Hello Fellow Crypto Academians, I'm grateful to be here again. Today I will be doing the homework task from the lesson by prof @awesononso on The Bid-Ask Spread Part 2. this week, the study was focused on the order book, limit orders, market orders, market makers, and market takers.

.png)

1: Define the Order Book and explain its components with Screenshots from Binance.

.png)

Order Book

The order book is an electronic list of orders (both buy and sell) of an asset used by almost every exchange. The order book shows the list of orders on an asset arranged in prices.

The order book distinguishes the orders using two different colors, with the red color representing the ask or sell orders and the green representing the bid or buy orders. The order book helps traders know the availability of an asset, its Liquidity, a transaction initiated, and traders' psychology. This allows traders to make more informed decisions when trading.

The order book is updated in real-time, meaning every order placed on the asset reflects and changes the order book listing making it dynamic.

Components of an Order Book

Every order book is peculiar to the exchange. Still, there are fundamental components of the order book that can be seen in all exchanges, namely;

- The Bid Order And Bid/Buy Prices

This is a part of the order book that shows the bid/buy orders arranged in prices. This is the green part of the order book; it shows the prices buyers are willing to pay for the asset. The highest bid price is at the top, as shown in the screenshot above.

- The Ask Order And Ask/Sell Price

This is the sell/ask part of the order book. All sell orders are reflected here and arrange in prices. The sell order is the red part of the order book that shows the price at which sellers of an asset are willing to sell, usually arranged from lowest to highest.

- Amount

This section of the order book is seen in the Bid and Ask part showcasing the Amount either the buyer or sell has placed to be bought or sold. For instance, a buyer may be willing to buy 1 BTC for $45k, and a seller is willing to sell 2.4 BTC for $45.5k. in the amount section 1 is shown in the Bid part of the order book for that buy order, and 2.4 is shown on the Ask part of the order for the sell order.

.png)

2: Who are Market Makers and Market Takers?

.png)

Market Makers

Market markets are those sets of traders that place orders shown on the order books. The market makers place limit orders on an asset to be bought or sold at a particular price. This helps improve the Liquidity of an asset. If, as a trader, I set a limit order on an asset to either buy or sell the asset at a fixed price, at that point, I am considered a market maker.

Market Takers

Market takers are traders who place market orders on an asset. A market taker places an order for an asset to be bought or sold at a price corresponding to the asset's current price. Market takers fill the orders placed by market makers.

.png)

3: What is a Market Order and a Limit order?

.png)

Market Order

This is an order given by the trader to buy or sell an asset at the asset's current market price. Market takers place these orders as they do not have a preferred price to buy or sell the asset. They only care that the order is executed immediately.

Limit Order

This is an order entered by a trader for an asset to be bought or sold at a price set by them. A limit order is a request by the trader to the exchange to execute a trade when the price gets to a point selected by them, giving the trader control over when they buy/sell an asset. Market makers set a limit order as they create a list of orders to be executed and filled.

.png)

4: Explain how Market Makers and Market Takers relate with the two order types and Liquidity in a market.

.png)

Liquidity of an asset or a crypto pair is dependent on how quickly an order placed can be executed. With this in mind, the market takers and market makers play a vital role in the Liquidity of the asset.

A market maker places a limit order, stating their intentions to the exchange to execute their order when Price gets to their desire point. Meanwhile, a market taker places a market order for an asset to be bought at the current asset price.

When there is a fair percentage of market takers with their market orders and market makers with their limit orders on an asset, the Liquidity of such asset is improved. This is because every limit order placed will be filled by the market orders indicating a high liquidity market.

The Liquidity of an asset can be said to be dependent on the fair percentage of market makers and market takers.

.png)

5: Place an order of at least 1 SBD for Steem on the Steemit Market place by a) accepting the Lowest ask. Was it instant? Why? b) changing the lowest ask. Explain what happens. (Make sure you are logged in to your wallet).

.png)

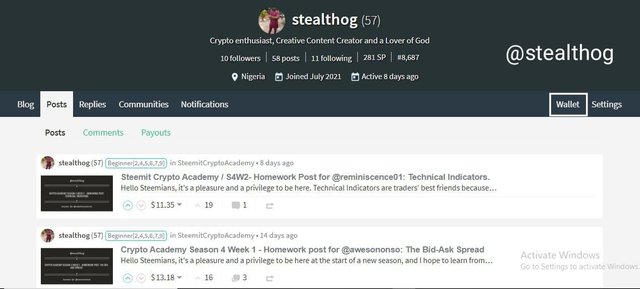

To perform the transaction of trading SBD for Steem, I will have to visit the Steemit currency market.

On the steemit platform, I clicked on my wallet.

On the wallet, there is a drop-down menu on the balance of SBD. I clicked on Market

The steem wallet marketplace is open.

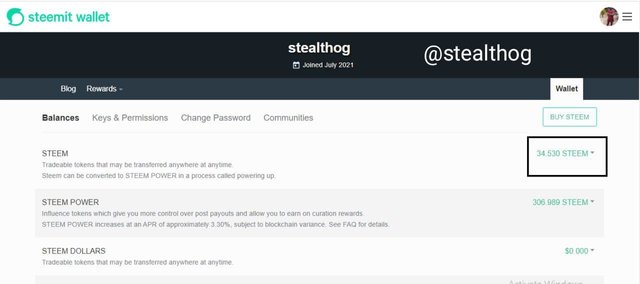

Accepting the Lowest Ask Price

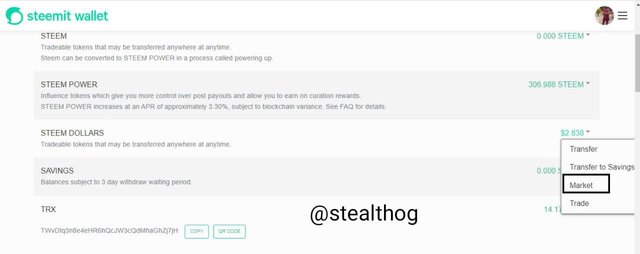

On the steem market, I will be trading 2.838 SBD for 34.530 Steem using the lowest ask Price of 0.082188 as shown below.

I clicked on buy steem and confirmed the order placed.

After clicking on ok and input my active key, the order was executed quickly. As seen below, the 34.530 Steem has been added to my steem balance.

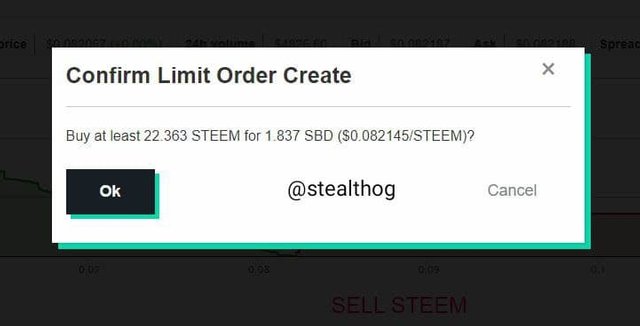

Changing The Lowest Ask Price

Another transaction was initiated with the Price of steem that I am willing to buy at different from the lowest Price.

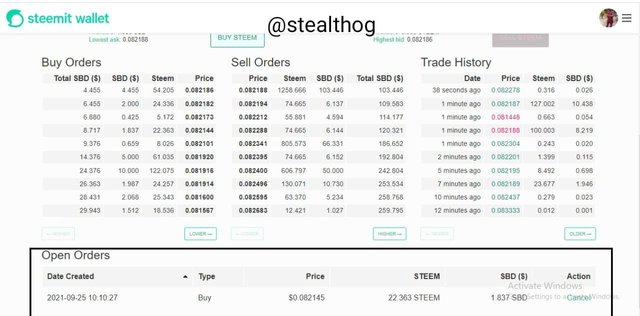

I placed an order to trade 1.838 SBD for 22.363 Steem using a set price of 0.082145 as shown below. The Lowest price ask price is 0.082188

I clicked on buy steem and confirmed the order.

I am waiting for the Price to get to that point; the order is placed on my open orders.

.png)

6: Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

.png)

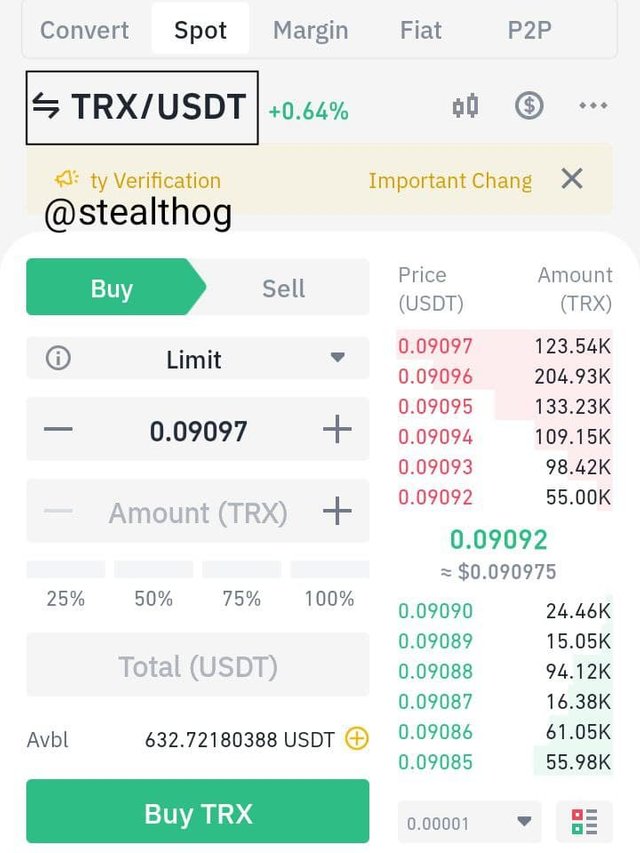

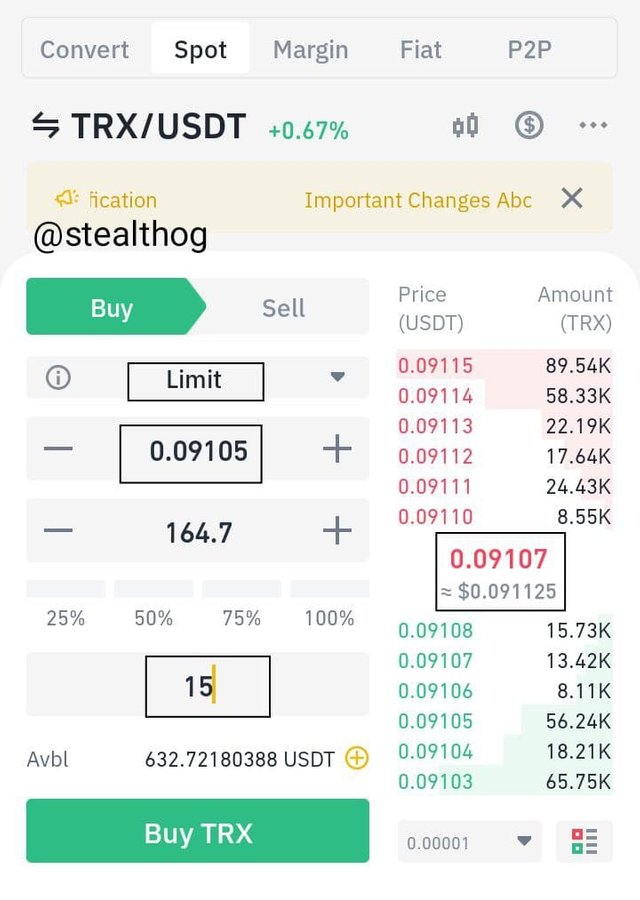

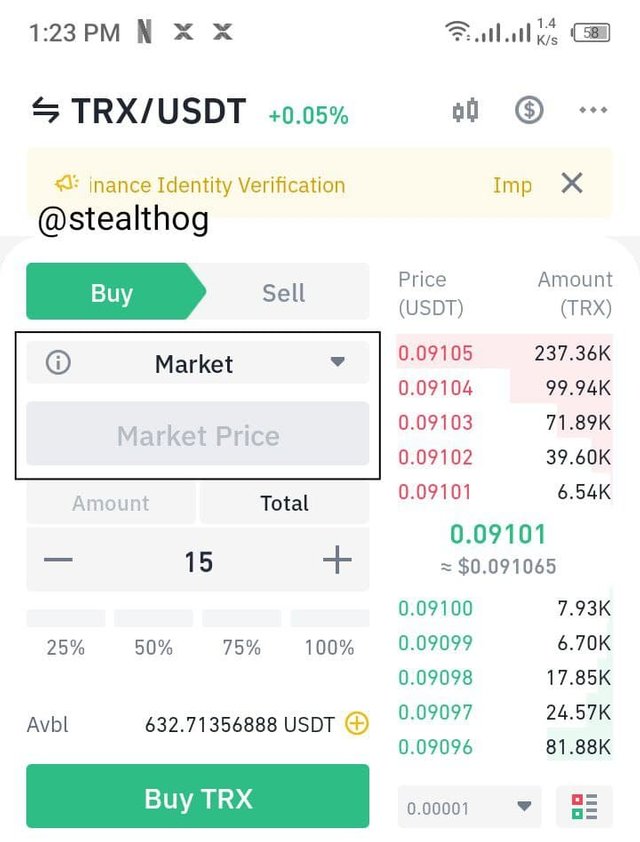

Buy TRX/USDT Limit Order On Binance

To place a Buy Limit Order on the TRX/USDT pair, I had to log in to my Binance account. On my Binance account, I clicked on Trade and searched for the pair TRX/USDT.

I selected 0.09105 as the price I intend to buy with the current Price at 0.09107. Therefore, the chosen amount was 15 USDT as shown below.

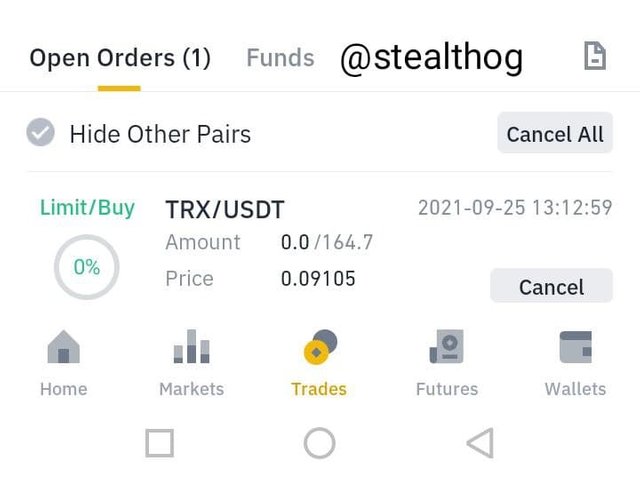

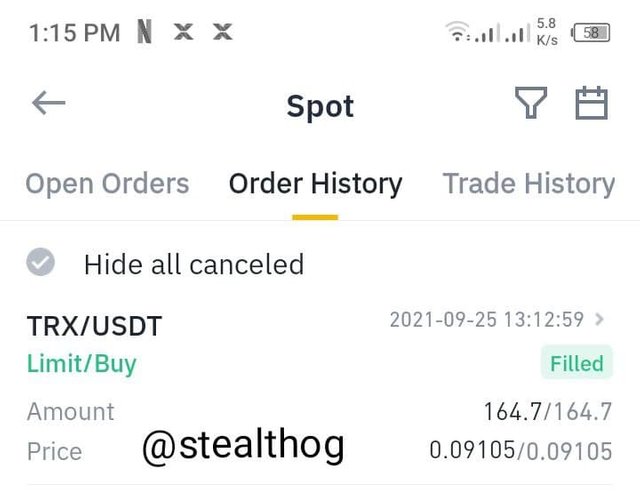

The limit order was entered, and the order was placed under open orders waiting for Price to get to that point. This made me a market maker as I have added to the list of pending orders to be filled, adding to Liquidity.

My order entered the order book as part of the bid orders, and when Price got to 0.09105, my order was filled.

.png)

7: Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

.png)

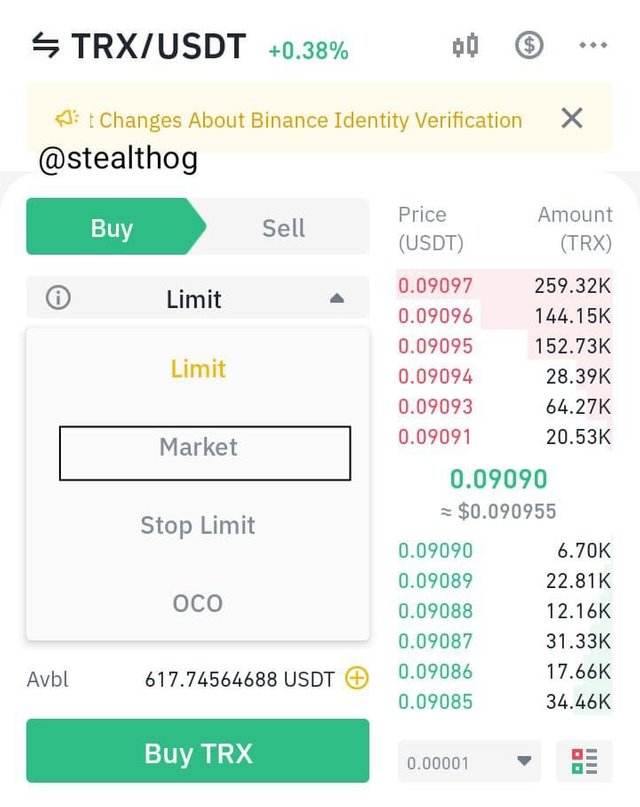

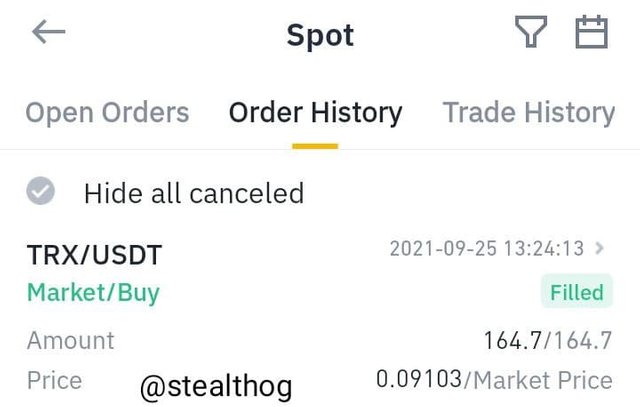

Buy TRX/USDT Market Order On Binance

Still, on the Binance trade page, we change the order of the asset from limit to market

After choosing the market order as the preferred order, I initiated a trade to buy 15 USDT wroth of TRX at the market price.

Once I clicked on Buy TRX, the trade was executed immediately. In doing this, I became a market taker as I filled an order set at that Price.

.png)

8: Take a Screenshot of the order book of the ADA/USDT pair from Binance on the day you perform this task. Take note of the highest bid, and lowest ask prices: a) Calculate the Bid-Ask. b) Calculate the Mid-Market Price.

.png)

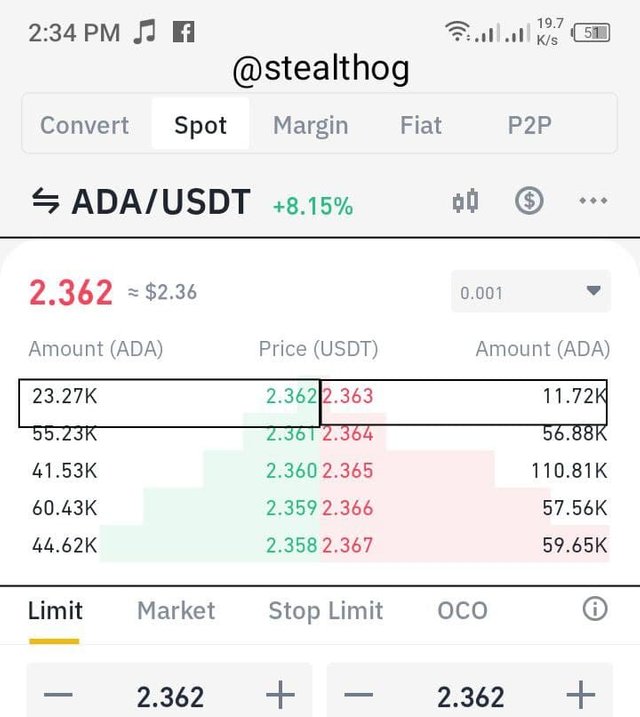

The Order Book of ADA/USDT, as seen on Binance, is shown below.

Highest Bid Price = 2.362USDT

Lowest Ask Price = 2.363USDT

Calculate The Bid Ask

The formula for Bid-Ask is given as;

Bid-Ask = 2.363 - 2.362 = 0.001

Calculate The Mid-Market Price

The formula for the mid-market Price is given as

Mid-Market Price = (2.362 + 2.363)/2 = 2.3625

.png)

.png)

This was an excellent lesson as it engaged in understanding through practicing the concept of limit and market orders.

Limit orders are orders placed by traders on an asset at a price different from the current market price, hoping that the market price gets to that point and the trade initiated by the exchange. The traders involved in such orders are tagged market makers as they add to the asset liquidity.

Market orders are orders given by traders for an asset to be bought at the market price. The traders who give such orders are called market takers as they take from the asset liquidity.

Hello @stealthog,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You explained the topic properly.

Question 4 still needs some work.

You did not properly explain your observations in question 5.

You did not state the impact of your order in 7.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit