

EASY TO USE:

The trading spot is very much easy when compared to other types of trading as it simply requires just for a trader to either buy or sell their asset at the current market price or create a buy order in other to buy at a predictive future market price.

COMPLEXITY:

Spot trading is simple and doesn't necessarily requird the use of complex indicators or the use of stop losses as prices of assets doesn't fluctuate so widely within a short period.

DISAVANTAGES OF SPOT TRADING

SLOW PROFIT MAKING:

Spot trading doesn't usually give quick profit as asset prices are fixed to their actual prices and it follows its actual price movement in real-time which is usually slow.

CONVERSION CHARGES:

Spot trading is the conversion of one cryptocurrency to another usually from nonstable coins to stain coins or just buying and holding in wait of price appreciation. In cases of conversion, there are charges involved.

CAPITAL IS EQUIVALENT TO PURCHASING POWER:

One's trading capital during futures trading is equivalent to one's purchasing power which limits low capital traders from purchasing more than their capital which in turn limits their profits.

MARGIN TRADING

Margin trading is a type of trading similar to futures trading but very much different from spot trading.

Margin trading allows traders to acquire assets far more than their capital. A margin trader can borrow funds from the exchange or another investor. There are several unique features in margin trading and unlike soot trading, profit-making in margin trading is much the same as the risk. When the market is going against the trader's prediction to the point of almost losing all capital, the traders get a margin call issued by the borrower in warning not to go below the current capital and if the trader's loss goes against the warned capital, the borrower can close the trade even without the consent of the trader.

ADVANTAGES OF MARGIN TRADING

HIGH PROFIT:

Profit-making is much higher in margin trading due to leverage unlike in spot trading. A trader can increase his purchasing into 10× his capital through leverage.

ABILITY TO BORROW FUNDS:

A trader can borrow capital in other to be able to open a much wider position which would, in turn, yield a much larger profit.

AUTOMATIC STOP LOSS:

When there is a maximal loss, an automatic stop loss which is set by the borrower tends to stop loss. This automatic stop loss is what we know as a margin call.

DISADVANTAGES OF MARGIN TRADING

HIGH RISK OF LOSING CAPITAL:

Margin trading is very risky due to leverage. The rate of profit for a trader using 10× leverage on a $100 trading capital is equivalent to the loss if the market should go against the trader.

COMPLEXITY:

Margin trading is complex when compared to spot as traders are required to set their leverage values at points that best suits their trading capital in other to minimize loss. All this setup makes margin trading complex for beginners.

FUTURES TRADING

Futures trading is a type of trading that requires advanced trading knowledge from a trader in other not to get liquidated. Trading futures is all about taking advantage of the market up and down movements. When a trader buys because he believes that the price of an asset would go up he is said to belonging, when he does the opposite, he is said to be shorting. Risks in futures trading are very much high as a trader can lose all his trading capital in a matter of minutes if the price should go against him. This loss of complete capital is what is known as liquidation.

ADVANTAGES OF FUTURES TRADING

LEVERAGE:

Being able to increase purchasing power is a good thing when it comes to trading as the more assets one has, the more profit one makes if the price movement is well predicted.

TEACHES DISCIPLINE:

Futures trading teaches a trader the ability to take responsibility, especially in decision making. You don't just and decide to either buy or sell because you know that any wrong decision will cause a lot.

DISADVANTEGS OF FUTURES TRADING

HIGH RISK OF LOSING CAPITAL:

Similar to margin trading, futures trading also has a high risk of losing capital which is a result of leverage.

LIQUIDATION:

There is no such thing as liquidation in spot trading as trader can still continue to hold thier assets even if the price drops to the lowest minimum. This is not so in futures as a traders capital tends to vanish if there is no enough capital to keep the opened position open.

QUESTION 2

Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed).

Just as the name implies, an order is merely an instruction given to a broker by an investor in a request to buy or sell an asset.

There are different types of orders which include;

- Market order

- Pending order

- Exit order

MARKET ORDER

Just as the name implies, a market order is a type of order initiated by a trader in other to buy or sell an asset at the exact market price. This is one of the most common orders and the most used one, the reason being that it is most often used by newbies as they usually don't know about the other types of orders.

PENDING ORDER

This is a type of other that a trader makes in other to buy or sell at a possible future price.

A trader either sets the order to buy a particular asset at an already surpassed price because he believes that the price of the asset will fall to his predicted price the same thing happens when a trader wants to sell but in the opposite way.

There are different types of pending orders which includes;

- Limit order

- Stop limit order

- OCO order

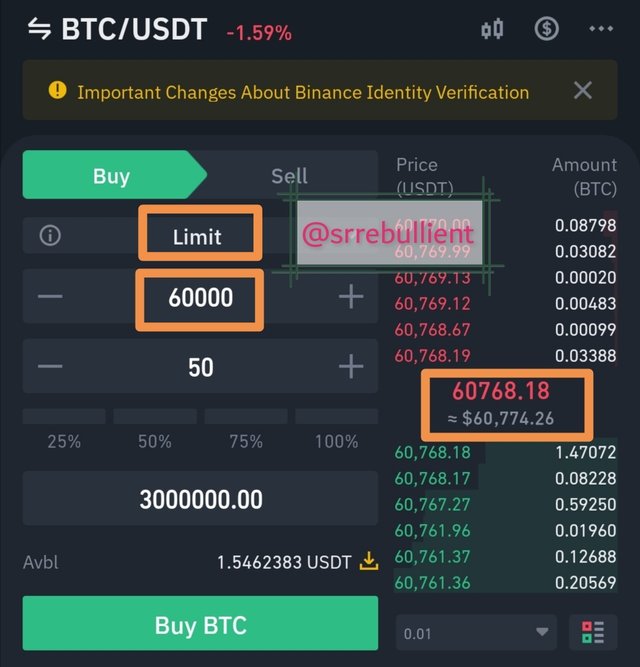

LIMIT ORDER

A limit order is a type of pending order that allows a trader to buy or sell an asset at a particular price of choice. Just like in the above instance where a trader is allowed to set a buy price and wait for the asset he wants to buy to retrace to that price before buying.

Looking at the price below the limit, you will see that the price is set at $60,000 when the current price of BTC is at 60,768. This means that the trader is expecting the price to retrace to 60,000 and once that happens, his buy order will be initiated.

screenshot from my Binance App

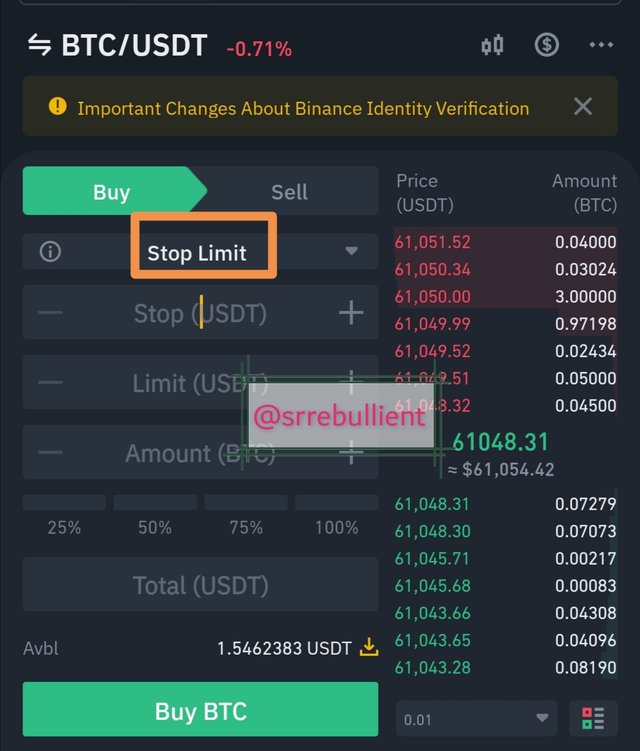

STOP-LIMIT ORDER

This is a type of pending order that executes orders when a price reaches a stop price. It is mostly used to minimize risk.

screenshot from Binance App

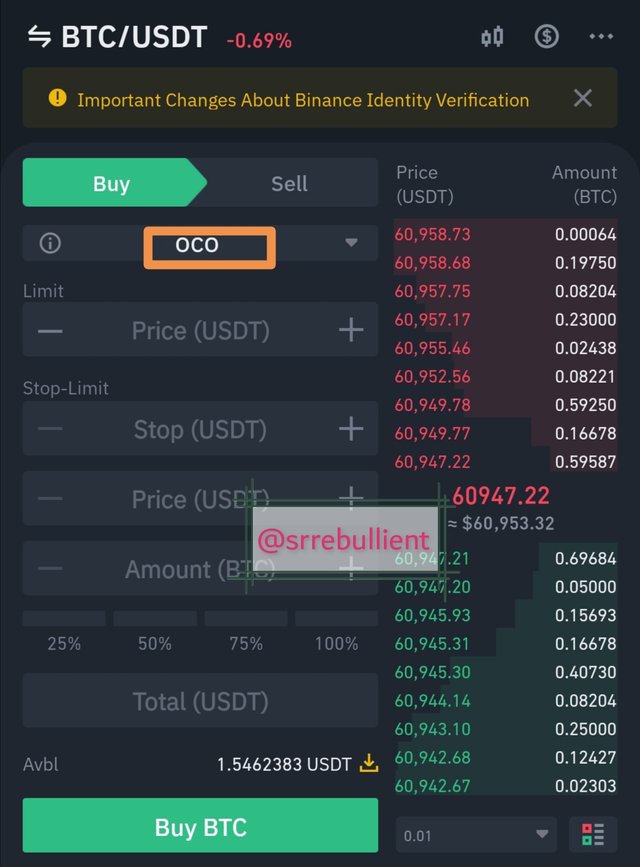

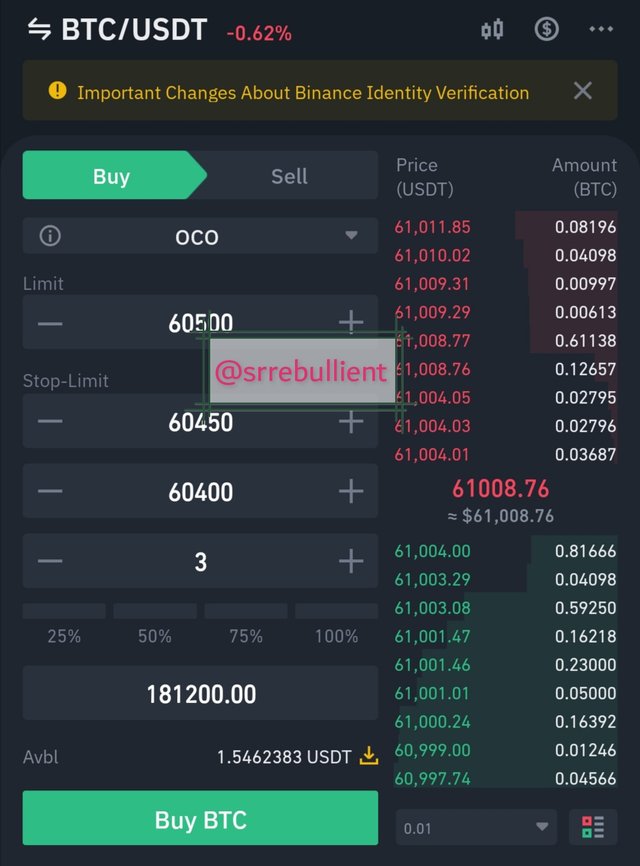

OCO ORDER

This is a type of pending order that allows two different others to be placed and when one is executed, the other gets canceled.

It's just like setting an order to buy BTC at $60,000 and also set to sell at $65,000. If the other of $60,000 is executed first the order to sell at $65,000 gets canceled.

screenshot from Binance app

EXIT ORDER

Exit order is a type of tradering order specially made to close open trades.

There are two types of Exit orders which include;

- Stop loss

- Take profit

STOP LOSS

Just as the name implies, a stop-loss order is a type of exit order set to minimize loss. It is set below the current price of the asset if the trader is taking a buy position and above the price if the trader is taking a sell position. He closes the trade once the price reaches its set price.

TAKE PROFIT

Similar to stop loss but opposite, the take profit order serves to secure a trader's profit at a set price without the trader having to be constantly on the chart. This is set on the predicted direction of the asset price. It is set above when the trader is taking a buy position and below when the trader is taking a sell position.

How can a trader manage risk using an OCO order? (technical example needed

The OCO which stands for One Cancels the Other is a type of pending other that allows two different others to be opened and when one of the others is executed, the other is automatically canceled.

screenshot from Binance app

I set a limit order to buy 3 BTC at $60,500 and a stop-limit to buy at $60,450 when the stop price is at $60,550.

QUESTION 3

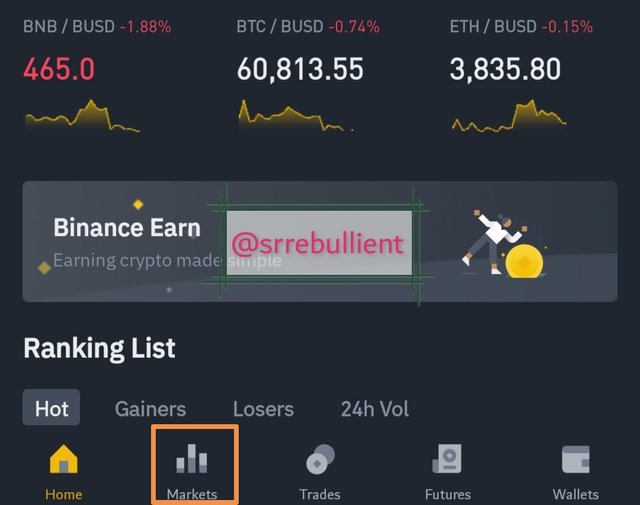

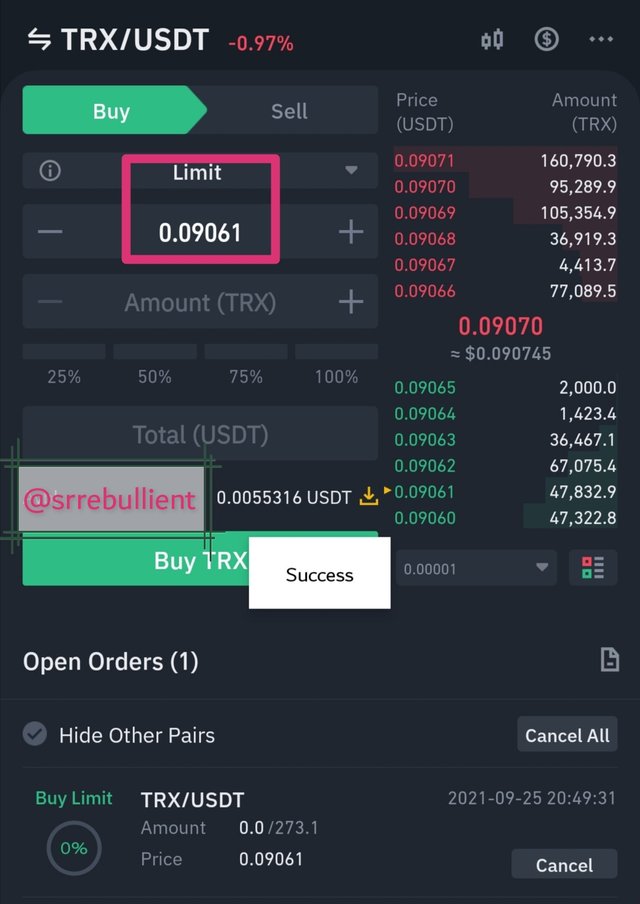

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

I will be performing this task using my Binance exchange application and I will be trading on TRX|USDT pair using spot wallet.

