This week the topic that Professor @kouba01 brings us is "Crypto Trading With Rate Of Change (ROC) Indicator", an oscillating technical indicator that when used properly is very useful for traders. Undoubtedly it is an interesting subject of which you can find the content taught by the professor HERE.

As always, I thank the professor for sharing his time and knowledge and all those who make this initiative possible.

The content of the homework task is extensive, so without further ado, let's get into the subject...

Homework task

1- In your own words, give an explanation of the ROC indicator with an example of how to calculate its value?And comment on the result obtained.

The ROC is an oscillator type indicator that measures the price variation in percentage of an asset over a given time, i.e. it compares the current price with the price of "n" periods ago. The choice of the period will depend on whether we are interested in analyzing the price in the short, medium or long term. For example, if we use the 10-period ROC on a weekly chart, we will be looking at the calculation of the price variation of that asset from 10 weeks ago until today, and if we are analyzing a weekly chart, it is because we are interested in projecting the price a few months from the current date; for shorter timeframes, we can opt for a daily candlestick chart. In other words, the larger the leg we want to analyze, the greater the number of periods of the indicator must be, but to be able to adapt it to our needs, as Professor Kouba01 indicates, we must know what is behind that number, how it is calculated and what implications it has.

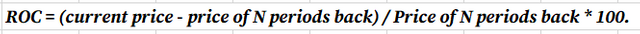

The formula for calculating the ROC is as follows:

The result of this equation will give us a percentage value that will oscillate around zero and can be positive or negative. The strength with which the indicator changes will be directly proportional to the strength of the upward movement, if it is going up, or to the strength of the downward movement, if it is going down. Theoretically, the buy signal is given when the ROC crosses the zero line upwards, while the sell signal is given when the opposite occurs, i.e. when it crosses the zero line from the top downwards. When the ROC oscillates around 0, it denotes a phase of indecision. However, Prof. Kouba01 warns us in his lecture that experience is required to use this indicator properly, as the zero crossings do not always have the same reading. The strength with which the price varies is important and after it crosses the 0 line in a trend change, we should wait for it to slow down the momentum it brings from the previous move. The further it moves away from the zero level, the more strength the trend has and the closer it gets to zero, the less strength it has.

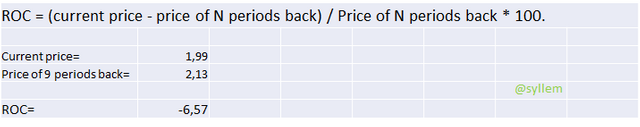

Next, you can visualize the ROC from the OKEX Exchange, which has included the option to use the Tradingview chart. The default ROC value displayed is 9 periods, in this case I used a daily candlestick chart, so then that time refers to 9 days backwards from the current date.

ROC Indicator - Screenshot Chart ADA/USDT 29/10/2021 Fuente

To calculate the ROC in this case, we punctuate the current price of the cryptocurrency which is 1.99, then we look for its closing price nine candles ago, which in this case was 2.13 and apply the formula described above. The result was - 6.57, very close to the one shown in the chart, I guess the difference is given by the rounding of the decimals used for the calculation.

ROC Indicator - Screenshot Chart ADA/USDT 29/10/2021 Fuente

Screenshot of ROC spreadsheet

Now, this negative value of the price of ADA simply tells us that this cryptocurrency has lowered its price 6.57% in relation to nine days ago, given that the chart is of daily candles, so in this temporality it has a bearish momentum. The chart shows that ADA in recent days has remained below the zero line.

2 - Demonstrate how to add the indicator to the chart on a platform other than the tradingview, highlighting how to modify the settings of the period(best setting).(screenshot required)

The OKEX exchange brings the ROC indicator among the options available by default at the bottom of the chart, so just click on the indicator and it is activated.

Activation of the ROC indicator in OKEX- Screenshot Chart ADA/USDT 29/10/2021 Fuente

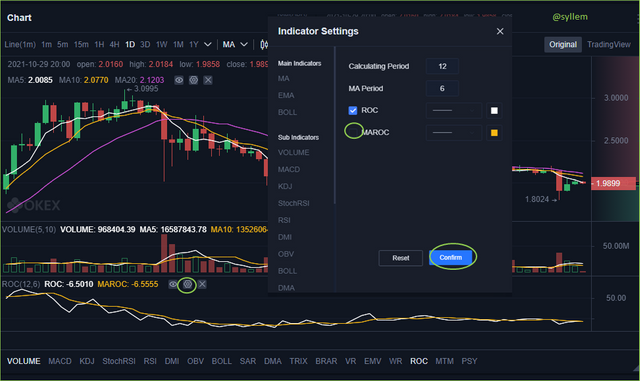

When activated, it shows the ROC 12 periods and MAROC for 6, which is an arithmetic mean.

Activation of the ROC indicator in OKEX - Screenshot Chart ADA/USDT 29/10/2021 Fuente

Now I will proceed to leave it only with the 12 periods, which according to theory is the best option, although, as I mentioned before, it will always depend on the temporality that is convenient for us to use in our negotiation. To do this we must enter the configuration option, the wheel that is displayed next to the ROC values, from there uncheck the MAROC option and then confirm our choice, as shown in the following image. In "Calculating Period" we can modify the period and adjust it to the desired number.

OKEX configuration of the ROC indicator - Screenshot Chart ADA/USDT 29/10/2021 Fuente

For this example, I also unchecked the volume, leaving only the 12-period ROC. You can also change the line style and color, but I'll leave it as is because I'm happy with the way it looks.

ROC indicator in OKEX - Screenshot Chart ADA/USDT 29/10/2021 Fuente

3 - What is the ROC trend confirmation strategy? And what are the signals that detect a trend reversal? (Screenshot required)

Indicators are used to detect signals that indicate possible trend changes, since as traders we must follow them to avoid losing money in the market or for the return of our investment to be in the shortest possible time. Even so, our strategy should not be based on just one indicator, the more information we handle in the analysis, the more accurate we will have, as far as possible, since as we know, the cryptocurrency market is quite volatile. As any other indicator, the ROC can give us false signals, however, it is a very good indicator to determine the buying and selling moments by identifying the strength of the current trend.

As already explained, this indicator moves between positive and negative percentage values and crossing the 0 line is taken as a confirmation of the current trend. If the ROC comes from negative values and crosses the 0 line, it means that the uptrend is accelerating, when the ROC loses momentum and even changes direction, in this case downwards, it is a sign that the strength of the uptrend is decreasing, alerting us to possible changes in the market trend. When the ROC value comes from positive values and crosses the zero line reaching negative values, then we know that the downtrend has gained strength.

In practice, if the indicator line crosses the 0 level from bottom to top, it is our buy signal and if it crosses this level from top to bottom, it will be our sell signal. When the ROC oscillates around zero without moving far from that line, it means that there is indecision in the market.

Signals of trend change with ROC - Screenshot Chart ADA/USDT 30/10/2021 Fuente

In the example of the previous image the buy signal is clearly identified, the ROC indicator line exceeds the zero line, which confirms the change of direction of the movement from bearish to bullish, which was reflected in the price action.

In relation to the sell signal, with the available information I can easily identify it in the area of the chart where I placed it, even, as the teacher did not teach in his class, it is observed that when the price reached the maximum, the indicator had changed direction and began to go down strongly, but the price did not accompany this movement, it remained in a kind of range and even went up slightly, this confirmed that the upward movement had already weakened and it was time to prepare to sell.

I wanted to add, in relation to the sell signal and as an exercise, that I believe that at that moment I would have placed it just two candles earlier, when it crossed the zero line, although in the end the result was the same, a change of trend from bullish to bearish.

4 - What is the indicator’s role in determining buy and sell decicions and identifying signals of overbought and oversold؟(screenshot required)

In a trending market, signals that indicate the direction of the trend are more reliable, therefore, overbought and oversold signals are more reliable in sideways markets, when the price does not vary considerably over time.

In general, overbought or oversold levels are identified with this indicator, when it is at its upper extreme or when it falls to its lower extreme, however, it is good to accompany this analysis with other indicators such as the RSI, for greater certainty.

A practical way to use it for this purpose, is to take as a reference the values of 3% or 4%, that is, if it exceeds these percentages in the upper part we can take it as an overbought alert and if it exceeds them in the scale of negative values, it will be a sign of oversold. In theory if there is overbought the price could fall and if there is oversold it could rise, so it can translate as buy and sell signals, but that may take time to happen.

If we are inside the market, an oversold signal alerts us to decrease the risk in our positions and take the decision to sell a part, which could be the majority according to our investment plan; in trading it is always good to take profits and decrease the risk.

If we are oversold, and we are inside the market, it would rather indicate that it is not the right time to sell, because prices could turn upwards. In another scenario, if we are in an oversold zone and we are not inside the market, we could decide to enter with a percentage of our capital, according to our risk management.

Now let's see an example in which I will mark on the chart a reference line at -4 in which case, the ROC crossing that line when coming from above, would be indicating that we are entering an oversold zone. In addition, a slight recovery in the price of the cryptocurrency can be observed afterwards.

Oversold zone as of ROC - Screenshot Chart ADA/USDT 30/10/2021 Fuente

In the following chart the reference line is at a value of 4, when the ROC crosses that line from the bottom to the top, it would be an overbought signal. In this case you can see how the price falls after crossing it.

Overbought zone as of ROC - Screenshot Chart ADA/USDT 30/10/2021 Fuente

5 - How to trade with divergence between the ROC and the price line? Does this trading strategy produce false signals?(screenshot required)

Divergences between prices and the ROC alert us that the strength of the movement is weakening.

Bearish Divergence

Simply put, if the ROC line changes its direction from up to down, but the price does not follow it and continues to move up or stays up, then a bearish divergence is formed, which alerts us that the movement has weakened and that most likely the trend will change to range or downtrend behavior (according to my short experience, mostly downtrend).

Bearish Divergence - ADA/USDT 30/10/2021 Fuente

Bullish Divergence

On the other hand, if the ROC line changes its direction, in this case from down to up, but the price continues to fall, then a bullish divergence is formed, which tells us that most likely the next move will be a price bounce to the upside.

Bullish Divergence - ADA/USDT 30/10/2021 Fuente

False signals occur when a divergence is visualized, either bullish or bearish, however, the market trend continues; for example, if according to our analysis with the ROC we observe a bearish divergence, we think that the price may retrace, but instead it continues its course upwards. I have observed this recently on the Bitcoin chart, as you can see below:

False signals - BTC/USDT 21/08/2021 Fuente

Therefore, nothing in the cryptocurrency market is totally certain, one can try to reduce uncertainty by using other indicators and market information in general, however, there will always be a margin of error, as the market is highly manipulable and manipulated.

6 - How to Identify and Confirm Breakouts using ROC indicator?(screenshot required)

Breakouts occur as a consequence of strong momentum, but the signal is not always true. Breakouts can be identified with the ROC, since in theory, when the price consolidates the ROC will reproduce flat values, so a strong rise or sustained fall would be confirmation that the breakout trend is sustainable.

In breakouts, resistance or support is broken at the price level suddenly and forcefully, usually after a stage of market lateralization, which is when consolidation occurs.

When the price manages to overcome the levels of either support or resistance, then we must detail how the ROC line behaves, to see if it accompanies this breakout movement.

Let's look at a case study:

Bullish Breakout - BTC/USDT 21/08/2021 Fuente

Looking at the chart you can quickly identify a consolidation phase of the price, in the area enclosed in the rectangle; however, additionally I could notice, that at that stage the ROC was gradually increasing, but not the price of BTC, this in theory would be a sign of bullish divergence. Then the resistance level is broken and the ROC also shows strength by increasing its value, which confirms the movement.

7 - Review the chart of any crypto pair and present the various signals giving by ROC trading strategy. (Screenshot required)

For this part I will also use the 1 hour BTC Vs USDT chart.

Signals giving by ROC trading strategy - BTC/USDT 21/08/2021 Fuente

Broadly speaking, I was able to identify the following from the graph:

1: Sell signal is given when the ROC crosses the 0 line from the top to the bottom. From that point on, we see the momentum shift from bullish to bearish which is reflected in prices.

2: The ROC goes below -4, which indicates that it is entering an oversold zone and that a rebound in price is likely to occur in the short term.

3: A bullish divergence is observed, as the ROC has been gradually increasing, while the price remains sideways, up to the point where the price breaks strongly to the upside and is accompanied by the ROC crossing the zero line with force.

4: Next we can see that the ROC is above the +4 level, which indicates that it is in an oversold zone and that this movement is likely to be followed by a correction in the price.

5: After a quick correction, BTC goes sideways again, just like the ROC that keeps oscillating near O. Then it goes up a little more.

6: Again BTC price sideways, but this time we see how the ROC is gradually increasing, as in point 4, so, according to what we have learned, then it is possible that the next move will be another upward impulse.

8 - Conclusion:

The ROC is an oscillator-type indicator that measures the percentage change in the price of an asset over a given time, i.e. it compares the current price with that of "n" periods ago. The measure of the current price relative to a defined retrospective period is the typical definition of the "Rate of Change".

The ROC is an oscillating indicator and its values will be above or below zero. When ROC is above zero, it suggests an uptrend in the market; while a reading below zero implies a bearish sentiment in the market.

ROC is useful for determining momentum, overbought and oversold conditions, divergences, as well as trend direction. It is an indicator similar to, but not the same as, MACD and RSI.

In the ROC, the longer the range we want to analyze, the greater the number of periods of the indicator should be. According to the literature and based on traders' experience, a period that fits well for medium-term analysis is 12 periods.

On the other hand, +3/-3 or +4/-4 can be used as ROC limit values to identify overbought and oversold zones.

As for divergences, they are identified when the price of the asset goes in the opposite direction to the ROC line, for example, if a price is reaching a higher and higher value and the ROC is decreasing in value.

As with other indicators, ROC should not be used on its own, because like other oscillating technical indicators, it tends to give late signals or false signals, for greater certainty it should be combined with others such as Moving Averages, RSI and volume.

There is no infallible method of trading, because the cryptocurrency market is highly volatile, however, using tools like this properly, we can reduce losses considerably and thus maximize our profits. At all times, good capital management and risk management are indispensable to trade the market successfully.

Sources consulted:

https://buscandocryptodinero.com/leccion/3-10-roc/

https://www.avatrade.es/educacion/professional-trading-strategies/roc-indicator-strategies

Thank God for every moment of life

and to you for joining me in this reading.

The photograph shown is my own, edited in Photocollage.

Emojis made with the Bitmoji application.

The separator used was made in PowerPoint.

Translation courtesy of DeepL.com

Great presentation of lesson your work is very good and beautifully written with Markdowns.

My pleasure 😃.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! I'm glad to hear you liked it.

Have a nice day

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @syllem

Thanks for participating in the Steemit Crypto Academy

Feedback

Total| 8.5/10

This is good work. Thanks for demonstrating such a clear and well detailed understanding of trading using Rate of Change indicator.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your teachings.

Have a great day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit