1. Explain Rectangle Pattern in your own word.

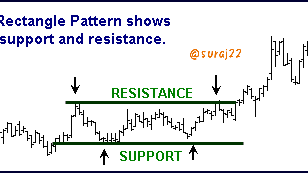

Rectangle pattern is one of the patterns in viewing the candle on a cryptococurancy value chart, this pattern once {price | Price | Price} is experiencing fluctuations in critically important value where the movement is being seen as a resistance level and therefore the lower level is being seen as rules where these 2 lines are cryptocurancy chart Breakouts occurring in the rectangular pattern are not always seen in one direction, so this rectangle pattern is used as a continuous pattern and trend reversal within the cryptococurancy market.

2. How to identify Rectangles. Explain with Screenshots.

A very chart area unit is a touch to the output rectangular spot.

We usually reach this according to this trend or horizontal trend. To understand the events of the triangle pattern, someone should be aware of a consolidation with the type of consolidation and a consolidation which appears like a consolidation. The identity of the triangle pattern is noted with the characteristics. The price trend once appears to get traders at certain levels, thus making charging patterns, there is fluctuations between these levels. Once worth Price | Price} Finally gets out of its value pattern, it can indicate a major change in emotions.

Price trend can be a style of consolidation viewed within the triangle pattern. It means that the cost of the cost of the lower finish creates a worth chain, while the cost business creates a worth chain, while the cost business between the specific market intervals, which is a direct horizontal line representing resistance. If 2 or extra line support from those costs, then it is considered as a triangle to make the position of this market. Triangulum pattern once runs horizontally should win the hearts of merchants.

Screen shot from trade view app

you will be able to see that the tendency that was optimistic before shaping the size of the climb pattern was optimistic. Thus, after you see, you will be able to see that after trying the rally, the structure of the Olong pattern is only the structure of Zigzag and therefore once again goes down. It means that each resistance level and therefore there is a similar rate of increase and decline. Here the horizontal trendline, once the value of the listed plus is once a very optimistic or pessimistic trend is well specified. With this trend, there has been a rectangle next to the trend. Once the price rebound and therefore at the same rate and within the same approach. Within a method of separating an Olong chart pattern, it will be wise where there is a horizontal movement on the chart, for that time the price should be buried between level (flat top) and support (flat bottom). It will be understood that these structures have been referred to as rectangle because the worth the tricks should be to become a home between them in a very wing-zag type, clearly in the form of the increase and decline of the value of the plus within the chart.

Can we use indicators with this pattern to get accurate results? Explain with Screenshots.

Yes. We will use indicators with rectangle patterns to urge many correct results. There are several indicators within the market to investigate the market in many approaches. Some areas use to find the unit trend. Some people ask the market to predict the moves, some of these indicators predict the value. The boller band indicators in the form of Bollinger Band Indicators from these indicators are the tendency to use to find the trend within the market. This indicator works well with parontocream patterns to insist on many correct results. This indicator is incredibly common within the crypto market and direct use. There are 3 lines. The high line is understood as high band, the middle line which is called the middle band and called the lower band. The movement of these 3 band shows what the trend in the market is, what is the amount of market and either in the market overbott area or overload area. When the lines grow upwards with the area unit, it indicates that it is an uptrand. Once the lines grow downwards, it indicates that there is a pessimistic trend. Once the unit of these lines is about each other once, it is often time to have less volatility within the market. Once the line area exits each other, it indicates that there is high volatility in the market. After this we will use this indicator together with rectangle patterns. In rectangle pattern, shopping for shopping and business pressure is similar. Thus, at this point the market is not prompted in the definite direction, there is less volatility in the market. Bollinger band be sure to show lines about each other. Once the Bollinger Band Lines unit unit has to be considered very accurately after the unit unit. This ensures that it is often a rectangle pattern prepared on the price chart. When the lines come out of each other, it shows that it is escaped and it is not worth ahead of the previous direction. Merchants get information about the market rectangle pattern and after analyzing the lines of Bollinger band, after finishing this pattern. Below it was that the chart was in the direction of the most important position below. On the other hand the trend stopped and therefore the aspect approach starts to show on the chart. Begin to move forward inside a range and moves. This indicates that rectangle patterns have been prepared on the chart. Then we have the tendency to attract support and resistance level. The price was moving forward between support and resistance level.

So we have the tendency to add Bollinger band indicators. The movement below the lines shows that the market has declined. At the time of rectangle pattern, the lines of the Bollinger band were about each other, which indicates that there is less volatility. After running once more and up towards the top, the lines come out of each other which shows that instability increases.

4. Explain Rectangle Tops and Rectangle Bottoms in your own words with Screenshots of both patterns.

When the price is moving upwards and enters a rectangle pattern, it is called a rectangle Top. Once the price enters the rectangle pattern from the bottom, the rectangle pattern is considered to be a rectangle high. The coin is in an uptrend. Price is moving upwards. Then moving from the bottom up, once the rectangle pattern is in place, this rectangle pattern is called rectangle high. It is not necessary that the price should break the prison in an upward direction when the rectangle is high. It is not necessary that when the prison is broken, the price can move in an upward direction. It will move in any direction; like up or down.

More than that wherever on the chart we can see that the most important price was moving up. There is an uptrend. The price is moving from the bottom up. Then the parallelogram pattern was created and recorded during this pattern from below. So this is often a rectangle high.

rectangle down

When the price is falling downwards and enters the rectangle pattern, it is called the rectangle bottom. Once the price enters the rectangle pattern from the High, the rectangle pattern is considered to be the rectangle bottom. The coin is in a downtrend. Price is going down. Then going from high to low, once the rectangle pattern is arrived, this rectangle pattern is called the rectangle bottom. It is not necessary that when the rectangle is down, the value is captured in the downward direction. It is not necessary that when the jail is broken, the price can go in a downward direction. It will move in any direction; like up or down.

What's more, wherever on the chart we can see that the most important price was falling down. There is a downtrend. Price is moving from high to low. Then the rectangle pattern was created and was recordable during this pattern from the high. That's why it's often down the rectangle.

5. Show full trade setup using this pattern for both trends. ( Entry Point, Take Profit, Stop Loss, Breakout)

There are many things that have to be worked at once, there are many things that have to be worked on, there is a loss of workers. These things should not be made dangerous and we should use some settings so that the signals given by the rectangle patterns of workers can maximize our profits. Currently I will show you two styles of trends, in particular pessimistic tendencies and optimistic tendencies.

we can see the trend within the market is showing an edge where costs have increased and reproduced several times. And I can see the high and low trendline lines as resistance and support levels, yet I can see that BNB touches a rectangle pattern on the market where the candle holder touches the resistance and support levels so that the rectangle pattern needs Be after that. Objective At that point, it is a point that wherever I start entering trades with short positions, I place the stop loss level slightly above the resistance level and move the take profit level down with respect to the risk/reward

we can see that the trend within the market is showing an edge where costs have increased and has become breeding at times. And I am higher and lower than trendline resistance and support levels, however as a result of those fluctuations, there are a lot of stacks that usually typify best and lowest objectives where price | Price} BNB movement starts significantly in price until it breaks with the resistance level on the higher range. The jail-breaking objective is that wherever I start entering a trade with a long position, I place the stop loss level slightly below the price and the risk/reward at the highest with the risk level .

Conclusion:-

Most advisory traders of crypto planning advocate these technical methods more than technical indicators. From my expertise, although technical indicators are very economical and reliable, they tend to spot signals much later than technical methods such as break retest break (BRB) and market structure break (MSB).