Hello everybody.

Welcome to this post. I hope that all of you will be good and happy and enjoying your good health with the grace and blessings of Almighty Allah. Today, I am here to present the Trading Post in the Season 6 of the Steemit Crypto Trading Competition. This is a very golden chance for all of us to utilize the knowledge that we have gained from the academy so far. So, let's start the task without any wastage of time.

This is my 2nd trade this week and I am going to open a Short Future Trade in the AVAX/USDT pair. Let's discuss the reason for selecting this pair and the trade-in detail.

Coin Pair and Exchange Name

Today, I am going to trade one of the most popular and high-rated pairs that are AVAX/USDT. AVAX is one of the most popular and the most successful coins at this time. I am going to execute a Short Future Trade in this pair. I will try my best to analyze the market completely and open a successful and profitable trade.

As I have already told you that the AVAX coin is one of the most popular and the most successful coins of the time. It is also present in the top 10 cryptocurrencies of the time so the pair of AVAX coins with the USDT is very impressive. The AVAX coin is one of the strongest coins at this time as it belongs to a very strong platform, Avalanche Blockchain. This pair is also one of my favorite pairs in crypto trading. I have executed many trades in this pair and made very good average profits so far. So, these are some reasons behind the selection of this pair for today's trade.

I have selected the Binance exchange because I personally like it very much. It is quite simple to use and also it is a very safe and secure exchange for trading cryptocurrencies. I have also used a number of other exchanges like Poloniex, Huobi Global, etc. But I liked the features of the Binance exchange very much and I am familiar with most of the features of the Binance exchange.

Binance Exchange is the most popular centralized exchange of the time. Its popularity is due to its number of unique and useful features. It allows the users to trade almost all of the good crypto pairs. The P2P trading and the Margin trading of this exchange are also impressive. It allows the users to set the leverage of the futures trades up to 125X which is really impressive. There are also many other unique features of this exchange that made this exchange listed on top in my book of trading.

Fundamental Analysis of Avalanche (AVAX)

- Introduction and History:

The AVAX coin is the native currency of the Avalanche Blockchain. The use cases of the AVAX coin in the blockchain are so wide and that's why it is one of the most successful coins at the time. The AVAX token can be used for the security and privacy of the Avalanche blockchain and also carry out the transactions that are taking place in the blockchain.

The Avalanche Blockchain is actually an Open-Source blockchain platform that is actually considered as the opponent of the Ethereum blockchain. The developers of the Avalanche blockchain claimed that it is better than Ethereum blockchain due to its improved scalability, affordability, and many more other features. Avalanche Blockchain can carry out up to 4500 transactions per second which is much more than the TPS of the Ethereum Network.

The Avalanche Blockchain was developed by the AVA Labs in 2020. The founders of this blockchain include Sir. Emin Gün Sirer, Sir. Kevin Sekniqi, Maofan “Ted” Yin, and Gün Sirer. There are also many other personalities that are involved in the development of this platform but these figures are most prominent. The main motto behind the creation of the Avalanche Blockchain was to develop such a platform that can overcome the scalability problems of the Ethereum Network.

The Avalanche Blockchain actually works on the basis of X-Chain (Exchange Chain), P-Chain (Platform Chain), and the C-Chain (Contract Chain). These chains work together to make the Avalanche blockchain one of the best Smart Contract based platforms of the time. The advantages of this platform include the High Transaction Speed, Impressive Reward System for the Stakers, and this platform also supports many DeFi projects.

The AVAX coin is used as the governance currency of the Avalanche Blockchain. The transaction fees are reducted in the form of AVAX coin and the validators are also chosen on the basis of the staking of the AVAx coin. The AVAX coin is also used for the protection/security of the Avalanche blockchain. Thus, the AVAX coin is one of the strong coins of the time.

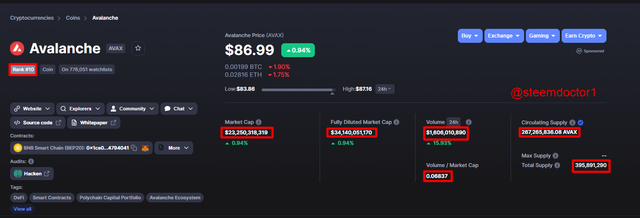

- CoinMarketCap of AVAX Coin:

On exploring the CoinMarketCap of the AVAX coin, I have got a number of useful information about the AVAX Token. So, have a look at the following screenshot in this regard.

