background source

Hello Professor @yousafharoonkhan , it is a pleasure to participate in your conference and to have acquired this knowledge that serves to be able to apply it in trading. After having completed the task I feel confident to make decisions when making a trade.

Here is my homework:

.png)

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted).

After reading the lecture, I decided to start by defining Order Book, to understand the difference between Local Order Book and Cryptographic Order Book.

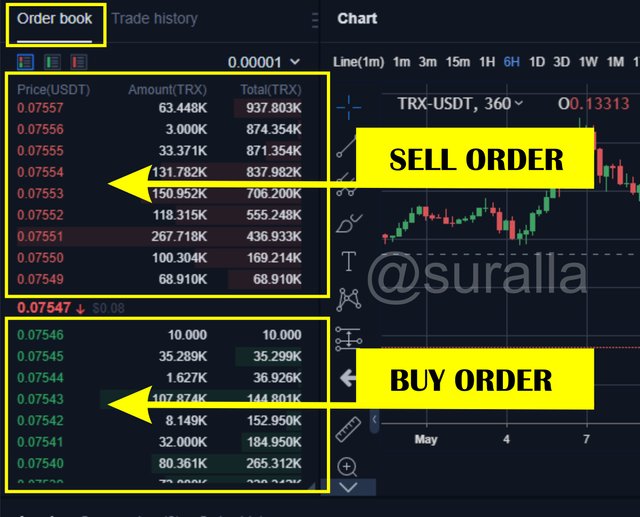

An Order Book is a fundamental tool in a market, where there is an exchange of assets and the buy and sell orders of the different users are registered. Each type of market has a different way of keeping this record.

In the local market, the price to be agreed is chosen, generally the local currency is used, the prices are almost always fixed so there are not many negotiation options, and the information register recognizes the identification of the people who are operating in the market in the purchase and sale orders. This information is classified.

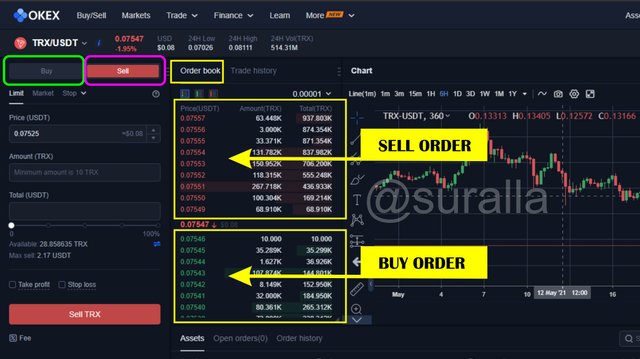

Unlike the local market, the Order Book is available to those interested in placing a buy and sell order for a specific asset, with bids constantly visible to all users within an Exchange. This asset exchange is represented by pairs and each pair has its own Order Book. For example, if I want to exchange my TRX Asset, for USDT, then to trade and place a buy or sell order, I must search for my TRX/USDT pair in the Exchange, and see the different offers in the market.

Diferencias:

Mercado Criptográfico:

• Cada criptoactivo formado por Pares, tiene su propio libro de órdenes .

• Nos revela información de la oferta y la demanda de los activos, el precio de los activos y la cantidad que hay en el mercado.

• Podemos ver el flujo de compra y ventas de forma organizada.

• La forma en que se proporciona la información, permite crear estrategias para un intercambio exitoso.

Mercado Local:

• Los clientes buscan un precio a convenir según la disponibilidad de su capital.

• El Mercado Local no utiliza tecnología avanzada en los libros de pedidos y no se trabaja con pares criptográficos.

• La compra y venta en los Mercados locales depende de la variación de precio del mercado en los diferentes lugares aunque no es muy significativa.

.png)

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

- Pairs

- Support and Resistance

- Limit Order

- market order

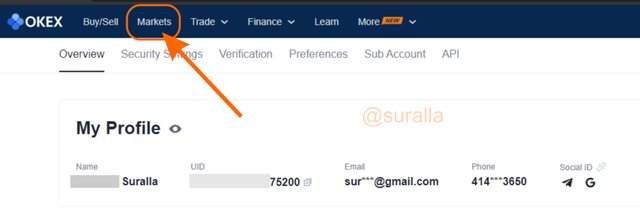

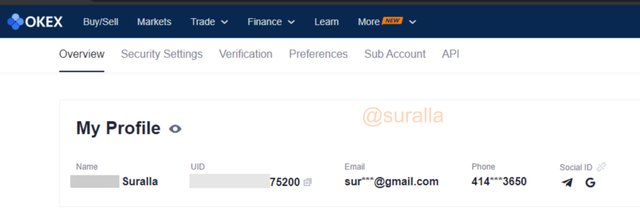

a.- To answer the question and find the order book, I used the Exchange Okex.com , with my verified account.

b.- Then, at the top we found the "Markets" option.

Screenshot Okex.com

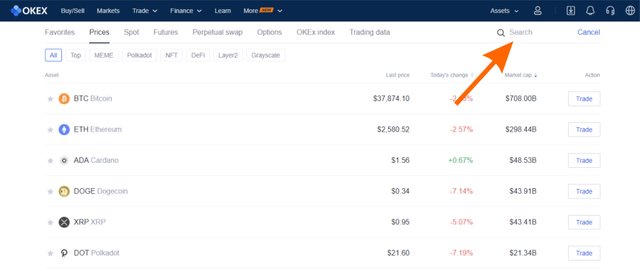

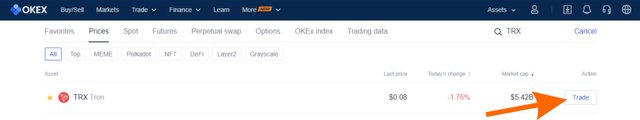

c.- The list of all the currencies in the market appears with their prices and market capital, then, we look for the currency of our interest in the search option, in this case TRX and then we click on "Trade".

Screenshot Okex.com

Screenshot Okex.com

d.- Once opened my "trade" option, we can observe our trade, we can also choose within it, the pair with which we want to work, in this case I have selected the TRX/USDT pair. But if I want to change the TRX pair, for example to TRX/BTC I go to "Spot Trading" and I can change it, but it is not the case, I will stay with TRX/USDT.

Screenshot Okex.com

e.- Once we have chosen the pair of our interest, we can look at the Order Book option, in this way we have found it and we can place a Buy or Sell order in the order book, taking the order book as a reference. Okex]( https://www.okex.com/)

Screenshot Okex.com

Pairs:

They are Exchanges that exist between 2 Cryptoassets, which could be 1 pair of cryptocurrencies, example: BTC/ETH , which means that we can exchange a Cryptocurrency BTC for a Cryptocurrency ETH, the other is the pair formed by a cryptocurrency and a fiat, example: BTC/USDT which means that we can exchange a BTC for the fiat USDT. These pairs are used to trade and enter the market according to the strategy chosen by the traders, this requires a previous analysis to choose the right pair and avoid losses or very low profits.

Markets

The market order is one that is made according to the price that is in trend, this order to buy or sell will only be completed when it coincides with the price that is in the market. If we give the instruction to buy or sell in our Exchange and we want an immediate result or in a very short range of time, the amount to place must be the one that is at the moment in the market so that it is executed at that moment.

Limit Order

It is a buy or sell order established by the investor with the most favorable price or the most convenient one, taking the current market as a reference, in this way the investor assures his profit only when the price reaches the one he established in his order. For example, if the investor wishes to buy an asset at a price that favors him, he places his limit order, which will be executed or completed only when the market price matches his order.

Support and Resistance.

Support:

It is understood by support, the price level that is below the market price, hoping that at the time of ending the price decline, this will stop, due to a strong amount of purchases by investors, taking advantage of this low price, which would cause a rebound effect and begin to rise again, that limit that is found at the end of the bearish behavior, is what we call, support.

Screenshot Okex.com

Resistance:

It is the opposite of Support, we can say that the "resistance" is the maximum price reached above the market price, where the sales of investors to opt for their profits, exceed the purchases and put an end to the bullish behavior, causing the price to go down. That ceiling that exists before starting the price decline is known as Resistance.

Screenshot Okex.com

.png)

Question no 3 :

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words).

Screenshot Okex.com

First I present my verified profile of my wallet Okex.

Now let's talk about the important features of the order wallet.

The most important Features, as we have learned in the class are :

The Buy and Sell Section.

It is where we can place the orders we want to achieve the exchange, in this section there are different tools that facilitate the process of buying and selling, you can also observe the variation of the market and the placement of orders.

In the order book, it can be identified by a green area and a red area, where the green area refers to the purchase and the red area to the sale. There, traders or buyers decide to place their buy or sell order.

To enhance the trading experience, we have three ways to buy or sell, these are: Limit order, market and stop-limit.

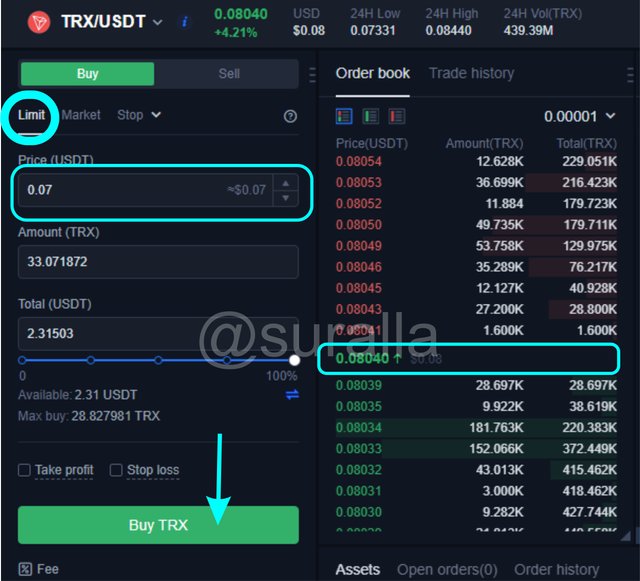

Limit Order

Allows you to choose the price at which you want to buy and sell with this order. The price can be the current price or a better one.

Screenshot Okex.com

Screenshot Okex.com

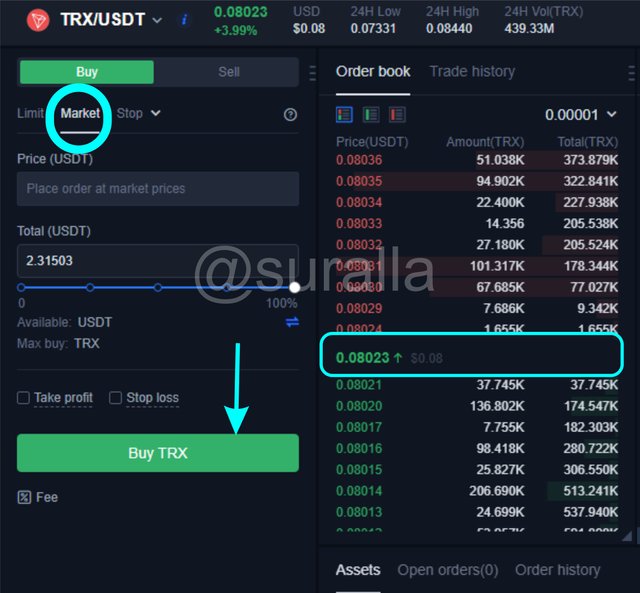

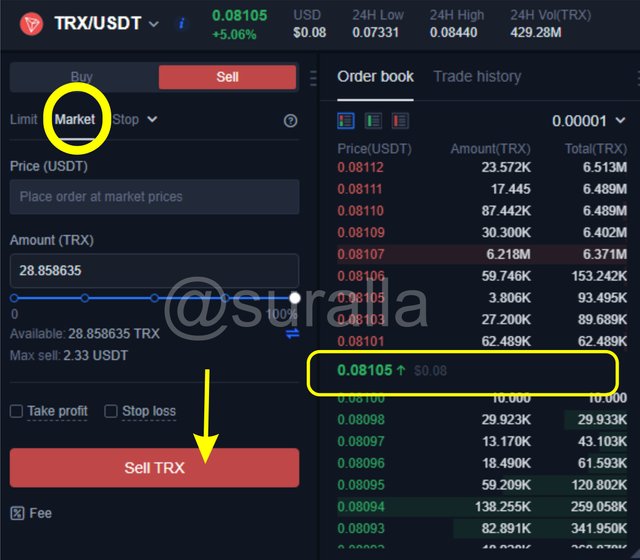

Market

Allows us to make an immediate purchase or sale by setting the market price.

Screenshot Okex.com

Screenshot Okex.com

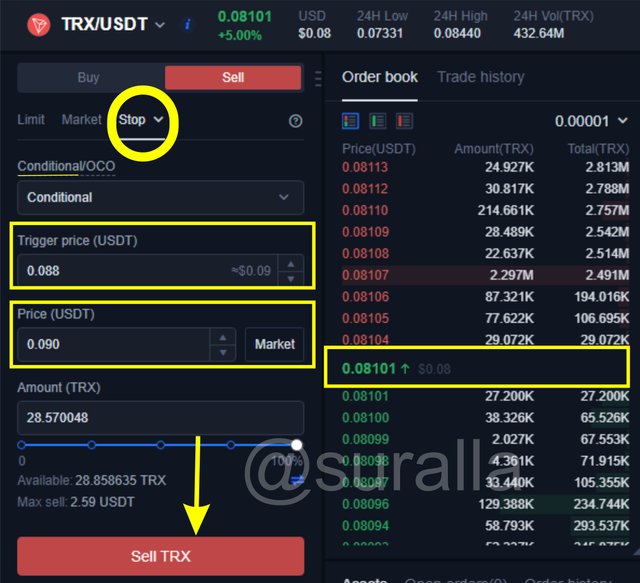

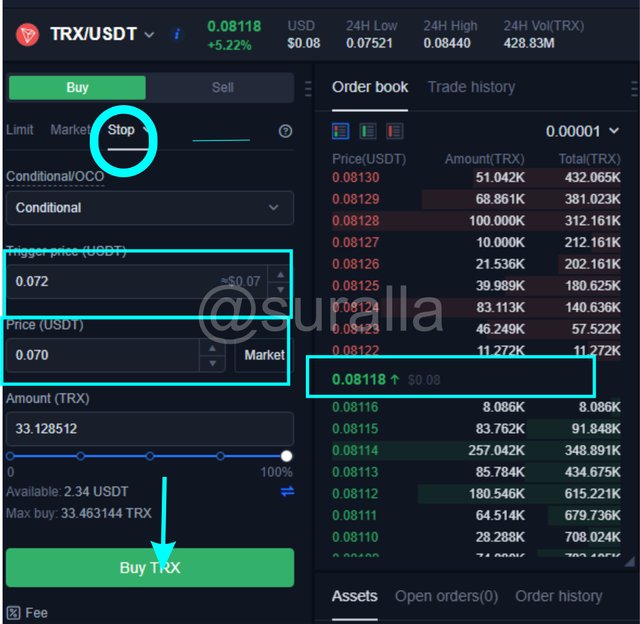

Stop-limit

Allows you to place a price where you want the buy or sell order (Trigger price) to be activated, and the order to be filled once the market price matches the one set in the buy or sell order (Price).

Screenshot Okex.com

Screenshot Okex.com

Order book.

It is a tool for quick visualization of the market prices both in buying and selling and the flow of cryptocurrencies, providing the user with the necessary information to opt for an organized operation with better results. It is also possible to visualize in this section the buy and sell orders made by the users.

Screenshot Okex.com

.png)

Question no 4 :

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

To place Buy and Sell Orders on stop-LIimit and OCO trades let's start by looking at the market section, and choose the trading pair we want, for this task I will choose the TRX/USDT pair and select buy or sell as the case may be and then I will explain in my own words, how to place buy or sell orders with Stop-Limit and OCO.

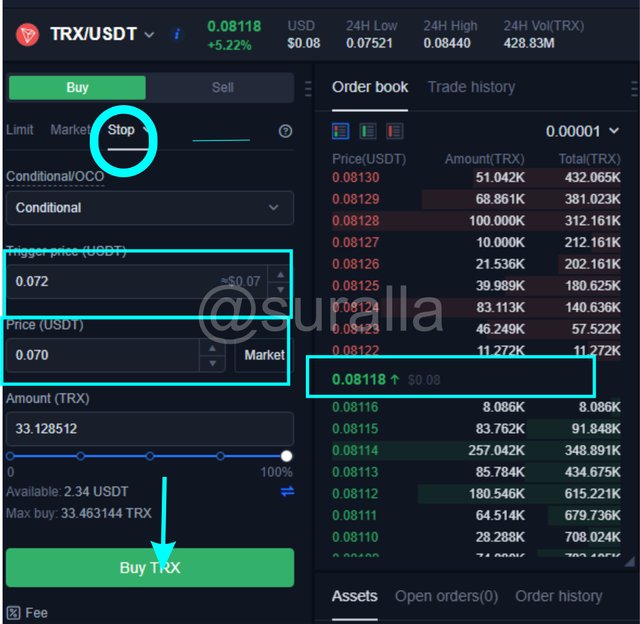

Buy with Stop-Limit

I have chosen to buy TRX with USDT, (TRX/USDT), the market price is 0.08118 USDT, in order to make a profit, I must buy at a price below the market price. In the Trigger Price area I place the value or price where I want the purchase to be triggered (0.072 USDT), in case the market reaches that point. Once the order is activated, my wish is that the purchase is executed when the price coincides with the price chosen by me for the purchase, in this case (0.070 USDT), then I choose the amount I want to invest and proceed to Buy on the green button.

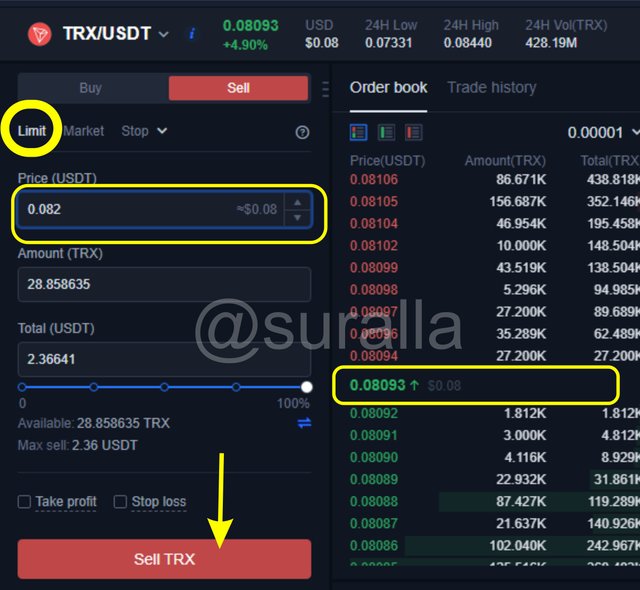

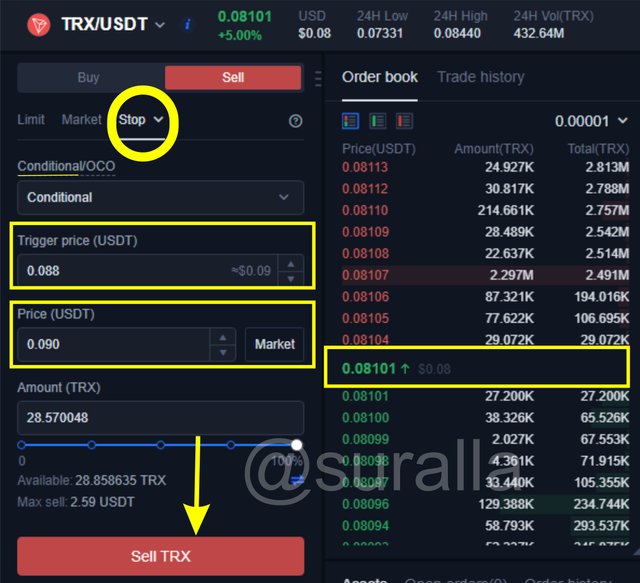

Sell with Stop-Limit

Would be a similar procedure as for buying, but this time I must set a price above the market price. Once I have chosen the profit margin I wish to have, I proceed to elaborate my stop-limit order. In this opportunity the market price is at 0.08101, then, I place in the Trigger Price area an amount, (0.08 USDT), so that the sell order is activated, and is executed at the price set by (0.09 USDT), to conclude the sell order I click on the sell button. After activation, once the market price matches the trigger price, a sell order will be placed and filled when the market price reaches (0.09 USDT).

Screenshot Okex.com

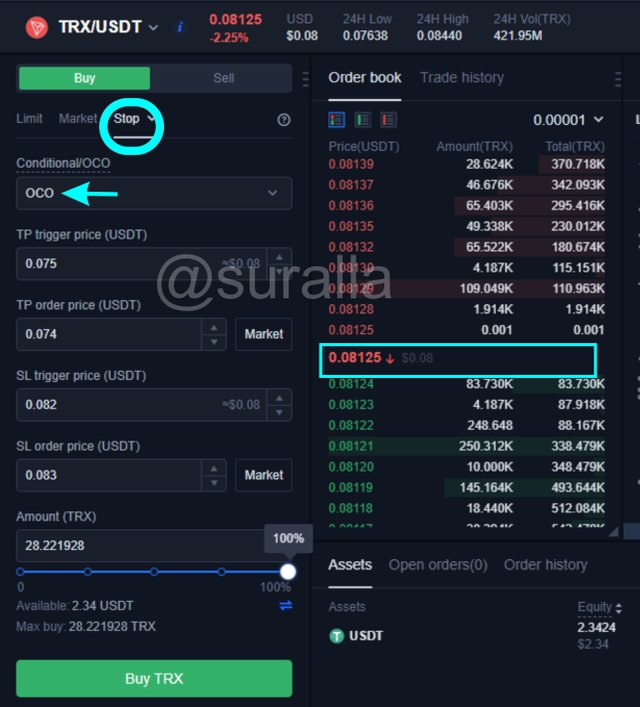

OCO Order.

I am still using the TRX/USDT pair for buy and sell orders, now I will show you how to execute OCO orders. It is important to know that when one of the 2 orders is filled, the other one will be deactivated since OCO, means: One Order Cancels Another.

OCO Purchases.

To make a Buy with OCO, we must first choose our pair, in this case (TRX/USDT), then we look at our market price of the TRX which is at 0.08125 USDT, we set our trigger price above the market price (0.075 USDT) so that the purchase is made at the price of 0.074 USDT. What makes the OCO Order different is that we can set a Limit Order (SL), which will trigger at the price we have placed of 0.082 USDT and will be filled if the market price matches the SL order of 0.083 USDT.

Screenshot Okex.com

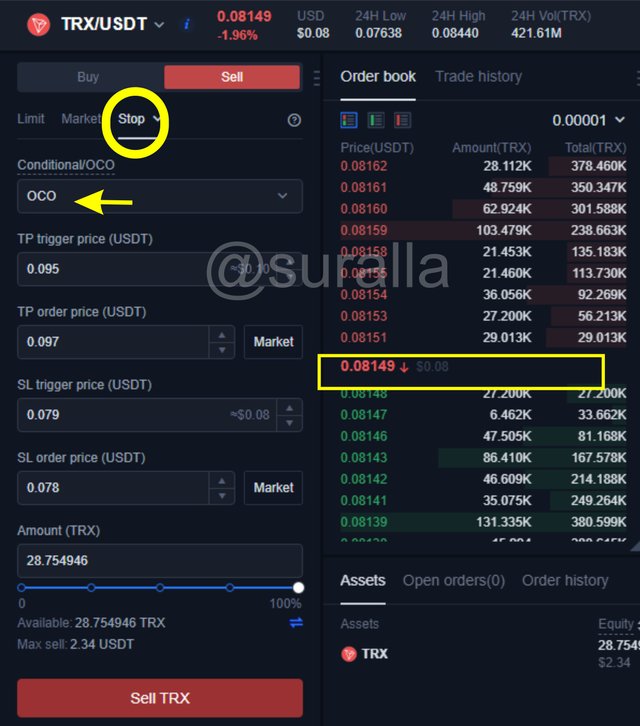

Sale with OCO

To make a sale with OCO, we must choose our pair (TRX/USDT), We look at our market price which is now at 0.08149 USDT and place in the trigger price a price above the market 0.095 USDT, so that the sale is made at price 0.097 USDT and thus make a profit. Now I will set the Limit Order to stop loss by placing the trigger order when the market price reaches 0.079 USDT and make the sell at 0.078 USDT. Once one of the 2 orders is triggered, the other one will be automatically cancelled.

Screenshot Okex.com

Question no 5 :

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

It is very important to know the order book for the trade. This order book offers options that allow the trade to use them to have profit benefits when used. These options are: Limit order, market order, and stop -limit order.

These allow for short term, long term, buy and sell trading using an OCO order or you can lose with a small loss. The OCO order acts when there is volatility in the market and helps to have higher profits.

Before trading in the order book, one should look in the order book the volume of the buy order and observe the sell orders, also know the trading chart of two days, fifteen minutes, or one hour and then observe the amount of buy and sell orders at the current time and in this way the results are effective. It is also important to understand the flow of orders in order to be able to identify possible resistances or supports according to how the flow of buy and sell orders in the order book behaves.

.png)

Conclusions

The order book is an important tool because it contains the orders that are needed to obtain profits and better trading operation.

The OCO is a binding with the orders to have a better management with the orders and it increases the profits, decreasing the losses.

The order book is beneficial for trading because it offers options and technical indicators to make profits when using your order book,

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

look fine homework

Grade : 8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Prof @yousafharoonkhan for your relentless desire to transfer knowledge.

I observed that this post from 2 days ago by @pangoli is yet to get an assessment from you. Having read through it, I've been looking forward to seeing the grade score. I believe he's expecting to see how much grade his work will worth too. Please help clarify this, thank you.

#steemitcryptoacademy #yousafharoonkhan-s2week7 #cryptoacademy #steemexclusive

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit