Hello steemains!!!

Hope you all are good and enjoying your lives. I'm inviting you to review my homework for season 2 week#2 by@fendit

a) Which is your risk aversion, which of these products you find the most appealing and why?

Whenever you invest there is equals possibility to get profit or may loss so how much you can tolerate your loss on your investment is risk tolerance.

An investor may face loss after investing their assets so how much money trader would feel comfortable losing if his investments have a bad year .

Other factors that affecting risk tolerance are the time period you have to invest in market , your earning capacity in future , and the possession of other assets like pension, home, an inheritance or social security . And it's normal , you can take more risk with your investment when you have more stable sources of money available other than your investment in market.

As I haven't invested any assets in crypto world market and we all know the volatility of it, but I think to get more profit you must take high risk and I more likely to take aggressive risk tolerance.

In my opinion you will never face always loss if you take your decision after researching the market. So as much assets that I have invested and want to get more profit. So as I'm not thinking of any loss means can afford the big loss in my investment. On the same tolerance risk I'm doing a small business of boutique but crypto world is different from this.

Yesterday I was trying to invest on Trons by myself without concerns any expert. I have 250000 PKR and wanted to invest through Binance but due to some lack of knowledge and experience I could not attempt successfully.So I like the aggressive approach to investment.

b) Explain in your own words fixed and flexible savings, high risk products and launch pools.

fixed /locked savings :

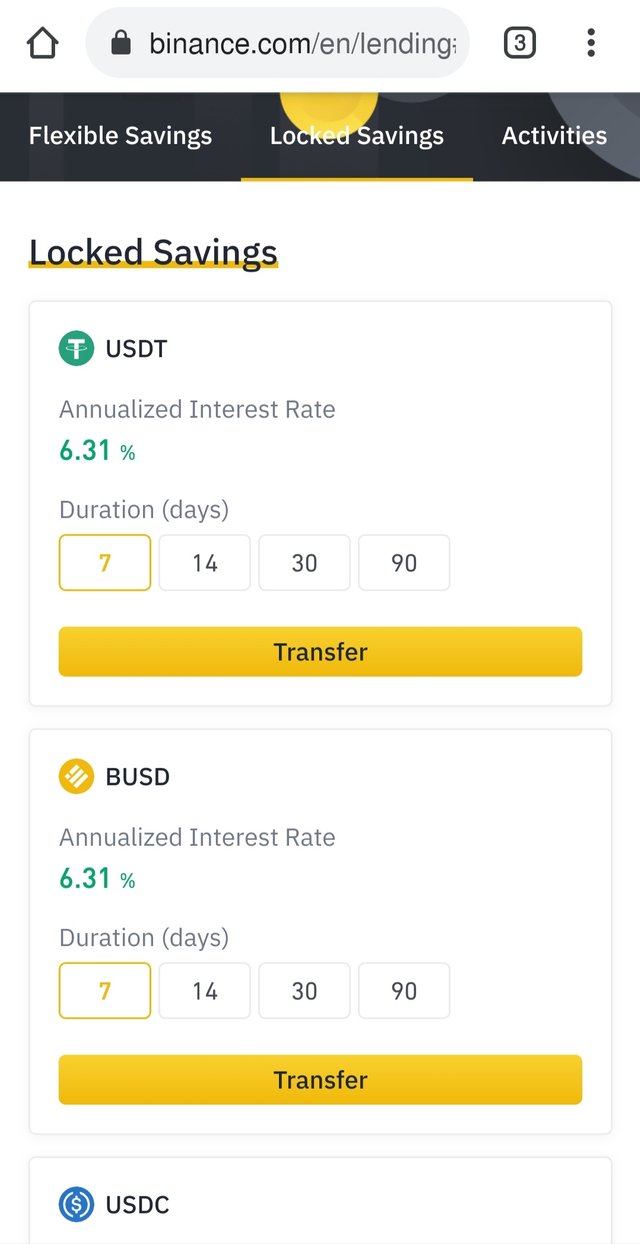

In this type of investment you deposit your assets in a crypto bank for a fixed time period and they give profit according to your investment but you can't take out your assets before that time for which you have fixed your assets. If you have moderate risk tolerance than you should go towards fixed investment and get profits.

On Binance we can do fixed investment /locked savings. Just deposit your funds at Binance locked savings in a desired currency for a particular time period. You can't withdraw your funds before that time but get started the profits from funds.

When you subscribe at Binance they would charged for the subscription and deduct the funds from your exchange wallet. They started giving you profits on their funds with the percentage of interest (APY). And it's depends on the time period for which you have staked your funds. Longer the time greater would be the interest.

flexible savings :

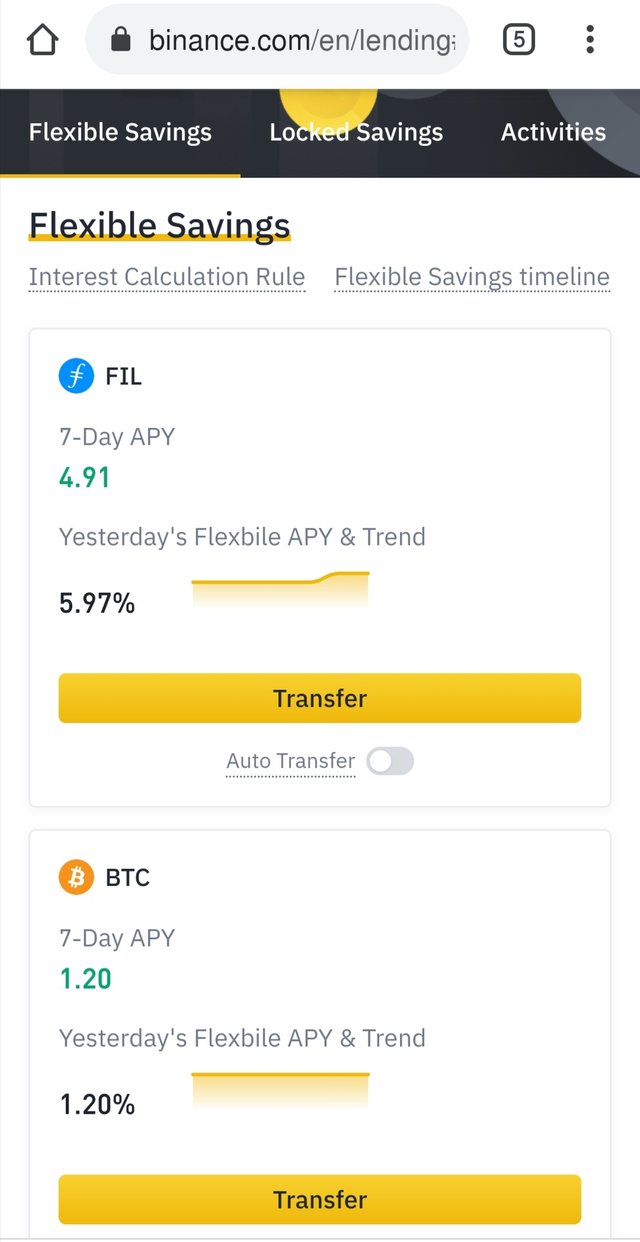

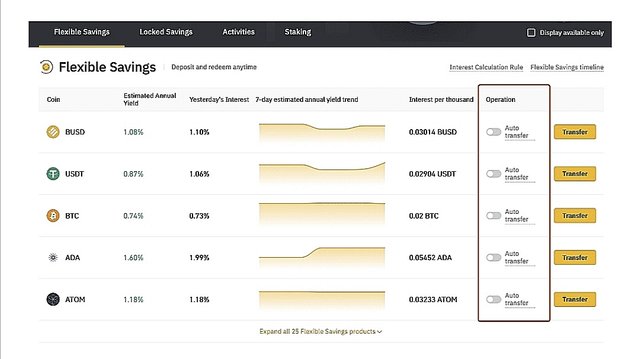

In this savings account you start getting profits after 24 hours of funds deposit and you can withdraw your funds at any time. But you get comparatively low APY then you get from fixed savings.

Binance Flexible Savings allows users to lend and get interest. Each trader can lend their crypto assets to Binance and start making returns. Flexible Savings are also your Crypto savings account. Flexible Savings accounts designate your held crypto as loanable to start earning interest

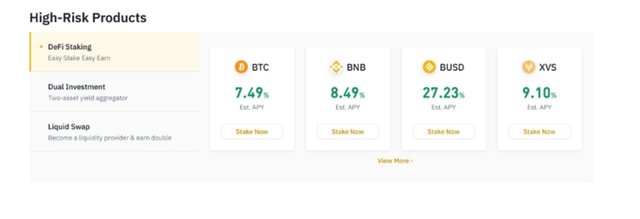

high risk products :

As name shows there is high risk so these types of investments are chosen by traders, who have high risk tolerance. High risk products offers three different types of investments

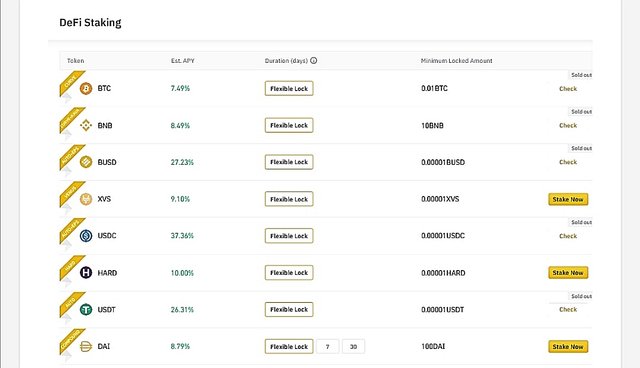

- Defi staking

- dual investment

- liquid swap

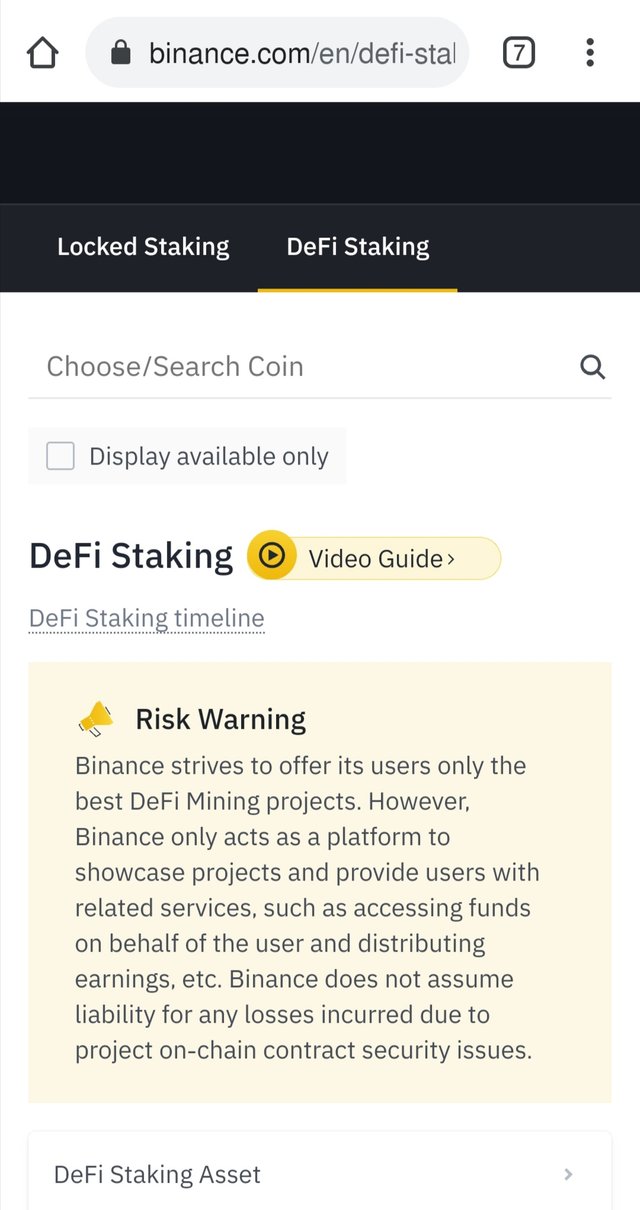

Defi Staking :

DeFi (Decentralized Finance) is providing financial services to traders through smart contracts of crypto market. DeFi projects have aim to give higher annualized profits for specific crypto currencies.

Binance provides Dfi projects to the users, through Binance you can get profits without issues of any keys and other complicated issues of exchange. You can invest your funds in either fixed DeFi stake or flexible DeFi stake. Other platforms are also provided the DeFi stake investment such as Compound, Hard, VENUS, Kava ans curve etc

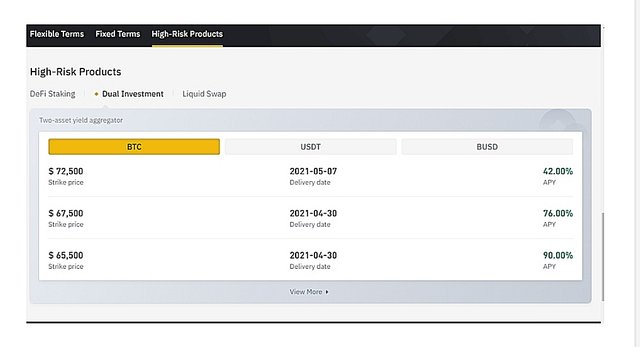

Dual staking :

Binance provides Dual Staking, yeilds on your stakes are earn in two different assets,one is the staked asset and the second one is BUSD. Profits are evaluated by both settlement index and strikebprice. If the settlement index is lower at the end of stake than the strike price, profit is paid in staked currency but, If the value of the settlement index for the crypto asset is higher the strike price at the end of the stake, profits are paid in BUSD.

Liquid swap

A liquidity pool organised based on the Automatic Market Maker (AMM) principle. It comprises of different liquidity pools, and every liquidity pool consist of two digital tokens or fiat assets.

By investing funds You can provide liquidity in the pools and can be a liquidity provider. You can earning transaction fees and flexible interest .

In liquid swap, you can choose two digital tokens or fiat assets in the liquidity pools.

Binance also provides liquid swap

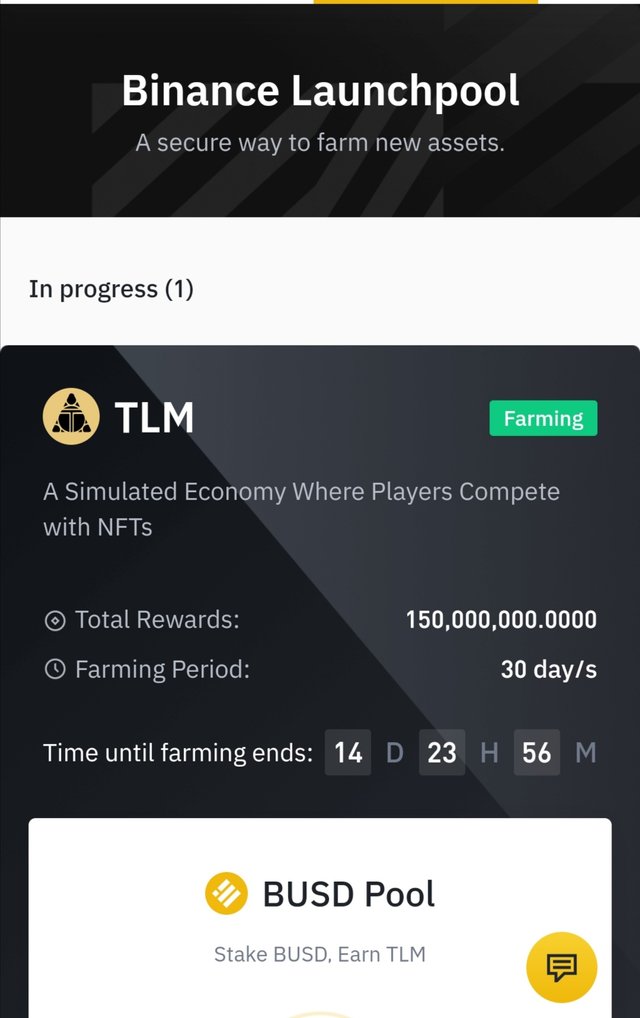

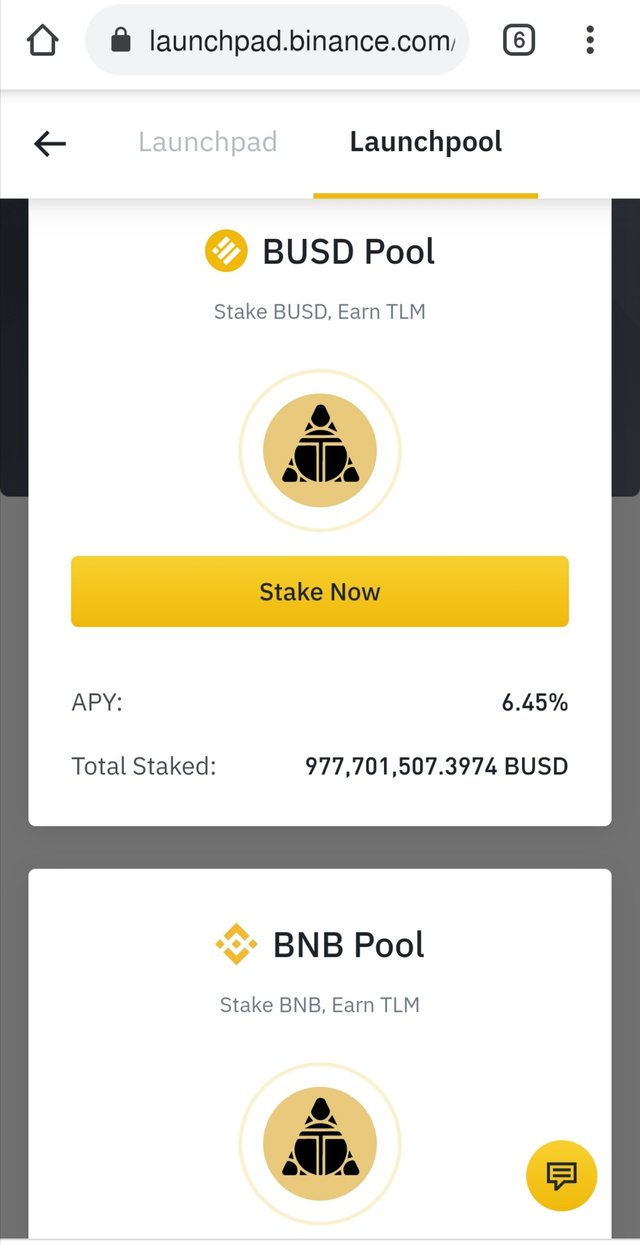

LaunchPool :

Binance LaunchPool is a good option to earn passive income by staking BUSD,BNB or other required coins in a flexible way. Binance offers several tokens in their launchpool these are DODO, LIT, BTCST, and many more. Coins can be unstaked at any time after staking them so it is flexible investment.

Show and give detail on how to set the investment you chose in Binance. If you don't use Binance as your exchange, let us know which alternatives you have in your own exchange and simulate the process of investing in Binance.

Binance Launchpad and Launchpool :

They are platforms that advise and help project teams on how to issue token and to launch their token at best level. Binance provide a full service from before the token is even issued, to post-listing and marketing support. It allow project teams to focus on their project development and continue building products, and also handle the marketing, exposure and initial user base.

Farm in Launchpool two major coins that can be used, BNB, and BUSD, other coins can be specified. A specific amount of token allocated against these coins and snapshots are done after every hour to check the balance to find how the token will be distributed to holders.

How Launchpool farming can be done with Binance

- To invest in Launchpool farming, you deposit your available coin to BNB or BUSD.

- First Click on Launchpad.

- Then Click on a project to farm and stake the cryptocoin of your choice (BNB/BUSD)

Now use the custom allocation that is used to stake coins.

Redeem rewards or leave them there and you can get them automatically in your spot wallet after the farming period.

Conclusion :

Using Binance to get passive income . The Binance ecosystem provides several investment platforms and products but while trading in any of this, you should keep in mind your risk management and risk tolerance.

Thanks for reviewing my homework

Mentioning respected @fendit to review my homework

Disregarded as it contains plagiarized content

https://www.binance.com/en/defi-staking

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Is any other plagiarism detected in my content??

Now what should I do? As plagiarism was not detected by plagiarism checker so I posted. And

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow nice work 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reviewing my homework

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit