Canva

.png)

.png)

The term Cross-asset correlation is really simple to break down, I would do that in the most simplest format. Cross-asset in crypto ecosystem has to do with the communication and interaction between two asset as a particular period of time which the term correlation simple means the mutual relationship between different assets or individuals at a specific period or time. So therefore In the simplest format.

Cross-asset correlation is the mutual relationship between different assets at a particular period or time. Cross-asset correlation is simply about how different types of investments, such as stocks, bonds, real estate or even cryptocurrency move together or independently. For example I want to use human as examples a positive correlation is more like two different individuals or friends moving in same direction, but negative correlation is a different case scenario because it's more like a different individuals walking in the opposite directions.

In analyzing a portfolio, it's very important to understand this the moving direction. Cross-asset correlation is known for how to create risk management and making sure your investments hit stop-loss at same time. This is really awesome strategy especially whenever you are running or trading with multiple assets at same time.

In other words, the correlation coefficient of a trade is an important manner of measuring just how your assets moves at the same time, to avoid losing out or forgetting your assets moving. For crypto traders we can say we have experienced this before, we have seen cases where Bitcoin and ethereum moves in similar directions and same speed.

The significance of cross-asset becomes very essential when analyzing the dynamic nature of financial exchanges. The correlations of assets are not static; they act dynamically in it movement as time goes by it also affects various factors such as economic conditions, fundamental news, and market structure. So therefore it's helps in the regularly monitoring and adapting to changes in the cross-asset correlations is very important for managing a diversified portfolio.

As I have said one of the most important benefits of cross-asset correlation is the ability help in risk management while trading. This is done by scattering your investments over assets with lower correlations, investors can reduce or help stop the impact of a wrong signal on a particular asset or market. This risk management technique is particularly vital during a market whether higher volatile or lesser volatile market.

.png)

.png)

Understanding correlations between different cryptocurrency assets is very for generating very effective diversification strategies in any crypto portfolio. Cryptocurrencies, which are known for their volatility and unique market dynamics structure, gives both opportunities and helps to traders seeking to make extra profit from their holdings. By properly analyzing the correlations between the different cryptocurrencies, a knowledgeable trader can easily construct a well-balanced portfolios that helps managing risk and enhance improving

potential profits.

Cryptocurrency markets are known for their high volatility and fast price movements. Same speed this volatility can generate massive trading opportunities with profits, it could also increases the chances of having massive loss. That's to say, using the diversification technique becomes necessary to find risk management efficiently. However, unlike trading assets that are less volatile than that of the crypto market for example stocks market bonds, and Fiat market.

One of the primary benefits of understanding correlations between different cryptocurrency assets is risk management. Cryptocurrencies tend to experience price higher volatile driven fluctuations that are caused by different factors related to the digital asset like new big Wales or SEC meetings, such as regulatory developments, technological advancements, and market sentiment.

For example, imagine a trader who holds a portfolio that consist of only Bitcoin, if the sell pressure increases and Bitcoin experiences a sharp bearish trend in price due to any reason regulatory or technical, the entire portfolio's value may suffer loss and the trader might get liquidated. But if the trader invested into asset of different prices movement, the other asset might help the trader reduce chances of losing anything.

Moreover, understanding correlations between different cryptocurrency assets allows investors to easily take advantage of portfolio allocation. Correlation analysis helps efficiently find assets that exhibit powerful price movements, providing diversification benefits.

.png)

.png)

For easier understanding Imagine the crypto market as a big occasion while the assets represent the guests, as we all know some the guests are in the occasion to eat and dance while the orders are in the occasion just look for reason to condemn the occasion. Every crypto trader on investor would understand what I say in this little proverbs in the market some assets actually do very very well by going bullish while other asset goes down terribly.

In a bullish market, is usually a period everyone's holder are Happy because of the are running in profit, traders start feeling joyous about making money and otherwise is the feeling of investors or holders when the price of their assets goes bearish this is because they would start running in loss.

Before I continue for the sake of those who are you to cryptocurrency and it's complex terms like bullish and bearish I would be define and explain this term before I continue

In the crypto ecosystem the term Bullish which usually is tied to the symbol of a beer or a greenish chat means that the price of an asset is going upward or would I say experiencing an uptrend or upward movement at a particular period of time also it can also be called long movement this movement usually signifies profit from an asset or increasing price of an asset in a particular period. Why in the other hand we have the bearish which is tied to the symbol of a bull usually painted in red it also shows that an asset is expressing a downtrend or downward movement which another word means they're an asset is losing the value or there is decreasing in the price of the asset at the particular period of time

An example of cross asset correlation with STEEM AND COMP

On a bullish market the price of an asset moves upwards so therefore causing other traders to want to buy out of excitement and anticipation that comes with the bullish market, so therefore there are more chances of experiencing positive correlation because most asset goes bullish. In a summery there are higher chances of seeing two asset moving in same upward direction due to excitement.

But on a bearish trend the price of an asset moves downward so therefore causing some traders to want to sell out of fear of losing and other traders holding with hopes that the bearish trend doesn't last. so therefore there are more chances of experiencing negative correlation because of different actions in the market, due to the indecision so asset gose bullish while other goes bearish. So therefore most asset goes in different direction causing negative correlation.

.png)

.png)

The basic goal and benefits of the cross asset correlation is that it inspire users or traders to spread their investments into different assets to reduce the chances of running into massive loss and losing all their asset in no distance to. But when the spread their or money into two different assets than has a negative correlation between them, when one is on loss the other might be in bigger profits. This will help the profit and recover their losses in no distance time, in this case they make profit in every condition.

For example if I invest on Both Bitcoin and Dodge coin which unfortunately has negative correlation, if they bitcoin goes bullish with +10 and DODGE coin goes bearish with -3. Although I got affected with the dodge price movement, I would still be in profit because of my Bitcoin asset went high or bullish

Also you can make profit from trading on assets with positive correlation this is because if the both asset you invest in are both positive driven correlation but with different volatility then you make massive profit from the both trade, though they asset with higher volatility is expected to make you more money or profit.

For example if I invest on Both Bitcoin and Dodge coin which has a positive correlation, if they bitcoin goes bullish with +10 and DODGE coin goes bullish with +5. I would make double profit from both trade at a short period of time

.png)

.png)

In a normal note, with out technical analysis trader of steem and Bitcoin would tell you that STEEM in most cases love's to move in Same direction with the BITCOIN and ETHEREUM crypto currencies, below I would use different techniques to help us confirm if our assumptions are True and accurate.

Note

💥 White 🤍 Square ⬜: Side movement

💥 Green 💚 square 🟩:Bullish movement

💥Red ♥️ square 🟥: Bearish movement

Above is a chart comparing the correlation between STEEM, Ethereum and Bitcoin. From the above chart we can see recently th the three asset are moving in a positive correlation between each other. From the chat you could see where I labeled with a white square, it signifies that when Steem moved side way Bitcoin moved sideways and Ethereum also moved sideways.

Also From the chat you could see where I labeled with a green square, it signifies that when Steem moved bullish, Bitcoin also moved bullish and Ethereum also moved bullish and finally From the chat you could see where I labeled with a red square, it signifies that when Steem moved bearish Bitcoin moved bearish and Ethereum also moved bearish

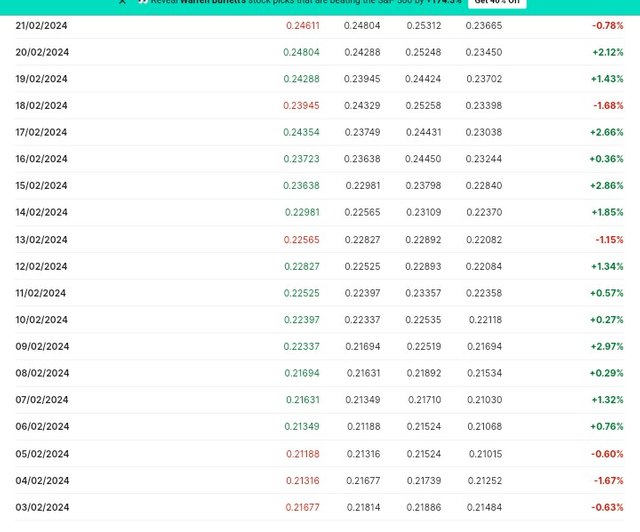

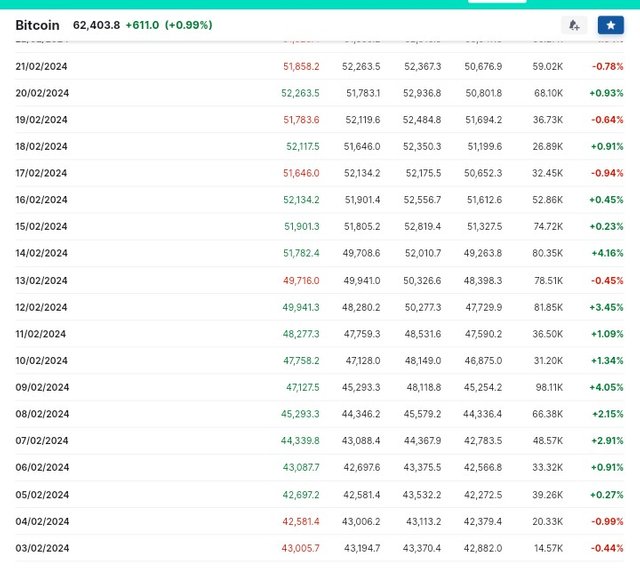

Steem

Bitcoin

Because the question was asking about historical data, above is a data of both STEEM and Bitcoin from 03 of February 2024 to 21 of February 2024 . From the above analysis we can see that steem and Bitcoin correlation was very positive because most times the moved in same direction by show green on the chart on same day and time. In summary the correlation between STEEM and Bitcoin was proven to be positive almost throughout last month.

Also using the correlation coefficient technical analysing indicator to analyze the correlation between the Steem and Ethereum is really awesome. Before I want to start I want to explain how the indicator works this technical analysis indicator is a mini chart that starts from 1 to -1 , whenever the line goes closer too the 1 it means the positive correlation between the asset is high while if it moves at -1 the is a higher chance of a negative correlation between the two asset.

So therefore we are right to say the positive correlation between STEEM and Ethereum is very positive because the line is going upward which is very close to the 1 or the +1 point, and whenever it goes towards the -1 we can say the positive correlation is very weak and the negative correlation is very much high

All images we gotten from

Investing.com

Trading view.com

.png)

.png)

In conclusion I would say the course assets correlation technique is a very powerful important and necessary to use to help easily find risk management techniques to escape deadly loss or market liquidation, which could change someone life terrible. That's why I keep on saying a big thank you to the professor who opened our eyes to this powerful technique that could save one's life and investment.

I wish to invite @sahmie, @ngoenyi, @chants and @hamzayousafzai @virajherath @kathy-cute @dove11 @emmy01 @shanza1 . Thanks for going through I appreciate, remember starrchris cares ❤️

Understanding how different things like stocks or cryptocurrencies move together or apart is like having a roadmap for investors. It helps them know if assets are dancing to the same tune or doing their own thing.

When things are going well in the market, everyone holding assets feels good, and traders get happy about earning money. It's like a positive vibe spreading around when the market is in a good mood.

Considering how assets relate to each other is like having a strong and needed tool. It makes it easier to figure out how to manage risks, avoiding big losses or getting caught up in a messy market situation.

Good luck and more success.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your loving comment i appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks witness i appreciate your support

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post is upvoted by CCS curation trail from CCS - A community by witness @visionaer3003.

Vote for @visionaer3003 as witness.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks dear friend i really appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Brother I'll say you so nail it.

This really interest me and worth every minute spend.

This strategy so help investors to analyze the interaction, behavior and relationships between two different coin market.

It so help in risk management and build traders approach properly.

You're indeed perfect in this as a pro, I'll love reading more sir.

Good luck 🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for such supportive comments friend i really appreciate your good job

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post is always in detail and very inspiring

You have defined so well that it is very easy to understand written in simple language and the most importantly when you talk about bullish and bearish trend I think it's clear for everyone

Your concept is very clear the last question was very difficult but you have defined so well

Best wriitten post

Best of luck for the participation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks very much friend its really an honor, i appreciate your comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome keep up the good work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you do any work online like crypto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

AsslamuAlikum dear brother @starrchris clearly you have made an effort to understand how cryptocurrency trading and data management works. Comparing your purchase to the newly acquired company can make it easier to understand.

Differentiation and risk management are very important in the market and the information you provide shows that investors can get advice on what to do How can analyzing cryptocurrency flows increase investment and returns.

Your posts are informative and well structured making it easier for readers to understand complex topics you are doing a great job dear friend. Best wishes from my side hope you will achieve success in this contest.

Best regards [@danish578]

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow i appreciate how you broke down this complex terminologies, into simpler one in your educative comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your nice compliment ❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post is awesome. You have beautifully attempt to cealrify think. Yes cross asset correlation is very important term. People use it in different markets. You can use it both inter markets and intra market. I believe the diversification option here is very much useful. It minimize the risk Ratio UpTo a great extant.

You have very well defined the strategy for Steemit. The comparison made here Is just awesome. Thank you for inviting me here too.

Wish you good luck here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really appreciate your comment good friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You participated at edge time of deadline of this engagement challenge but I can understand that you take your enough time to understand about this topic and then you have shared your analysis and basic information about cross asset correlation...

You have presented an example of BTC and Dogecoin with us by giving us an understanding of negative correlation which is existing in both of them that how if one currency is in downtrend then other currency would act as a safety for you because it would be in upward trend in this case so investors would be able to make any profitable decision according to the situation.

You have also shared some of the charts with us that are giving clear understanding of STEEM relationship with Bitcoin and Ethereum so overall you presented your topic very well that's why I really want to say that may you get success in this challenge..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea the article was really time consuming

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But good that you answered each question very well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for serving us this quality post @starrchris, you explained it very well. The most liking part of your article is when you including much of simple terms, so a beginner like me can understand it easily. Peace from afar!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks very much friend i really appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your explanation of cross-asset correlation is clear and straightforward making it accessible to a wide audience. You've effectively highlighted the significance of understanding these correlations especially in terms of risk management and diversification strategies in the cryptocurrency market. The use of relatable examples like the analogy of friends walking in the same or opposite directions adds a touch of simplicity to complex concepts. Your insights into the dynamic nature of correlations and their impact on portfolio management are commendable. Great job

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit