Hello everybody.

Welcome to this post. I hope that all of you will be happy and good and enjoying your good health with the grace and blessings of Almighty Allah. Today, I am here to present the homework post for dear professor @nane15 in Week 3 of Season 6 of Steemit Crypto Academy. The lecture was nicely explained by the professor and I will try my best to explore all the questions properly. So, let's start our task without any wastage of time.

There are some questions that are asked by the professor as the homework for this week and I will try my best to explain all of them in the given order.

(01)

Explain your understanding of charts, candlesticks, and time frames. (Use your own words and put screenshots)

As we all know that the market of cryptocurrency is so volatile that it is very difficult for traders to even predict the trend and the next move of the market. There are some types of analysis that can be used to predict the future prices of cryptocurrency. Fundamental Analysis deals with the prediction of the upcoming prices by the study of the events in the market. Sentimental Analysis deals with the study of the psychology of the traders to predict future prices. Technical Analysis deals with the study of the previous price data to predict the future movements of the prices in the market.

There are some Technical Analysis tools that are used by crypto traders to make good trading decisions in the market. So, have a look at these tools one by one.

Price Charts

Price Charts play a vital role in the technical analysis of the crypto markets. The chart is actually the graphical representation of the activities of the traders in the market. The charts represent the psychology of the traders in the form of supply and demand in the market. So, the price charts are of unique importance in technical analysis as the traders can make valuable decisions by studying the price charts.

The price charts of the cryptocurrencies are of unique importance in the determination of the current trends of the market. From the price charts, the traders can also seek a number of other information like the support and resistance levels, chart patterns, price reversals, and other important things as well. So, the price charts are of unique significance in the technical analysis.

There are many types of the price charts like the Line Chart, Hollow Candles Chart, Japanese Candlestick Pattern, Bar Chart, Heikin Ashi, etc. Line Chart is the simplest and the most used type of price chart. It consists of a single line that is drawn by joining the closing points of the prices in a particular timeframe. Line Chart is used by many technical analysts to make good trading decisions as the use of the Line Chart is very simple. Below is an example of the Line Chart.

Japanese Candlestick Chart

As we have discussed that there are many types of price charts that can be used in technical analysis. So, the Japanese Candlestick Chart is also of these price charts. The Japanese Candlestick Chart is the most common and the most important type of the price chart and almost all of the technical analysts prefer the Japanese Candlestick chart for the technical analysis as it contains the candles that provide very necessary information about the prices data.

As I have already discussed that the Line Chart is the most simple and easier chart but there are many drawbacks of the chart as it does not show the low, high, close, open points of the prices. Also, it does not reveal the momentum of the market price that is the reflection of the psychology of the traders. The interaction between the buyers and sellers of a market is also studied with the help of the Japanese Candlestick Chart. Let's have a look at an example of the Japanese Candlestick Chart.

In the above screenshot, we can see a Japanese Candlestick Chart of the TRX/USDT pair. We can see that the price of the assets is actually represented in the form of candles that are moving from left to right in the chart. The momentum of the price can be determined by the length of the candle. Also, the length of a candle also gives information about the volatility of the market. I have actually used the 45 minutes candlestick chart, which means that a candle had formed after 45 minutes.

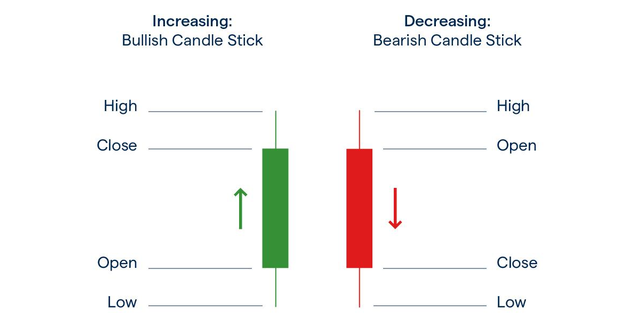

There are actually two types of candles that are presented in the Candlestick Chart. One of them is the Bullish candle that is of green color in default and represents the increase in the price due to an increase in the demand of the asset. Similarly, the second candle type is the Bearish candle that is of Red color in default and represents the decrease in the price due to an increase in the supply of the assets. Let's have a look at the anatomy of these candles.

There are actually four points of each candle, no matter it is a bullish candle or a bearish candle. These parts are discussed below.

- Open:

The opening price of the candle within a particular time is presented by the Open point. For a Bullish candle, the Open point is at the bottom of the candle while for a Bearish candle, the Open point is at the top of the candle.

