We know and have seen how the Shark Fin look like when it comes above the water level, juts like this  . It just looks like a sharp triangle. In the crypto market we often see such structure form on a price chart which is called the SharkFin model or SharkFin Chart pattern.

. It just looks like a sharp triangle. In the crypto market we often see such structure form on a price chart which is called the SharkFin model or SharkFin Chart pattern.

Explain the concept of the Sharkfin model. What is a Sharkfin pattern and how can it be identified on a price chart? Describe its main visual characteristics.

➜ The Concept of the Sharkfin Model.

In Stock or Crypto market trading, the Sharkfin model looks like a Shark's fin on a price chart. Traders used Sharkfin model to find possibilities of market trend reversal. Sharkfin model is one of the type of chart pattern which is useful in stock and crypto market that indicate the overbought and oversold situation in the market that triggers traders for the potential reversal trend in the market either up side or the down side.

➜ What is a Sharkfin pattern and how can it be identified on a price chart?

As mentioned the Sharkfin pattern is one the chart patterns that look like Shark's fin and it helps traders to predict the market reversal point. This pattern can be formed by sharp price movement either up side or down side and then equally sharply reverse the price movement in opposite direction , and then continue in the same direction.

To identified Sharkfin pattern on a price chart, when Sharkfin pattern getting form on price chart then there is huge spike we see with the asset price either up side or a down side, it just look like mountain pick or Shark Fin. Then suddenly the asset price start moving in a opposite direction. Sharkfin pattern includes; quick and fast price moving at one direction and then it turn to the opposite with huge volume.

➜ Sharkfin pattern main visual characteristics.

Visually the Sharkfin pattern, one of the main characteristics is the asset price sharply increases or decreases which creates a pick point either up side or down side.

After pick point the asset price quickly take opposite move which exactly creates a mirror image of previous price movement. This Sharkfin pattern ups and downs creates in short period of time

During formation of Sharkfin pattern, the trading volume gets spiked and creates high volatility in market.

Explain how the RSI (Relative Strength Index) indicator can be used to identify Sharkfin patterns. Give a real-world example of RSI metrics (like overbought and oversold levels) and explain how these metrics help spot Sharkfins.

Depending completely on a Sharkfin pattern may difficult to predict Sharkfin pattern pick point means in trading the Overbought and Oversold zones and possibility reversal trend.

Relative Strength Index (RSI) indicator can be a effecting indicator which can be used with Sharkfin pattern. As we know Relative Strength Index (RSI) include upper level at 70 and lower level at 30. Relative Strength Index (RSI) indicator price at and below 30 is considered an oversold zone and possible for the trend reversal at up side. Relative Strength Index (RSI) indicator price at and above 70 is considered an overbought zone and possible for the trend reversal at down side.

When asset price is sharply moving in one direction either upside or downside, at the same time look at the RSI indicator price. When RSI indicator price is above 70 level then check the price chart to see if an asset price formed a pick point at the up side and starting moving in the opposite direction means down side. Consider this point as asset price in overbought zone and possible selling start at any point. Then once RSI indicator price crosses the 70 level below from above then it can predict the trend reversal movement, Bearish Sharkfins spot. The buyers can consider this situation for exit and book the profit and short seller can consider this as entry point

When RSI indicator price is below 30 level then check the price chart to see if an asset price formed a pick point at down side and starting moving in opposite direction means up side. Consider this point as asset price in oversold zone and possible buying start at any point. Then once RSI indicator price crosses the 30 level above from below then it can predict the trend reversal movement, Bullish Sharkfins spot. The buyers can consider this situation for entry level and short sellers can consider this as an exit point and book the profit.

Below is the price chart with RSI indicator. In the image below, we can see the asset price was continually creating high points and moving up side, there was a spike in the up side. At this same time the market situation, if we look at RSI price then it is also moving up side and crossed 70 level from below to above. This indicate Sharkfin pattern pick point and due to RSI above 70 level which also indicate overbought zone and the trend reversal and future price may decline. According to this, we see further fall. This is a bearish Sharkfin pattern with confirmation of RSI price.

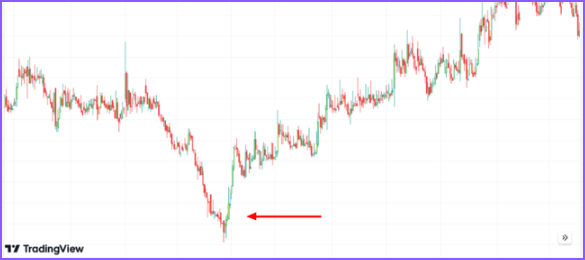

Similarly on the other hand. In the below image we can see the price continually decline and then a major spike occurred that pulled the asset price down. Here, if we see RSI then indicating oversold zone means it is below 30 level.This potentially creates a Sharkfin pattern pick point at the down side. This also indicates the trend reversal and future price may be bullish. According to this we can see in the below image that prices rise with similar speed. This is the Bullish Sharkfin pattern with confirmation of RSI price.

This is how the RSI metrics overbought and oversold levels can help to spot the Sharkfins.

What are the trade entry criteria when using the Sharkfin model applied to the Steem token? Describe the specific signals you are looking for before entering a position, using example price setups and indicators.

For trade entry criteria for a Sharkfin model applied to the Steem token, we will apply the RSI indicator on the Steem token price chart and below are the signals or conditions that we will look for before entering a position.

1️⃣ The Steem token price continues to move in a down side and then a sharp movement triggers that pulls the Steem price more down side.

2️⃣ The RSI price crosses 30 levels from above to below.

3️⃣ The Steem token price suddenly starts moving up from the downside pick point.

4️⃣ The RSI price crosses 30 levels from below to above.

At the time when RSI price crosses 30 levels from below to above, this is confirmation that Steem token price may rise now. For fresh buyers, this level can be entry level. For Short sellers, this level can be exit trade.

The below image explains graphically how the price chart should look like for the entry trade. Here, we can see the Steem Token price was continually moving downward, then a major spike occurred in price movement that pulled the Steem token price more down side. However, at the same time the RSI indicator crosses 30 levels from above to below which indicates that the Steem price is now in oversold zone and possible buying starts anytime which leads Steem price to go up.

Next, when the RSI indicator crosses 30 levels from below to above, it's a point for the entry trade for the buyers. Further we can see how the price started moving upside.

Describe the trade exit criteria for a Sharkfin model applied to the Steem token. What signals or conditions tell you it is time to exit a position?

For trade exit criteria for a Sharkfin model applied to the Steem token, we will apply the RSI indicator on Steem token price chart and according to the below signals or conditions we will look at them that can tell us that it is time to exit a position.

1️⃣ The Steem token price continues to move up side and then a sharp movement triggers that pull the Steem price up side.

2️⃣ The RSI price crosses 70 levels from below to above.

3️⃣ The Steem token price suddenly starts falling from the pick point.

4️⃣ The RSI price crosses 70 levels from above to below.

At the time when RSI price crosses 70 level from above to below, this is confirmation that Steem token price may fall now. This level is an exit position. For Short sellers, this can be entry level.

The below image explains graphically how the price chart should look to exit the trade. Here, we can see the Steem Token price was continually moving upwards , then a major spike occurred in price movement that pulled the Steem token price more up side. However, at the same time the RSI indicator crosses 70 level from below to above which indicates that the Steem price is now in an overbought zone and possible selling will start anytime which will lead Steem price to down.

Next, when the RSI indicator crosses 70 levels from above to below, its a point to exit the position from the market. Further we can see how the price declined.

Show a detailed example of a transaction based on the Sharkfin model on the Steem token. Use real charts and historical data to illustrate your trade, including entry and exit points, and the reasoning behind each decision.

Below Steem/USDT price chart will show you the detailed example of a transaction based on the Sharkfin model on the Steem token. You can see the tag for buy and sell which are the possible points as per the Sharkfin pattern and confirmation with RSI indicator.

The above Steem/USDT price chart is from 18 November 2018 to 10 August 2019. In the above Steem token price chart we can see before 18 November 2018, the Steem price was in down side, then there was spike executed due to which Steem price sharply fell till 0.20 USDT and created Sharkfin model pick point at low side. At this time the RSI indicator shows below its 30 level means the Steem/USDT price is in oversold condition. The user should consider this as a buy opportunity because the reason is when RSI is below its 30 level then there is a possibility that Steem price may go up from here.

Then as soon as it falls, the Steem/USDT starts rising, we can see the RSI indicator line crosses 30 levels from below to above, and Steem/USDT price comes at 0.16 USDT, this is the buy entry as now there is potential for price to go up.

Next, when RSI crosses its 70 level from below to above, it will consider it as an overbought zone and anytime the Steem/USDT price can fall. Also it forms Sharkfin model pick point at up side As soon as the RSI started moving below its 70 level, also Steem/USDT sharply falls quickly after creating pick point at up side, this will exit trade because from here Steem/USDT price can fall.

Then again we can see a buy opportunity at around 0.30 USDT when RSI just went below the 30 level and pulled back. But this time we can see it did not go above the RSI 70 level and just from RSI middle level the RSI price started moving down, also the Steem USDT price came down. As not all indicators and patterns are 100% accurate and to avoid potential loss, we already place a stop loss at the previous support level just below. Further, we can see the Steem/USDT price came down and Stop loss is triggered. It is fine that we did not get profit this time but we safe our capital by accepting stop loss and from the further fall.

Disclaimer: The information provided in this blog is for educational and informational purposes only. It should not be construed as investment advice or a recommendation to buy or sell any securities mentioned. Investing in the stock and crypto market involves risks, including the potential loss of principal. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author of this blog is not liable for any losses or damages arising from the use of the information provided herein.

Author,

@steam4u

If you like this blog, you can join me in the comment section of this blog.

You have clearly explained the Sharkfin model in its simplest way and you have graphically shown the pattern of the sharkfin model for both bullish and bearish and also stated the criteria that caused the movement.

Your understanding of the RSI indicator in the entry and exit of trade using this model is also amazing. It is good to know that RSI levels 70 and 30 are always taken into consideration to determine the reversal or exit of the position of the trade. I wish you success in this contest my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

On Twitter X - Mastering the Sharkfin Model for Trading..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tipu curate

Holisss...

--

This is a manual curation from the @tipU Curation Project.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 6/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We have to do that now and then.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

THE QUEST TEAM has supported your post. We support quality posts, good comments anywhere, and any tags

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings my friend @stream4u,

It's awesome how you broke down the Sharkfin model in such a clear way. The line that stands out to me is, "Visually the Sharkfin pattern, one of the main characteristics is the asset price sharply increases or decreases which creates a pick point either up side or down side." Your explanation is both simple and insightful! 🎯

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit