Hello everyone hope so you all are good so today again i am hear for completing my homework post for Professor @reddileep for which i am really very excited.

Question 1:

Define Heikin-Ashi Technique in your own words.

Answer 1:

Heikin-Ashi is a type of candle stick which is used in the Charts for reducing the noise while reading the charts. Heikin-Ashi is a Japanese origin which means Average Bar as it takes into consideration the average price and makes a smooth pattern which makes trading very easy on it.

Information of the previous candle is used for the formation of the present candle as average of the previous candle price are being used.

It was developed in early 1700 by Munehisa Homma as these candles were used for finding the trend direction and the strength of the trend.

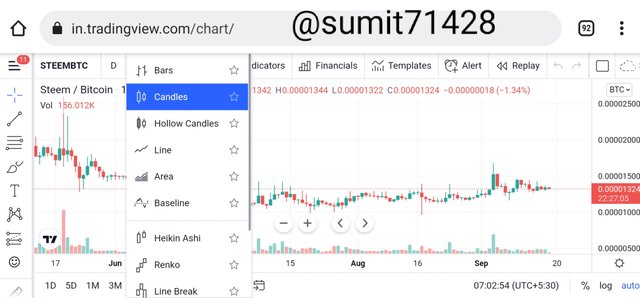

For using the Heikin-Ashi candle just select the Heikin-Ashi candle on the trading view.

After the application it will look like this.

Now you can trade based on this candles and take your position based on your analysis.

Question 2:

Make your own research and differentiate between the traditional candlestick chart and the Heikin-Ashi chart. (Screenshots required from both chart patterns)

Answer 2:

No matter whatever candlestick we use they are generally sane for a layman but for a trader even a slightest difference matters and make huge difference for them in there trading cycle.

For better understanding i will be using steem/btc chart for traditional candlestick and Heikin-Ashi candles on chart for understanding it better.

Steem/Btc chart using traditional candlestick.

Steem/Btc chart using Heikin-Ashi candlestick.

The difference which we can notice from the above shown charts are:

| Heikin-Ashi Candlestick | Traditional Candlestick |

|---|---|

| Clear up or down trend is been reflected through the colours as most of the time the colours are in continuation making it very easy for trader to analyse it. | No proper reflection of colour is taking place making it difficult to identify the trend. |

| As it takes the average into consideration so the formation of new candle take place from the middle of the previous candle. | It do not take into consideration the average so it opens from the previous candle closing which can be anywhere. |

| For bigger time frame the price may not match the current market due to the average taken into consideration. | The price will always match with the market as it is always starting from the previous end point. |

| The charts made from Heikin-Ashi Candlestick is very smooth as it eliminates majority of the noise from the chart giving it a clear picture. | The charts made from traditional Candlestick are very unpredictable and full of noise as they tend to react with all the market news and sentiments affecting it. |

So these were the major difference which can be seen from both the charts above.

Question 3:

Explain the Heikin-Ashi Formula. (In addition to simply stating the formula, you should provide a clear explanation about the calculation)

Answer 3:

Any candlestick is made from these 4 things:

- Opening Price of Candle.

- Closing Price of Candle.

- High of Candle.

- Low of Candle.

For finding all these different formulas are used.

Opening Price of Candle:

The price from which the next candle make its opening is called opening price of a candle and it is find through this formula.

Opening Price= 1/2( Opening price of previous candle + Closing price of previous candle)

Closing Price of Candle:

The price at which the closing of a current candle takes place is called closing price of candle.

Closing Price= 1/4( Open Price + Closing Price + High Price + Low Price) of current candle

High of a Candle:

The high of a candle is assertain as the highest

price of the present candle and for this no formula is required as whichever point will be the highest will be termed as the high of a candle.

So it can be anything open, close, high etc.

High Of a Candle= Maximum price of present candle.

Low of a Candle:

The low of a candle can assertain from the lowest price of the present candle even for finding this no formula is required as you just have to take the lowest price of a candle and that's all.

Low Of a Candle= Lowest price of the present candle.

Question 4:

Graphically explain trends and buying opportunities through Heikin-Ashi Candles. (Screenshots required)

Answer 4:

Trend:

Heikin-Ashi is called a very strong trend indicator as it is helpful in finding both upward trend and downward trend which can been seen clearly seen from the charts.

Downtrend

As you can see that there is two confirmation of downtrend one being the colour and the second one is that the candle don't have upper wick it only has the lower week indicating a strong downtrend.

Uptrend

Even hear as well we can see two confirmation being made one with the colour and the second one being the candle with no lower wick and only upper wick making it extremely bullish sign for coins to rise.

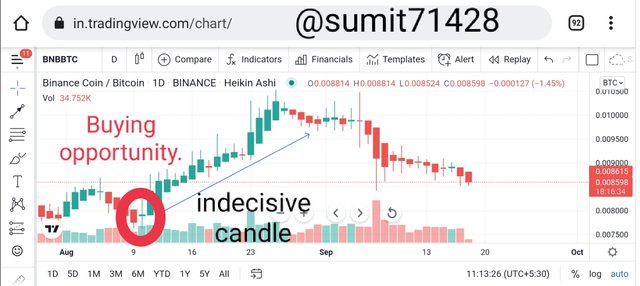

Buying Opportunities:

Whenever the market is bullish then only the opportunity to buy get's created and if we are able to identify it then no one can stop us from getting good buy opportunities.

As we already know how to identify a upward trend but with just one confirmation it is not possible to buy as it might lead to loss so for proper confirmation we must find this candle with small body and huge wick on the both the sides called indecisive candle and if after the formation of this candle if we see candle with no lower wick then it is a perfect buy opportunity.

As in the above case we can easily see this opportunity being created in the BNB/BTC pair and if someone would have grabbed this then definitely he would have earned some great amount of profit.

Question 5:

Is it possible to transact only with signals received using the Heikin-Ashi Technique? Explain the reasons for your answer.

Answer 5:

If we will talk from a beginner point of view then definitely it is a good option to transact by using the Heikin-Ashi Technique but as we tend to learn more then the efficiency level keeps on decreasing making it hard for us to make profits.

But if we can pair it with other indicators then it can really turn out to be a great tool for making some extraordinary profits.

Many a times while trading we tend to encounter fake signals which can make our trade go in opposite direction leading to loss so Heikin-Ashi strategy help us identify fake signals and act as a speed breaker for us saving us from taking trades.

Question 6:

By using a Demo account, perform both Buy and Sell orders using Heikin-Ashi+ 55 EMA+21 EMA.

Answer 6:

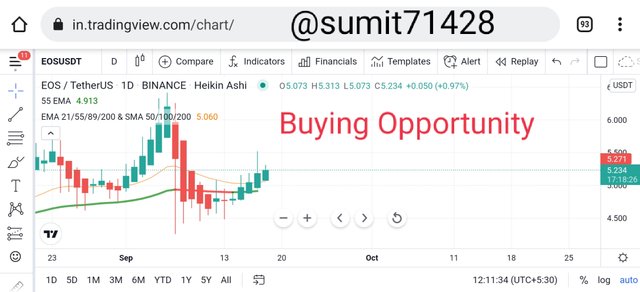

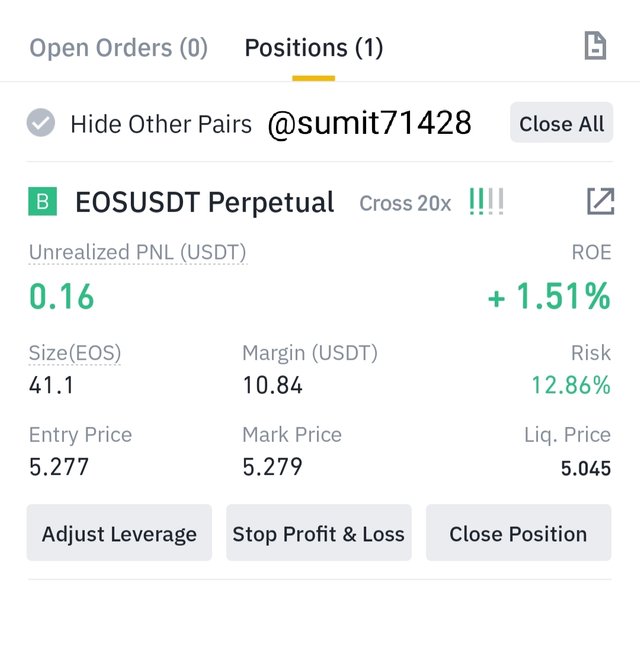

Buy Trade of EOS/USDT.

Over hear there is a formation of indecisive candle with green sign and just after that a new candle is been formed with no downward wick also both the EMA are above the price building up our confidence in buying it.

So after the confirmation i took the trade and as of now it is going in profit and my target is around 5% to 6% which can be achieved soon.

Sell Trade of DOGE/USDT.

As we can see the creation of indecisive candle in red colour which shows the sign of downtrend and at the same time there is a cross over of 21 EMA falling below 55 EMA giving us support for this trade so i took the entry of short in my account.

The price was going down and i am sure enough that it will continue to drop till my targets won't achieve.

Conclusion

It was an great lecture with great amount of learning opportunity being thrown at us which i have utilised it and i must thank professor @reddileep for such amazing content and explanation making it a great learning experience.

From now onwards i will try to master this technique as if done properly it can do wonders for sure.

Thanks friends have a great day ahead.

Please sir, my achievement post will expire tomorrow.

It is not curated

https://steemit.com/hive-172186/@rocknrule111/basic-security-on-steem-achievement2-by-rocknrule

Please help

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi sir plz verify my achievement 4

https://steemit.com/hive-172186/@peerfaizan/224kt5-achievement-4-by-peerfaizan-task-applying-markdown

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit