Professor @lenonmc21

This is the homework done by me @steemco on the topic above.

- Define in your own words what trading is, what its function is and how it relates to the cryptocurrency market.

- Define and explain what are the tools used for trading ( Technical Analysis and Fundamental Analysis ) and at least one example of each. ( A screenshot is required ).

- Name at least 3 cryptocurrency exchanges with the highest trading volume where we can buy our first cryptocurrencies and explain in your words the ways to buy cryptocurrencies on at least one of these platforms ( Do not use Binance ).

- Define in your own words what trading is, what its function is and how it relates to the cryptocurrency market.

What is Trading?

The buying and selling of commodities and services, with compensation provided by a buyer to a seller, or the exchange of goods and services between parties, is a fundamental economic notion. Between producers and consumers, trade can take place inside an economy. International commerce allows countries to access new markets for goods and services that they might not otherwise have had access to. It is for this reason that a consumer in the United States can chuoose between a Japanese, German, or American vehicle. Because of international trade, the market is more competitive, resulting in lower pricing for consumers.

Consumers and countries might be exposed to items and services that are not available in their own country thanks to global trade. Food, clothing, spare parts, oil, jewelry, wine, stocks, currencies, and water are just a few of the products available on the international market. Tourism, finance, consultancy, and transportation are just a few examples of services that are traded.

What is its function?

Trading creates a kind of platform whereby seller of a products and services can meet with a buyer that is in need of such goods and services.

Another thing is that, Trading serves as a means of income generation for the seller. Sellers will make profit from buying at lower price and selling at higher Price

What is the relationship of Trading and Cryptocurrency?

A cryptocurrency is a digital or virtual currency that is protected by encryption, making counterfeiting and double-spending practically impossible. Many cryptocurrencies are built on blockchain technology, which is a distributed ledger enforced by a distributed network of computers. Cryptocurrencies are distinguished by the fact that they are not issued by any central authority, making them potentially impervious to government intervention or manipulation. This is a type of digital asset that is distributed among a large number of computers via a network.

One of the most common ways to benefit from cryptocurrencies is through cryptocurrency trading. This form of internet trading is quite similar to trading stocks, currencies, or commodities. The basic goal is to acquire at a cheap price and sell at a higher price (or vice versa, when you open the short position).

The most significant distinction between this style of trading and others is the high level of volatility. Many traders, particularly newbies, desire to make thousands of percent profit, and although Forex trading, for example, can take years to produce such quantities, crypto can provide you with a faster rate of profit.

.png)

QUESTION 2. Define and explain what are the tools used for trading ( Technical Analysis and Fundamental Analysis ) and at least one example of each. ( A screenshot is required ).

The tools used for trading are two namely:

Technical analysis and fundamental analysis

What is Technical Analysis?

Based on market data, technical analysis is a technique or approach for predicting the likely future price movement of an asset such as crytocurrency. The validity of technical analysis is based on the idea that all market participants' aggregate activities buying and selling accurately reflect all relevant information about a traded asset and as a result, assign a fair market value to the asset on a continuous basis.

The following are the most important technical analysis methods for identifying current market trends:

Charts: Line charts, bar charts, and candlestick charts are the most prevalent chart kinds. Line charts show the price movements of financial instruments over time; closing prices for a certain time frame are connected by a line in line charting.

Support and resistance level: The extremes at which price movement varies are known as support and resistance levels. Support levels are below current market values and resistance levels are above them. Most market participants are unwilling to pay above a certain price level, which is known as a resistance level.Trends: are the general directions in which financial asset prices move over time. There is a supply-demand mismatch, with uptrends when buyers dominate and downtrends when sellers dominate.

Indicators: Thousands of indicators are available in technical analysis to show different aspects of price movement and aid a trader's decision-making process.

The following two major groupings of indicators deserve special attention:

Moving averages: It balance out the impact of extreme values over a certain period, highlighting the predominance of a trend.Stochastic oscillators. Oscillators can also help you determine if a currency pair is overbought or oversold.

Example of Technical Analysis

What is fundamental Analysis?

Fundamental Analysis aims to establish how external factors, particularly those that aren't immediately evident, can affect a company's or project's progress. These elements are more qualitative and less observable, such as a company's leadership and how those leaders have done in previous commercial undertakings.

Fundamental analysis also aims to have a deeper understanding of the industry-specific market and the product or service's future potential in that market. Their ultimate goal is to arrive at a quantitative price that can be compared to the real price of the asset in question. In other words, FA is a technique for determining whether or not something is true.

Example of fundamental Analysis is

The Whitepaper

Whitepaper

This is a detailed document outlining the cryptocurrency concept. A good whitepaper should clarify the network's aims and, ideally, provide information on:

- The Technology that is being used for the asset

- Its use case(s) to which it aspires to cater

- The upgrade roadmap

- The scheme for producing and distributing it

.png)

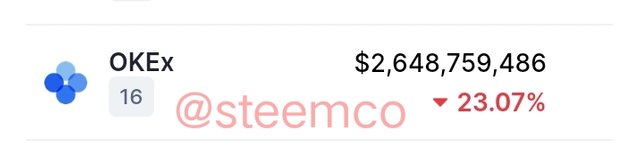

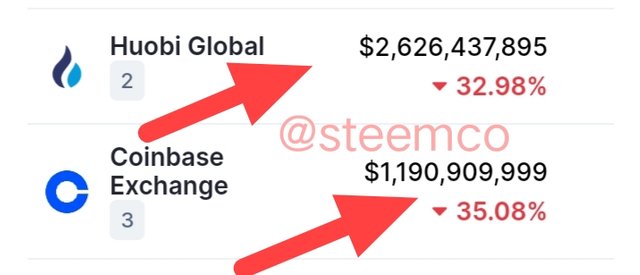

Question 3: Name at least 3 cryptocurrency exchanges with the highest trading volume where we can buy our first cryptocurrencies and explain in your words the ways to buy cryptocurrencies on at least one of these platforms

We can't find the list of Exchanges at the coinmarketcap.

From the Coinmarket list, we have this list of Top Exchange

- Binance

- Coinbase

- Huobi

- OKEx

- KUcoin

- FTX

- Kraken

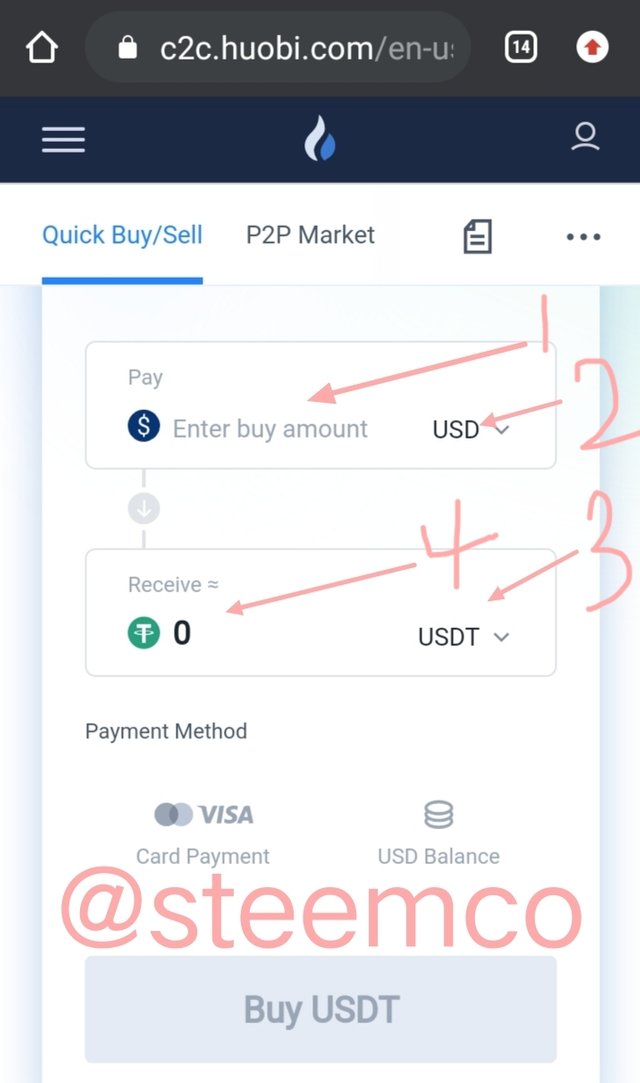

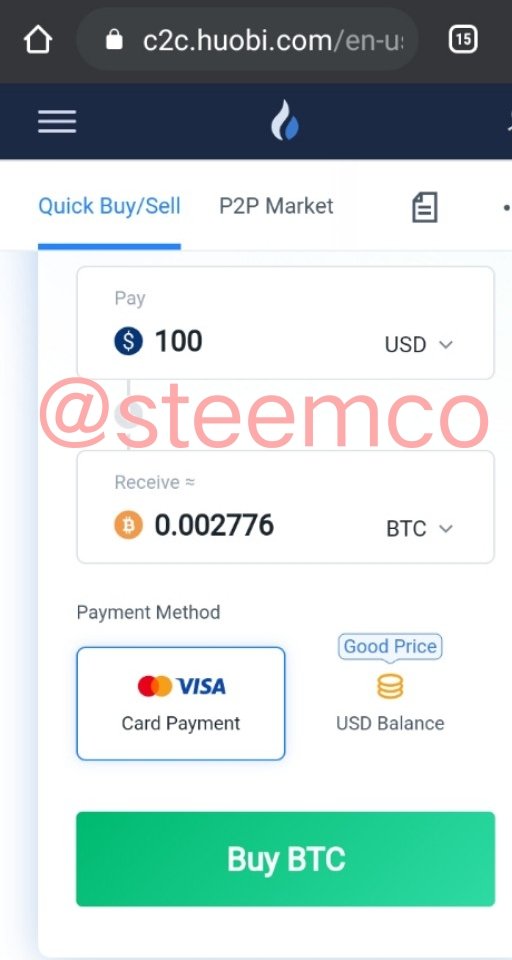

How to buy Cryptocurrency on Huobi Exchange

Huobi:

Huobi,is one of the largest cryptocurrency exchanges in terms of trade volume. It was designed with the Chinese market in mind, but it has now grown to over 130 nation's

To buy Cryptocurrency from Huobi you first have to visit their site Huobi.com and

There is a shortcut to buy Cryptocurrency on Huobi global by following this link:

https://c2c.huobi.com/en-us/one-trade/buy

and log in with your account. See the screenshot.

Write how much you want to pay (In my case 100 USD)

Select the coin you are paying (In my case USD)

The quantity of the coin you want to buy

In my case 0.002776 BTCSelect the coin you want to buy (In my case BTC)

- The payment option is there i.e buyer can choose to pay via the USD balance on the internal wallet or through the Bank card. After you have done everything, we will click on Buy.

.png)