So hello everyone how are you all hope so everyone is well and good so friends i am back again with one of my homework task and i am really very happy that i got this opportunity to complete it really thankful to professor @stream4u.

Question 1:

What Is the Importance Of the DeFi System?

Answer 1:

Decentralised financial system are very new in the market and they way they have captured it simply shows how important they are for our modern world with just over a year of existence it has gained so much popularity that it is really a very integral and important part of today's crypto world and with a set of important aspects.

Importance of Defi System:

- It provides some great platform for exchages, prediction market, loan services, staking etc.

- It removes the use of intermediaries or third parties for any service they want they are basically free from any third party it's just they and the service they want.

- As the system is free from third parties which leads it to be very cost effective and the fees are very low making it a very convenient option for users for utilising there service.

- The system is on the open source which makes it very transperent and no fraud can be done with it.

Question 2:

Flaws in Centralized Finance.

Answer 2:

There has been a lots of flaws in our centralized financial system which gave rise to the decentralised system of finance:

- It has a governing body and your funds are not in control of you it is in the hands of bank and they have the complete authority against it.

- We save money in order to keep its value intact but when inflation come into play it makes it very dificult for our money to keep up its value just because the intrest which we get from the bank is hardly sufficient to beat the inflation.

- The born of cryptocurrency was just because of the huge transaction fees which was incurred by the bank as they tend to charge us for each and every thing making it it's one of the flaws.

- Cross border transaction are very time consuming even cross bank cheque clearance take huge amount of time making it a simple waste of time.

- It has a time limitations making it only accessible on the working hours thought online facilities are available but in few of the cases it is of no use.

Question 3:

DeFi Products. (Explain any 2 Products in detail).

Answer 3:

The market is full of defi products ever since they came on the spot light making it a solution for every problem around the financial world.

Pancake Swap:

This is the first ever defi product which i have came accross a way back or you may say it was one of the first defi product i started using it completely.

There are lots of facilities which is been provided on it from swap to buying lottery it has got almost all kind of features which we will be discussing.

How to use it:

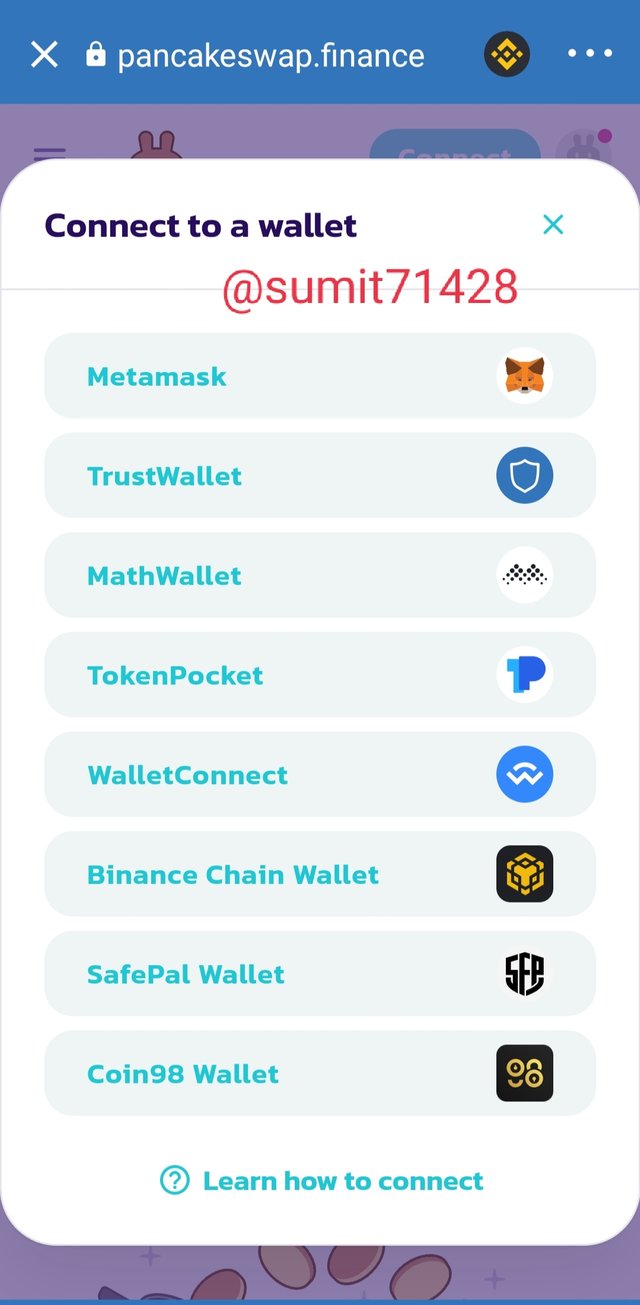

- Just go to the pancake swap and you will find the option to connect your wallet.

- Just click on the connect option and now you will find so many wallet options through which you can connect your wallet with the website and use it.

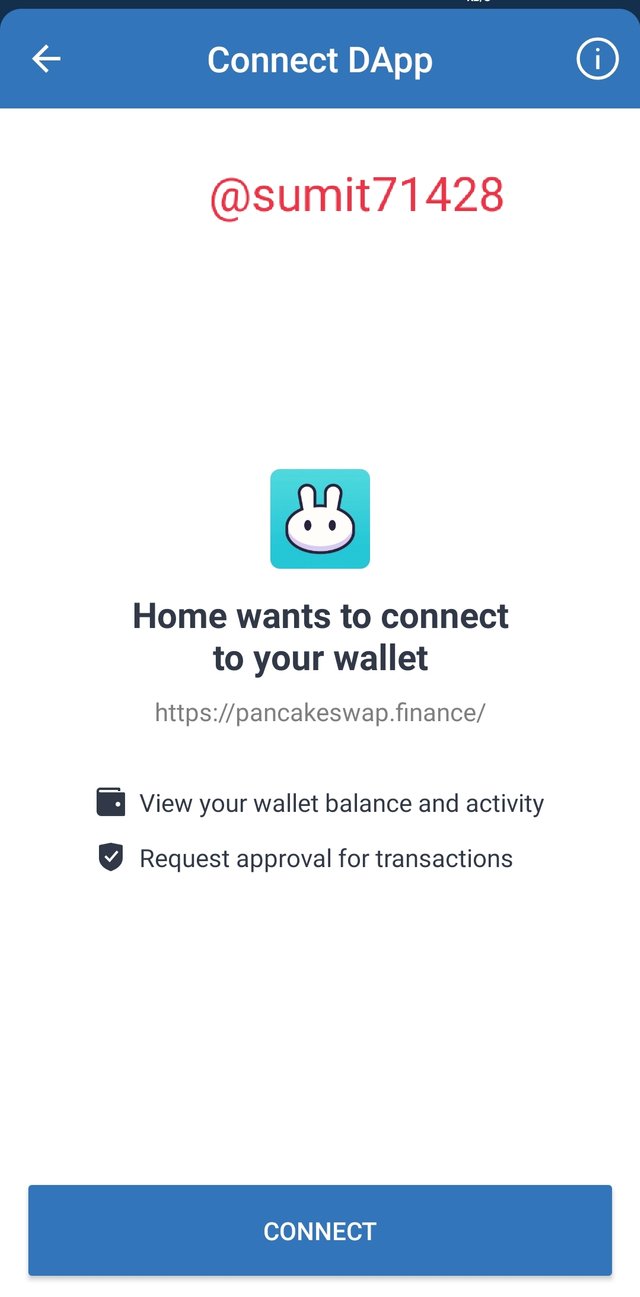

- Trust wallet and metamask are one of the most and widely used wallets for the purpose of swap and other uses so i connected my wallet with trust wallet. After connecting you will get the option to confirm the connection and after doing it you are all set to use it.

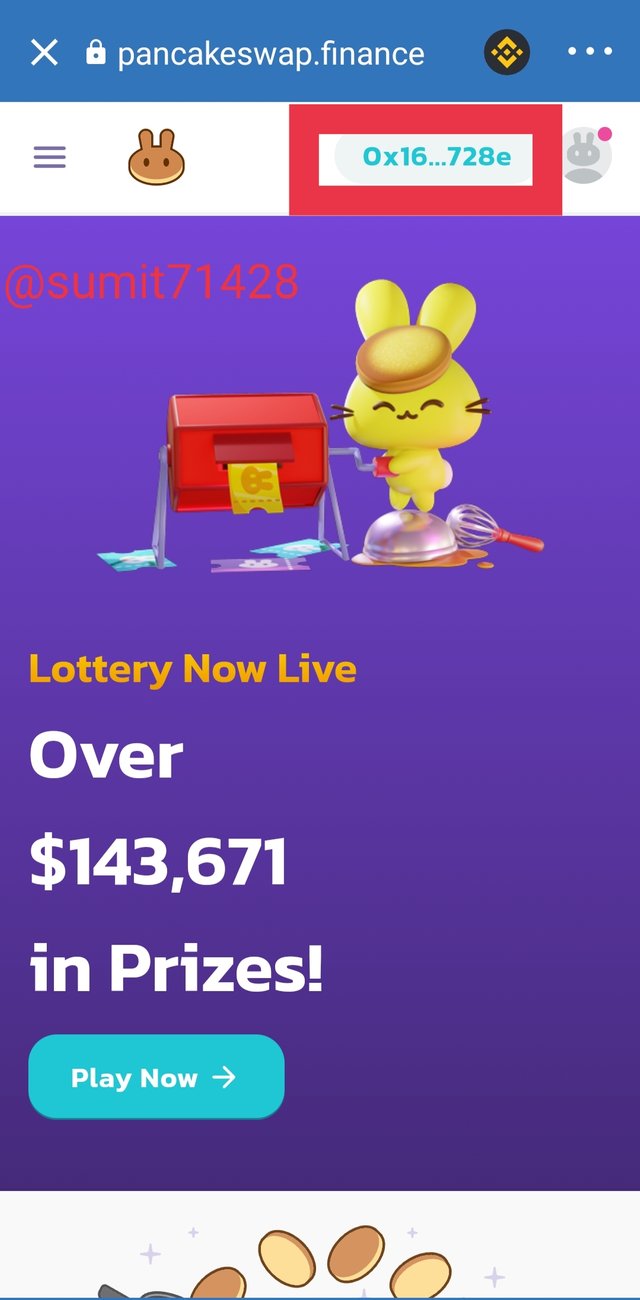

- Now your wallet address will reflect at top right which indicates that your wallet is connected and now you can use all the features of pancake swap.

Features of Pancake Swap:

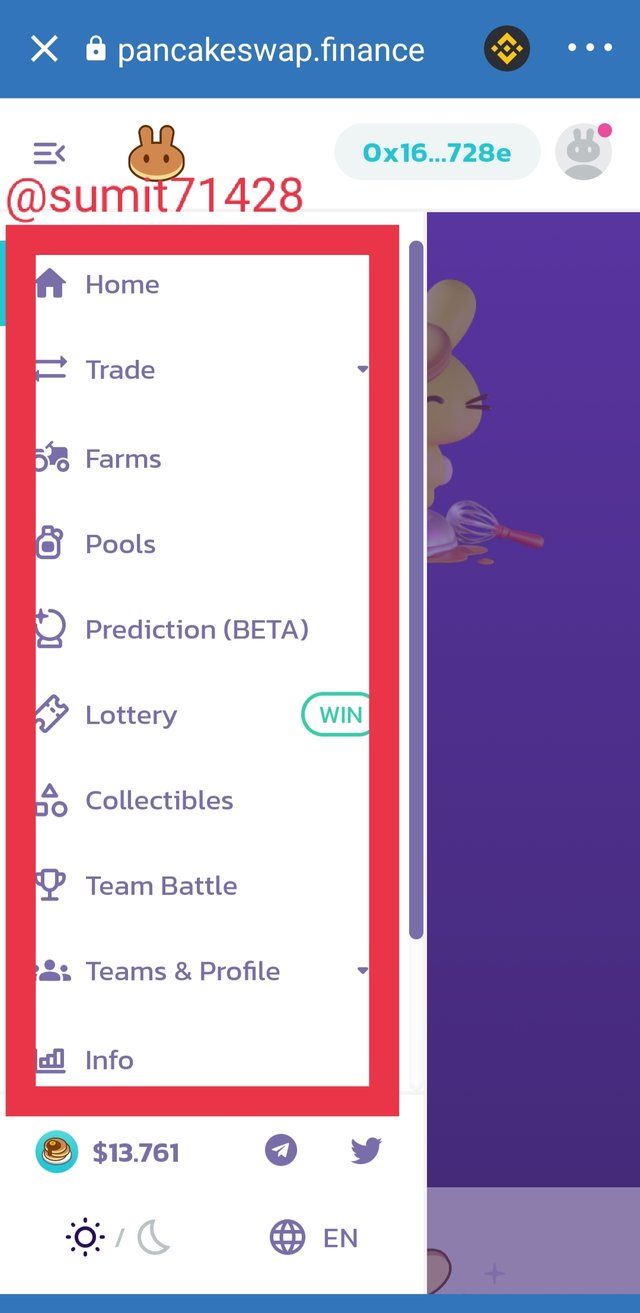

It has a very big set of features which you can use in order to make your experience completely worth it.

So hear is the list of all the features which it provides from staking to providing liquidity or to doing prediction it has got all making it an complete package.

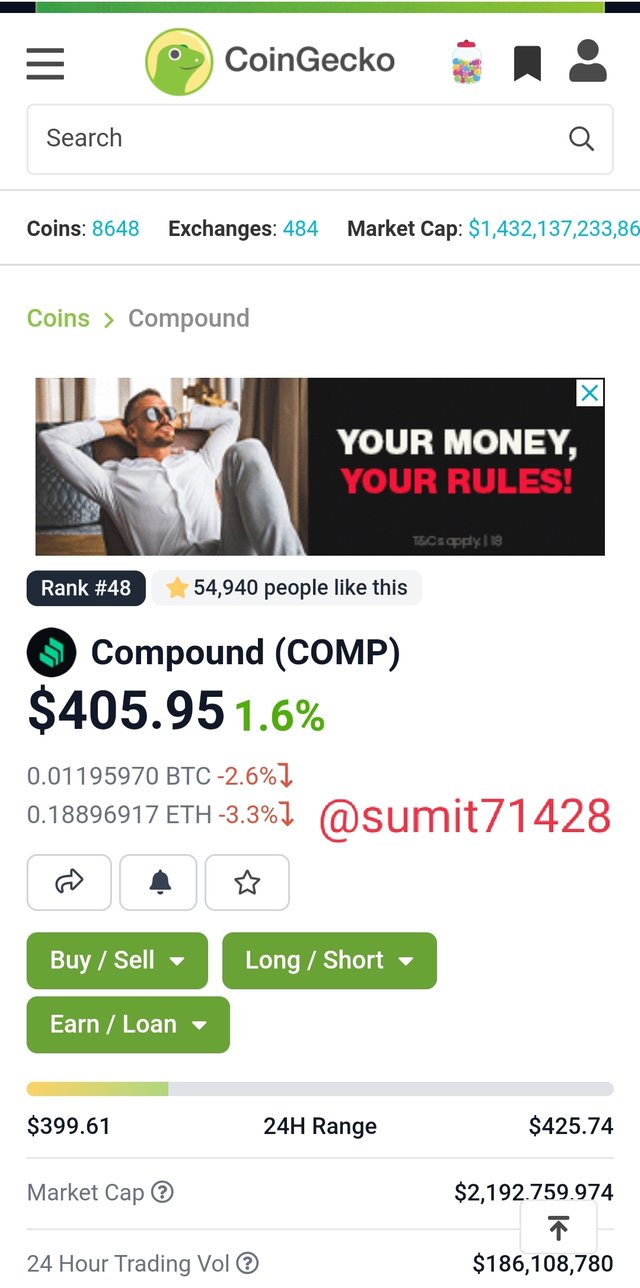

Compound:

Whenever we hear this name we tend to imagine a loan provider which has taken the opportunity from the crypto world and made it alive. With its unique loan providing facilitie it has gained a lot of popularity in the crypto market making it one of the valuable defi projects.

The process to use it's website is very simple as you can get instant loan of providing the crypto as collateral. Also you can use this platform to give loans to others and earn some % intrest on the money which is sitting idel on your account.

Though i haven't used this service but i am sure you will really enjoy it in case of emergency when you will be needing money.

Question 4:

Risk involved in DeFi.

Answer 4:

As the ownership of your funds are in your hand so basically you are liable for every loss incurred by you so some of the risk which is involved with defi are:

- Hacking: Hacking of funds are very common these days and hackers try to lure the users with various techniques leading it to a complete loss of there account.

- Impermanent Loss: This is one of the major cause due to which many people looses there money as while providing liquidity and that to when the market is very volatile leads to a complete loss of funds.

- No future orders can be placed: The dex and all other swaps work on real time transaction and it is not possible place future orders as the buy or sell will take place on real time basis so this is one of the drawback which annoy me a lot.

Question 5:

What is Yield Farming?

Answer 5:

Yield farming has made its way to the main stream crypto world by the way of passive earning as this is something through which you can make good amount of passive earning and that too without doing anything at all and with the flexibility to get those funds back whenever you want.

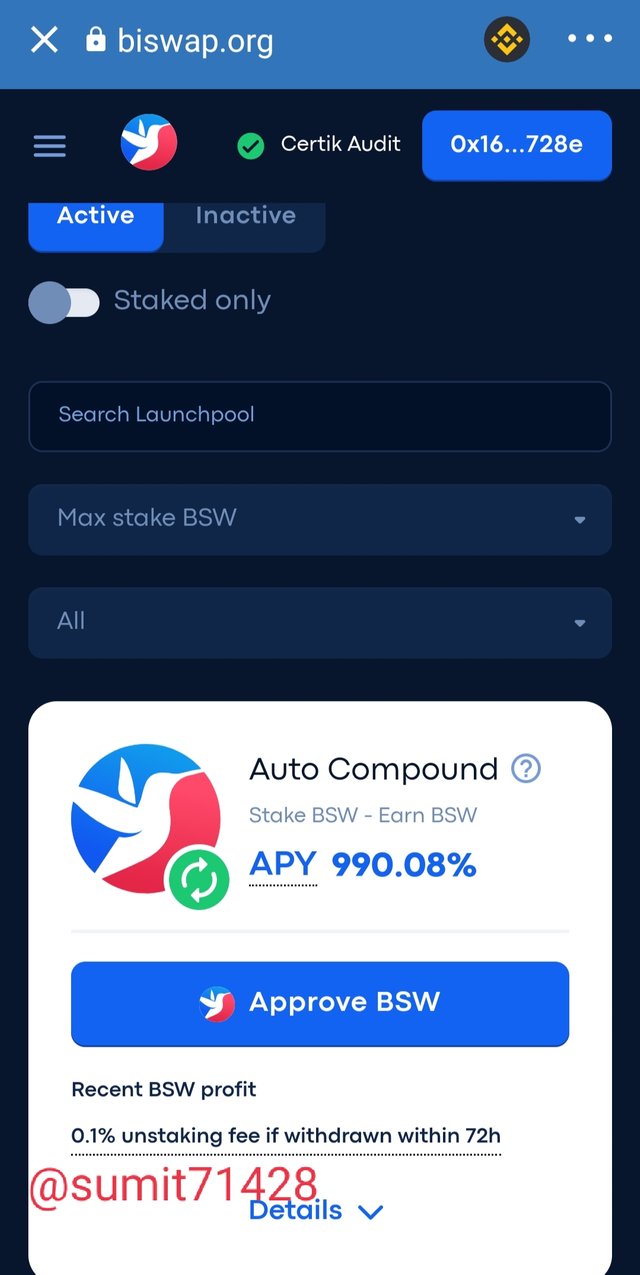

There are many platforms through which you can do yield farming by holding your specific crypto in there respective platform which will generate you some massive returns which can vary from 10% to as high as 1000%, though the higher Apy always lead to losses as these platforms are not geniune but on an average and safe side you can easily get around 50% Apy.

This platform has an Apy of over 900% leading it to be very profitable but at the sane time making it extremely risky. So higher the risk higher is the reward and the chances of getting exploited.

Question 6:

How does Yield Farming Work?

Answer 6:

In the front end it is just staking of funds or providing of liquidity on the respective platforms and it automatically starts generating returns based on the Apy provided.

But when we get on the backend then the story completely changes as the main important work is on the back end as after the users has approved a certain amount of fund which get stored or locked in the smart contract making it a very secure and free from outsider intervention.

After you have approved your funds then a set amount of calculation is been made and we tend to see the returns generated from the back end to front end which we can withdraw any time in majority of the cases and in some cases a time frame or lock in period gets introduced.

In my opinion it's an best way to make some healthy and passive money from the coins which you are already holding.

Question 7:

What Are the best Yield Farming Platforms and why they are best. (Explain any 2 in detail)

Answer 7:

Pancake swap is one of the very first Yield farming platform which i came accross and since ever then i am using it as an primary source for earning some passive earning.

The reason why i consider it to be best is due to its backing by the Worlds leading exchange binance and also with it's tough security making it one of the most secured defi out there.

On Pancake Swap we can mint even tokens which are about to get listed or are in real hype making it extremely profitable also the listing process of pancake swap is excellent making it a great launchpad for majority of the coins and most of the coins reaching the 100× mark are from Pancake Swap only making it one among the top picks for majority of the people.

Cub Defi this platform is made by one of our old Steemit user who has now shifted to hive blockchain even this platform is excellent in providing some high apy even higher than the apy which are available on the Pancake Swap.

I personally love the team behind it and due to them only it made me convinced to invest in it though at present i am in loss but that is just because of the downtrend but i am sure enough that soon it is gona touch the 10$ mark and that too with ease.

So these are my top picks in the yield farming zone and they are simply best.

Question 8:

The Calculation method in Yield Farming Returns.

Answer 8:

The calculation process is something which most of us don't follow as there are many calculators available online making it extremely easy but still we should be knowing the process for the calculation of the yield farming and it is basically done by two ways:

Annual Percentage Yield (Apy): Apy is something for the calculation of which a formula is used and after using it the calculation becomes extremely easy.

Formula: (1+r/n)n-1.

r: rate of interest.

n: time period.

So let's calculate by putting the details in.

r= 70%

n= 1 year

= (1+70%/365)365-1

= 1.01

So multiple this number with the investment amount and you will get the returns generated from it.

** Annual Percentage Rate(Apr):** The calculation of Apr is very simple you just have to multiple the % with the amount invested and you will get the returns generated through this method.

Suppose 100$ invested @60% will yield you 160$ of total earning in combination of yield and capital.

Question 9:

Advantages & Disadvantages Of Yield Farming.

Answer 9:

Advantages:

- A great way to earn passive income.

- Provide us with great returns without doing anything.

- Can get hold of new coins which are about to get listed giving us an early mover advantage.

Disadvantages:

- Chances of getting the contract hacked and loss of funds is very.

- Fees are very high on some of the chains while other's have a lower fees making it very challenging for new users with small funds.

- There is always changes in the % yield based on the total value of funds being locked making it very difficult to stick to a constant earning.

Question 10:

Conclusion on DeFi & Yield Farming.

Answer 10:

Defi and yield farming has really taken crypto world into a whole new level with so much things to offer it is really a useful thing for majority of people and if used properly then it can lead to some massive gains and that too passively.

My major source of passive earning rely on these defi platforms and i am making some good amount from it and it is ranging somewhere between 15$ to 30$ per day which is an decent amount for a person like me.

Overall if investment in these platforms are done carefully and with proper research then it can give you some extra ordinary returns so use these knowledge to start your first step towards passive earning.

I am really thankful to @stream4u for organizing this course thanks a lot sir really it was of an great help.

Thanks friends have a great day ahead.

Hi @sumit71428

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

vote for Daily Report as Greeter Helper for Newcomers Achievement Program (26/06/2021). By @sumit71428. (Report 23)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit