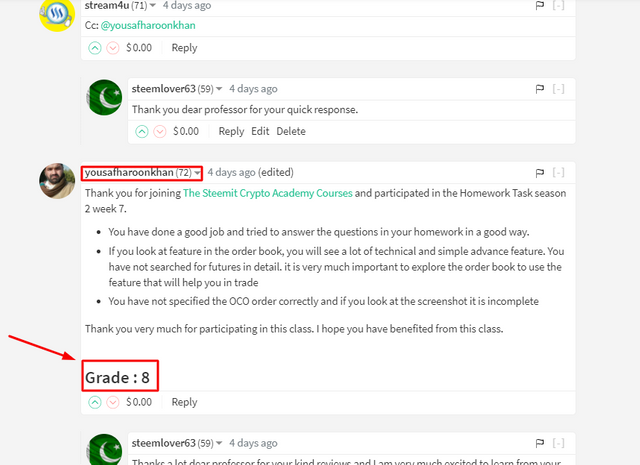

Hello, dear professor @yousafharoonkhan. This is my homework re-post for your lecture as this post was not curated but it has been paid out. Here is the screenshot of my proof.

Non-Curated Post

Hello everybody, Assalam-O-Alaikum and welcome to this post.

Hopefully, all of you will be happy and enjoying your time with the grace and the blessings of Allah Almighty. After 14 successful weeks of Crypto Academy. This is the beginning of week 15. This post is actually the homework submission for the dear professor @yousafharoonkhan from Pakistan in the 15th week of Steemit Crypto Academy. I have read the whole of the lecture post and I have understood all the points clearly. Now, I am going to make my homework for the professor. Today our topic of discussion is Exchange Order Book and its Uses and Method to place the orders in the market.So, let's start our today's task without any wastage of time.

There are some questions asked by the professor as the assignment of this week. So, let's discuss the brief answers to all these questions one by one.

(01)

Order Book

Order Book as referred to by the name, is a set of orders that may be either in the form of sell orders or buy orders. In our daily life, we meet the order book very times whenever we got the experience to go to the bazaar. We notice that every shopkeeper and every dealer holds a book in which the brief information about his selling and buying are put on the book. This is actually what we called the Order Book.

The same is the case in the world of cryptocurrency. There is an order book in all the cryptocurrency exchanges where the whole of the information about the recently made trades(buy or sell) is put on. This is called the crypto Order Book. The Order Book plays a very significant role while making trades and while assuming the value and status of any respective token or coin. The Order Book in the exchanges considers the buying and selling of assets in the form of pairs. one pair consists of the relation and comparison between any of the two assets which we are studying about.

Difference between crypto market and local market Order Book

The Order Book which is found in our daily life example is almost the same as the Order Book present in the crypto market. However, there is a difference between these two types. Now, we will consider the difference between them.

The local market order book is just something like the book we used to read in our daily life. It is the collection of the papers that are collectively referred to as the Order Book. While on the other hand, the Order Book in the cryptocurrency exchanges is virtual and is in digital form. It represents the recent trades made by different traders present in the system.

The Order Book in the exchanges is transparent and is visible to all of the users of the specific exchange. This thing helps the traders to assume the market value and behavior of the crypto assets in pairs.

The main difference between the local market order book and the crypto market order book is that in the local market order book, the selling and buying details of a specific item are placed. The local market order book consists of information about the trade of a specific respective item. While on the other hand, the cryptocurrency market order book consists of the information of the recent trades makes in the form of pairs. Pair means that in the cryptocurrency order books, the details about the trade of a specific item are not considered separately. It is considered in the form of crypto pairs. As we know that in cryptocurrency, the tokens and the coins are exchanged with other tokens and coins. So, the information of both of the coins or tokens is put in the order book.

Examples:

Local Market Order Book:

An example of the local market order book is that book that is present at a utility store. The order book of the utility stores contains the sell and buy orders of all of the items separately. This is a good example of a local market order book.

Crypto Order Book:

In the case of the crypto order book, we will see the pair of assets in which we are going to trade (sell or buy). For example, if we want to exchange the STEEM token with the USDT then we will have to put a look at this pair STEEM/USDT. When we open the trade of this pair then we can see the STEEM/USDT order book.

So, this is a little difference between the local market order book and the cryptocurrency order book.

(02)

Method to find order book in exchange

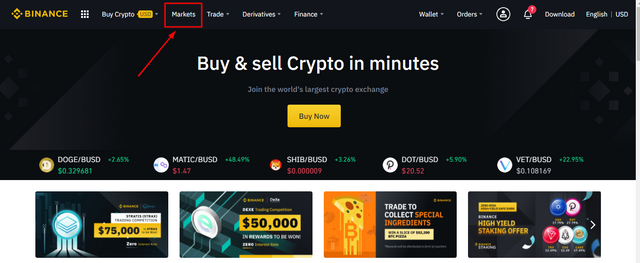

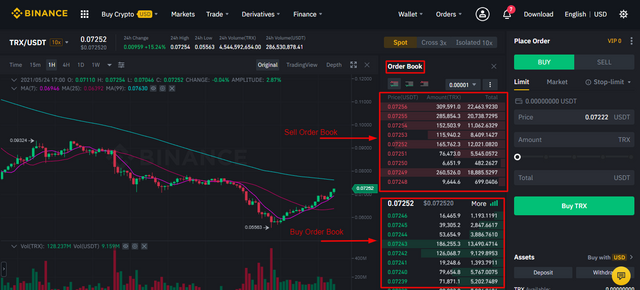

As we have discussed the brief introduction and details about the Order Book in exchanges. Now, I will discuss the method to find the order book of the specific trading pair. I will discuss the method to find out the ordered pair in the Binance exchange. Let's see the following method:

- First of all, open the Binance via the website or the Binance mobile application and log in to Binance. You will see the home page of Binance, as shown below.

- Here select the Markets option available in the top menu as shown in the above screenshot.

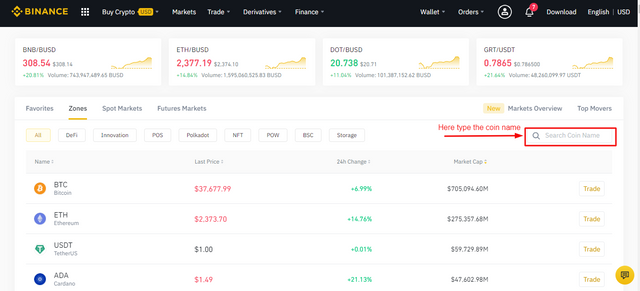

- You will see a number of markets. Here in the Search Box, you have to search the name of the coin in which you are going to trade.

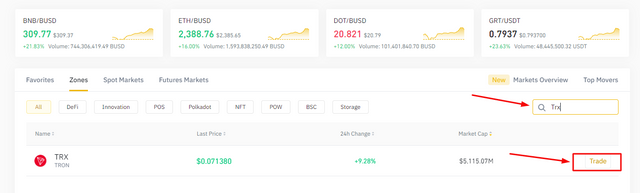

- I searched the TRX token as shown above. Now, click on the Trade option located next to the coin stats.

- Here you can see the Order Book of the TRX/USDT pair. The sell and the buy order book of this pair is shown separately in the above screenshot.

So, this is the method to find out the Order Book in the Binance exchange.

Now, I am going to discuss some points that are asked by the professor.

=> Pairs:

As the whole of the discussion above clears that the order books of the crypto consist of the information about the pairs. In the cryptocurrency world, two coins or tokens are linked with each other and can be traded for one another when needed. One of the coins of the pair can be traded (sell or buy) for the other coin and the other can also be traded with the first one. The trading pair is of two types.

- Crypto-Crypto Pair (BNB and BTC)

- Crypto-Fiat Pair (STEEM and USDT)

=> Support and Resistance:

During trading in cryptocurrencies, there come such levels when the buying and the selling, and the buying of the assets are preferred. These states are known as the Support and the Resistance level respectively. The Support level is the state when the downtrend seemed to be stopped or paused and the uptrend is expected to start. This is the state or the level where the buyers got active and purchase more and more assets to earn better whenever the price of the asset goes up.

Resistance level is the state or the condition when the upward trend of a respective asset is seemed to be at its maximum height. From where the downward trend of the asset is expected to start and it is the state or the condition where the seller got active and sell their assets in order to get a chance to earn better profit.

The Resistance and the Support levels are mentioned in this picture. You can see, at the maximum height, the level is resistance while at the lowest height the level is Support.

=> Limit Order:

As we know that the prices of cryptocurrencies are not constant. They are increasing and decreasing randomly in the market. Limit Order is a beneficial and useful feature in this regard. Limit Order means to put a price limit of a respective asset that whenever the price touches this limit, the asset should be traded on its own. There are two types of Limit orders in cryptocurrencies, first one is the Buy Limit Order and the second one is the Sell Limit Order. Let me explain this with an example, Suppose I want to buy 1 ETH token. I checked the price of the ETH token which was 2500$ at the time but this price is very much high for me as I want to buy it at a low price of about 2000$. So, I can place the buy limit order at 2000$ and whenever the price touches this limit, I will be notified and I can buy the ETH token. The same is the case in the Sell Limit Order. Suppose I want to sell an ETH token and the price of the ETH token is 2500$ at the time but I want to sell it at a high price. In this situation, I can place the Sell Limit Order at 3000$ as the price touches this limit I will be able to sell my ETH. So, that's all about the limited orders in the world of cryptocurrency.

=> Market Order:

Market Order, as represented by the name is the buy or sell order of a respective asset at the current market price of the asset in a specific piece of time. Whenever the buyers or sellers place the buy and sell orders respectively at the market price of the asset then it would be called the Market Order. Consider an example of an ETH token. Suppose the current market price of the ETH token is 2875$ and one placed the buy or sell order at this current price then it is called the market order.

(03)

My Binance Verified Account

First of all, I want to share the screenshot of my verified account of the Binance exchange as asked by the dear professor.

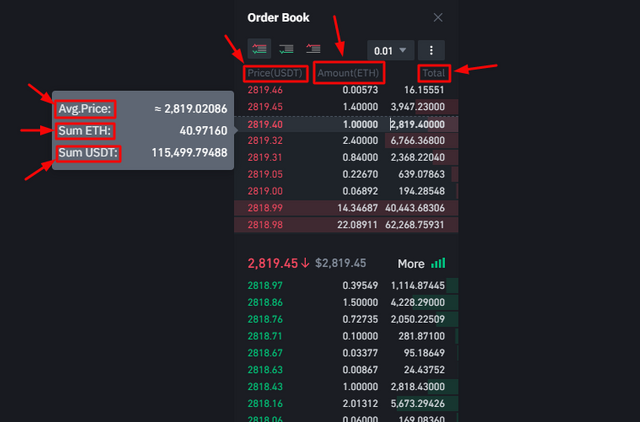

Features of Order Book:

As the whole of the above discussion is about the Order Book of the trading of the cryptocurrencies. The cryptocurrencies are exchanged in the form of pairs and each trading pair consists of two assets. The Order Book consists of the information of the buy and sells orders of the respective trading pair. Now, we will discuss some of the important features of the Order Book.

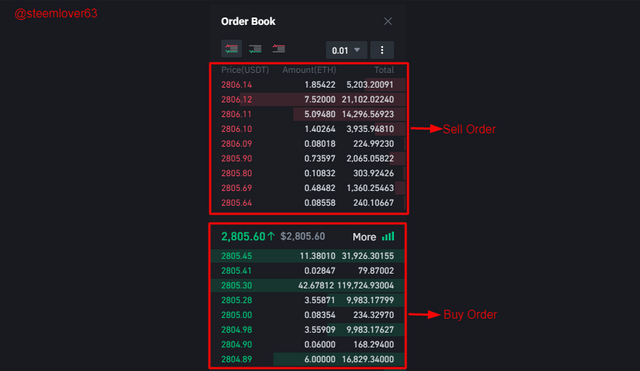

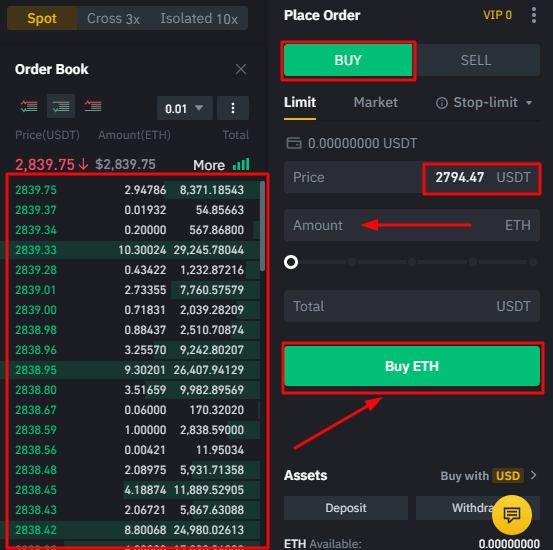

The two main and the most important features of the Order Book are the Buy and the Sell Order as mentioned separately in the above screenshot. The green color trades represent the Buy order while the red-colored trades represent the Sell order accordingly. The sell and buy orders of the respective asset pair are the ever-changing parameters and they are changing continuously. One can difficultly notice the same orders at a time. The above screenshot represents the Buy and Sell order of the ETH/USDT assets pair.

Some other most important features of the Order Book are mentioned in the above screenshot of the ETH/USTD trading pair. These features of the Order Book includes:

- Price of the asset(USDT)

- Amount of the asset(ETH)

- Total

- Average Price (Avg. Price)

- Sum ETH

- Sum USDT

All of these features are mentioned separately in the above screenshot of the Order Book taken from my Binance account.

Buy Order:

One of the most common and the most important feature of the Order Book is the Buy Order. Buy order means the information of the orders that are put by the buyers of the coin or the asset to by the respective coin at the market price. Whenever a trader or a buyer buys an asset, the information of the order is placed in the green area of the Order Book known as the Buy Order of the respective Trading pair.

We can buy the coin or the assets whenever we want simply by putting the details of the order like the amount of the token or asset which we want to buy and the amount of USDT we are going to utilize in this order. After putting this information simply click on the Buy ETH button located at the bottom of the page and your order will be put in the market of the respective trading pair.

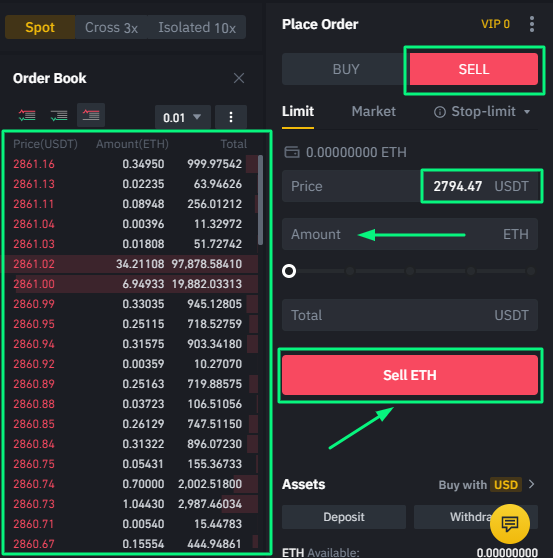

Sell Order:

Whenever we put a view on the Order Book in any of the exchanges like Binance we will see the red area which represents the Sell Order of the respective asset pair. Sell Order means the information of the orders that are put by the sellers of the asset at the market price. When a seller puts an order in the market of the respective asset pair, we will the details about his order in the Sell Order area as mentioned in the above screenshot.

We can place a Sell Order in the market just by putting the information of our order in the side-by area like the number of coins we are going to sell and the amount of the USDT we will get in return. After putting all this information we simply have to click the Sell ETH option located at the bottom of the page and our Sell Order is placed in the market of the ETH/USDT pair.

These are some important key features of the Order Book of the respective trading pair.

(04)

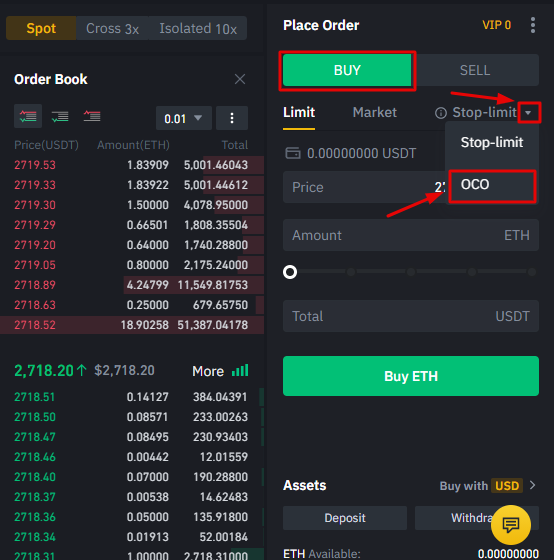

Method to place Stop-limit Order

Now, we will discuss how can we place a stop-limit order in the market of a specific trading pair. Firstly, we need to know about the Stop-limit order. A stop-limit order is an order in which a trader or an investor wanted to get profit from the volatility and avoid himself from the sudden and great loss. In this type of order, a trader puts his order in the market and creates a limit of the price of the respective coin by keeping in view the support and the resistance levels of the respective trading pair. Two main things are under the consideration of the trader that is the stop-loss and the limit price of the respective coin. So, now we will discuss the method to place the Stop-limit order in the buying and the selling of the coins respectively.

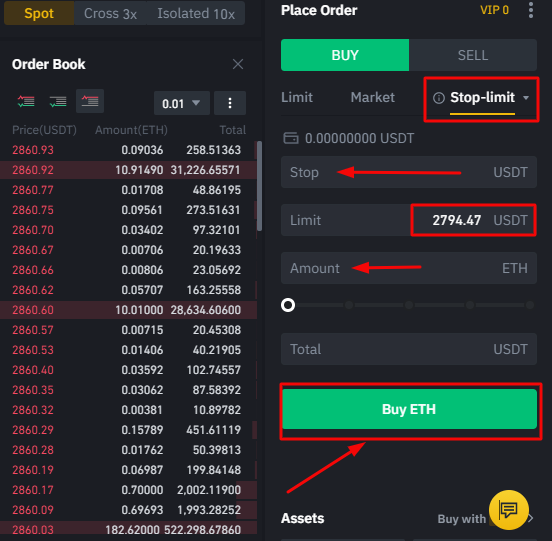

Buy Stop-limit :

In order to place a Buy stop-limit order in the market of the selected trading pair we have to follow these steps:

- First of all click on the Stop-limit option located in the top bar of the Place Order menu of the Binance exchange.

- At the place of the Stop box, place the price of the asset at which you want to place the buy order.

- At the place of the Limit box, place the price of the asset at which you want to place the order if the price of the respective asset goes lower than the Stop price. If it happens then your order will be placed at the Limit Price you have just put in.

- Write the amount of the ETH token or any token which you are buying in the Amount box.

- After putting all this information you simply have to click the Buy ETH option located at the bottom of the page. By clicking on it, your Stop-limit order will be placed in the market of the respective trading pair.

All of these steps are mentioned in the above screenshot.

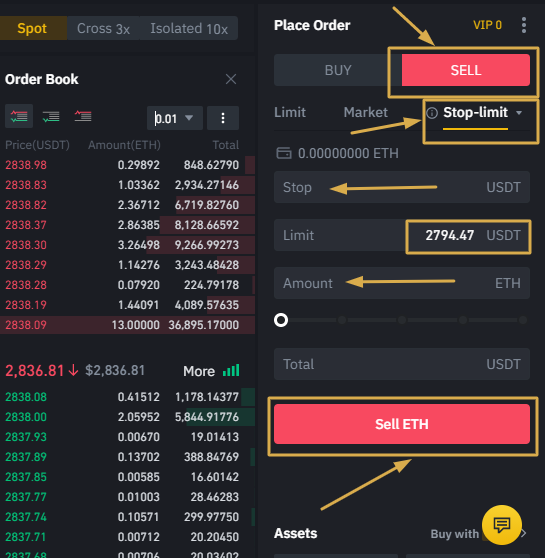

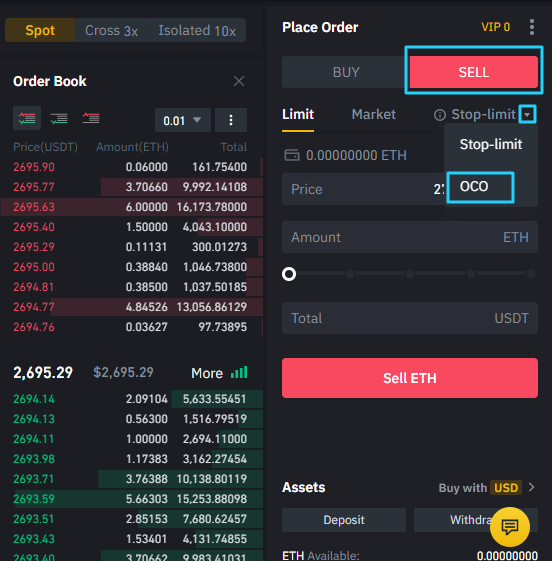

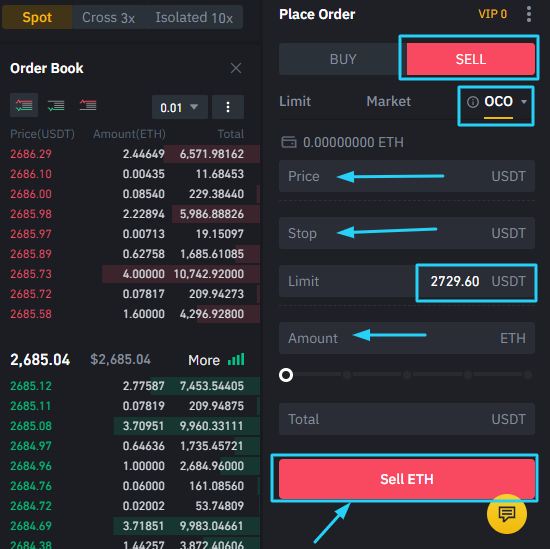

Sell Stop-limit Order:

In order to place a Sell stop-limit orders in a market of the respective trading pair, one has to follow these steps:

- In the Place Order menu, click on the Sell option and then click on the Stop-Limit option at the top left corner of the top bar.

- In the Stop box, enter the price at which you want to sell the coin or place the sell order.

- Next, place the price of the asset at which you want to sell the coin if the price of the respective coin goes further upward in the limit box. In this case, when the price of the respective asset crosses the stop-loss price then the sell order of the coin will be put into the market at the limit price.

- Then paste the amount of the coins or the ETH token that you want to sell in the amount box.

- After putting all of the above information in the respective boxes, we have to simply click the Sell ETH option located at the bottom of the page. By clicking it, the sell order will be placed in the market of the respective trading pair.

So, these are the methods to place the Sell or Buy Stop-limit Order in the market of a particular asset pair.

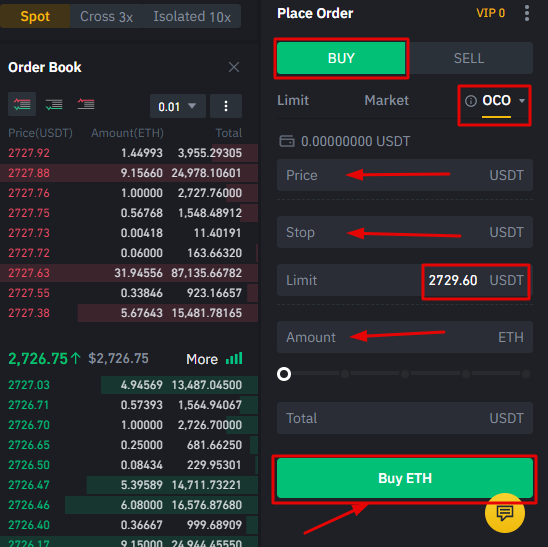

OCO Order

Now, we will study the OCO order. OCO stands for One-Cancels-the-other-Order and it is the type of order in which two orders are placed at the same time. The first one is the limit order and the second one is the Stop-limit order. But only one of these two orders is implemented at a time. If the limit order is implemented then the stop-limit order cancelled its effect and if the stop-limit order is implemented then the limit order will be cancelled automatically. This type of order is executed to avoid the sudden loss of the volatility of the market prices of the assets. They are also of two types. The first one is the Buy OCO order and the Sell OCO order. Now, we will discuss the methods of implementing both of these orders respectively.

Buy OCO order:

- Open the Binance and click on the down arrow located in front of the Stop-limit option. You will see a pop-up menu and select the OCO in this menu. This is mentioned in the screenshot above.

Now, place all the entities one by one that is required.

- Firstly, put the limit price of the asset in the first box which you see in the menu. This will be the limit order.

- Then, you have to put the stop-limit order ( First the limit price and then the stop-limit price of the asset). This will fill your next two boxes named Stop and Limit respectively.

- After that, you have to put the amount of the ETH token or any other coin which you are going to buy in the next box which will show as the Amount box.

- After putting all these values, you simply have to click on the Buy ETH option and your order will be placed in the OCO order market of the respective coin pair or trading pair.

Sell OCO order:

- First, click on the down arrow shown next to the stop-limit and select the OCO in the pop-down appeared menu bar.

- In the first box put the limit price of the asset at which you want to place the limit order.

- In the second and third boxes, place the Stop price and the limit price values respectively to place the Stop-limit order in the market of the specific trading pair.

- Now, enter the amount of the ETH or any token which you are going to sell.

- After providing all the information in the respective boxes, click on the Sell ETH option located at the bottom of the page.

So, above are the methods to place the buy and sell OCO orders in the respective trading pair to be safe from the sudden loss of the market.

(05)

Benefits of Order Book in trading to earn better Profit

As we have discussed the brief introduction of the Order Book, Features of the Order Book, Sell Order, Buy Order, Limit Order, Market Order, Support and Resistance levels, limit orders, Stop-limits orders, OCO, and many more in the above segments so now I am going to discuss the benefits of the Order Book in the trading world.

Order Book plays a very significant and important role in the development and the success of the expert traders. It helps the traders to keep a constant view of the ever-changing market behavior and trends of the assets or the coins in which they are going to trade.

The Order Book helps the traders to place their orders in the market. Suppose I want to buy a coin say any of the coins. Suppose the price of the coin is at the support level and I think that it is a better situation for me to buy this coin and wait for its uptrend and then sell it at a high price to earn better profit. For this purpose, I can place the Buy Market Order in which my order will be placed at the market current price which is low and it does not take much time for this order. Just by clicking, our order will be placed and I will get the coin abruptly.

The exact same is the case for the sellers of the coins. Suppose I hold any of the coins and I want to sell them. Consider the price of the coin is high enough for me that I can get a better profit t this price. In this case, I can place my Sell Market Order and can sell my coin at the current market price of the coin without any wastage of time.

The limit, stop-limit, and OCO features of the Order Book are also helpful and beneficial for all of the traders who are afraid of the volatility of the market of cryptocurrencies. One can place the limit, stop-limits, and the OCO order according to his taste and his preference to minimize the loss and maximize the profit from the trading.

The Order Book is also helpful in the technical analysis of the assets. If we put a view on the Order Book, we can assume the Support level by considering the high number of buyers of the assets. Similarly, we can also predict the Resistance level. If we saw that the number of the seller of the assets is very much enough then we can say that it might be the Resistance level. The Support and the Resistance levels can also be noticed by joining the peaks of the technical chart graphs of the respective assets.

Conclusions

Order Book is an important feature of all of the exchanges, especially those that are related to cryptocurrencies. Order Book helps the traders to predict the market behavior and trend of the respective asset pair. There are many features of the Order Book like Buy and Sell order, Limit Order, Market order, Stop-limit order, OCO order, and many more. All of these are discussed in the above sections. One can earn better profit by the timely implementation of the features of the order book.

That's all about the task for this week. Hopefully, all of you will like this post warmly.

Special thanks and mentions to dear sir @yousafharoonkhan for this great lecture and I am looking forward to his kind reviews on this task.

Take care

Regards: @steemlover63

Cc:

@yousfharoonkhan

@stream4u

@steemitblog

The link to the post has been reviewed but not curated.

https://steemit.com/hive-108451/@steemlover63/crypto-academy-week-15-homework-post-for-yousafharoonkhan

Looking for your review and support.

CC:

@stream4u

@yousafharoonkhan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear sir @yousafharoonkhan I am worried that my post is not yet re-marked and 3 days have to go but still not re-graded. I request you to re-mark my post ASAP so that I should get the reward of my efforts. Thanks a lot.

Cc:

@stream4u

@yousafharoonkhan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Checking

Cc: @yousafharoonkhan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ok

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit