Source

1. Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Dark Pools are a form of cryptocurrency exchange portal that is made private where it is possible to exchange or trade crypto assets in a way that cannot be seen by the general public who may also be investing or trading on such assets. Equally, they are often referred to as dark pools of liquidity. Primarily, the intention behind the creation and availability of Dark Pools is to make block trading a possibility for institutional investors or traders. Such institutional traders do not have the intention of impacting the market of such a crypto asset with the large orders they wish to undertake. Sometimes Dark Pools may be portrayed in a bad light by some traders. However, the larger intention behind the use of Dark Pools is to make it possible for large trades to be executed in a way that does not adversely affect the wider market of the trading public.

Why has the exchange of cryptos through Dark Pools become necessary in the world of cryptocurrency trading? Let us take a look at this scenario of an institutional investor who wishes to sell off 2 million shares of Litecoin crypto asset before Dark Pools came into existence. The investor may have undertaken the steps below:-

- Look through the orders that are displayed on the exchange order books for a few days or generally study the chart to hope for the price to come up to around a descent region where he or she may be willing to sell

- If the price comes to a reasonable region, he or she can then split the order into maybe 10 pieces of, let's say, 200,000 units per day

- He or she would then sell off these assets in the smaller units into which they have been shared out with the hope that a large buyer could become willing to buy the assets

The impact of executing this sell off through the normal exchange order book can be quite sizable. Equally, there is the risk that the price could actually decline while the investor was being patient to wait to sell off his large position in smaller bits as described in the illustration above. The solution to this problem was realised when Dark Pools were eventually introduced into the trading of cryptocurrencies as had been earlier witnessed in other stocks and assets before now.

The fact that Dark Pools is a place where large orders are executed or carried out means that it is a lot easier for an institutional trader to come across a buyer who may be willing to take off the whole position at the price that the seller has specified through the limit order without the seller having to be afraid of possible price declines.

The fact that the Dark Pools do not make use of visible order books as is seen in the case of public exchanges means that the trades are not showcased to the public and may only become known to the public after there have been concluded. The block trade through which Dark Pools are executed simply refers to a transaction that involves a very large quantity of a particular coin which is executed at a price which is predetermined.

2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

I wish to examine the Kraken dark pool here. On the Kraken dark pool, orders are opened and these orders can only be filled by other orders which are opened on the dark pool as well. On the platform the market orders have equally been removed considering the fact that such orders should only be used when there is a visible order book. Hence, only limit orders are permitted and this is based on the fact that invisible orders are used on the Kraken dark pool.

Anytime the limit orders that have been placed on the dark pool cross each other the trade is executed due to this fact the minimums on the dark pool of the exchange are usually large the need for this is to ensure that traders are not be able to decipher the other side or the point where the order was executed from the other side.

The dark pool does not permit trading on margins and users would have to meet the large minimums from their own balances. So, traders are unable to understand whether they are market takers or makers. Again, fee distinction between the two was obscured for this purpose. Hence, the same fee structure is followed by everybody.

3. What are the supported assets on the dark pool mentioned in (2) above?

The supported assets which can be traded on the Kraken crypto exchange in the dark pools are available for Ethereum (ETH) and Bitcoin(BTC) currency pairs.

For bitcoin pairs:-

- BTC/GBP

- BTC/CAD

- BTC/USD

- BTC/JPY

- BTC/EUR

For Ethereum pairs:-

- ETH/GBP

- ETH/CAD

- ETH/USD

- ETH/JPY

- ETH/EUR

For Bitcoin-Ethereum pairs:-

- ETH/BTC

What are the requirements for getting involved in dark pool trading on the platform?

Some of the requirements for trading on the Kraken dark pools include:-

- It is only users or clients who have been verified up to the pro level that can participate in it whether they are using the personal or business account

- For the BTC pairs the minimum size of orders that could be opened must be equal to about 100k USD

- For the ETH pairs the minimum size of orders that could be opened must be at least 50k USD.

- The only type of orders permitted are limit orders

Is there any fee attracted? Explain.

For trading on the Kraken dark pools a trading fee which ranges between 0.20% to 0.36% is agreeable. This represents an additional 0.20% in trading fee when considered against ordinary limit orders which range between 0% to 0.16%. Also, the range rate depends on the 30-day trading volume of the user considered in USD equivalent.

As you trade more on the exchange or Dark Pools in general your trading fees reduce. This is mostly considered on a 30-day trading volume.

4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

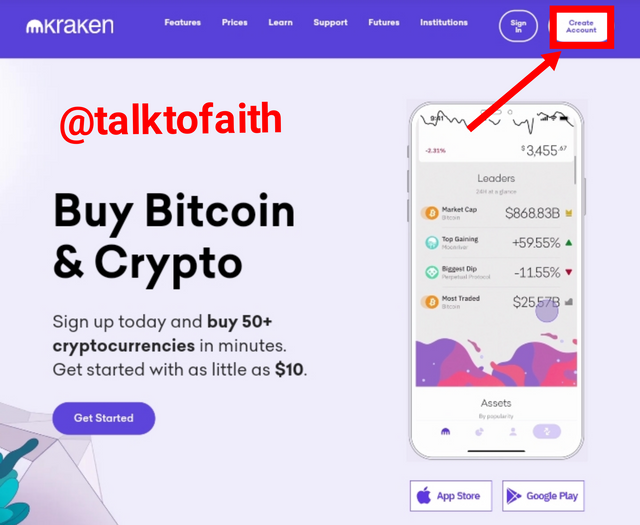

- To be able to partake in the Kraken dark pool I would first have to create an account. For this I have to visit https://kraken.com.

Source

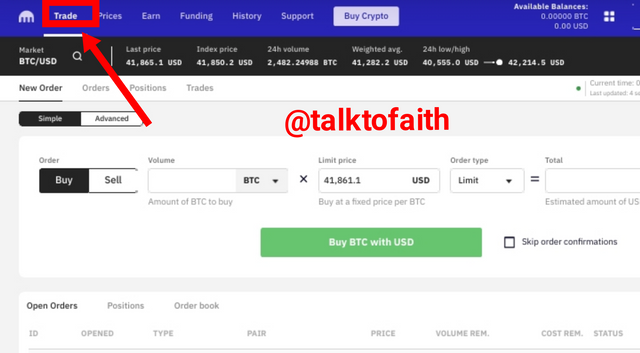

- After creating the account I logged in and I was launched into the trading platform. On the trading platform I have to first select Trade.

Source

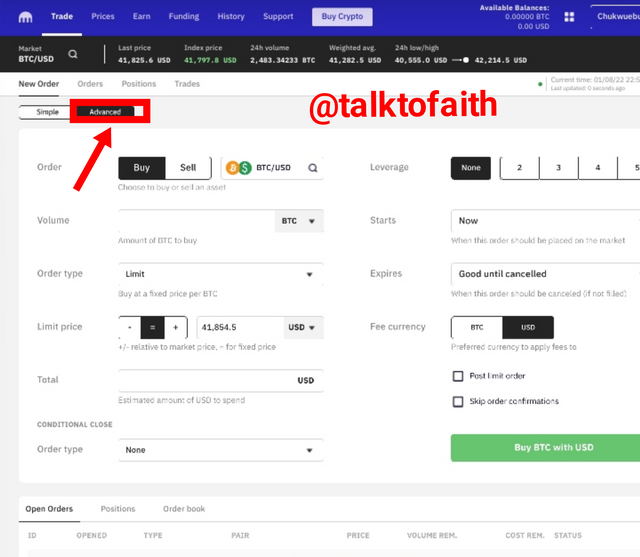

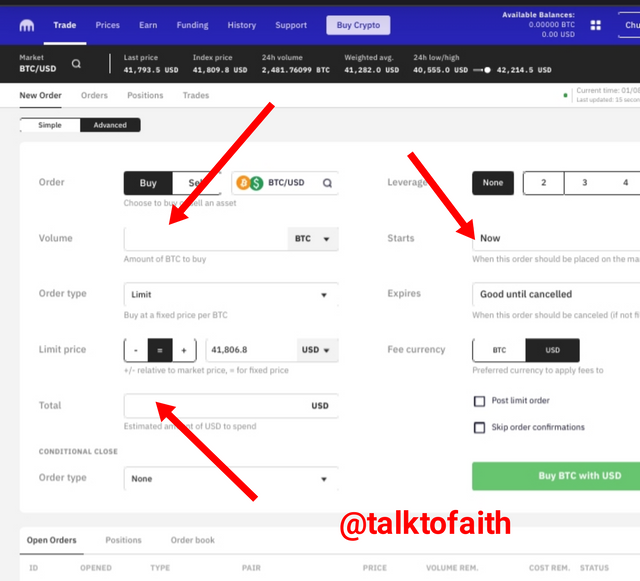

- Next, I toggled Advanced

Source

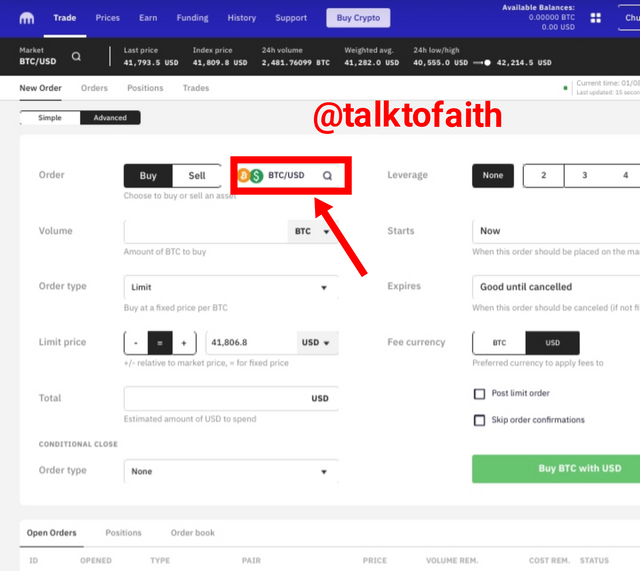

- Now, I have to select the trading pair

Source

- After this I would have to enter all the other necessary details like volume (which is the amount of BTC I wish to buy), total (being the amount I wish to spend in USD), as well as a few other parameters.

Source

5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

In the traditional equity markets Dark Pools have existed for quite a number of years and even decades. However, Dark Pools have of course extended into cryptocurrency trading and are available on different platforms or trading exchanges. These are often referred to as decentralized Dark Pools. The decentralized Dark Pools when compared to the other traditional or their regular counterparts come with advantages which include methods for verification digitally in a secure manner. In this way it is possible for the Dark Pools that are decentralized to have a fair market price and be able to maintain this price so that it is binding for all participants to use such prices. There is possibly no room for the manipulation of the prices.

When it comes to executing trades that go across different blockchains, use is made of atomic swaps that are cross chain in nature in order to ensure that such trades go through. This means that third parties or intermediaries are not needed when it comes to the operation of decentralized Dark Pools. Interestingly, decentralized Dark Pools have also been making use of some other novel technologies that are cryptographic in nature such as the zero-knowledge proof technology. This particular technology is very useful for the verification of transactions in the decentralized Dark Pools to maintain integrity.

The use of decentralized Dark Pools also come into play in the operation of cryptocurrency markets that are illiquid. This is because they make it possible for such large cryptocurrency trades to be executed in a manner that does not result in any form of slippage. If these large orders were to be executed in an ordinarily illiquid cryptocurrency market on the exchange it could have a considerable impact on the market. At present there isn't really a lot of institutional traders in the trading of cryptocurrencies - at least not when compared to traditional stocks. This means that decentralised Dark Pools have not had major effects in the market generally. Nevertheless, this could change anytime soon as the crypto space is gathering a lot of disruptive momentum.

Zero-Knowledge Proofs

Zero-knowledge proof is often simply called ZK protocol. It is a type of method adopted for verification that is set up between a verifier and one who is required to prove his identity in the verification process. In this system or methodology for verification the one who is required to be proven has the ability to prove to the verifier that he has knowledge of a certain information (for instance, a mathematical equation) without the prover who is to be proven having to reveal the content of the information actually. In the modern verification process modern cryptographers have relied on this system to bring about an increased level of security transparency and privacy.

This concept was described first in a paper presented in MIT in 1985. This paper was published by Shafi Goldwasser and Silvio Micali. They succeeded in demonstrating the possibility of proving the properties that belonged to a particular number and one would not even have to necessarily disclose the number or to even reveal any information additionally.

Ordinarily, for a protocol to be described as a ZK proof technology there are two basic requirements it must fulfill and these are named as soundness and completeness. Completeness is used to describe the ability of the one who is proving to be able to demonstrate a proper and good knowledge of the information he wants to relay to a very high degree that must showcase a high level of probable accuracy. Soundness, on the other end, means that it should be possible for the verifier to determine in a very reliable manner whether or not the one who is proving actually has possession of the information which is to be relayed between them.

Finally, before a protocol can also be completely described as being truly zero knowledge proof, these two qualities of completeness and soundness must be achieved in the proof system and the information does not necessarily have to have been communicated between the two parties involved. The zero-knowledge proof is more prominently used in the real world blockchain technology and cryptocurrencies. Usually, the intention is usually to achieve a high level of security while equally maintaining privacy. ZK proof can be employed by systems for authentication in order to verify identities and credentials without the need to divulge the same.

6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

Source

I introduce to you the Darkpool Protocol which came out as the very first protocol that acts as a bridge between the world of DeFi and the broader world of digital assets. The project was initiated with the aim of enabling interoperability. Initiated by a team of experts in cross-chain operations, the Darkpool blockchain protocol makes it possible for new markets to be hosted on the Cosmos ecosystem, hence, enabling liquidity for users and creating a fundamental ingredient for DeFi services and applications to be run efficiently. With the protocol, there is no need for a trusted third party in the operation of the dark pool. Equally, the protocol provides incentives in the form of crypto tokens for the purpose of governance. This enables a scalable, decentralized and secured dark pool environment to be developed which has the ability to process billions of daily trading volume.

Furthermore, the protocol is developed with the purpose of enabling ERC-20 tokens, BTC and Ethereum to be exchanged through the decentralized dark pool trading system. It was initiated by a team which succeeded in creating this environment after having conducted research extensively into different cryptography subfields. One of such subfields which they took time to study is the technology of multi-party computation. The implementation of this technology makes it possible for them to have built a system which enables a matching engine that works with a hidden distributed order book.

Atomic swaps are used to enable trades across different blockchains. The Darkpool is said to be more secure than its centralised counterparts. It removes the risk of your crypto being stolen. Furthermore, it ensures the lack of malicious interference from the crypto operators. Additionally, centralised authorities cannot confiscate your assets on the platform. This makes it possible for the protocol to build up enough trust between the decentralized dark pool exchange and the institutional investors. Still on this, the dark pool protocol has been made available universally and it comes with operations that are highly transparent.

Technically the protocol makes it possible for such a decentralized dark pool to be operated by maintaining a decentralized network of nodes that function by matching orders without knowing about such orders. In making this possible use was made of a technique in cryptography which had been researched for more than three decades. This cryptographic technique was modified in line with the decentralized computational environment. The moment orders are placed by traders the matching is computational run by the nodes until they are able to locate a matching order before it expires.

The computational nodes are then rewarded with the DAP token for performing the duty of matching computation. This is because no one would be ready to undertake such a venture without financial incentives considering the cost that could even come with it. Equally, the tokens are used to pay a sort of bond that makes it possible for the Registrar to permit the matching of orders thereby enabling traders to make efficient use of the Darkpool protocol.

7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

In this case, I would be comparing Kraken Dark Poolwhich is a centralised crypto exchange for Dark Pools with the Darkpool(DAP) dark pool which is a decentralized crypto exchange for Dark Pools.

| Kraken Centralised Dark Pool | Darkpool Decentralized Dark Pool |

|---|---|

| It holds the funds of traders in custody and hence there is an increased risk of insecurity and loss of funds | It does not hold the forms of thread is in custody and this reduces the risk of insecurity and the loss of funds |

| It comes with a higher level of increased risk since the market could be manipulated from the centralised managers | The risk of manipulation and control is reduced since there are no centralised managers of the funds and orders |

| It does not enable cross chain operations through atomic swaps | It enables cross chain trades with the use of atomic swaps |

| The centralized managers could have access to your funds which are domiciled with them | It is not possible for your funds to be confiscated and even your balances are not known |

| Orders are matched by the centralised exchange ordinarily | Use is made of a network of nodes that is decentralized in nature and which work by matching orders without prior knowledge of such orders |

| There is no reward for any nodes that carry out order-matching | The computational nodes that carry out the matching of orders are rewarded with the DAP token |

| There is no native token which is used for incentives | Additionally, the DAP tokens are used as payment to the Registrar which enables the matching to the traders at the first place |

8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

Source

In this section I would be describing the effect of Elon Musk's announcement that Tesla would no longer accept bitcoins as mode of payment and how this had in a way caused a likely sell-off as recorded by JP Morgan. On the 19th of May 2021 Bitcoin fell to as low as about $30, 000. This was quite dramatic in the opposite direction considering the fact that it had recently sliden upwards especially in the second half of 2020. It was believed that part of why the weakness occured in Bitcoin was because acceptance for the coin was at least temporarily weakened.

This was due to the fact that there had been some negative headlines which came from Elon musk the CEO of Tesla owing to unfavorable Chinese government regulations. This resulted in the more than 30% pullback caused by a strong selling force that had been witnessed throughout that week. Ether which is actually the main coin on the Ethereum blockchain equally went down breaking below $2,000 to represent a more than 40% drop which occurred in a period of less than 24 hours.

Actually, when Elon Musk had earlier announced the purchase of more than $1 billion BTC, it made different payment firms begin processes in upgrading their services to accept cryptos. This included major Wall Street banks which began to process cryptos for their clients. A crypto exchange called Coinbase equally went public in the middle of April. This caused an upsurge in the price of the coin.

However, when Musk announced that he would no longer be collecting BTC due to environmental concerns, exchanges like Coinbase recorded very low gains. Based on reports issued out by JP Morgan after studying crypto futures contracts they discovered that a lot of institutional traders seemed to be moving from investing in bitcoins and going back to investing in gold. This could have been the cause of the risk sell-off that negatively affected the price of BTC in that period.

9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

I would like to share the result of a research carried out by authors Takanobu Mizuta, Shintaro Kosugi, Takuya Kusumoto and Wataru Matsumoto in this section. It was extensive research but I would present it in a resume.

In summary it was discovered that the inefficiency in the market in terms of functionality and price discovery and its effect on the price of the asset increased sharply when the value of the amount of value traded on the Dark Pool was raised. Conversely, it was discovered that market inefficiency was decreased with a decrease in the share of the amount of value traded in the dark pools. Generally, this gives an indication that an optimal usage of the dark pools is important for the market to remain efficient in terms of price discovery of an asset.

Market inefficiency increased when Dark pools reached the level of usage that is more than 70% because trade execution in the market where order books are used were greatly reduced as a result of a lot of market orders being channeled into the different available Dark Pools. So, when the dark pools exceeded 70% usage and the amount of trading value was raised in such dark pools market inefficiency increased greatly.

Market inefficiency is decreased when Dark pools are used in a percentage that is less than or equal to 70 because the rate in which trades are executed in the ordinary exchange markets would not be reduced due to less market orders being sent to the dark pools.

Let us consider this scenario below:-

Too Much Usage Of Dark Pools

When dark pools are used too much the normal exchange order markets become greatly inefficient. This is because in this scenario more than half - it is assumed - of the waiting buy orders have been channeled to the Dark Pools. In this case the market price will be higher than the normal price of the asset. Consequently, when market sell orders are made even in the normal exchange market they could be sent to the Dark Pools by a certain SOR(assumption).

However you should note that this research makes the assumption that when large buy orders in the dark pools are set up in a situation whereby Dark Pools have reached a percentage that is more than 70 in usage when compared to normal market then the price of the asset in the normal exchange is adversely affected because a lot of sell orders would be matched to the dark pools where the larger buy orders which have been predetermined at higher prices means that there is lack of price convergence resulting in manipulated prices.

On the whole the research was quite complex and uses a lot of different formulas to achieve its aim. I would invite you to take a personal look Effects of dark pools on financial markets’ efficiency and price discovery function: an investigation by multi-agent simulations".

10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Dark Pools do have some interesting advantages. Nevertheless, they equally come with a commensurate level of downsides or demerits. Both will be examined shortly. Some of the advantages of dark pools include:-

Reduced impact on the sentiment in the market:-

The use of Dark Pools obscures the intention of a trader who wishes to execute a large size of an asset from the general investing public. This reduces the impact such a huge trade could have potentially on the market sentiment.It improves price:-

Usually, in the execution of trades in the Dark Pools they are normally matched according to mean of the best bid and ask prices that are currently available. This means that the buyer as well as the seller are very likely to get their trades executed at a price that is more favorable to them. This is quite unlike what could have been obtained in the open market where the buyer could rather buy at a higher price while the seller sells at a lower price as a result of negative slippage.Lack of slippage:-

Most Dark Pools involve trades which are executed at prices that had been earlier predetermined. This comes with the advantage that a trader is reassured of executing his entire trade at the price which he had earlier intended.

In spite of the numerous advantages associated with Dark Pools there are a few controversies or demerits that can be identified. Some of these disadvantages include:-

Conflicting interests:-

We should remember that the order books are not seen. This means that we cannot be certain that the trade was actually carried out at the best price available. So, it is possible that the institution which is facilitating the transaction may have an interest which conflicts with that of the trader. In this case, it has the power of hiding the real price at which the trade was executed.Could still have an effect on the price in the market in a negative way:-

Actually, if most of the trading activities should be carried out in the Dark Pools the prices of an asset which is shown on a public exchange may not really be a reflection of what the actual market price should be. In the world of cryptocurrency trading and investing, decisions usually rely on information flowing freely in order to guide the investing public aright. The use of Dark Pools makes this a difficulty.The risk of high frequency traders(HFTs):- High-frequency traders could often use Dark Pools to carry out predatory practices. If such traders could come across data on the order books, they could use it against the unsuspecting traders in a way that will be advantageous to themselves only. Equally, there is the problem of pinging that involves a situation whereby large number of small orders are issued out to fill a hidden order which is equally large. High frequency traders use this to ascertain the places where a lot of liquidity lies in the hidden order books. This is usually seen as not being healthy as the high-frequency traders often take advantage of this reality in a way that does not favour the investing uninformed public.

Reduced size of average Dark Pool trades:-

Over time it has been realised that the number of average trades that are executed with the Dark Pools have decreased significantly since it was introduced in the 1980s. So, it has been uncovered that apart from financial institutions even ordinary traders are beginning to make use of them. Consequently, it begins to lose its allure as the broader market could be affected in an unhealthy way. Executing smaller orders through the public exchanges in a way that is very transparent and open to everybody through the order books may actually prove to be more beneficial than relying on the Dark Pools which lack some level of transparency.

CONCLUSION

Dark Pools exist in the world of cryptocurrency trading as a portal through which the trading of crypto assets can be carried out without being made available to the investing public. They provide liquidity which are usually referred to as dark pool liquidity. The primary intention is of course to obscure large trades by institutional investors.

There are centralised crypto dark pools as well as decentralized dark pools in crypto trading. While the centralised dark pools can hold custody of users' funds, the decentralized dark pools mostly may not require such custody and come with the zero-knowledge proof which means that orders are matched without knowledge of the content of such orders.

Some of the advantages associated with dark pools is that they reduce the potential impact of very large trading orders from institutional traders on the sentiment in the market. Equally, their improved pricing policies reduce or totally obliterate negative slippages. Nevertheless, there could be some demerits like conflicting interests and the too much use of dark pools could lead to inefficiency in the normal trading systems.

CC

@fredquantum