- Step 1

Open binance and click on markets just as seen below

screenshot from Binance app

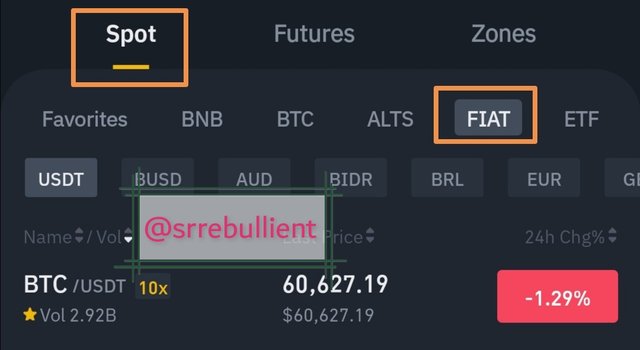

- Step 2

Click on fiat since we are dealing with usdt pair. Make sure you are also on spot just as indicated below

screenshot from binance

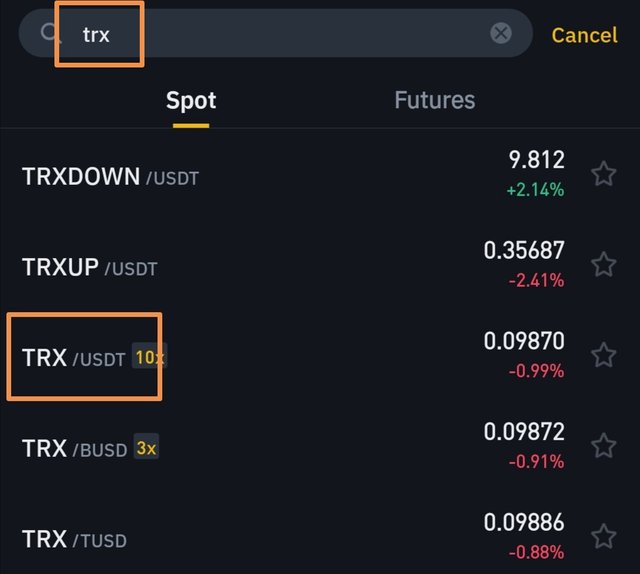

- Step 3

On the fait section of the spot wallet, search for Trx in other for it to bring out various Trx pairs.

screenshot from Binance exchange app

- Step 4

After selecting TRX|USDT pair, click on buy

screenshot from binance app

- Step 5

Place the trade after setting your limit to the amount of choice. Once the price of TRX falls to the amount set as limit, the trade gets executed

screenshot from binance app

The limit order price is below the current market price of TRX which means that the order will remain pending until the price of TRX falls to the limit order price before thr order gets executed.

QUESTION 4

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected. (i)Why you chose the crypto asset (ii)Why you chose the indicator and how it suits your trading style. (iii)Indicate the exit orders. (Screenshots required).

I will be performing this task using my MetaTrader 5 App.

On MetaTrader 5 app, I will be trading ETH|USD pair using exponential moving average indicator.

TRADING ANALYSIS

screenshot from MT5 App

RESULT

screenshot from MT5 App

WHY I CHOSE THE CRYPTO ASSET

I choosed ETH|USD pair because ethereum is one of the most traded cryptocurrencies in the world which in turn makes its liquidity high. This liquidity makes it easier for a trader to enter and leave the market.

WHY I CHOSE THE INDICATOR AND HOW IT SUITS MY TRADING STYLE

The indicator used above is EMA which stands for EXPONENTIAL MOVING AVERAGE INDICATOR.

The EMA indicator is a trend-based indicator that helps in filtering out minor fluctuations on price trends thereby making obvious the actual price trend. It does this by either trending above the price chart in a bearish market or trending below the price chart in a bullish market.

HOW IT SUITS MY TRADING STYLE

After choosing my currency pair, I added an EMA indicator in other to verify the actual direction of the market trend. Seeing the EMA indicator trending above the price chart made it clear to me that the market is on a bearish trend. After confirming the market trend, I went ahead to verify if the trend is still strong by looking out for lower lows. After confirming the strength of the trend, I moved into drawing my trendline once and wait for a breakout in other to execute a trade. A breakout occurs when the candlestick breaks through the trendline. Once the breakout occurred, I initiated a sell market order which in turn yielded a very massive profit for me.

CONCLUSION

Cryptocurrency trading has become very popular in the world today and that makes it very important for one to know how to go about it and the risks involved. There are different types of trading as seen in this lecturer and different levels of traders have a type of trading that best suits him or her as regards their level of experience. This lecture by professor @reminiscence01 has widened my knowledge of the various types of orders and their role in minimizing losses. Thanks to professor @reminiscence01 for this awesome lecture.

Hello @srrebullient, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @srrebullient, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit