Hey Steemit!

Here is my homework post for Professor @reminiscence01. It was a great lesson, and I hope you will enjoy reading my post.

.png)

1. What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

We all know that no indicator or strategy or any prediction has a winning chance of 100 %. Even if you have all trades successful in a row, a trade will eventually occur that you will not win. Therefore, it's obvious that there is a losing risk associated with trading. But this loss can be minimized if you trade with proper risk management. If you do not manage your risk, then there is a possibility of your capital getting liquidated.

When you manage your risk, you still face losses when the trade does not go according to your prediction. But, the difference here is that you do not lose much of your capital. Instead, you exit the market with minimal loss. You can manage your risk by using risk management tools that help you successfully continue your trading journey. Therefore, we can say that Risk Management does not stop you from losing trades as it is a part of the trading journey, but it minimizes your losses and makes your trading journey better.

2. Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

1% Rule

The 1% Rule is one of the important risk management tools. As the name suggests, this rule means risking 1% of your capital in your trade. So if the trade doesn't go according to your prediction, you will only lose 1% of your capital. Following this rule will save your capital from getting liquidated and help you continue a successful trading journey.

Let's take an example here of the 1% Rule. Suppose you have a portfolio of $5000, and in each trade, you are willing to risk 1% of your capital. Now let's suppose that you take ten trades and lose all of them. This means that you will lose 10% of your capital, which will be $500. After this, you will still have $4500 left, which will be enough to take more trades and cover your losses. If you had not followed the 1% rule and let's say you would have risked 10% on each trade. Then losing ten trades would have meant losing your entire capital. Therefore, the 1% rule is very important.

Risk-reward ratio

This is another important tool to ensure that your risk is managed properly, thus helping you to continue your trading journey successfully. You do not win all the trades; there are trades that you even lose. Thus, it is important to set a risk-reward ratio that will keep you in profit even if you lose some trades. The risk-reward ratio that I personally recommend, and the Professor too, is 1:2. This means that if you lose the trade, you lose 1% of your capital, but if you win the trade, you earn 2% of your capital.

Let's suppose you have a portfolio of $1000. If you take ten trades and you have a win to lose ratio of 1:1. This means that you win five trades and lose five trades. The five trades that you win will get you a profit of 10% of your capital, and the five trades that you lose will bring you a loss of 5% of your capital. If we subtract the loss from the profit, you will still be in 5% profit. If you had taken a risk to reward ratio of 1:1, you would not have been in profit in this scenario.

Let's suppose another scenario in which you lose six trades and win four trades while following the risk to reward ratio of 1:2. You would have gained 8% of your capital out of the four trades you win, and you would have lost 6% out of the six trades that you lost. This means that even when the majority of your trades were a loss, you still managed to be in 2% profit. But, if you had been following a 1:1 risk to reward ratio, you would have been at a loss in this scenario.

Stoploss and Take profit

Stoploss and take-profit are basically two types of orders. A Stoploss is an order in which you exit the market when the market does not move according to your prediction, and it prevents your capital from getting liquidated. Stoploss makes you exit the market with a minimal loss if determined before the trade. If you place it after the trade has been going for a while, it can also be placed at breakeven to avoid any loss. But, it is preferable to place the stop loss before the trade. Whereas a Take profit is an order in which you exit the market when your desired target gets hit, and it brings you profit.

It is very necessary to place a stop-loss when you are taking a trade. This is due to the chances of the market not moving according to your prediction as we all know that we can just predict the market, but we cannot script it. Therefore, stop-loss helps you to manage your risk while take-profit makes you exit the market with your desired profit. If you do not place a take profit, the market might move in the opposite direction after reaching your target. The movement of the market in the opposite direction can also get you at a loss at some point.

Previously, we said that it is preferable to place a stop-loss before executing a trade. This is so that you can manage your risk properly. Determining a stop-loss and a take profit before executing a trade helps you determine your risk to reward ratio. This helps you manage your risk and invest accordingly, and it maintains your trading psychology, too, as you know how much you will risk if the market fails to follow your prediction.

3. Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

The following are expected from the trade.

- Explain the trade criteria.

- Explain how much you are risking on the $100 account using the 1% rule.

- Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions.

- Place your stoploss and take profit position using the exit criteria for market structure.

Trade on Trend Reversal using Market Structure

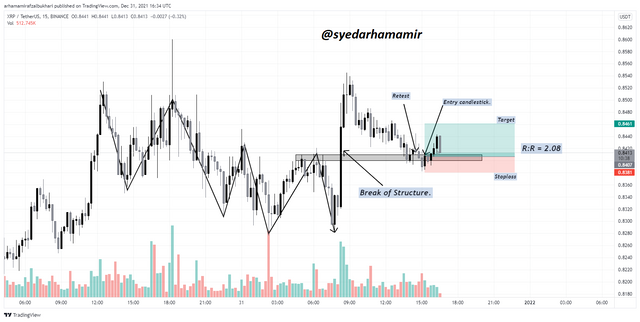

In the chart below of XRPUSDT, we can clearly see a downtrend in the market, forming lower lows and lower highs. A break of the structure was observed, after which the market formed a higher high. The retest was also done, which ensured the break of structure. Now, we had to take our entry. A bullish engulfing candlestick was formed, which became our entry candlestick.

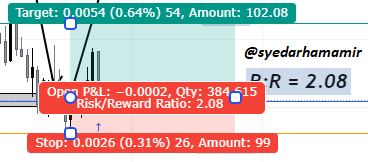

I used the long position tool and risked 1% of my capital which is $1. I placed my stop loss below the support, and then I set my target while maintaining a risk to reward ratio of at least 1:2.

Finally, I placed my target at the nearest resistance and got a risk to reward ratio of 1:2.08.

Then, I placed a demo trade using tradingview's paper trading account. The trade details and proof of execution can be seen in the screenshots below.

Trade on Trend Continuation using Market Structure

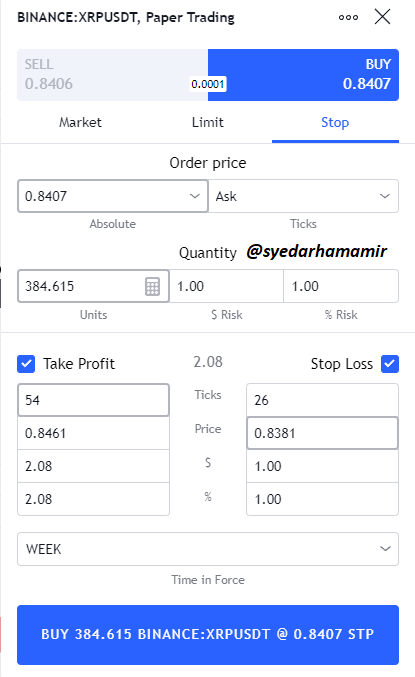

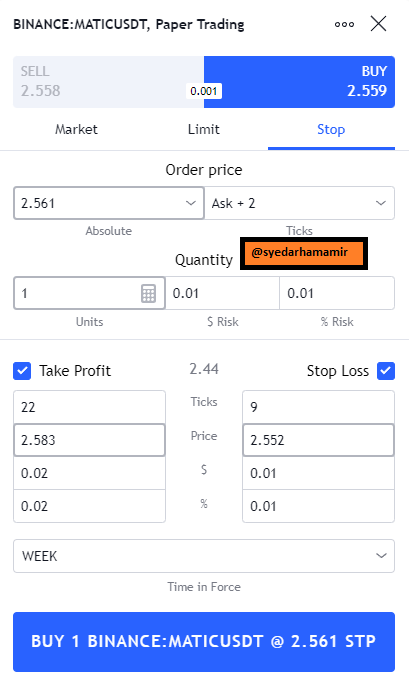

In the chart below of MATICUSDT, an uptrend can be observed in the market, forming higher highs and higher lows. A break of structure was observed, after which the market formed a higher high. The retest was also done, which ensured the break of structure. Now, we had to take our entry. A bullish engulfing candlestick was formed, so that became our entry candlestick.

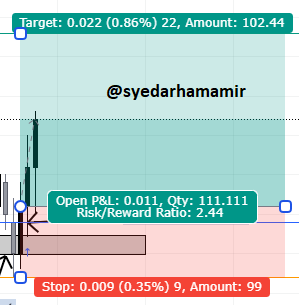

I used the long position tool on the chart and risked 1% of my capital which is $1. I placed my stop-loss below the support, and then I set my target while maintaining a risk to reward ratio of at least 1:2.

Finally, I placed my target at resistance and got a risk to reward ratio of 1:2.44.

Then, I placed a demo trade using tradingview's paper trading account. The details of the trade and proof of execution of the trade can be seen in the screenshots below.

Risk Management in trading is one of the most important things. Risk Management helps you in your trading journey. It teaches you discipline and also enhances your trading psychology. Following Risk Management will save your capital from getting liquidated in this highly volatile market and keep you in profits even if you lose some of the trades. I thank Professor @reminiscence01 for giving us such an amazing lesson.

Hello @syedarhamamir, I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

I totally agree.

Recommendation / Feedback:

Good work!

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit