Introduction DeFi

Decentralized finance, or DeFi, is an umbrella term for a number of public blockchain applications and projects aimed at posing a threat to established financial institutions. Financial applications built on blockchain technologies, typically using smart contracts, are referred to as DeFi.

DeFi was inspired by blockchain technology. Smart contracts are enforceable, automated agreements that can be accessed by anybody with an internet connection and do not require the use of middlemen to implement.

DeFi refers to decentralized blockchain-based applications and peer-to-peer protocols that allow for easy lending, borrowing, and trading of financial instruments without requiring access rights. The Ethereum network is used in the majority of DeFi apps today, but there are a growing number of other public networks that offer better performance, scalability, security, and affordability.

Decentralized finance (DeFi) is a cryptocurrency system that provides financial services to crypto users using a decentralized network and protocols. DeFi attempts to eliminate the need for third parties to gain access to financial products.

DeFi also provides crypto users with frictionless and permissionless financial services, allowing anyone to easily access financial goods including as lending, staking, liquidity mining, and borrowing. DeFi additionally ensures asset protection with a peer-to-peer network and blockchain-based smart contracts.

1) In your own words, explain DeFi products and how it is shaping the present-day finance.

Explain DeFi Products

DeFi products are financial services technologies designed to decentralize the financial industry by removing the need for third-party evaluation. The DeFi solutions provide crypto customers a lot of options when it comes to accessing financial services while also delivering a high level of protection to keep their assets safe.

DeFi product development aims to disrupt the role of intermediaries in traditional financial services like loan, trading, investing, payment, insurance, and more.

DeFi products are effectively modular due to their design, which allows applications and protocols to be added to and mixed with one another. In addition to the benefits provided by blockchain technology, this provides for considerably greater flexibility and variety in the services you can provide.

How is DeFi Products Shaping the Present Day Finance

DeFi, grounded on what we have seen therefore far, has the implicit to help traditional finance. DeFi's pledge, like that of any disruptive technology, goes beyond simply perfecting the present quo. Rather, its abecedarian power rests in its capability to disrupt the fiscal services assiduity by enabling new forms of fiscal goods and services. Some ways in which DeFi products shapes the present day finance includes;

1) Borrowing vs. lending: DeFi has paved the way for the creation of peer-to-peer lending and borrowing solutions that benefit the end-user significantly. These services include cryptographic verification techniques as well as smart contract integration, which eliminate the need for intermediaries like banks to validate and conduct lending and borrowing transactions.

This makes the procedure much cheaper and faster while still ensuring the safety of the transaction's counterparties. Transactions are settled instantly, and transactions are more accessible.

Compound is a platform that has a lot of clout in this industry. On the site, lenders can contribute crypto assets to a number of lending pools from which other users can borrow. For this reason, these lenders are entitled to a portion of the interest that borrowers repay to the pool.

The interest rate a lender receives is determined by the amount of money they put into the pool as well as the liquidity of the crypto assets.

2) Savings: People can now manage their funds in innovative ways thanks to the rising popularity of DeFi lending services. As previously stated, consumers start collecting interest on their crypto assets by locking them into lending protocols like Compound.

As a result, DeFi saving apps have emerged that may connect to various loan protocols in order to maximize their users' income earning potential. Yield farming is a word that has been used to describe the behavior of users shifting their idle crypto assets around through multiple loan protocols in order to increase their profits.

3) Stablecoins: Stablecoins are crypto currencies that are tied to a stable asset or basket of assets, similar to crypto synthetic assets. Stablecoins are typically linked to fiat currencies such as the US dollar, although they can also be pegged to commodities or cryptocurrencies. Stablecoins attempt to eliminate cryptocurrency price volatility and make the case for adopting blockchains as payment solutions stronger.

Based on the method employed to maintain their value, we can classify stablecoins into three categories. The coin issuer is required to hold the assets against which their coin is tied in collateralized stablecoins (fiat currency, gold, silver, etc.). Other coins are linked to cryptocurrencies and have over-collateralization and stability procedures to keep their value. Finally, there are non-collateralized tokens, whose prices are algorithmically maintained at predetermined levels.

In many respects, stablecoins are the fuel that powers the DeFi engine. They're commonly employed to enable remittance, lending and borrowing, and other DeFi services across the industry.

4) Marketplaces: DeFi is also beginning to have an impact on how we trade products and services online. The recent advent of decentralized exchanges (DEXes), which permit peer-to-peer trading of digital assets, is an example of this. One of the biggest players in this category is Uniswap.

Traditional financial tools, as well as tangible commodities and services, can readily be added to the notion.

2) Explain the benefits of DeFi products to crypto users. b) Discuss any DEX project built on the following network; i) Binance Smart Chain, ii) Tron Blockchain.

Benefits of DeFi Products to Crypto Users

1) Transparency: Unlike traditional financial systems, where transactions and system operations are not made public, DeFi products provide a transparent system by making transactions available to users and recording them on the blockchain.

2) Permissionless: DeFi products are designed to be accessible by anybody in the system. In the crypto market, there are no limits or hurdles for every user. This is in contrast to the existing system, which requires customers to complete some type of verification before being able to use financial services.

3) Banks, brokers, and financial institutions serve as transaction facilitators in the traditional financial system. This slows down the transaction because it must be approved and verified before it can be completed. Users' funds are also secure because they have access to their private keys, which gives them enough control over their funds.

4) Low Cost: As previously stated, eliminating intermediaries speeds up transactions while lowering costs. All thanks to DeFi's use of blockchain technology and smart contracts to automate transactions.

5) Immutability: Blockchain technology provides full immutability by utilizing smart cryptography and consensus procedures such as proof-of-work. This makes it nearly hard to manipulate data stored on a blockchain network. When combined with the previously mentioned capabilities, this provides a level of security that is difficult, if not impossible, to attain with standard methods.

Dex Project Built on Binance Smart Chain

PancakeSwap: PancakeSwap is a BSC-based decentralized exchange (DEX). This platform, on the other hand, serves as a DEX as well as a provider of decentralized finance (DeFi) services.

PancakeSwap is an exchange that allows you to swap cryptocurrencies and tokens without using a centralized intermediary while keeping control of your assets. It is based on Binance Smart Chain, the crypto exchange's blockchain technology.

PancakeSwap was constructed by unknown developers and is neither controlled or operated by Binance, despite the fact that it maintains a centralized exchange. Uniswap, the popular Ethereum DEX, has a similar appearance and feel to the service.

Although tokens from other platforms can be sent over via Binance Bridge and "wrapped" as BEP-20 tokens for use on the DEX, PancakeSwap is only for BEP-20 coins operating on Binance Smart Chain.

PancakeSwap's current features include trading, earning interest on various yield farms, and participating in the PancakeSwap Lottery.

PancakeSwap is a Binance Smart Chain AMM (automated market maker) DEX (decentralized exchange). PancakeSwap enables swapping BEP-20 tokens safe and easy, which is why it has periodically outperformed Uniswap in terms of trading volume. PancakeSwap, which is powered by BSC, is unquestionably cheaper and faster than Uniswap (average transaction time of 5-seconds).

It also serves as a launchpad for other projects to launch their own Binance Smart Chain coins as the most recent dApp on Binance Smart Chain (BEP-20). In addition, the BEP20 CAKE token was created by the development team to reward liquidity providers.

PancakeSwap is one of a growing wave of DeFi services that let crypto traders to perform transactions with trade tokens without having to pay a middleman a substantial fee. Although there are DEXs on Ethereum (such as Uniswap) with substantially higher average trade volume, it is one of the largest such DEXs on the Binance Smart Chain.

PancakeSwap is unique in that it allows users to unstake their CAKE tokens with no waiting period. It has also implemented 6-hour lottery sessions, with each lottery ticket costing 10 CAKE.

While the full implementation of ETH 2.0 will take some time, it is preferable to build your token on Binance Smart Chain rather than Ethereum.

Dex Project Built on Tron Blockchain

JustSwap is a decentralization exchange on the tron ecosystem that allow users to immediately exchange any TRC20 token at the system price.

Users can also earn transaction fees by acting as a liquidity provider on JustSwap, and they can even use the protocol without paying a commission. Users who use JustSwap can earn transaction fees and mining rewards in addition to swapping TRC20 tokens.

JustSwap is a TRON exchange system that allows you to swap TRC20 tokens.

Conversion between any two TRC20 tokens is simple and depends on the system pricing. All trading fees will go directly to the protocol's liquidity providers, rather than to the protocol itself.

This guarantees complete decentralization as well as security.

JustSwap's primary strengths are as follows;

It let traders can immediately exchange any TRC20 token for another. Market makers profit from the lack of entry obstacles.

Unlimited Liquidity: It's common knowledge that liquidity is critical to all cryptocurrency initiatives, trading platforms, and even the entire industry. And JustSwap gives limitless liquidity to thousands of dealers and hundreds of projects.

JustSwap enables for fast exchange without the need to match orders.

Full Availability: JustSwap is open to everyone, delivering on TRON's promise of a truly fair and open financial economy.

High profit: The user will receive a processing charge on a regular basis without having to pay a commission.

JustSwap is a liquidity exchange mechanism that is fully automated. There are no bids or matching orders required, and no organization or centralized entity is involved in the transaction. Each trading pool, which is run by smart contracts, facilitates the exchange of tokens, offers liquidity, and effectively maintains the x * y = k functionality that ensures transaction legality.

JustSwap allows traders to instantly exchange TRC20 tokens, allowing market makers to profit without having to pay a fee.

Thousands of traders and hundreds of applications benefit from the unlimited liquidity. Without having to wait for execution in the queue, this command is executed instantly. Users will be able to participate in open financial markets if they are given the necessary tools. With eternal transaction costs paid by 0 commission from the protocol, you can make as much money as you want.

As a result, TRONICs were widely anticipated. With new applications, use cases, games, and more, it appears like the TRON platform is doing everything it can to grow in the world of cryptocurrencies.

3) In the DEX projects mentioned in question 3, give a detailed illustration of how to swap cryptocurrencies by swapping any crypto asset of your choice. Show proof of transaction from block explorer. (Screenshots needed)

Detailed Illustration on how to Swap Cryptocurrencies

Using Pancakeswap on Binance smart chain

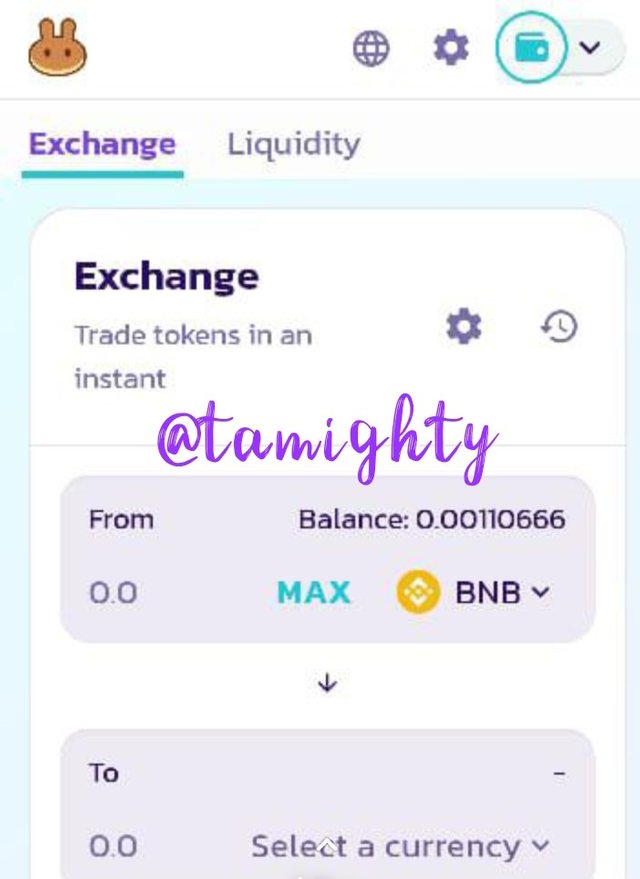

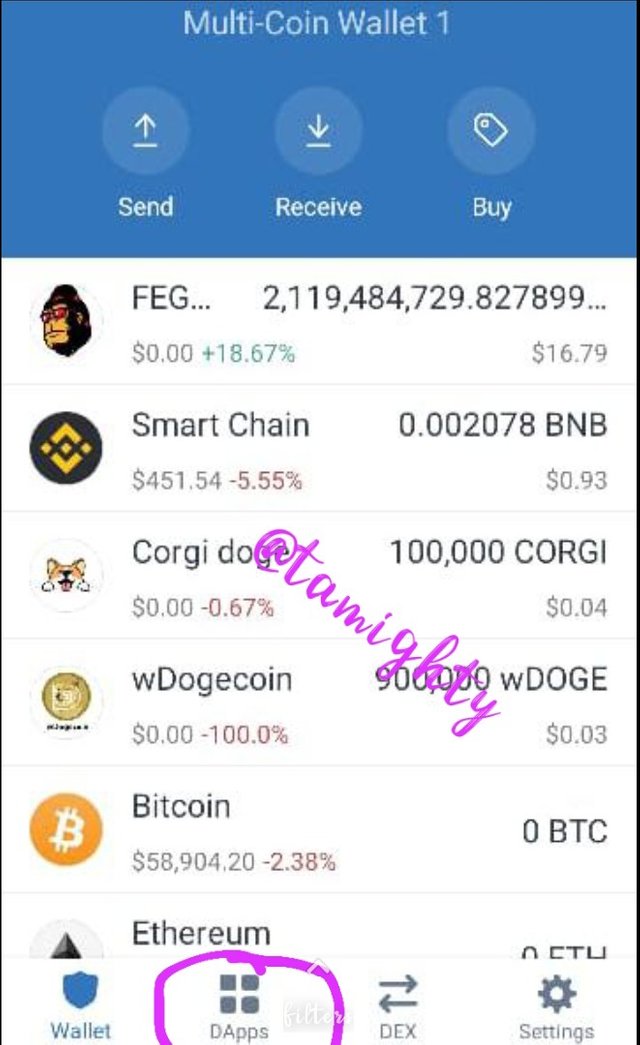

Step one: I launched my trustwallet app and then I clicked on DApps.

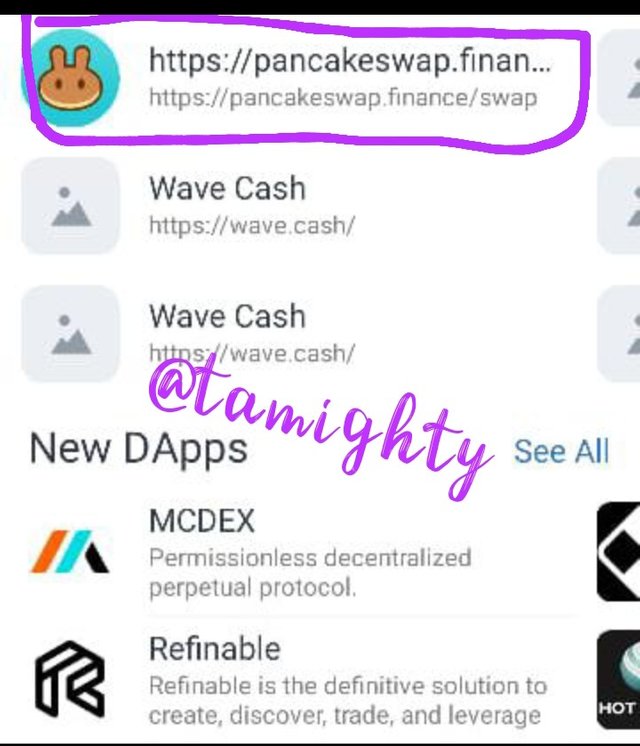

Step two: I was redirected to a page were I saw list of tokens, I searched for Pancakeswap and clicked on it.

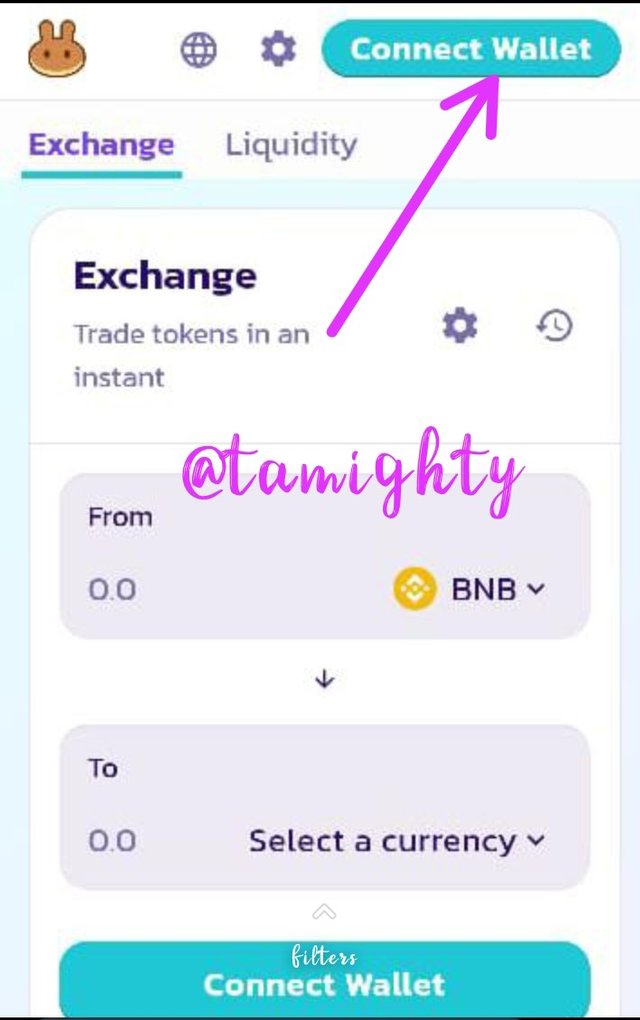

Step three: The pancakeswap page opened, I saw at the top right a write-up were I was asked to "connect wallet".

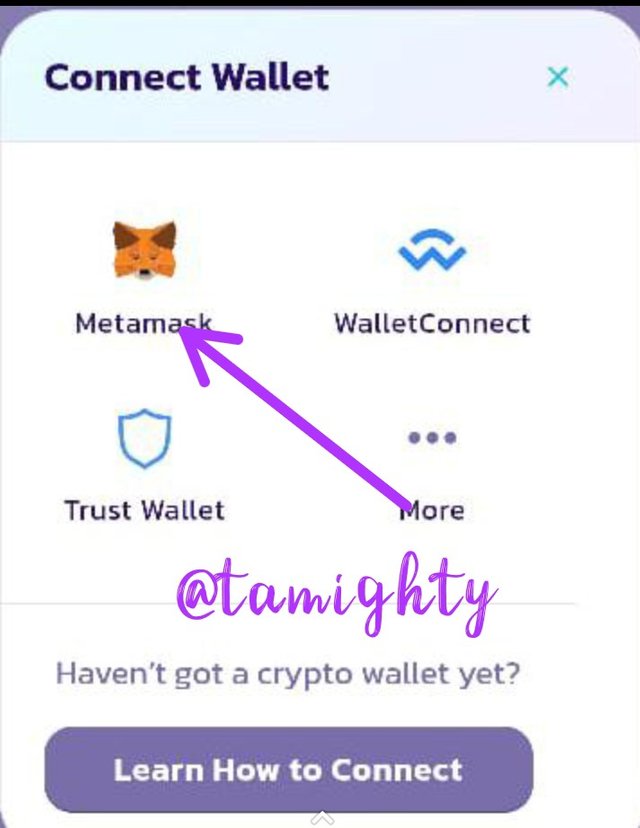

Step four: After connecting the wallet, a page opened and I clicked on metamask to continue with the transaction.

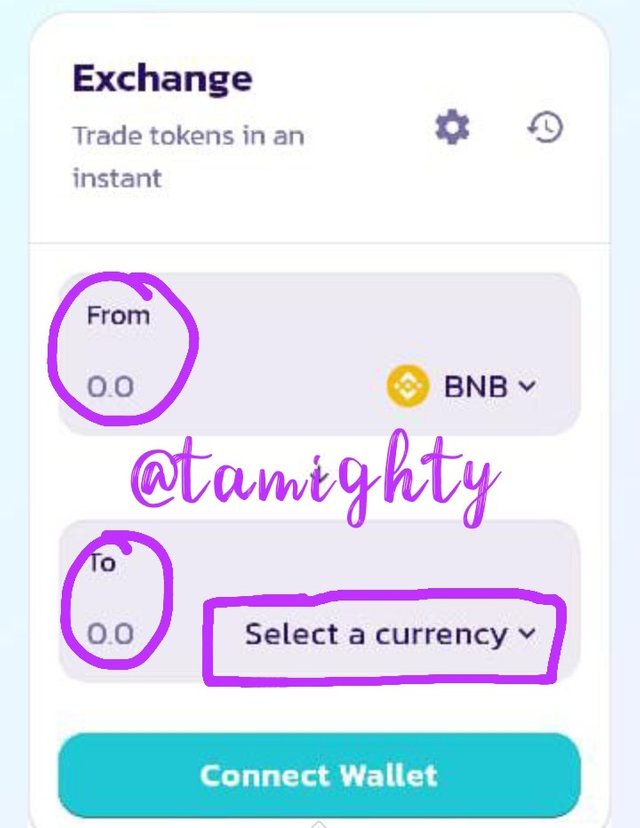

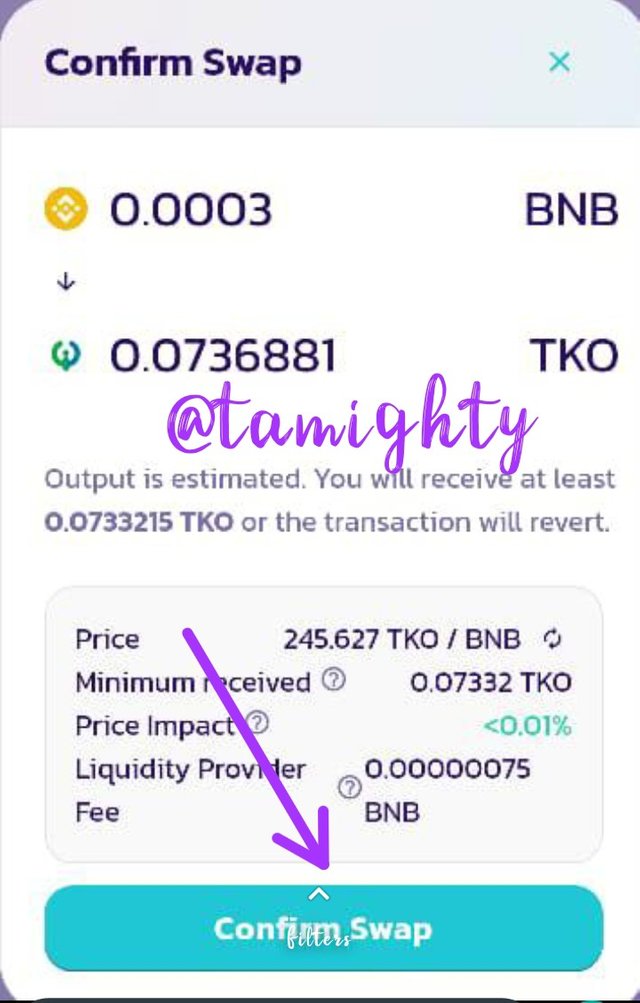

Step five: I moved to the next step were I was asked to select a currency and input amount.

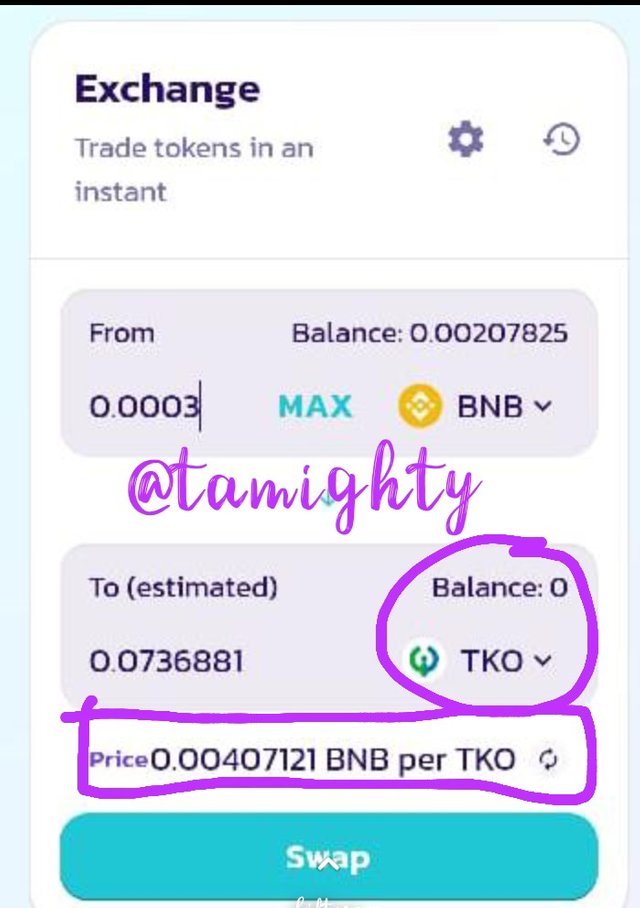

Step six: I searched for TKO and inputed the amount.

Step seven: Then I clicked on "swap"

Step eight: I confirmed the swap

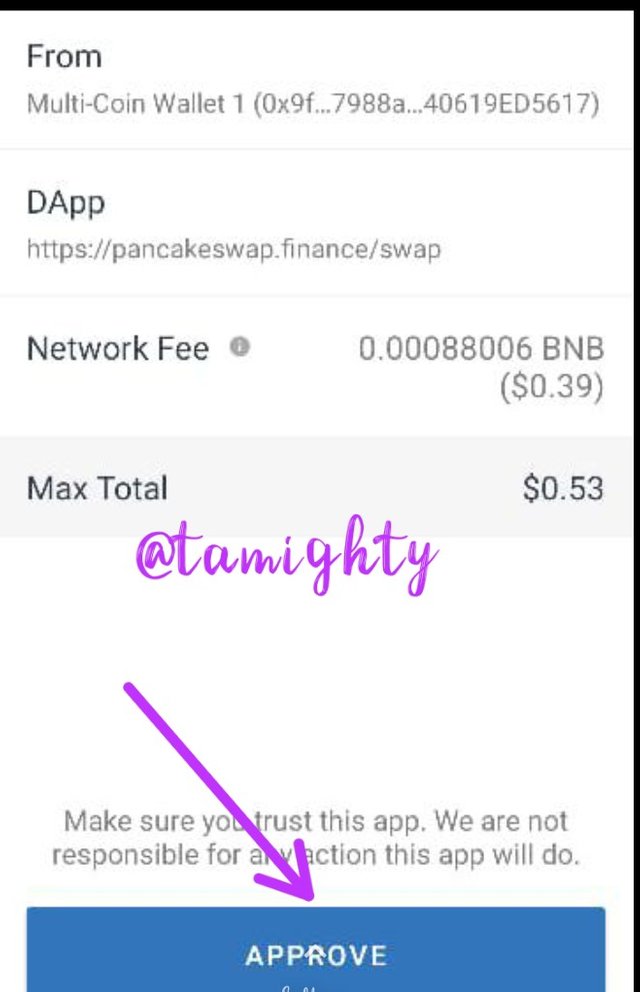

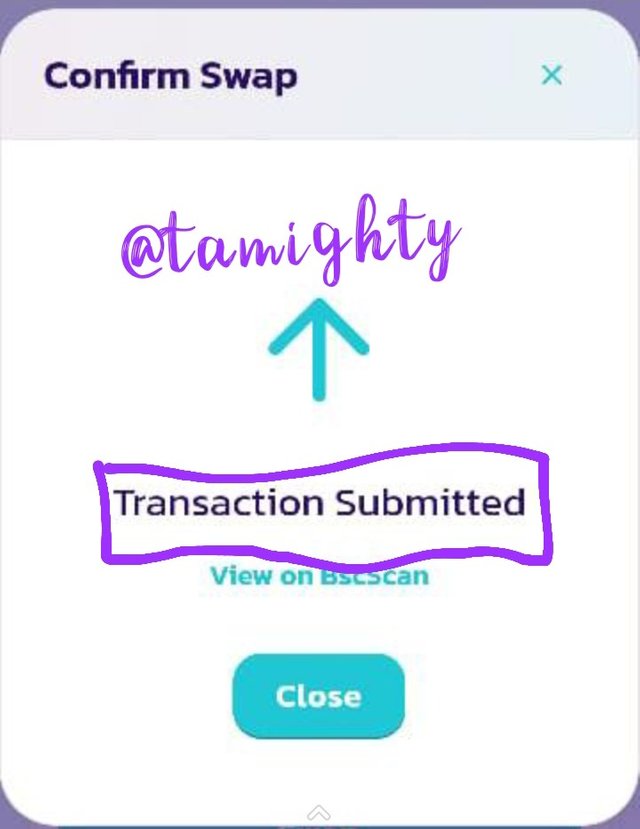

Step nine: Finally, I approved and submitted the transaction.

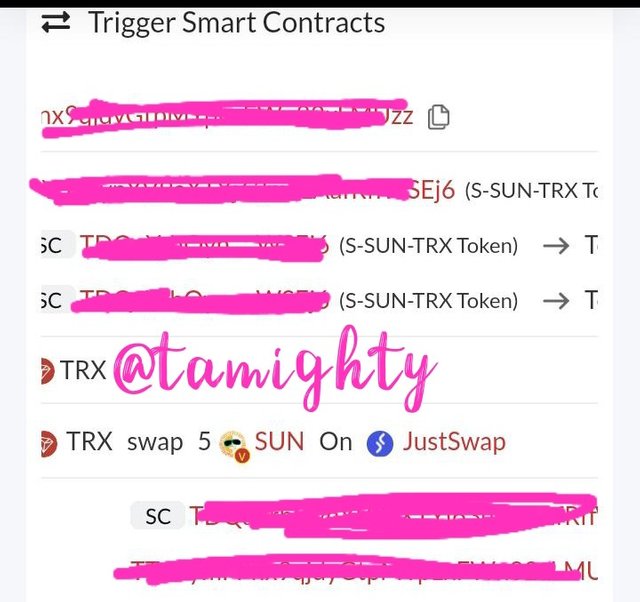

Using JustSwap on Tron Blockchain

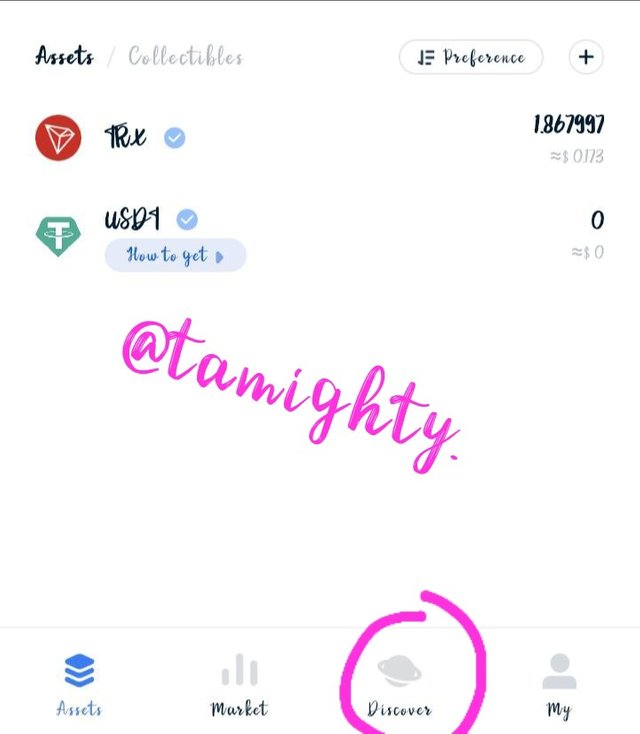

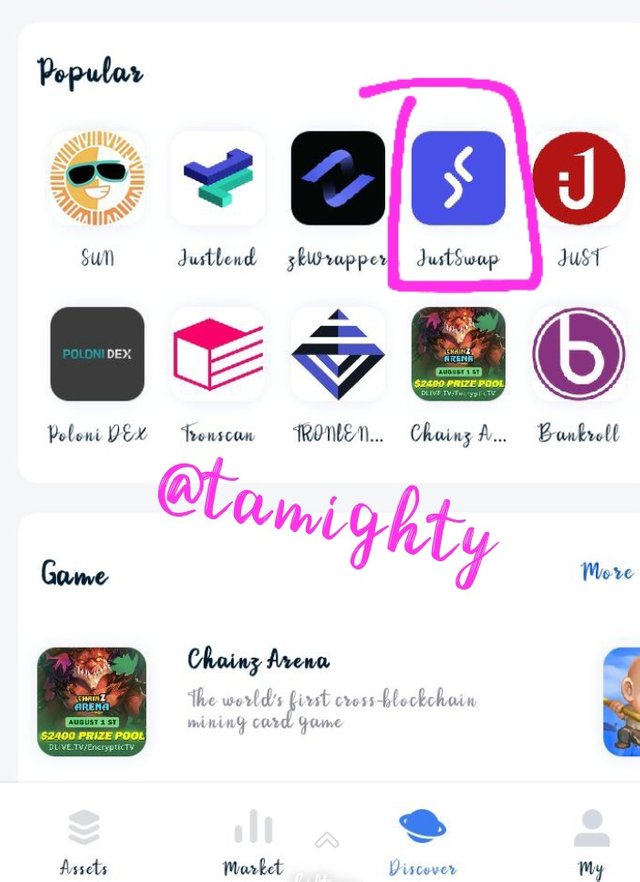

Step one: First of all I launched my Tronlink app and then I clicked on Discover.

Step two: After clicking on Discover it directed me to the place I saw decentralized apps and then I clicked on JustSwap.

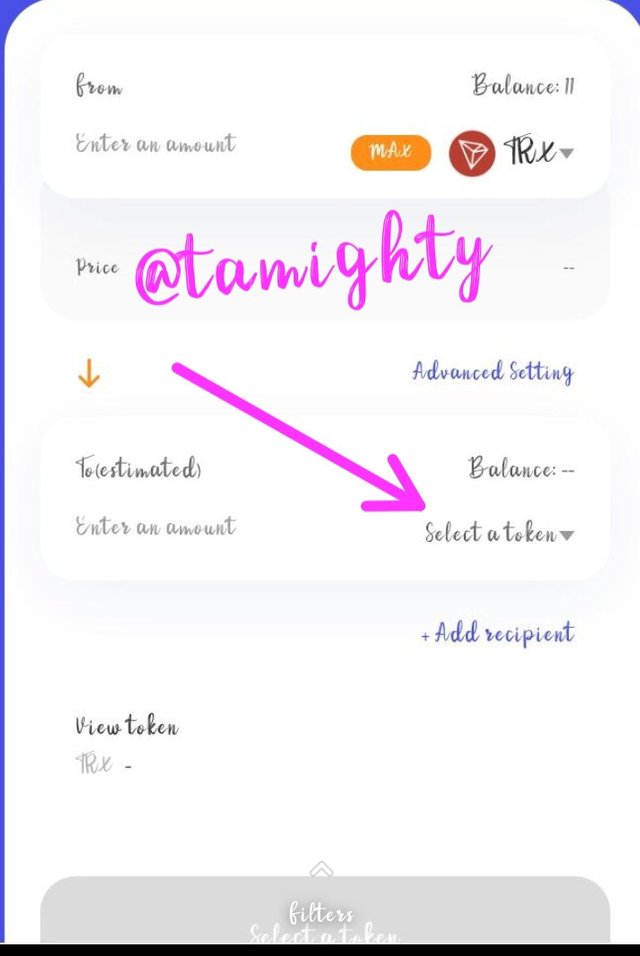

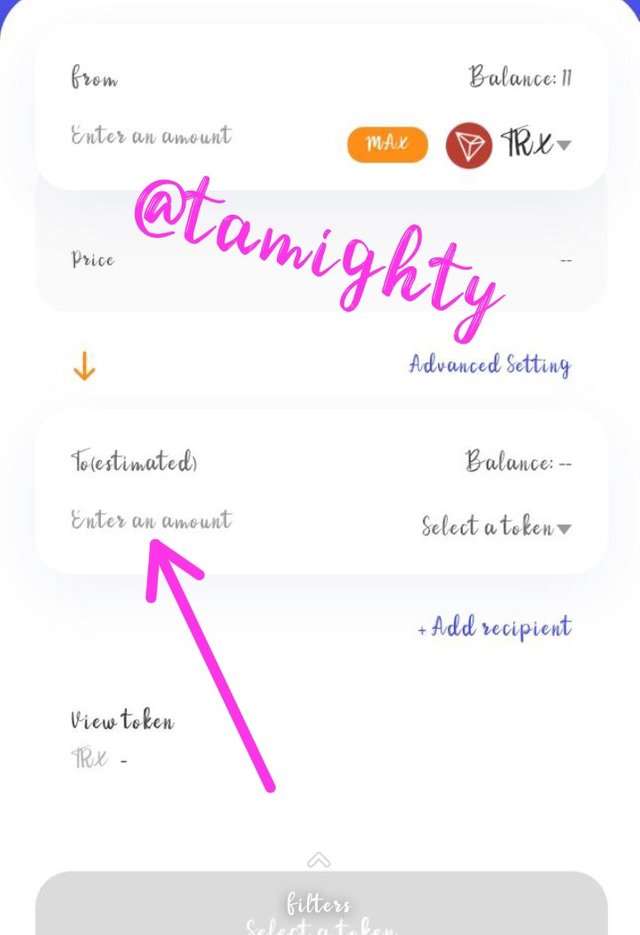

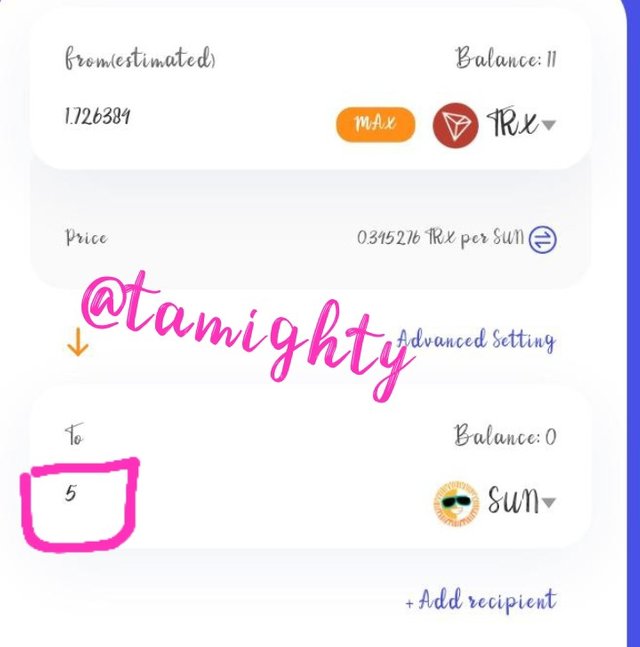

Step three: I was taken to a page were I was asked to select token and input the amount I want to swap.

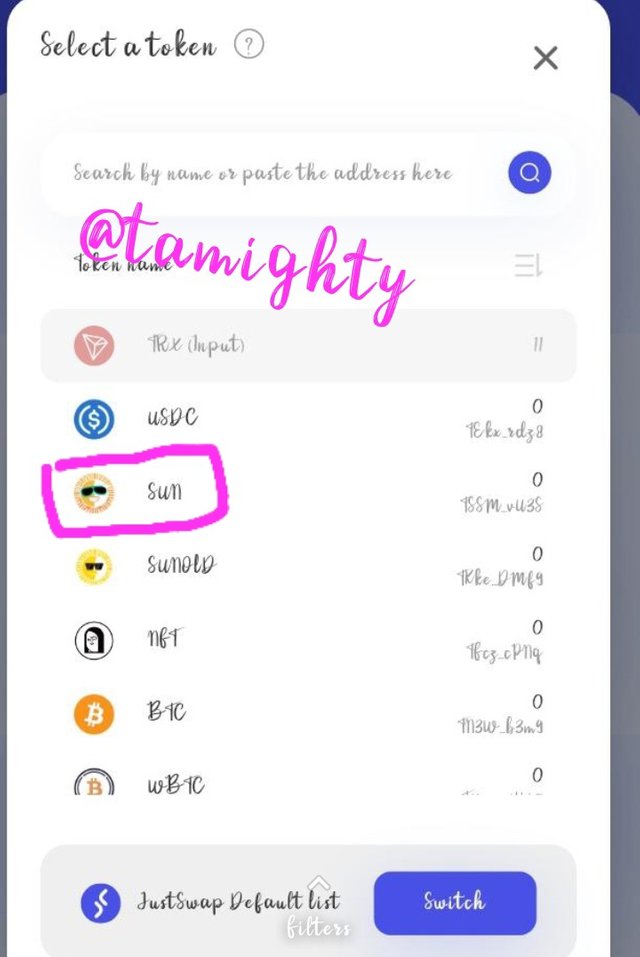

Step four: I selected the token which I wanted (Sun) and inputed the amount.

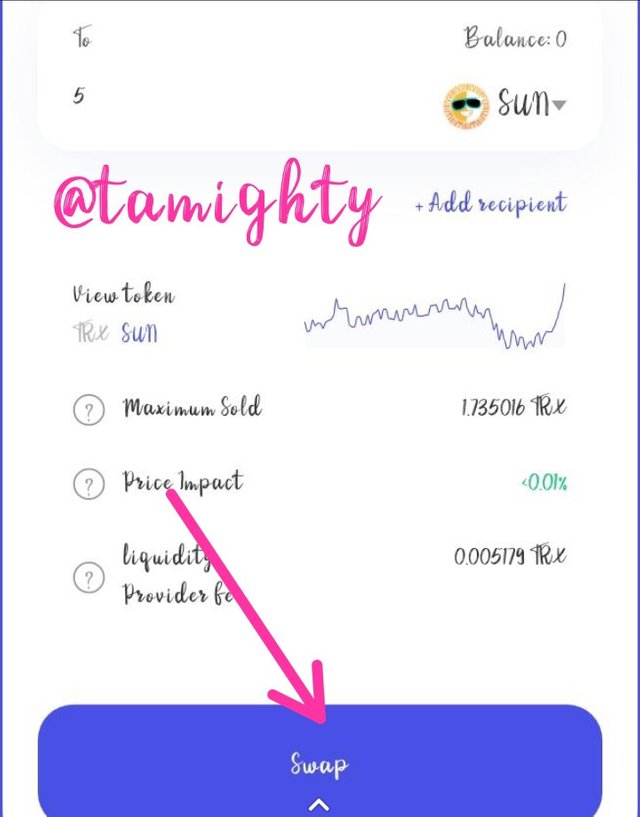

Step five: I clicked on swap which directed me to the next stage.

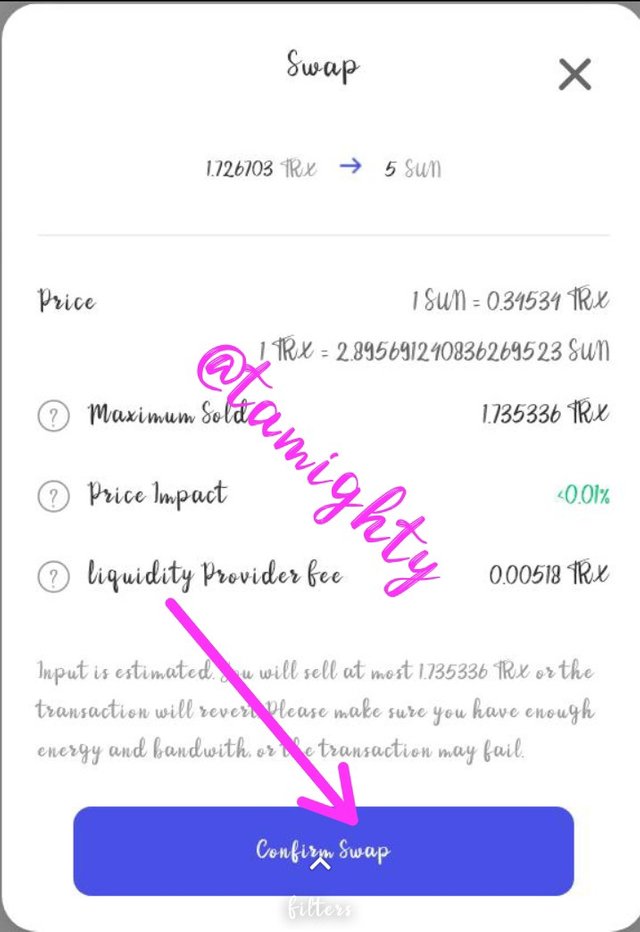

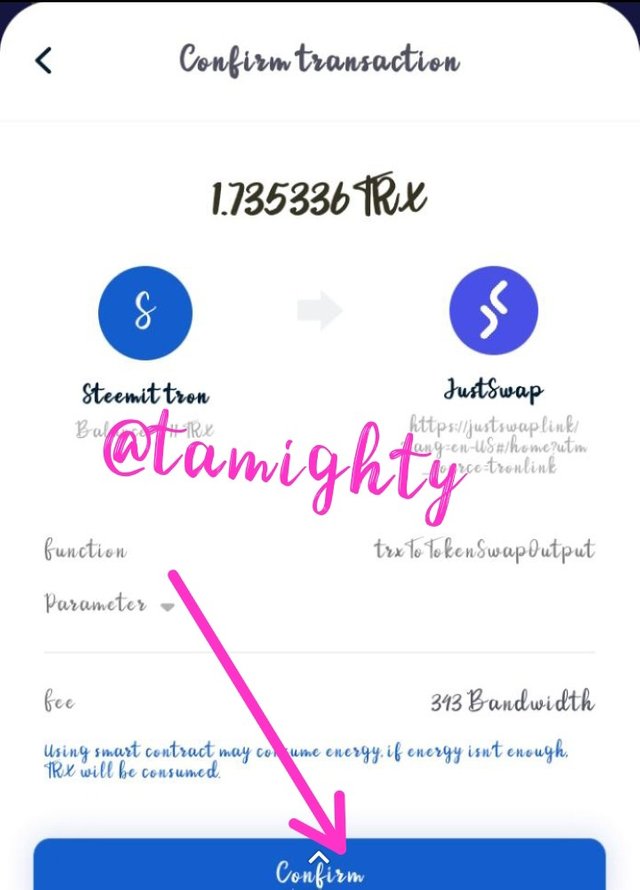

Step six: I was directed to a page were I was asked to confirm what I was doing, which I did.

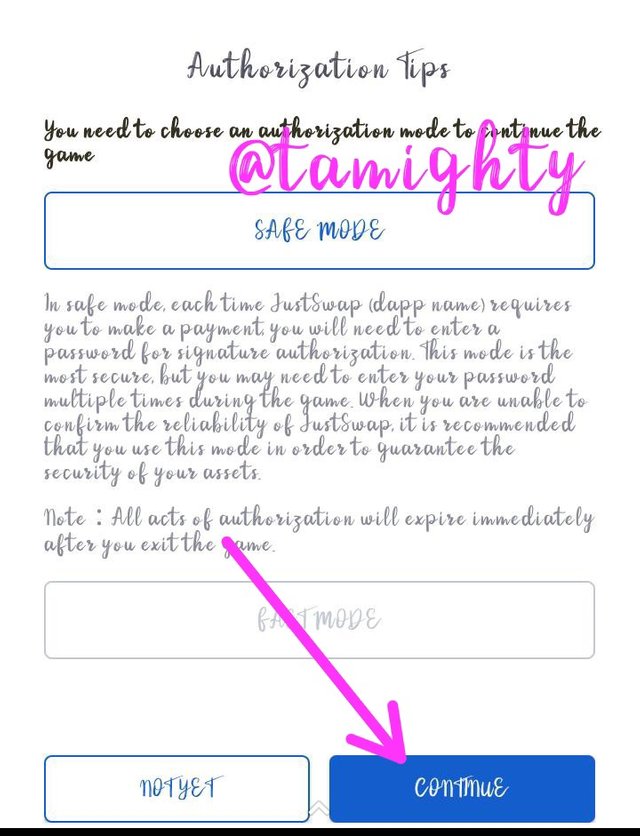

Step seven: After confirming, I was directed to an authorization page were I clicked on Continue.

Step eight: I continued and then was asked to confirm the transaction again which I did.

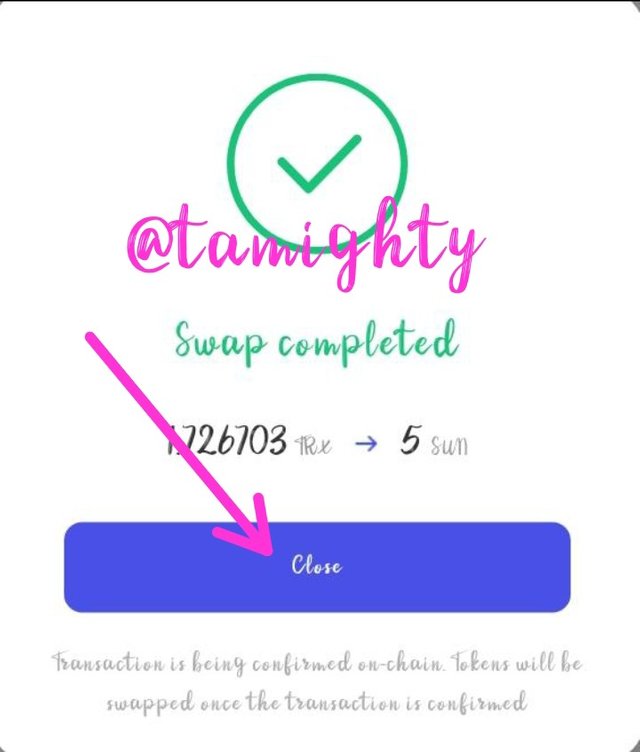

Step nine: I confirmed which completed the swapping process.

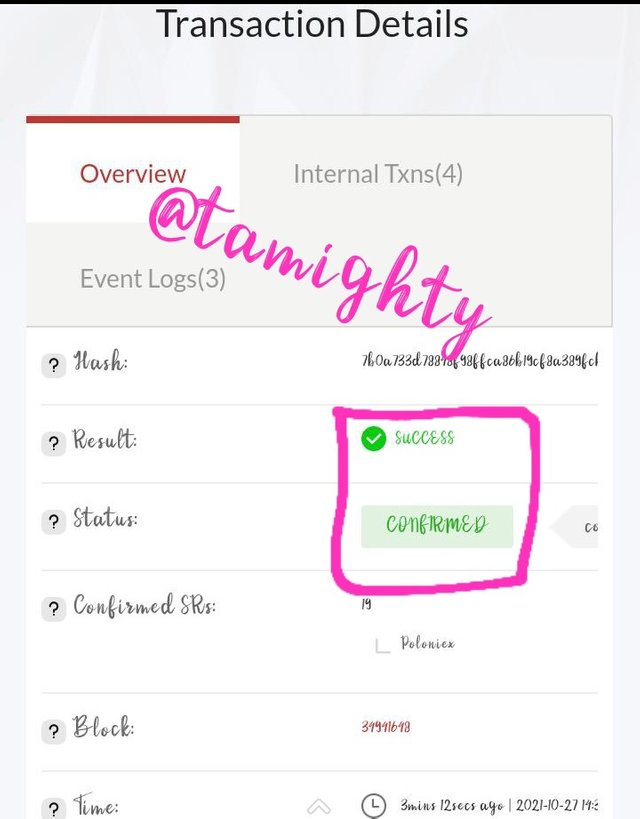

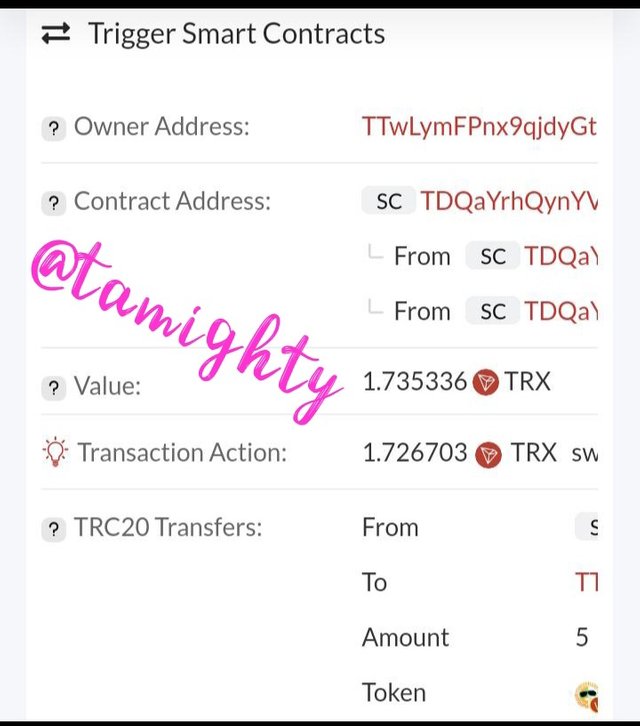

Step ten: Below are the transaction details of the swap.

Conclusion

It has not been easy doing this, but I am glad I was able to participate and complete this task.

I appreciate this privilege. I humbly await your response and corrections.

Happy reading.

Cc:

@reminiscence01