- Close:

The closing price of the candle within a particular time is presented by the Close point. For a Bullish candle, the Close point is at the top of the candle while for a Bearish candle, the Open point is at the bottom of the candle.

- Low:

The lowest price that a candle touches in a particular timeframe is called a Low point. For a Bullish candle, the Low point is just below the Open point while in the Bearish candle, the Low point is just below the Close point.

- High:

The highest price that a candle touches in a particular timeframe is called a High point. For a Bullish candle, the High point is just above the Close point while in the Bearish candle, the High point is just above the Open point.

Timeframes

The adjustment of the timeframe of the price charts is very important for the effective technical analysis of the chart. Actually, the timeframe is the period of time that is selected by the trader according to the trading strategy of the trader. After the selected time period, a new candle is formed that represents the interaction between the market traders in the given period of time.

The traders must have to use the timeframe of the chart according to the trading strategy of the traders. The short-term traders can use the short timeframe charts while the long-term or swing traders can use the charts of the long timeframe. We can set the timeframe of the price chart from the monthly candle to the daily or hourly candles. The scalp traders also use timeframes of a few minutes or even seconds to do scalping in the market.

Let's have a look at the below screenshots to determine the charts of different timeframes.

- TRX/USDT chart of 1-week timeframe:

In the above image, we can observe the price chart of the TRX/USDT pair of the 1-week timeframe. It means that a single candle represents the interaction between the traders (buyers and sellers) within a week. I have mentioned 11 candles that represent 11 weeks. The trend was bearish during this phase.

- TRX/USDT Daily Chart:

In the above screenshot, we can observe the price chart of the TRX/USDT pair of daily timeframe. It means that each candle represents the interaction between the sellers and buyers within 1 day. We can see that more market noises can be seen from the previous bullish trend.

The traders should use the timeframe according to their trading strategies. The higher timeframes are used for long-term investment signals while the shorter timeframes are used for short-term trading decisions.

(02)

Explains how to identify support and resistance levels. (Give examples with at least 2 different graphs)

As we have discussed the price charts of different types in the above sections so now we are going to discuss the two most important terms that are highly used in the trading world. These terms are Support and Resistance levels. Support and Resistance levels are actually the areas of high demand and supply in the market. The determination of the Support and Resistance levels is very important before entering the market of cryptocurrencies.

The Support and Resistance levels play a very important role in providing good trading decisions. The breakouts and the trend continuations can also be determined with the help of the Support and Resistance levels. Many traders draw the Support and Resistance levels to mention the entry and exit positions in the market. Let's discuss these terms in a bit more detail.

- Support Level:

Support Level is actually the area of high demand in the market. The price of the assets tends to move upward after touching the support level in the market. The Support level is drawn by combining the lows of the trends in the markets. A support level is mostly formed after the completion of the Bearish trend. A trend reversal from bearish to bullish can be expected from this region but sometimes, the support is broken and the price continues its downward journey.

Let's have a look at the below screenshot in which a support level is drawn.

In the above screenshot, we can see that a Support level is drawn by joining the lows of the market trends. We can see that the price bounced back after hitting each support level every time. So, the Support level could be considered a good entry position.

- Resistance Level:

Resistance Level is actually the area of high supply in the market. The price of the assets tends to move downward after touching the resistance level in the market. The Resistance level is drawn by combining the highs of the trends in the markets. A resistance level is mostly formed after the completion of the Bullish trend. A trend reversal from bullish to bearish can be expected from this region but sometimes, the resistance is broken and the price continues its upward journey.

Let's have a look at the below image in which a Resistance level is drawn.

In the above screenshot, we can see that a Resistance level is drawn by joining the highs of the market trends. We can see that the price bounced back after hitting each resistance level every time. So, the Resistance level could be considered a good entry position for Short trade or a selling position for the previously opened order.

(03)

Identifies and flags Fibonacci retracements, round numbers, high volume, and accumulation and distribution zones. (Each one in a different graph.)

Now, we are going to discuss some other technical analysis tools. So, have a look at them, one by one.

- Fibonacci Retracements:

Before discussing the Fibonacci Retracement, we have to discuss the term Retracement. Actually, there are two types of crypto markets, Ranging and Trending. In Ranging Market, the price of the assets makes a boundary between the support and resistance levels and oscillates between these two levels. While in the trending market, the direction of the market is in a particular trend (Upward or Downward). A trend is a collection of Bullish and Bearish candles that move either upward or downward. There are some candles that do not follow the trend as it is the area of the profit collection for the traders. This movement of the price against the trend is called Retracement.

Fibonacci Retracement is the technical analysis tool that is used to determine the retracements in a particular trend. Actually, this tool is helpful in determining the returning point of the price after the retracement. To determine the reversal of price after the retracement in the Bullish trend, we have to draw the Fibonacci Retracement tool from the previous low point to the recent high point of the market. An example of the Bullish Fibonacci Retracement can be seen in the below image.

In the above image, we can observe that the trend of the market was Bullish in nature. The price of the asset made some retracement points during this uptrend and moved a bit down. These points are actually representing the profit-collection points of the traders of the market.

To determine the reversal of price after the retracement in the Bearish trend, we have to draw the Fibonacci Retracement tool from the previous high point to the recent low point of the market. An example of the Bearish Fibonacci Retracement can be seen in the below image.

In the above image, we can observe that the trend of the market was Bearish in nature. The price of the asset made some retracement points during this downtrend and moved a bit up. These points are actually representing the profit-collection points of the traders of the market.

Round Numbers

As we all know the market of cryptocurrency is so volatile that we have to manage the risk of any trade that we execute in the market. We can make proper risk management by placing the Stop-Loss and Take-Profit points. The exit points in the market while making the trade can be determined with the help of the stop loss and take profit points.

Most traders used to place the take profit and the stop loss of 410 instead of 411.86. The minds of the traders affect the price movement and thus we can see that notice that the more the rush is seen on the same round numbers, the more the trigger of the take profit levels. Let's have a look at the below image in this regard.

In the above image, we can see different support and resistance levels at different prices. The reversals of the prices at the round numbers of the chart can be seen in the above picture. Traders can manage their stop loss and take profit levels by keeping in view these points.

High Volume

The Volume of the market also plays a vital role in determining the best exit and entry positions in the market. The length of the candles shows the volatility of the market at that point and as long as the candle is formed, the more is the volume of the market at that point/candle.

We mostly observe that the Volume of the market in the Ranging phases is low as compared to the volume in the trending phase. The volume of the market must be kept into view before making any trading decisions in the market. Let's have a look at the below image to see the concept more deeply.

In the above image, we can observe that firstly, the market of the asset was in the ranging phase and the volume of the market was low at that point. After that, the price started moving down abruptly, and then the Volume of the market also increased. This shows that the volatility of the market increased.

From the above image, the importance of the Volume indicator can be determined clearly. We must have to pay full attention to the volume of the market in the accumulation or distribution phase before making any trading decision in the market.

Accumulation and Distribution Zones

For making profitable decisions in the market, the accumulation and the distribution phases play a very important role for the traders. The accumulation and the distribution phases are formed at the start and the end of the market trends. These phases are also known as the profit collection areas for the buyers or sellers of the market.

The Accumulation Phase is actually a type of ranging market that is formed after the completion of the bearish trend in the market. During the accumulation phase, the Strong Hands of the market take their profit from the Short trades that they have executed before. This thing makes the price movement in a particular boundary and after that, the Strong Hands of the market starts entering the market for the Long positions so the market price goes upward.

While the Distribution Phase is actually a type of ranging market that is formed after the completion of the bullish trend in the market. During the distribution phase, the Strong Hands of the market take their profit from the Long trades that they have executed before. This thing makes the price movement in a particular boundary and after that, the Strong Hands of the market starts entering the market for the Short positions so the market price goes downward.

An example of the Accumulation and Distribution phases is seen in the below screenshot.

(04)

It explains how to correctly identify a bounce and a breakout. (Screenshots required.)

The Support and Resistance levels are of great importance in the market and it is also very difficult for inexperienced traders to execute any trade at these levels. At the Support and Resistance levels, the traders avoid executing any trade as the price of the asset could break the support and resistance, or otherwise, it bounces back.

So, it is very important to study if the price is going to make the breakout on the Support or Resistance levels or going to rebound. Let's have a look at the below image to understand the concept properly.

In the above image, we can observe that the price action line made a breakout on the support line and after that, the price action line retested the broken support level two times. Then, the selling pressure increased and the price started moving downward heavily.

The rebound point is such a condition in which the broken support level turns into the resistance level for the next trend. Let's have a look at the below screenshot to understand the concept more briefly.

In the above image, we can observe that after the break of support level, the price retested the support, again and again, two times. After that, The price returned and started a downtrend. The Rebound is actually considered as the confirmation of the breakout point. We can see that the price made the rebound region two times and then started moving downward. If the rebound did not happen, the breakout would be considered invalid.

(05)

Explain that it is a false breakout. (Screenshots required.)

As we have discussed before that it is very difficult and risky to execute trades on the Support and Resistance levels. Most of the traders are psychologically trained that they must have to execute the Long Trade at the Support level and the Short trade at the Resistance level as the price is expected to bounce back after touching these levels. But it is not mandatory. We must have to wait for a while at these levels for a better signal.

Let;'s have a look at the below image.

In the above screenshot, we can observe that the price action line cut the Resistance line, and looking like a Bullish trend reversal had happened and a Bullish trend is going to start. But after some time, the price returned to the broken resistance level and started its journey in the downward direction. Actually, the breakout that happened on the resistance level was a Fake Breakout.

We can filter out the false or fake breakouts from the market with the use of other technical analysis tools. We must wait for a while and ensure the formation of a complete breakout pattern or we should have to apply other indicators on the chart to confirm the breakout and make a profitable trading decision in the market.

(06)

Explain your understanding of trend trading following the laws of supply and demand. It also explains how to place entry and exit orders following the laws of supply and demand. (Use at least one of the methods explained.)(Screenshots required.)

In crypto trading, the determination of the current market trend is very important for the traders before making any entry or exit trade in the market. The trends occur in the market due to the force of supply and demand in the market. When the number of buyers in the market is increased, the demand of the market is increased and hence the price of the asset enters the bullish trend. Similarly, when the number of sellers in the market increases, the supply of the asset is increases and hence the price of the asset follows the bearish trends.

The demand and supply of the assets remain constant to an extent during the ranging market condition. When the demand for the asset is increased due to the increase in the number of buyers in the market, a bullish trend starts along with the formation of higher high and higher low levels in the market. Let's have a look at the below image in this regard.

On the Other Hand, When the supply of the asset is increased due to the increase in the number of sellers in the market, a bearish trend starts along with the formation of lower high and lower low levels in the market. Let's have a look at the below image in this regard.

Entry and Exit Orders According to Law of Supply and Demand

- Final Retracement (Elliott Waves Theory):

Elliott Waves Theory is a very useful technical analysis tool that is of unique importance in determining the trend reversals in the market. The end of the previous trends and the start of the new trends can be determined with the help of the Elliott Waves theory. The Impulsive Waves of the Elliott Wave represent the previous trend and the Corrective Waves (a,b,c) represent whether the previous trend is reversed or continued. Let's have a look at the below image and then talk about it a bit more.

In the above screenshot, we can see that first, the trend of the market was bullish due to the higher highs and higher lows formation of the impulsive waves 1, 2, 3, 4, and 5. After that, the Corrective waves are formed and for the confirmation of the upcoming, we must have to look at the corrective waves properly.

We can see that the corrective wave 'c' had less volume than the corrective wave 'a'. Also, the low of wave 'b' is higher than the previous low. The wave 'c' cut off the resistance created by the wave 'b' so a bearish trend is going to start. Traders can execute a sell trade there. The setup of the sell/short trade is shown in the below image.

From the above screenshot, you can see that the Entry position is mentioned when the wave 'c' cut off of the resistance level created by the wave 'b'. The Stop-loss level is set just above the high point of wave 'a' and the take profit level is set below the entry point to secure good profit.

- Entry After Pullback:

The retracement points during the trending market could also be very good entry positions for the traders. During a Bullish trend, the price makes higher high and higher low points and retracement points are also formed accordingly. These retracement points could be very profitable for entering the market. After the Impulsive wave that is in the direction of the trend, the retracement wave occurs that is in the opposite direction and when this retracement wave crosses the high of the previous impulsive wave, this could be a very good entry point. Let's have a look at the below image in this regard.

In the above image, we can see that the price was in an uptrend and when the retracement wave cut the high level of the previous impulsive wave, we can make a buy entry in the market. The Stop Loss could be placed at the previous low and the take profit level at the upside of the entry. Let's have a look at the trade setup by using this method.

- Market Trap:

Some intelligent and clever traders use this strategy to make profitable decisions in the market by taking the advantage of the False breakouts in the market. The false breakouts are manipulated by Strong Hands to provide liquidity to the market. When the price action breaks the support or resistance level and after some time, again enters the previous boundary and started moving above or below the level, this is a false breakout and traders can make entries in the market when the price re-enters the broken level. Let's have a look at the below image.

In the above image, we can see that the price made a false breakout on the resistance line and re-enter the resistance line. This could be a good entry position for the Short trade in the market. The Stop Loss must be set to just equal to the peak that is formed by false breakout and the Take Profit is set below the entry point. Have a look at the below image to see the Trade Setup.

(07)

Open a real trade where you use at least one of the methods explained in the class. (Screenshots of the verified account are required.)

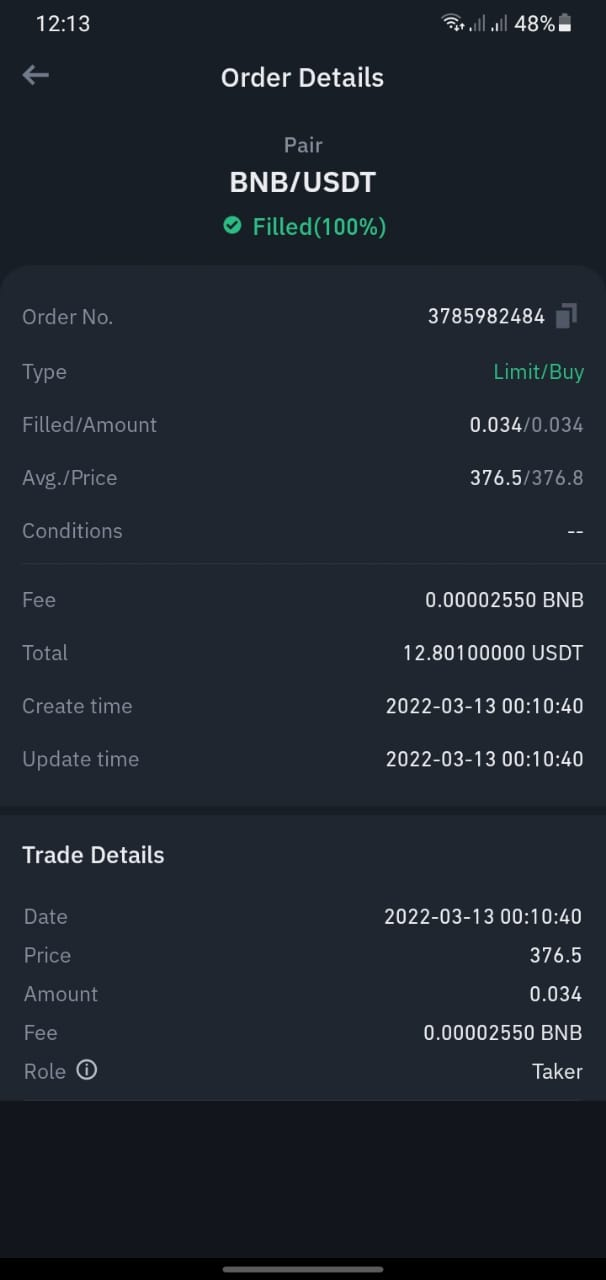

Now, I am going to execute a real trade by utilizing the knowledge that I have gained from this lecture so far. I have chosen the BNB/USDT pair for this trade. I am going to do the technical analysis first. So have a look at the below image.

In the above image, we can see that a fake breakout had occurred on the support level of the chart at the timeframe of 3 minutes only. I have chosen a small timeframe because I am going to execute a scalp trade. The price breaks out the support line and again entered the support level so it is a better entry position in my view.

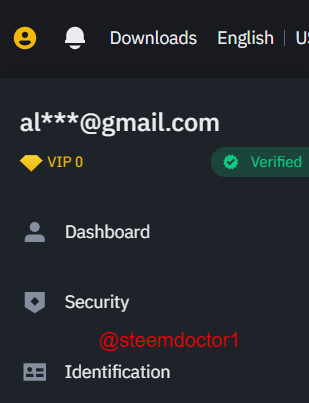

The take profit is mentioned above the entry and the stop loss is mentioned just below the low point created by the breakout. I have executed the trade on the Binance exchange. The entry of my trade in the market is actually 378.5. The screenshot of my verified Binance exchange account is shown in the side image and the proof of the transaction that I have executed is shown in the below image.

Conclusions

Technical Analysis plays a very important role in the determination of the future trends of the market by keeping in view the past data of the prices of the market and the movements of the price action. The graphical representation of the price movement in the market and the interaction between the sellers and the buyers are represented in the price charts.

Support and Resistance Levels play a very important role in the technical analysis. The breakout of the support and resistance level is very important for the traders for making profitable trading decisions in the market. So, we must analyze the charts properly before making any trading decision.

So, that's all about the homework post for this week. Hopefully, all of you will like it. Special thanks to dear professor @nane15 for such an amazing lecture.

Writer: @steemdoctor1 (Crypro Student)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit