For this occasion, Professor @fredquantum brings us, "Trading Crypto with Aroon Indicator" an easy to use technical indicator that guides us, among other things, about possible trend changes in the market and can give us buy and sell signals if we know how to use it properly. For those who wish to see the content of this class, you can find it HERE.

Homework task

1- What is Aroon Indicator in your own words? What are Aroon-Up and Aroon-Down? (Show them on Chart).

It is a technical analysis indicator that seeks to detect the beginning of a trend and trend reversals early. In a nutshell Aroon helps us to identify the market's intention and possible direction in advance. I find this interesting, because I have read before that many of the oscillator indicators are delayed reaction indicators.

The Aroon indicator is made up of two lines:

Aroon Up, which determines the number of periods separating us from the last historical high.

Aroon Down, which indicates the number of periods separating us from the last historical low.

For example, the default period when placing the Aroon indicator on the Okex Tradingview chart is 14 periods, for that time span, the Aroon Up would be indicating the number of periods that have elapsed since the last historical high at that time.

AAVE/USDT 24/11/2021 Source

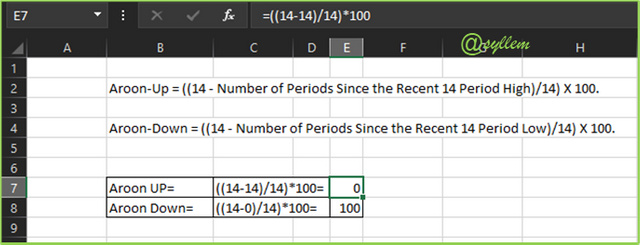

2 - How is Aroon-Up/Aroon-Down calculated? (Give an illustrative example).

For Period = 14

Aroon-Up = ((14 - Number of Periods Since the Recent 14 Period High)/14) X 100.

Aroon-Down = ((14 - Number of Periods Since the Recent 14 Period Low)/14) X 100.

I will do the exercise for the 14 days enclosed in the rectangle in the following figure:

AAVE/USDT 25/11/2021 Source

This is an interesting case, because we see that the minimum value of the period occurs at time 0, that is, the same day of the calculation, and the maximum value occurred fourteen days before, the maximum time of the period, resulting in an Aroon Up of 0 and an Aroon Down of 100. These results are consistent with the Aroon values shown in the graph for that day, as can be seen in the previous image.

Screenshot of my spreadsheet

As we can see, this gives us an idea of how much time has passed since the last previous high and the last previous low.

In theory, the strongest bullish scenario is when the Aroon Up line remains close to 100% and the Aroon Down to 0%, so in this case, market traders should be vigilant.

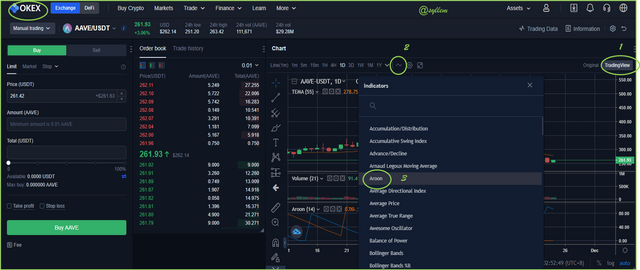

3 - Show the Steps involved in the Setting Up Aroon indicator on the chart and show different settings. (Screenshots required).

From the Okex exchange, first change the chart view to "Tradingview", then enter the symbol marked with the number "2" in the figure below, where you will find the list of available indicators and Aroon can be displayed among the first ones. When selected, it appears on the chart with a default setting of 14 periods.

AAVE/USDT 25/11/2021 Source

If you wish to change the default settings, simply click on the configuration symbol (1) next to the indicator at the bottom of the graph and under "Inputs" / "Length" enter the desired number and then confirm the operation by clicking on the "OK" option.

AAVE/USDT 25/11/2021 Source

In the next tab, "Style", the appearance of the lines is modified. In this platform, the default Aroon Up is orange and Aroon Down is blue.

AAVE/USDT 25/11/2021 Source

4 - What is your understanding of the Aroon Oscillator? How does it work? (Show it on the chart, kindly skip the steps involved in adding it).

As I mentioned before, this indicator gives us an idea of how much time has passed since the last time we had the highest or lowest price of the asset we are trading.

The bullish scenario is latent when the Aroon Up line is above 70% and is strongest when it is close to 100%, while the Aroon Down is close to 0%. If, on the other hand, the Aroon Up line is near 0% and the Aroon Down line is near 100%, then it is a sign of strong bearish momentum.

If, for example, there is a strong bullish intention, we would have to look for the crossing of the Aroon Up line (which for charting purposes is blue) which in turn should be above the Aroon Down line (colored orange).

In the following AAVE/USDT daily candlestick chart, we can see three signals according to the crossing of the lines. The first buy signal is given when after a bearish momentum in which the Aroon Up was several days below the Aroon Down, it changes direction and both lines cross, leaving now the Aroon Up above, indicating an upward momentum. The second signal shown, which is a sell signal, occurs due to a new crossover, but this time after the Aroon Up was above the Aroon Down for several days. Finally we see another buy signal, although the subsequent behavior of the price has not been so clear, even though a bullish momentum was predicted.

AAVE/USDT 25/11/2021 Source

5 - Consider an Aroon Indicator with a single oscillating line, what does the measurement of the trend at +50 and -50 signify?

If the Aroon indicator were a single oscillating line ranging from 100 to -100, we could say that if it is above +50 the market is in a strong uptrend and if it is below -50 it is in a strong downtrend. On the other hand, if the oscillating line is around 0, it is an indication that the market is in a range or consolidation.

6 - Explain Aroon Indicator movement in Range Markets. (Screenshot required).

As we already know, the crossing of the Aroon up with the Aroon Down, alerts us of a possible change of trend, either up or down, which is very helpful when it comes to finding good buying or selling areas.

However, it also happens that the market price goes up and down, but not significantly, staying within a sideways range, indicating that there is no trend in the market. In this case, the Aroon-Up and Aroon-Down lines run parallel, so they do not cross.

AAVE/USDT 27/11/2021 Source

7 - Does Aroon Indicator give False and Late signals? Explain. Show false and late signals of the Aroon Indicator on the chart. Combine an indicator (other than RSI) with the Aroon indicator to filter late and false signals. (Screenshots required).

As the professor explained in his class, it is common for technical indicators to give false or late signals, because they depend on the price action and many times we see them on the chart after the market movement has occurred. The professor also mentioned that if the market is in range, it is common for multiple crossovers to occur that are not sustained over time, which would give us a false signal. In the following chart we identified with the number "1" a crossing of the Aroon lines that gives us the idea that a bullish momentum is coming, however, in the chart we can see that the bullish movement had started several days before. At number "2" we can see a false signal, a crossover that we could interpret as an upcoming bullish impulse, however, in a short time it crossed again and the price continued its downward movement.

AAVE/USDT 25/11/2021 Source

Moving averages are a good option to track the price of an asset, through them we can see if it is above or below the average price, according to the previously established period. By using the 20 and 55 period moving average, we will see an average at two different times. In theory, if the price is above both moving averages, it is more likely to have or continue an upward movement, while if it is below both, it is more likely to go downward.

On the other hand, when a 20 moving average comes from below and crosses the 55, staying above it, it is a sign of a strong upward momentum and if, on the contrary, after being above it, the 20 EMA crosses the 55, staying now below it, then the momentum is bearish.

In the example of the chart below, we see that the crossing of the two moving averages occurs even after the crossing of the two lines of the Aroon indicator, so the signal in this case is later. However, for the false signal, which we see identified with the number "2", despite the fact that according to the Aroon indicator a bullish momentum may come, we see how the price is below both moving averages and even at that moment a crossing of the 20 moving average occurred, passing below the 55, which is an indication of a bearish momentum, so it is very unlikely that the price has a bullish move in the short term.

AAVE/USDT 27/11/2021 Source

8 - Place at least one buy and sell trade using the Aroon Indicator with the help of the indicator combined in (7) above. Use a demo account with proper trade management. (Screenshots required).

For this exercise I switched to the Huobi exchange, since I have funds there and I intended to make a real trade.

First I started analyzing several Altcoin, but in the end I noticed that they all had the same BTC pattern, which is not very encouraging. As you can see in the following figure, the price of BTC has a week under the moving averages, also the crossing of the Aroon lines indicated sell signal since about 11 days ago, even since about 10 days before this crossing the price was already falling. So, first the price falls, then after 11 days the Aroon indicator gives a signal on the chart and about 10 days later, the moving average crossover confirms it. This indicates to me that the downward movement has strength and direction. As a market trader, I would not buy anything at this time.

As an exercise, I can identify a good buy and sell point on a chart. In the first circle that we observe, when the Aroon lines cross, it is the entry point, since we can also see how the 20-period moving average is looking for the 55 line until it crosses it, so it accompanies and reaffirms the signal. On the other hand, the sell signal given at the last crossing of the Aroon lines can also be taken as true, since the 20-period moving average goes down looking for the 55-period moving average, until it crosses it, so it is also accompanying the downward movement.

BTC/USDT, 1d, 27/11/2021 Fuente: Huobi.com

9 - State the Merits and Demerits of Aroon Indicator.

Merits:

- It is an easy to understand indicator and its calculation is not complex.

- It is a useful indicator for identifying trend changes and their strength.

- It allows to choose the period to use, according to the trader's experience and expectations.

- In combination with other indicators, the Aroon allows to identify good times to enter or exit the market.

Demerits:

- It is an indicator based on the price action, so the signals are usually late in relation to what happens in real time.

- It does not measure the magnitude of trend change.

- When used on its own, it is inaccurate, as it can give false signals.

This is the end of my assignment, I hope I have managed to understand the basic aspects taught by the professor in his class in a clear and precise manner.

Thank God for every moment of life

and to you for joining me in this reading.

Translated with www.DeepL.com/Translator (free version)

Emojis made with the Bitmoji application.

The separator used was cut from the main image, in PowerPoint.

Good job!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, I hope I have understood the content correctly.

Best regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit