What do you understand by trading? Explain your understanding in your own words.

What are the strong and weak hands in the market? Be graphic and provide a full explanation.

Which do you think is the better idea: think like the pack or like a pro?

Demonstrate your understanding of trend trading. (Use cryptocurrency chart screenshots.)

Show how to identify the first and last impulse waves in a trend, plus explain the importance of this. (Use cryptocurrency chart screenshots)

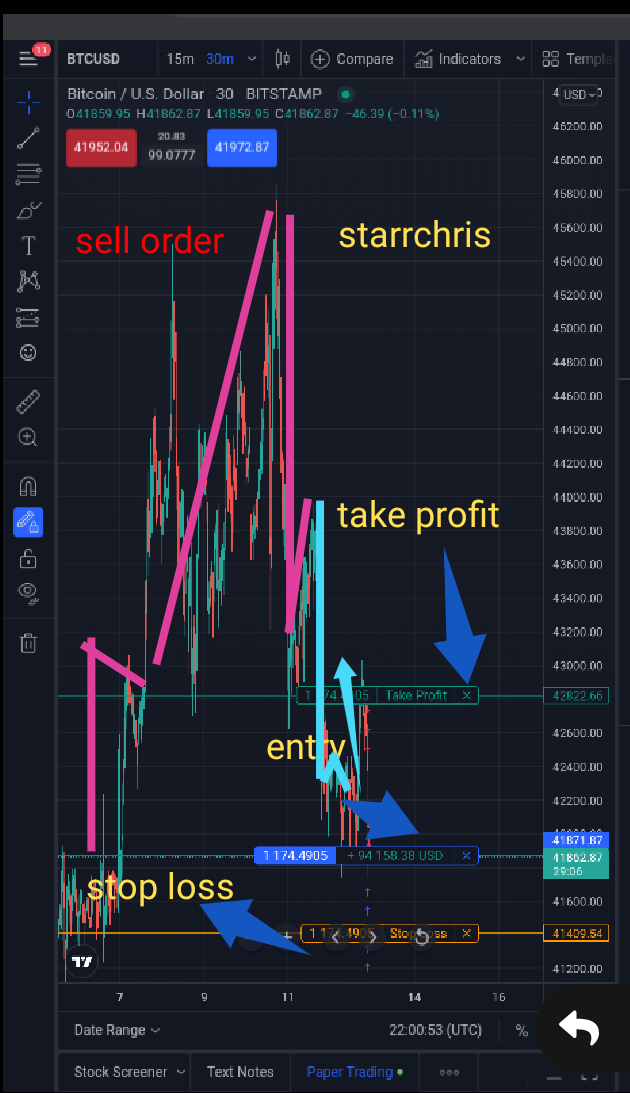

Show how to identify a good point to set a buy and sell order. (Use cryptocurrency chart screenshots)

Explain the relationship of Elliott Wave Theory with the explained method. Be graphic when explaining.

Conclusion.

What do you understand by trading? Explain your understanding in your own words.

Trading is the process exchanging goods and services between two more parties, persons, individuals, society or organization etc. Trading can also e defined as the act of selling and buying goods, product, coins, tokens, asset, commodities and services from a trader. A trader can be defined as one or an individual who perform trade actions like buying and selling to either another trader or a customer. In other to make profits, benefits or gain. Profit could be of different kind for example the profit from a trade could a coins, token, asset, commodities or service.

Trading as an act can be done by anyone, at anytime or place agreed by both participating bodies or individuals, that is so location, time, and amount or quantity involved has to be concluded by both participating sides the trade. For a trade or transaction to successfully occur they has to be a meeting point and this meeting point is what we traders know as a market place or it’s simply called a market. When a trader goes to market to buy or sell a required or desired asset or commodity he or she is told the value of the asset, which in turn results to the price range of the asset or commodity. The price pf an asset can also be affected by so many factors for which are

• Total numbers of buyers market

• Total numbers of sellers in market

• Weather Condition

• Location of market etc

As I had said the price of an asset depends on the trading activity happen in the physical or crypto market. That is to the total numbers of buyer and total number of sellers in the market, determine the price the asset would be sold or bought. For example in crypto market if the are much buyers of asset, commodities, coins or tokens.

What are the strong and weak hands in the market? Be graphic and provide a full explanation.

Strong and Weak hand are normally in every gathering, so therefore it also expected in crypto market. The strong hands are the ones who use the money and influence to control the movement of the candle stick and the also the price of asset and commodities in the market. The strong hands are mostly investors who invest so much funds into an asset or commodities at a particular period strong hands are usually group of rich in individual, organization, company or a very rich individual. For example Elon musk, @steemcurator01 and @steemcurator02 are strong hands in dodge and steem market respectively. Because this strong hands buy and sell their crypto asset in large amount, so therefore the affect the movement of price whenever the participate in a trade, whether if it’s a buy or sell transactions. This strong hand trader do wait till when the price of the asset falls to a lower price before the purchase very large amount of asset, so the the price of the asset start increasing as a result of their purchase after which the strong hands trader sell their asset as soon as the asset price increase to their satisfaction, then the sell their asset to make large profit, which in return makes the price of the asset to fall down.

Weak hands

In the other hands we have weak hands, these weak hands are known to be the traders influenced by the actions of this strong hands trader because the bear most of the lost as soon as strong hands start to sell their asset in the market. Weak hands are investor with lower capitals that can’t affect the price and movement of a crypto currency in the market.

Which do you think is the better idea: think like the pack or like a pro?

Thinking like a pro would be the best because most traders who lose the asset, lose their asset because the think like every other common trader in the market. To me I believe great success is achieved by people who perform unique and professional decisions in their trade actions or organization. If a trader acts like the heard or pack, the trader is expected to earn like the crowd, heard or pack. While if the trader act, think and trade like a professional , definitely the trader is expected to make large and big profits like a professional trader. Thinking like a pro means having patient, wisdom and using technical indicator to skillfully analyze a price of assets in the market. If you think like a pro trader you will always make profit like the pro’s and strong hands, otherwise the traders is expected to fall victim of losing their asset. Because pro don’t trade base on news heard from people but the wait for bearish and bullish signals to buy or sell their asset.

Understanding Trends

As long as crypto trading and chart is involved there basically two famous trends, which are known as

• Uptrend and

• Downtrend.

First of all in want to start by defining trends. Trend is known as the act of movement of the candlestick on the chart. That is to say a market trend can be defined as the movement of price assert, coins, tokens, or commodities at a particular period. So therefore if a market is experiencing an uptrend it means the price of the asset has increased, in other word I will say the candlesticks are moving in an upward direction. While a downtrend will signify the fall of price of the asset, that is to say the candlestick will move downward in the chart. So therefore as we have seen trends are so important to detect, we have to easily detect this trend. So there are so many ways to detect this trends,

According to what our prof, using Elliot theory they are basics three rules to follow:

• The second trend should not be seen lower than that of the first trend.

• The third should be the longest of all other trend.

•The fourth trend must not meet the peak of the first trend.

Show how to identify the first and last impulse waves in a trend, plus explain the importance of this. (Use cryptocurrency chart screenshots)

The fist impulse should be easily identified using Elliot wave, that is to say the first impulse can be easily identified after the 5 Elliot waves’

The first impulse wave have been detected to help traders buy asset at a cheaper price rate, so therefore helping traders avoid falling victims to strong hands price manipulation

To identify the last impulse wave, i did use Elliot wave theory. Now using at the Elliot wave theory, i can detect the maximum point of the wave which is wave 5. I discovered that after the trend , the price of the asset failed to create a new low.

Show how to identify a good point to set a buy and sell order. (Use cryptocurrency chart screenshots)

BTCUSDT

BTCUSDT

Explain the relationship of Elliott Wave Theory with the explained method. Be graphic when explaining.

As we have learnt earlier, on how strong hands traders influence crypto market with their large investment , when such happens in the market there is distribution and accumulation phase occuring in the chart. these can also be discovered using Elliot wave.

Checking the chart above, we can notice the accumulation on the chart using the Elliot wave. The accumulation can be seen just before the first trend or wave of the Elliot theory. It's has helped Alot of traders understand how the Pro and strong hand traders control the market. You can identify that after the accumulation, price break out into a new wave.mean while distribution stage identifies when the strong hands are closing their positions in the market which will cause price to fall. This distribution stage is the correction wave in the Elliot theory because it also gives signals a trend reversal in the chart.

Conclusion

Thanks to our prof for such awesome lecture on Elliot Wave theory. Elliot Wave theory has helped a lot of weak hands traders escape the trap set by the strong hands trader , causing the to also make profit like the pros.

Thank you professor @nane15 for this nice lesson.