Crypto Assets are still struggling to find a solid footing on trading

after crashing last weekend and garnering support from the tweet of Tesla boss Elon Musk.

Elon Musk appears unable to keep up with pressure to sell crypto assets from investors frightened of new rules and crackdowns from China.

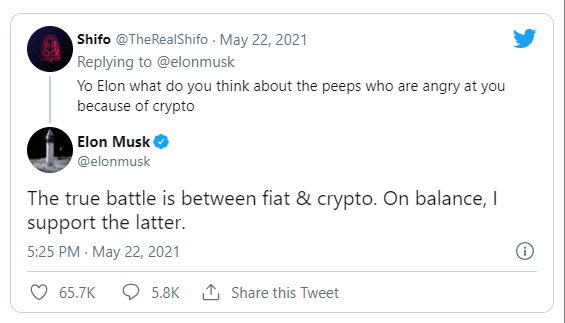

Musk re-opened his voice via tweet on Saturday giving support for cryptocurrencies in the "real battle between fiat and crypto currencies. Elon Musk chose crypto.

Bitcoin prices slumped as miners, which print crypto by verifying transactions, suspended operations in China following increased surveillance from the authorities.

Reporting from Reuters, bitcoin (BTC) rose to the level of US $ 35,970 from Sunday's position which was at the level of US $ 31,107, but other negative sentiments that are flowing through the 'foamy market' make this coin struggle boosting its value again, bitcoin price is still 45% below last month's record peak of $ 64,895.

The crypto market crash saw the world's largest digital coin return to its original trading position in BTC in February, before Tesla announced a US $ 1.5 billion purchase of bitcoin and decided to accept it as a payment method for buying Tesla cars. The decision which on May 12 was overturned by Tesla.

Another cryptocurrency, ether (ETH) fell to its lowest level in two months of around US $ 1,730 on Sunday and reversed its direction to a price of $ 2,101 on Monday before losing steam.

Dogecoin, launched as a travesty on Musk's favor and having risen more than a hundred times this year, was last trading at $ 0.30.

"After rising briefly from lows in several months in the last week, several types of paper-handed appear to have sold out," said IG Markets analyst Kyle Rodda, using the market term for short-term holders selling holdings.

"Or (they) decide to cut their losses and cut their losses," he said, "because the momentum of Bitcoin, and the speculators driving it, has almost completely disappeared."

The trigger for the initial crypto selloff appears to have come due to the stern words of Chinese regulators last week, last Friday when the State Council committee promised to crack down on crackdowns, especially the miners.

The concentration of miners also played a role, after months of rising prices, the world community began to focus on Chinese miners, who account for about 70% of the supply, adding to the negative sentiment.

"A lot of miners hold a lot of bitcoin / ETH or other coins they mine and don't hedge right away by converting them all to fiat," said James Quinn, managing partner at Q9 Capital, a Hong Kong-based cryptocurrency personal wealth manager.

"If they withdraw or close operations, they may need to reduce their balance of income in the short term."

Late that evening, Huobi Mall, part of the crypto asset exchange Huobi, said on Monday that it was suspending crypto mining serving mainland Chinese clients. BTC.TOP, a crypto mining pool, has suspended its business in China citing regulatory risks, while crypto miner HashCow said it would stop buying new bitcoin rigs.

In printing cryptocurrency, miners use sophisticated equipment or computer rigs that are more expensive so that they are more powerful and are specially designed to verify transactions more quickly.