The information that is obtained from the above screenshot can also be expressed in the form of tabular data that is given below.

| Coin Name | Avalanche |

|---|---|

| Nick Name | AVAX |

| Rank | 10 |

| Current Price | $86.99 |

| Market Cap | $23,250,318,319 |

| Fully Diluted Market Cap | $34,140,051,170 |

| Market Volume | $1,606,010,890 |

| Volume / Market Cap | 0.06837 |

| Circulating Supply | 267,265,836.08 AVAX |

| Total Supply | 395,891,290 |

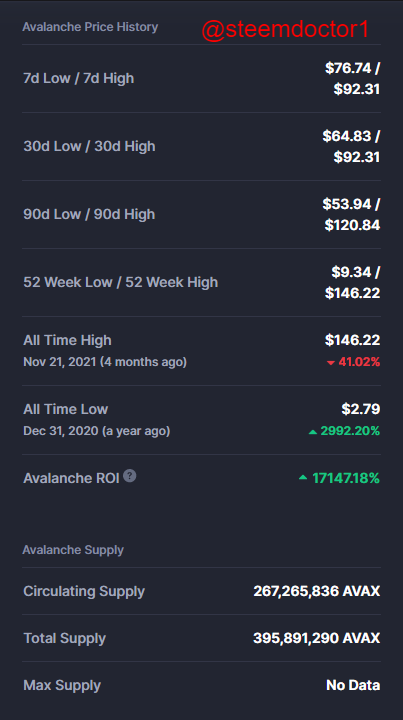

- Historical Price Data:

From the above screenshot, we can observe that the All-time High price of AVAX is $146.22 (21, November 2021) and the All-Time Low price of GMT is $2.79 (31, December 2020).

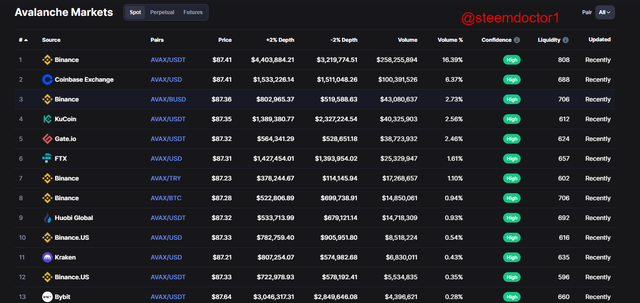

- Available Markets:

As I have discussed that the AVAX coin is one of the most popular coins at this time. So, it is available on almost all popular and successful exchanges and swap platforms. Some of them are listed below.

Technical Analysis of AVAX/USDT pair

As we all know that the markets of cryptocurrencies are so much volatile that it is very important to analyze the market completely before entering the market in any direction. There are actually three types of analysis. The Fundamental Analysis deals with the prediction of future prices by knowing the important events in the market. Sentimental Analysis deals with the prediction of future prices and trends y knowing the psychology of the traders in the market.

The most important type of analysis are the Technical Analysis. The Technical Analysis deals with the use of different technical analysis tools like price movements, trends, technical indicators, and many more. These technical analysis tools are applied on the price charts of the crypto pairs and the future market moves can be determined. I am going to do a proper technical analysis to open a profitable and successful trade in the market.

I have used three different indicators in the markets. These indicators are Relative Strength Index (RSI), Moving Averages (MA) and Parabolic SAR. I used these three indicators as I have a proper grip on the working of these indicators. These indicators are discussed below.

- Parabolic SAR:

Parabolic SAR that is also known as simply SAR, is a technical indicator that is actually a trend-following indicator and can be used to determine the overall trends of the markets, and the trend reversals, as well. This indicator consists of a dotted line that can move above or below the price action line. When the dots are above and below the price action line, it is a signal of Bearish and Bullish trend respectively.

- Moving Averages (MA):

Moving Average (MA) is also a trend-based technical analysis tool that is used to determine the trends of the market and the trend reversals that are happening in the market. It actually consists of a simple line that can move either above or below the price action line. When the line of MA is above the price action line, it is a Bearish Signal and vice versa.

- Relative Strength Index (RSI):

Relative Strength Index (RSI) is actually an oscillator and a volatility-based indicator that can be used to determine the Overbought and Oversold regions in the market. It ranges from 0 to 100. When the line is above 70, it is an Overbought region and a Bearish reversal. Similarly, when the line is below 30 range, it is an Oversold region and a Bullish trend reversal.

Let's have a look on the below screenshot in which these three indicators are combined.

In the above screenshot, we can see that the trade setup was claerly seen in the image. First of all, I opened the AVAX/USDT pair and selected the timeframe of only 5 minutes. I drew the Support and Resistance levels on the chart and applied the three indicators. The main points that are obtained from the chart are:

The Parabolic SAR dots were moving above the price action line that is a signal of Bearish trend.

The Bearish signal is then confirmed by the RSI line as it was moving downward after making an Overbought region. It seemed that it is going to enter the Oversold region soon.

The third confiramation of the Bearish signal can be seen from the MA line as the line was moving above the price action line.

Keeping in view the above all points, I decided to open a Short Future trade in the market of the AVAX/USDT pair. I decided to took advantage of the downward movement of the price so I opened the Binance exchange and executed a Short Future Trade with a leverage of 20X. The Take Profit and the Stop Loss levels of the trade are set at the ratio of 1:1.

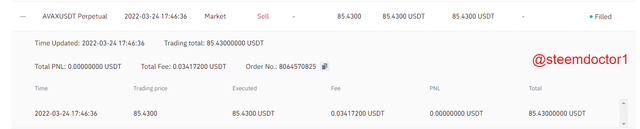

The Short Future trade that I have executed in the market of AVAX/USDT pair can be seen in the below screenshot.

After a few minutes, I observed that the price just hit my Take Profit level. So, I decided to close my Short position in the market at the Take Profit level. This can be seen in the below screenshot.

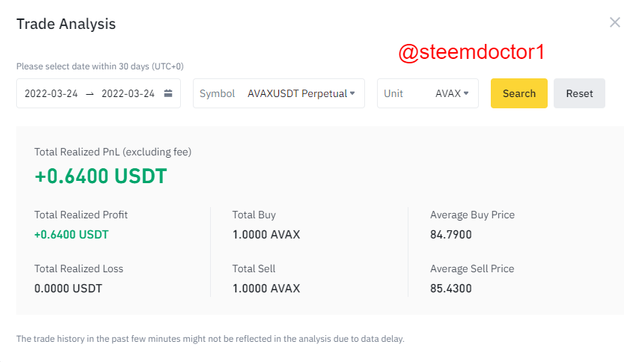

The results of the trade are shown below screenshot. I successfully secured a profit of $0.64 which is good enough according to my Margin. The close of the trade with profit is shown in the below screenshot.

My Plans and Recommendations

As you can see in the above section I have executed a Short Future trade in the market of the AVAX/USDT pair. I did not open this trade to hold it for a long time. I just opened the trade as I wanted to take advantage of the downward movement of the market. I did not plan to keep this trade for a long time so I had also used the low timeframe of 5 minutes only.

So, I did not hold this trade for a long time. I have just entered the market as the signal given by my technical analysis was Bearish. So, I executed a Short Future Trade in the market with proper risk management. After some time, the price followed my prediction and I closed my position at a reasonable profit.

- Recommendations For Others:

As the question of recommendations falls, I will recommend everyone to enter the market with a Short trade at the time of writing this post. I will never recommend anyone to hold it for a long term, especially in Future Trading as the future trades are always at the risk of liquidating.

I think the AVAX coin is a very good long-term investment as it belongs to a very strong platform. I will recommend that long-term investors must consider this coin for long-term investment. Moreover, one must have to do his own technical analysis properly before making any decision in the market.

Additional Information about Avalanche (AVAX)

We can also find the social media accounts of Avalanche (AVAX). We can get the latest and most important information and news from these social media accounts.

- Twitter:

- YouTube:

- Reddit:

Medium Account: https://medium.com/avalancheavax

Telegram: https://t.me/avalancheavax

Discord: https://chat.avax.network/

We can follow and visit all these social media accounts on daily basis to get updated about any new updates about the Avalanche Blockchain platform or AVAX Coin.

- Whitepapar: https://www.avalabs.org/whitepapers

Conclusions

In this post, I have made a Short Future Trade by doing the technical analysis of the AVAX/USDT chart. I used three different technical analysis tools that are Relative Strength Index (RSI), Moving Averages (MA), and Parabolic SAR. By analyzing the market, I opened a Short Future Trade and set the Take Profit and Stop Loss points at the ratio 1:1. After some time, I got a profit of $0.68 so I closed my position.

Thanks to dear professors @reminiscence01 and @nane15 for such an amazing opportunity by leading an amazing team.

Note: All the screenshots are taken from CoinMarketCap, TradingView and Binance

Writer: @steemdoctor1 (Crypto Student)

Cc:

@steemcurator02

@nane15

@reminiscence01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi dear professor @nane15 and @reminiscence01. My this REPOST is still not curated. Please have a look on this case.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @steemcurator02 this post is still waiting for your support. Please have a look.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit