Hello everybody.

Hopefully, all of you will be good and happy and enjoying your beautiful health with the grace of Almighty Allah. Today, I am here to present the homework post for dear professor @lenonmc21 in Week 4 of Season 4 of Steemit Crypto Academy. I have read the whole of the lecture post by the professor and have understood all the concepts. So, let's start our task without any delay.

There are some questions asked by the professor as the assignment for this week and I will discuss all of them in the given order.

(01)

Define in your own words what Price Action is?

Price Action, as referred to by the name, is the action of the respective asset in the market. The study of this action of price in the market is called as Price Action Technique. As we all know that the market of cryptocurrencies is so much volatile. Ups and downs are the regular games of the price. So, the representation of these ups and downs in the price of the cryptos is actually the Price Action.

The flow/movement of the price of any cryptocurrency is represented in the crypto chart of the respective asset. This chart consists of two types of lines, Green and Red. The Red lines (candles) show that the price of the asset decreased while the Green lines (candles) show that the price of the asset increased.

There is a number of technical indicators and other technical analysis tools and strategies that are used to study the behavior and condition of the market. These strategies and tools are also useful in determining the future position of the market but the best amongst these all tools and strategies is the Price Action Strategy. The reason is that the Price Action represents the current flow of the market and thus proved to be helpful in making better decisions by keeping a constant eye over the volatile markets.

Examples:-

Above all the examples of the Price Action in the chart of the ETH/USDT pair representing the Bullish and Bearish price flow respectively.

(02)

Define and explain in detail what the "Balance Point" is with at least one example of it (Use only your own graphics?

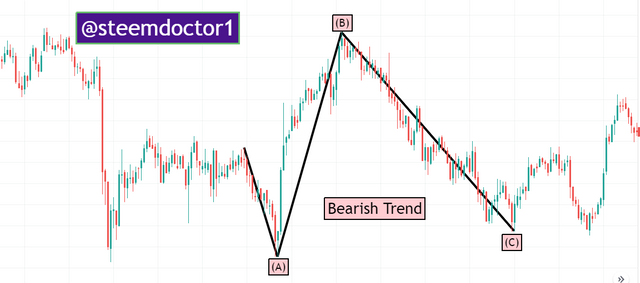

As we have discussed that the behavior and condition of the market can be studied with the help of Price Action. So, there is a term known as Balance Point, is greatly used in the Price Action Technique. Balance Point is simply the last point of the last candle at the end of a trend. Suppose, a bullish trend ends with a large Green Upward Candle (Bull), the Balance Point will be the last pint of that candle.

Balance Point is also known as Equilibrium Point and can be identified by drawing two straight horizontal lines that should be drawn at the high point (top) and the low point (bottom) of that candle.

Example:-

(03)

Clearly describe the step by step to run a Price Action analysis with "Break-even"?

As we have discussed the complete explanation about the Break-Even Point or the Balance Point in the above section so now I am going to discuss the method to run a Price Action analysis with the help of the Break-Even point. So, let's follow these steps for this.

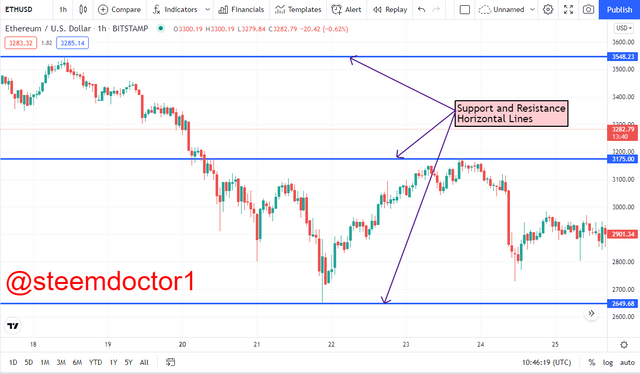

First of all, we have to set the time frame of our chart on which we are going to apply the Price Action Strategy. We have to manage the timeframe according to our trading strategy. If we are a scalp trader then we should set the timeframe of 1 hour and still use the 15 minutes timeframe for deeply studying the chart. While on the other hand, if we are long-term traders then we have to manage the timeframe according to our trading taste.

After setting the timeframe, we have to draw horizontal lines representing the Support and Resistance level in the area we are going to set out the Balance Point. We will use these points to make profitable decisions.

After drawing the horizontal lines and setting the timeframe, we have to study the trend that the market is currently following. Now, we will identify our Balance Points and search for possible opportunities for us to enter the market.

So, in this way we are able to apply the Price Action Technique on the chart of any crypto asset. Firstly, I took the 1-hour chart and mark the support and Resistance levels there. After that, I change the timeframe from 1h to 15 minutes to observe the graph more deeply. Then I marked the higher and lower Break-Even points in order to get better Sell and Buy opportunities in the market.

(04)

What are the entry and exit criteria using the breakeven price action technique?

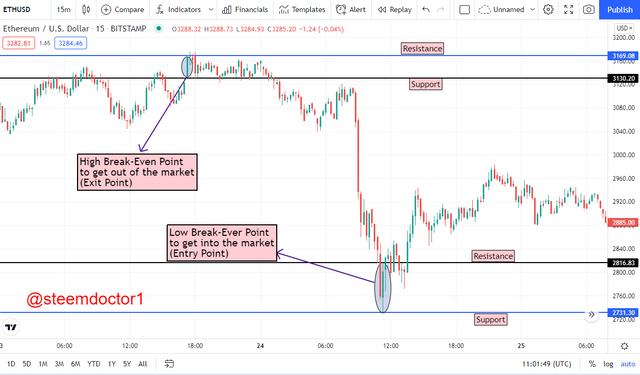

As we have discussed the complete method of putting the Break-Even points and analyze the chart in the above section so now I am going to discuss the entry and exit criteria from the market by using the price prediction techniques. So, have a look.

After a successful and satisfying analysis of the chart by the Break-Even points using the Price Action technique, we have to wait for a break in the market. This break is created by the market either on the upper Break-Even point or the lower Break-Even point. If the break is at the bottom balance point then it is the Entry Point and we have to open our buy order. But if the break is at the upper Balance Point then this will be the possible Exit Point and we have to open the Sell Order.

We must have to adjust a Stop-Loss just below the candles performing the Break-Even point at both ends. The Stop-Loss should be below the Break-Even point and the take profit will be above the Break-even point. The risk-reward ratio between the Stop-Loss and Take-Profit should be 1: 1.

(05)

What type of analysis is more effective price action or the use of technical indicators?

Technical Indicators are the technical analysis tools that are helpful in determining the flow of the market or the study that either the market is trending or ranging or if trending, then what is the trend, Uptrend (Bullish) or Downtrend (Bearish). Before this lecture, I was thinking that the technical indicators are the best technical analysis tools for traders to make profitable decisions. But after discussing the Price Action Strategy, I believe that only the technical indicators are nothing to get a good profit, the involvement of the Price Action is compulsory in this regard.

Some of the technical indicators are leading that represents the change in the market before the occurrence of that change while others are lagging that indicates the change after its occurrence. So, from this discussion, it is cleared that it is not possible to make a good analysis by the technical indicators only. The Price Action Strategy is the most effective way to analyze the chart as it shows the current market behavior and condition.

By keeping in view the concepts of Break-Even and other analysis tools in the Price Action Strategy, one can make profitable decisions in a flowing market and mention out best entry and exit points according to his trading strategy. In short, the Price Action Technique is more effective and simpler than the technical indicators in order to analyze the market.

(06)

Make 1 entry in any pair of cryptocurrencies using the Price Action Technique with the "Break-even Point" (Use a Demo account, to be able to make your entry in real-time at any timeframe of your choice)

Fo the accomplishment of this task, I am using the TradingView platform. So, have a look.

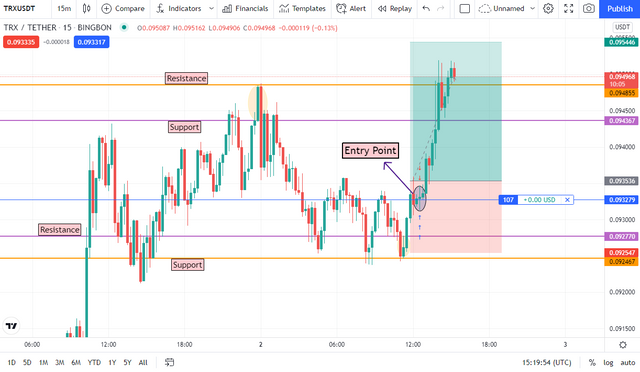

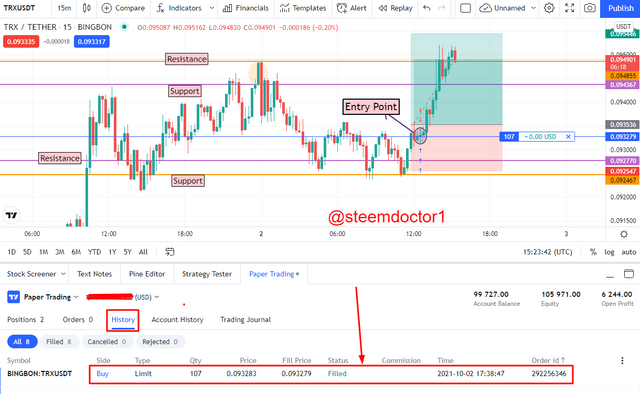

For of all switch to the Paper Trading mode (demo) of TradingView platform and I have opened the TRX/USDT pair.

Have a look at my entry point in the below screenshot.

- As you can see in the above screenshot that I have marked my entry point in the market of TRX/USDT. First of all, I adjusted the time frame to 15 min chart so that I could be able to analyze the chart completely and more deeply. Then, draw the high Break-Even point and the low Break-even point in the chart. After that, I entered the market at 0.093$, as marked in the screenshot above. The market crossed the Target Price set by me and goes to 0.0952. So, fortunately, I was in good profit by using this strategy.

So, it is cleared that the Price Action Analysis by the Break-Even Strategy is a highly profitable and effective one.

Conclusions

Price Action means the current flow of the price of an asset in the market. This flow of price is presented in a chart called as Crypto Chart. The Price Action is a very useful and profitable technique in the price analysis of a crypto asset. The last candle of any trend (Bullish or Bearish) gives raise to the Balance Point. Balance Point is also known as Equilibrium Point or the Break-Even Point. These points are used to study a chart more efficiently and effectively. The use of the Price Action rather than the technical indicators is more profitable and more effective for the chart analysis.

Thanks to all of you for stopping by ...

Writer : @steemdoctor1 (Crypto Student)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit