Assalamualaikum everyone!

Welcome to the post. Hopefully, all of you will be doing well and enjoying the time with the grace and blessings of Almighty Allah. Today, I'm here to be a part of the week 4 contest in our beloved SteemitCryptoAcademy. The topic of discussion for this week is very much important, Fibonacci Retracements. So, let's start the fun without any wastage of time.

In your own words, what are Fibonacci Retracements and what are they used for?

Fibonacci Retracements (FRs) are very important tools in the technical analysis of the cryptocurrency market. It is actually like dependable trail markers in the wild world of cryptocurrency trading, where prices can bounce like a rollercoaster on a sugar rush.

They help traders to determine the potential support and resistance zones in the chart. FRs are based on a complex mathematical sequence and a splash of historical price data, as opposed to physical markings used on the earth.

Consider prices as a mountain climber attempting to reach a difficult peak. The climber steadily ascends to a new peak, then takes a breath before continuing. That "breather" point, where the climber retraces their steps before tackling the next step, corresponds to a Fibonacci Retracement level in cryptocurrency trading.

The Fibonacci sequence is actually a series of numbers in which each number is generally the sum of the two previous ones (1, 1, 2, 3, 5, 8, 13, 21...), and it is the base of FRs. This sequence may be seen everywhere in nature, from sunflower spirals to tree branching patterns. What's more, guess what? It also appears in the crypto price dance!

To employ FRs in cryptocurrency trading, traders must first recognize a major price movement, such as a spike from a low to a high. Then, on the chart, they apply a Fibonacci Retracement tool, which automatically calculates and draws horizontal lines at crucial percentages of that price change.

Moving Towards Their Use Cases...

There are many important uses of the FRs. Traders can enter long positions (buy) before a price bounce by identifying possible support levels (such as 23.6% or 38.2%). In contrast, resistance levels (such as 50% or 61.8%) can indicate possible sell opportunities for the traders.

Another important thing is that the FRs are used to minimize potential losses if the price breaks through in the opposite direction, traders can place stop-loss orders immediately below support levels or above resistance levels. Consider it like putting up a safety net in case the climber falls.

Moreover, the FRs should not be utilized alone. They are most effective when used in connection with other technical indicators and fundamental analysis to create a more comprehensive trading strategy. Consider using trail markers in connection with a compass and a map to make your climb safer and more informed.

Explain the most important Fibonacci levels and show at least one example on a chart of a cryptocurrency pair.

In the world of cryptocurrency trading, where prices move like firefly on caffeine, Fibonacci Retracement levels (FRs) serve as dependable trail markers, identifying possible zones of support and resistance. These levels, drawn from the Fibonacci sequence, provide useful information for structuring your crypto adventure. Some important levels of the FRs are as follows,

- 23.6%:

The first important level is 23.6%. This level represents a potential "breather" point, where the price may briefly pause or retrace before continuing its uptrend (imagine the climber taking a small water break).

- 38.2%:

This level shows a higher possible reversal zone, similar to a climber approaching a ledge and debating whether to continue climbing or drop slightly for a better grip.

- 50%:

This crucial psychological milestone frequently serves as a substantial support or resistance zone, very similar to the climber reaching the halfway point and assessing the remaining step.

- 61.8%:

It is another level in the sequence. Also known as the Golden Ratio, this level represents another key potential reversal zone, analogous to a climber confronting a difficult overhang that may need a shortcut.

- 78.6%:

This final major retracement level suggests a significant decline, similar to a climber confronted with a vertical cliff and needing to strategize the final ascent potential.

Let's see an example on which Fibonacci Retracements are applied and the important levels are mentioned.

Use the STEEM/USDT chart and show how Fibonacci retracements work.

The application of the Fibonacci Retracements is very much simple and easy process. I have applied the FRs on the STEEM/USDT chart. Let's discuss all the steps one by one.

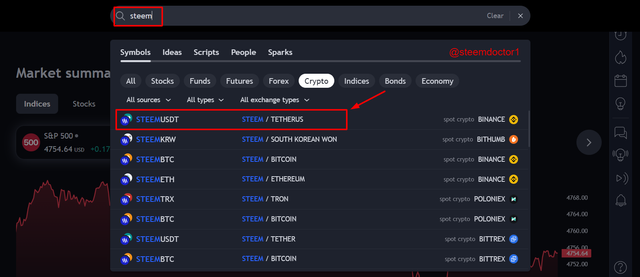

First of all, open the TradingView platform and search the desired market in the Search Bar. I have selected the STEEM/USDT chart from the search option. This is shown on the below screenshot.

After the launching of the chart, you have to click on the Retracements icon present on the side bar menu, as shown in the below image.

From the popped up menu, you have to select the Fib Retracements option as shown in the below screenshot.

After selecting the indicator from the menu, the Fib Retracements indicator will be showed and you have to apply in on the chart by determining a particular trend. Have a look at the below screenshot in which FRs has been applied successfully.

In the above screenshot, you can see a continuous pump in the price action of the Steem market in a whole week. At the start of the week, the price started moving up and then made a correction and then again started moving up. The break point has reflected by the Fib Retracements level.

After that, the price has continued moving in the upward trend and the retracements which are made during the upward journey are shown by the respective levels of the Fibonacci Retracements indicator. Different support and resistance levels that are temporarily created are mentioned by different levels of the FRs.

Advantages and disadvantages of Fibonacci retracements.

We have already discussed the complete details of the Fibonacci Retracement and also discussed their working in detail. So, let's move towards the possible gains and drawbacks of these technical analysis tools.

Advantages...

The first and the most important gain is that the FRs identify regions where the price may pause or reverse, providing useful information for trading entry and exit positons.

Secondly, the FRs can amplify trade signals and give an additional layer of confirmation to your strategy when combined with other indicators.

Thirdly, certain retracement levels such as 50% and 61.8%, have a psychological reflection for traders, potentially affecting market action.

Another important thing is that the FRs can be applied to a wide range of timeframes, from short-term charts to long-term trends, providing flexibility for a variety of trading techniques.

One more thing is that the FRs are very much easy and simple to use for the traders and the traders just have to understand them once and use for a long run.

Drawbacks...

One greatest drawback of the FRs is that creating and applying FRs can be subjective, resulting in trader disagreements and sometimes incorrect signals as well.

Another thing is that relying on psychological levels can generate a feedback cycle in which traders follow perceived support and resistance, pushing price action further and further.

FRs are not perfect forecasters of future price changes and can be broken or ignored by the market, resulting in misleading signals and losses.

Moreover, relying solely on FRs for trading choices can be risky, as it ignores other important aspects like as market fundamentals and technical indications.

Because FRs are dependent on prior price movements, they are lagging indicators that react after the price has changed, potentially resulting in delayed entries and exits.

Conclusions

Fibonacci Retracements is one of the most popular and commonly used technical indicators which is actually used for the determination of the possible retracements during a particular trend. It can be used to determine the trend continuation or the trend reversals by spotting the support and resistance levels even if they are temporarily created in a particular timeframe.

|  |  |  |

|---|

Greetings brother, Your explanation of Fibonacci retracements and their application in technical analysis was spot-on. It was clear, detailed, and really helped me understand how to use them effectively. The connection between Fibonacci retracements and the Fibonacci sequence, along with the golden ratio, adds a fascinating and mathematically aspect to studying the market.

Your analysis of the STEEM/USDT pair using Fibonacci retracements was incredibly informative. It was evident how the Fibonacci levels acted as potential support and resistance points during the price movement. I also appreciate that you took the time to provide a balanced view by highlighting both the advantages and disadvantages of using this tool. It's important to consider all aspects when making informed trading decisions. Keep up the fantastic work, Good luck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for such a nice comment dear 😌

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome sir, the pleasure is mine.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your comment has been successfully curated by @sduttaskitchen at 5%.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your comprehensive exploration of the Fibonacci Retracement and its advantages is commendable. Highlighting its crucial role in identifying potential pause or reversal points adds practical value for traders, aiding in strategic entry and exit decisions.

Additionally, the insight into how Fibonacci retracements amplify trade signals, especially when combined with other indicators, enhances the overall understanding of their application. The recognition of psychological reflections at specific retracement levels provides a nuanced perspective on market dynamics. Well done!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so mcuh for your beautiful comment 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM 4

Congratulations! This post has been voted through steemcurator07. We support quality posts and comments!Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot dear friend @chant for the support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

X Share Link:

https://twitter.com/mrsheraz7588/status/1738616053448810883?t=bGtBgfL4Dz1F84MFIgnuuA&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Estimado amigo, tu analogía del alpinista escalando por niveles hasta llegar a la cima es una magistral explicación de lo que significan los retrocesos de Fibonacci para un concepto que para muchos es complejo de entender matemáticamente.

Dejaste claro que los posibles niveles de soporte (23,6% o 38,2%) son el momento de entrar con posiciones largas y por el contrario los niveles de resistencia (como 50% y 61,8%) son las oportunidades de entrar en corto. Esto es crucial para la toma de decisiones.

Además, no menos importante, nos sugiere utilizar una estrategia para minimizar pérdidas potenciales si el precio rompe en dirección opuesta, así como complementar el análisis técnico con otros indicadores.

Tu aporte de conocimientos es apreciable, he aprendido mucho de tu contenido.

Gracias por compartir como siempre tu excelente trabajo.

¡Suerte, éxitos y un fuerte abrazo!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for your kind observation and leaving such a precious comment my friend 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sallam Dr shb😍

Your post shines with insightful explanations on Fibonacci Retracements, truly illuminating how these markers guide crypto adventures. Your effort to simplify their application & highlight their significance is commendable

keep sharing such quality insights! Your dedication surely enriches our understanding of trading strategies.

All the best in the contest, success for you! 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for praising my explanation. Good luck to you as well. Good morning

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey bro, nice work I must say

Yes friend This is true it's really risky very very risky to make prediction or an trading analysis based on just one indicator not to talk of these track did that has many downsides

Thanks for sharing wishing you success please engage on my entry.https://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s14w4-fibonacci-retracements

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the comment. Good luck to you also.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bhai aapane iska pic ko bahut acchi Tarah se explain kiya hai aur iske alava aapane fibonacci retracements hamen bahut acchi aur basically standing di hai ki hamare pass ek bahut hi mufeed tool hai jiske through Ham price ki fluctuations ko predict kar sakte hain aur Inka sahi tarah se dada Laga sakte hain aur iske alava aapane kuchh most important levels ko bhi discribe kiya hai or Bitcoin tether k chart 📈📉 ko hmarag Sath share kiya

STEEM USDT chart 📉📈 ko bhi aapane bahut explain Kiya hai aur iske alava aapane hamare Sath kuchh pros and cons bhi is time ko lekar explain kiye Hain jinse mujhe totally agreement hai aur Main aapko aapki mehnat per good Luck karta hun

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bohat shukria bhai

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hello @steemdoctor1 Your post explanation of Fibonacci retracements provides a clear understanding of their significance in the cryptocurrency market. The analogy of a climber ascending a peak, taking breathers at retracement levels, makes the complex concept accessible for readers.

The breakdown of the most important Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 78.6%) offers a practical guide for traders to identify potential support and resistance zones. The comparison to a climber facing different challenges at each level adds a vivid and relatable dimension to the explanation.

Your use of the STEEM/USDT chart to illustrate how Fibonacci retracements work is a practical application that enhances comprehension. The step-by-step walkthrough of the process on TradingView, along with the visual representation of retracement levels on the chart, adds practical value to your explanation.

Overall, your post strikes a balance between technical details and accessibility, making it a valuable resource for both novice and experienced traders interested in mastering Fibonacci retracements. Well done📈

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank yoh so much for your beautiful words

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @steemdoctor1. As usual, it was nice going through your post because of your detailed explanation and justifyong answers to this week's theme of the challenge, - Fibonacci retracements.

The Fibonacci retracements is a great indicator/tool that with good analysis, helps traders to make decisions on entry amd exits in the financial market. The root of the Fibonacci retracements is based on the Fibonacci sequence a mathematical concept or serious that can be calculated by adding the previous two numbers to get the next one.

Your clear and detailed explanation on the STEEM USDT paur as well as the other cryptocurrency pair, I was able to have another knowledge of how this tool works and how. You are highly applauded for that Sir..

The advantages and disadvantages of the Fibonacci retracements were all listed and discussed fully. ....

Thanks for sharing and good luck with the challenge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for spending time in reading my post and leaving a nice comment 😃

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes you are right brother the FRs are very important tools for the technical analysis of crypto currencies as they tell us about the market trends like increase or decrease points for trading of different crypto currencies. Yes I totally agree with your point of view that these tools are not valid all the times because it is widely used in the crypto market. And thank you so much for sharing a very interesting and well written post with us.

Best wishes 🍀🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Jazakallah Abdullah brother ♥️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit