I am glad to participate on the weeks crypt academy homework by professor @yousafharoonkhan. Let dive into the homework.

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy-paste or from other source copy will be not accepted)

An order book is a list of trades, either printed or written, that exchange uses to record market values at actual individual order prices. We can also say that an order book is a book created to meet records of buy and sell orders that are placed by traders at different rates at their convenience.

The Crypto order book is a little bit different. There record the order of traded pair of buyer and seller are kept. For instance, LTC/ BTC assuming a trader buys BTC in exchange for LTC. The record will be kept on the order book in the place of LTC/BTC buy orders. It goes on and on like that. It also implies the other cryptocurrency. For instance, another trader sells ETH from BTC the record will be kept in a specific section.

The order book is not peculiar to crypto trading only. Order books are used every even in our local market. There is some little difference like:

No technical analysis can be done in local markets to predict when there would be a high price or low price.

Orders are recorded manually in the local market order books.

There are no features like stop limit orders and market orders in the local market

Mostly a single currency is used to buy sell things in the local market.

Local market order books are only meant for the owner to access.

Explain how to find order book in any exchange through a screenshot and also describe every step with text and also explain the words that are given below. (Answer must be written in own words)

Pairs

Support and Resistance

Limit Order

market order

We can use finance through a web browser and also through the app.

Step 1

Login to your Binance app.Step 2

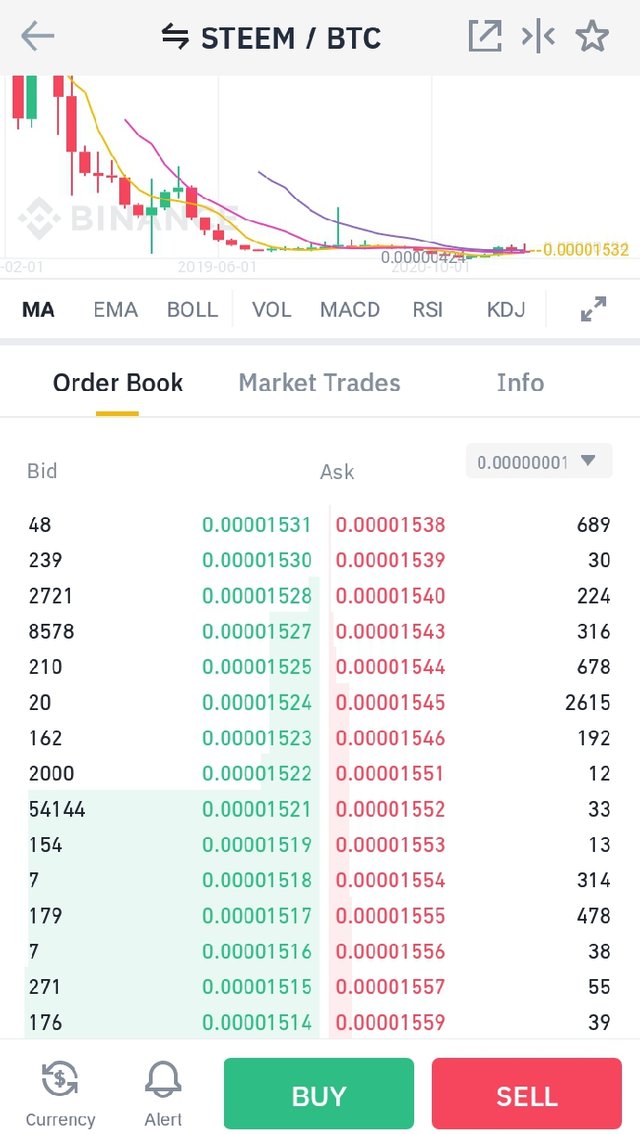

At the bottom part of the main page. Click on Market. It will take to the pages with a lot of trading pairs and different markets like spot, futures, and zone. Click on the pair you want to look for. You can search at the search bar. I searched for steem/BTC.

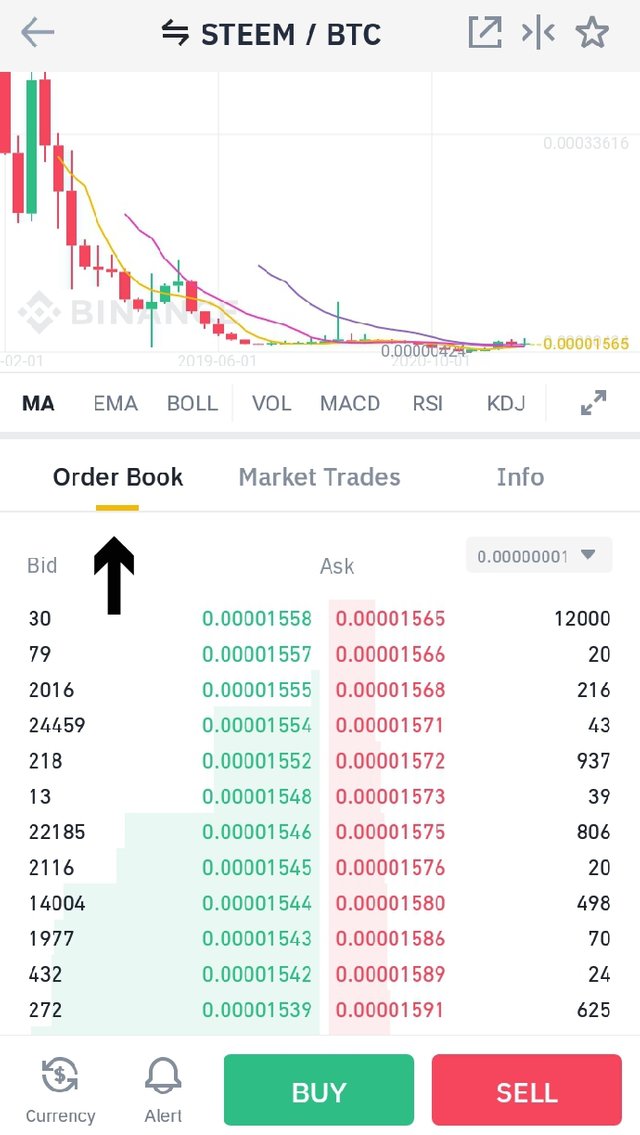

- Step 3

Click on the pair you intend to trade. The next page will show below the price chart of the pair the order book.

Trading pair

Trading pair means crypto-assets paired together on an exchange market that can be traded for each other. For instance, ETH/ BTC and other cryptocurrencies. It means can another cryptocurrency with a particular cryptocurrency. We can buy ETH from BTC and also BTC from ETH and we can also sell.

It can also be pair either crypto to crypto or crypto to fiat pair. That is BTC/ETH for crypto to crypto or BTC/USD crypto to fiat trading pair.

Support and Resistance

Support is the price degree where a bearish is expected to stop. At the point of the bearish price of asset decreases. The support line can be likened to the position which prevents the price from bearish. The support line can be seen by joining the tops of bearish price peaks.

Resistance means the point where a bullish trend is expected to stop. In other words, the value of a particular asset is expected to come down at that point. At that position, the traders are expected to sell the asset.

Limit order

It a type of trading system where a buy and seller set order of an asset at a price from the spot price or market price. For instance, I want to sell 1 ETH in the market but it was $3,500 at the time placing the order. So, I can set my price to $4,500. The sale will be carried out when the price reaches $4,500.

Market order

It is the type of buy or sells order where a buyer or seller places an order at the current price of the market. The order will be instantly carried out because it is the exact price of the market. Sellers and buyers are already available to trade at that current price.

Explain the important future of order book with the help of a screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

I will like to share a screenshot of my verified finance account as demanded.

Features of order book

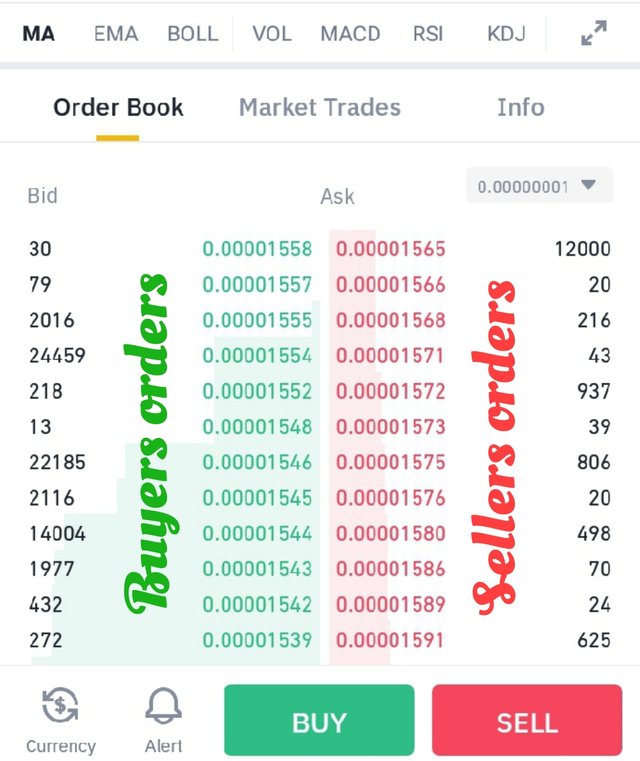

The crypto order book is a record of the buy and sells of crypto and also the value of an asset, market cap, and price are been a record.

It shows the buy and sell open order STEEM/BTC from binance account. The order of seller are written in red while the buyer orders are written in green.

The order book changes due continuous trading. This is the order book few times later below.

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

Buy order

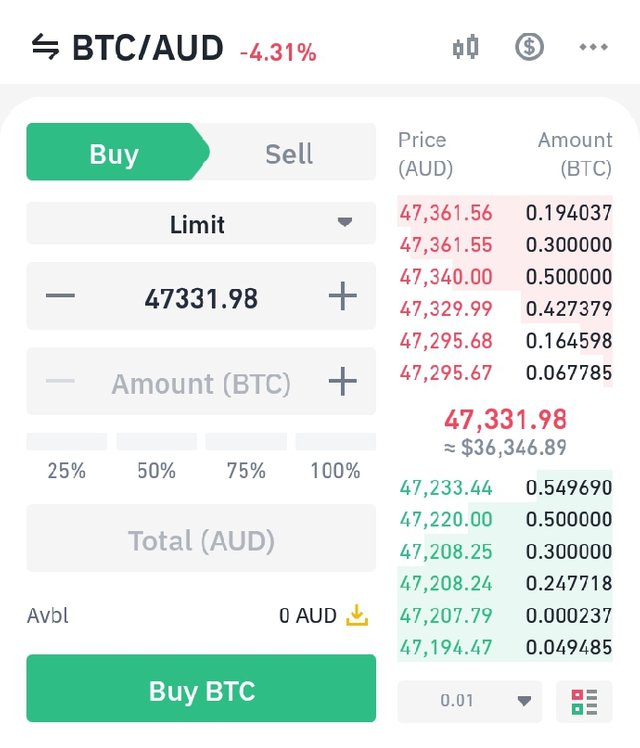

Buy order means you already have cryptocurrency that you want to exchange for other crypto or fiat. I will have to select a trading pair that you on your exchange wallet that wants to exchange to another cryptocurrency. I want to use BTC/AUD

After clicking buy, you will be directed to this page below.

Then we will set the percentage of AUD or whatever coin you want to buy and click buy.

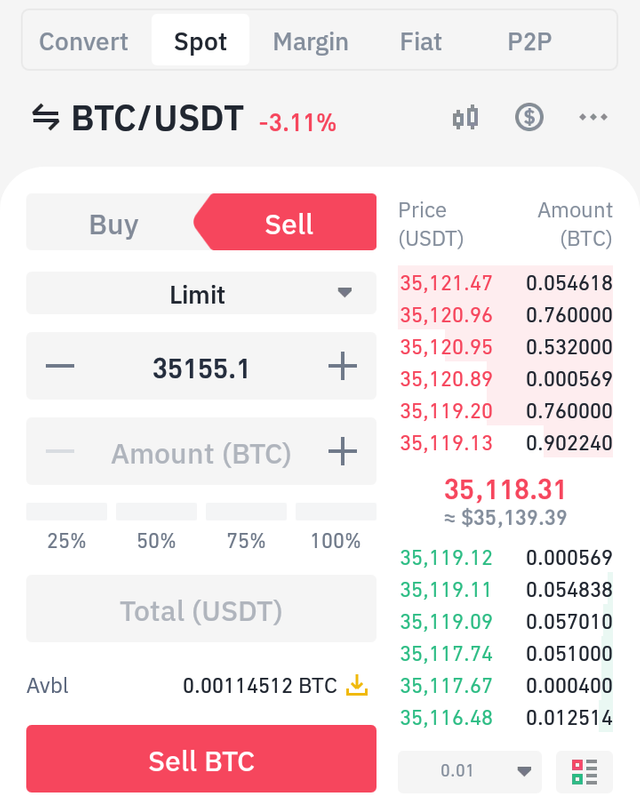

Sell order

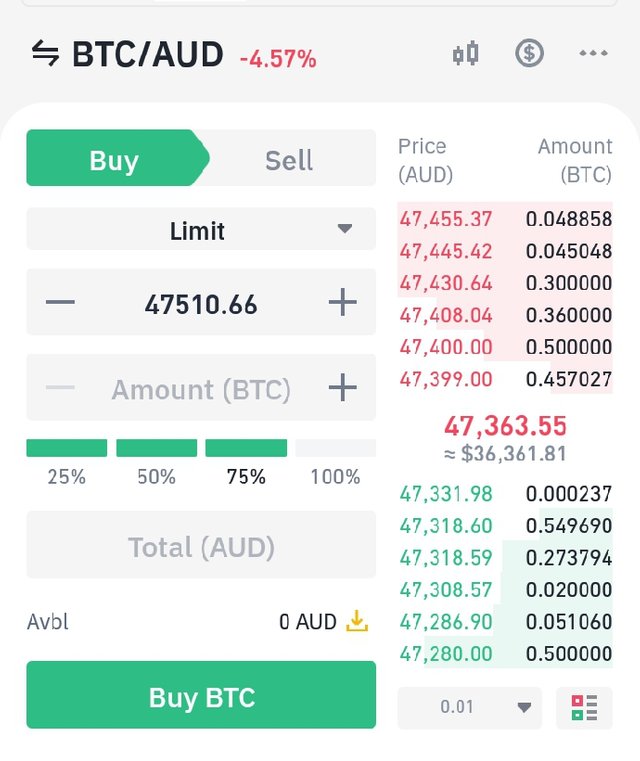

Sell order means you want to exchange the cryptocurrency for another cryptocurrency. For instance, I want sell BTC for USDT. Then, I will go to market, select BTC/USDT pair. It will load an order book. Click on sell.

Then, you will set your limit or market order and set to percent you want to sell.

I selected 100% BTC. Then, click sell BTC button.

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

STOP LIMIT ORDER

Stop limit order can be use to stop loss and limit order.

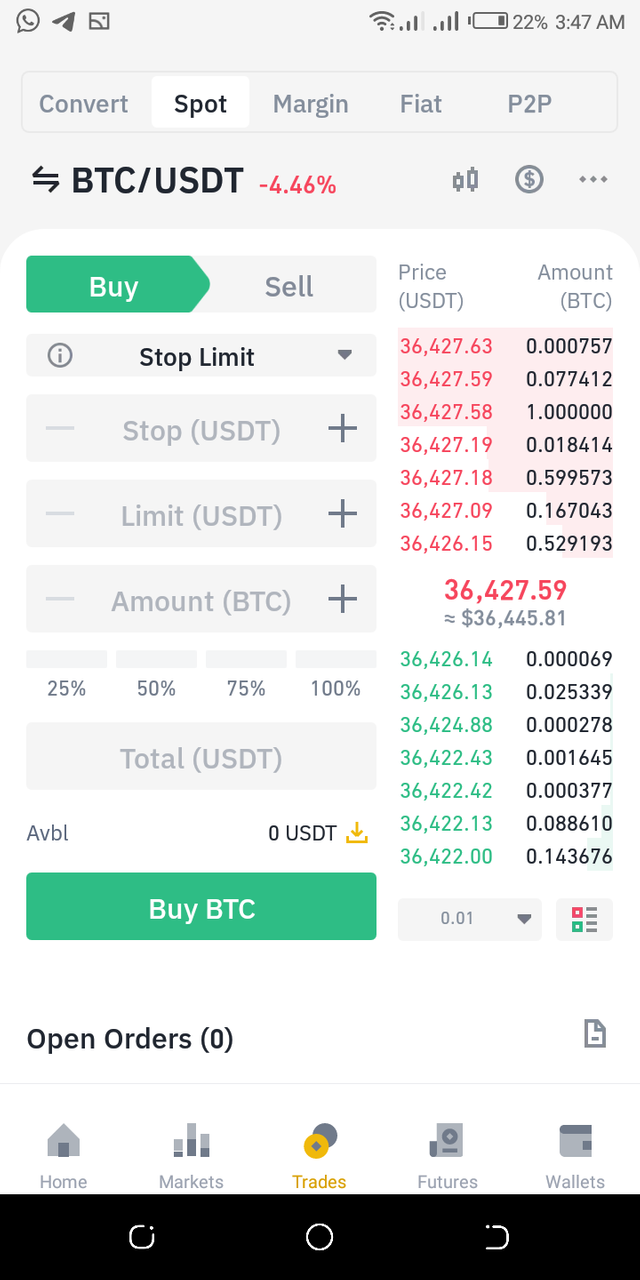

How to place stop - limit orders

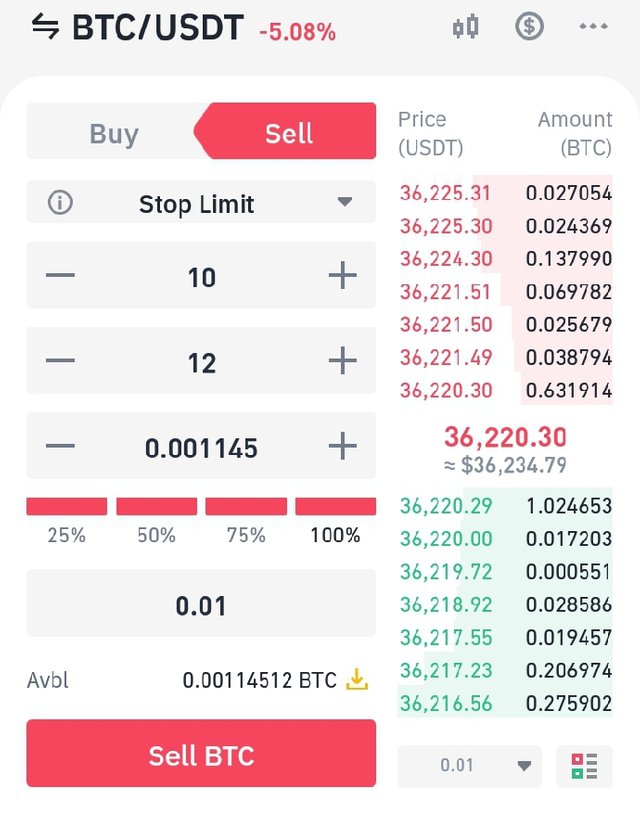

Go to your binance account. Click on market and select the pair to want exchange

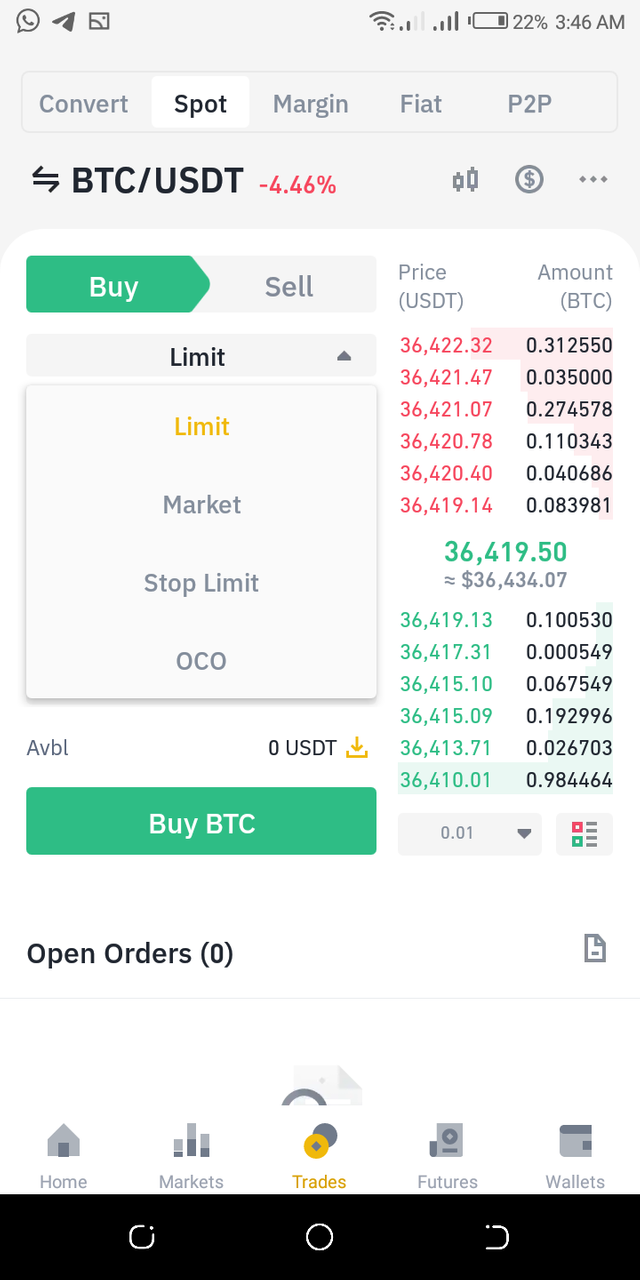

It below the buy and sell. Click on it and drop down will display. Select stop limit.

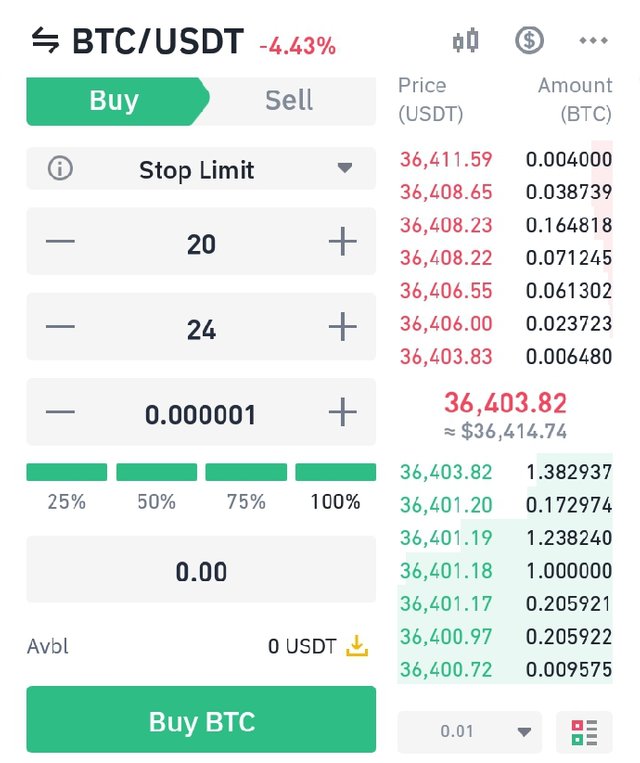

Buy stop limit order

Screenshot illustration

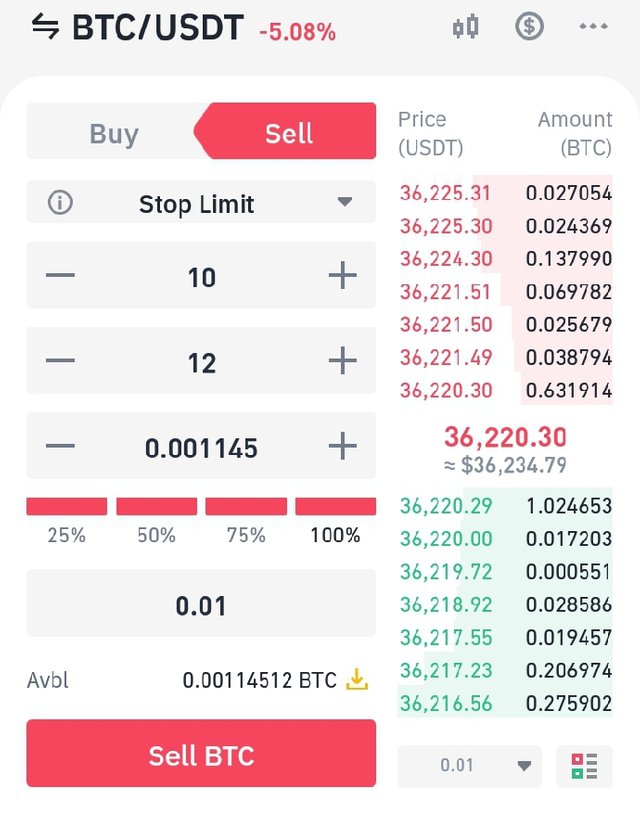

Sell stop-limit order

Screenshot illustration. I set stop at 10 and limit at 12.

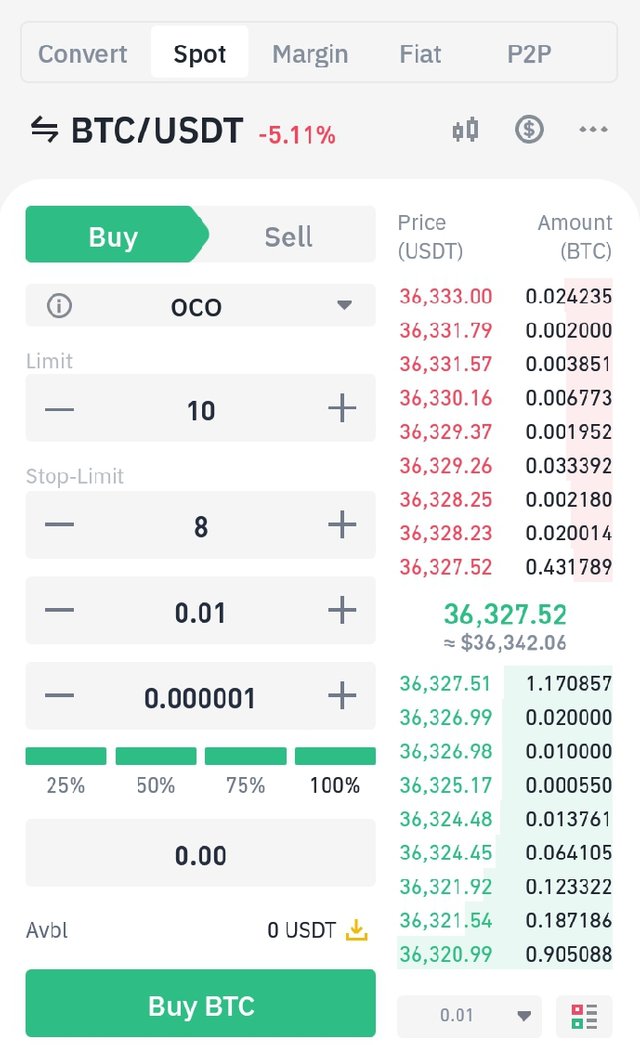

How to place buy and sell order in OCO

OCD is a pair that cancel by itself if the get carried out.

Buy OCD order

I'll try to buy BTC from USDT. I set the place limit and stop limit order. For limit order I set price 10 and for stop limit, I set stop price at 8. If the price reach the limit price of limit order, it will be carried out and the stop limit order will be cancelled.

Sell OCD order

How order book help in trading to gain profit and protect from loss? share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

Assuming you have a cryptocurrency and you saw that there sudden raise in price of the coins and you wanted to gain profit by selling this coin. The order book provides us the market order at the particular moment in which our order get executed immediately. The order at that particular moment help to gain profit. Assuming you saw the price of a particular cryptocurrency going down and you want to buy at that particular price. You can place the order at market price and purchase the cryptocurrency. Hold the cryptocurrency and sell it when the price goes up. If you're too busy to monitor the price and you want to sell. You can place your order and sell at your preferred price limit. Your order will be executed when the price reach the order limit.

The support help by monitoring at a price range where maximum buy orders are placed. We can also check on the price range which the highest sell order are place and check on the resistance level of an asset.

Conclusion

Order book is one of the important feature of any exchange. It helps in analyzing, placing buy and sell orders. It also help to monitor the market trend, demand and supply etc.

Thank You

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 4

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit