Good morning, everyone! I hope you're all doing well? I'd like to welcome everyone to season 3 of the Steemit Crypto Academy. We're already in week 4, and today I attended Professor @stream4u's lecture, in which he discussed the "DeFi, and Yield Farming concepts" in detail. He also assigned us a homework activity, which I shall now complete.

What Is the Importance Of the DeFi System?

The creation of blockchain technology (on which cryptocurrency is based) and other smart contracts, as well as the birth of Bitcoin, the first cryptocurrency, are all key milestones in human history.

As a result of these advancements in all fields, particularly finance, decentralized structures began to emerge. Decentralized finance, a new financial system that operates without the assistance of centralized financial intermediaries such as central banks, has made substantial development in the financial sector. Individuals can swap, invest and exchange their crypto tokens within the system thanks to advanced smart contracts that the decentralized finance system uses for operations.

I'll discuss some of the importance of decentralized finance.

- The Decentralized finance system has refined the decentralized exchanges, lending platforms, yield farming, prediction and lotteries platforms and so on.

DeFi enables users to obtain financial services without the participation of third parties, which is particularly beneficial for people who are unable to do so under the current and widely used traditional finance system.

DeFi can be accessed from anywhere in the world at any time; there are no time limits because it operates 24 hours a day, seven days a week, unlike traditional banking systems, which have working hours and so prevent users from accessing their products outside of those hours.

- Accessing DeFi system is very easily has most of the DeFi products need little or no verification, unlike the traditional finance system that you need to complete verification, provide some some documents and complete the KYC verification to access their products.

- Transaction on Decentralized finance system doesn't require any middleman or agent as we see in the banking system whereby to access loan or most of the service, the user will need to first discuss with the agent or middleman.

- Decentralized finance system operates on the blockchain, it utilizes the security of the blockchain thereby reducing the risk of fraud and mismanagement of the users assets.

- Decentralized finance system does not charge unnecessary fees, like the overdraft fees, wire transfer costs, card maintanance fee that we occured in the traditional finance system. Furthermore, the transaction validation is very fast and instant unlike the traditional finance system that usually takes long to validate transaction. For instance, transaction on PayPal usaully takes 2-5 working days to reflect.

Flaws in Centralized Finance.

There are many flaws in the Centralized finance system, some of which includes;

- The whole operation of the centralized finance system is governed by a central authority. This means that before a transaction can be conducted, it must first be approved by the central authority, limiting users' ability to conduct transactions at any time.

The centralized finance system requires the use of a middleman to complete any transaction, and these middlemen typically charge a high fee before approving the transaction, not to mention the time it takes to confirm and process the transaction. For example, transferring money from a PayPal account to a bank account normally takes two to five working days.

Another flaws in Centralized finance system is the possibility of physical theft. Banks and ATM's galleries robbery is a very big security issue in the centralized financial, here in Nigeria bank robbery is very common and rampant, and this can never happen in the decentralized system where all operations are done online

- The Centralized finance system charges fees for almost all the transactions and services, here we see fees like bank charges, card's maintenance, a stamp duty charges, monthly charges and so on, to make things worse the Interest rates which they pay to fixed account holders are very low, this is completely different in decentralized system.

- To access some finance services like loan, the process is usually takes time and stressful, for instance i tired to borrow some money from my bank to solve some financial issue, after providing some documentation and collaterals, it took the bank 5 business working days before tjey loan was approved and given to me. There is nothing like this on DeFi, the loan is usually instance and stress free.

DeFi Products. (Explain any 2 Products in detail).

There are numerous DeFi products on the industry now. I'll discuss Decentralized exchanges and Lending two of the most popular DeFi products.

Decentralized Exchange

Decentralized exchange is one of the major products of decentralized finance (DeFi), allowing users to exchange and provide liquidity for whatever token they choose without the need for a third party. Users on the decentralized exchange platform have complete control over their funds and can deal at their convenience without the need for third-party intervention. The popularity of decentralized exchanges (DEX) has skyrocketed in recent months. DEX protocols like as Uniswap, Pancakeswap, JustSwap, and others have risen to prominence.

AMM (Auotomated Market Maker) is used for Price on decentralized exchanges. AMM can be defined as an automatic market maker that uses funds from a liquidity pool to guarantee that customers meet the exchange requirement before completing a transaction.

I will quickly discussed about one of the popular Decentralized exchange.

JustSwap

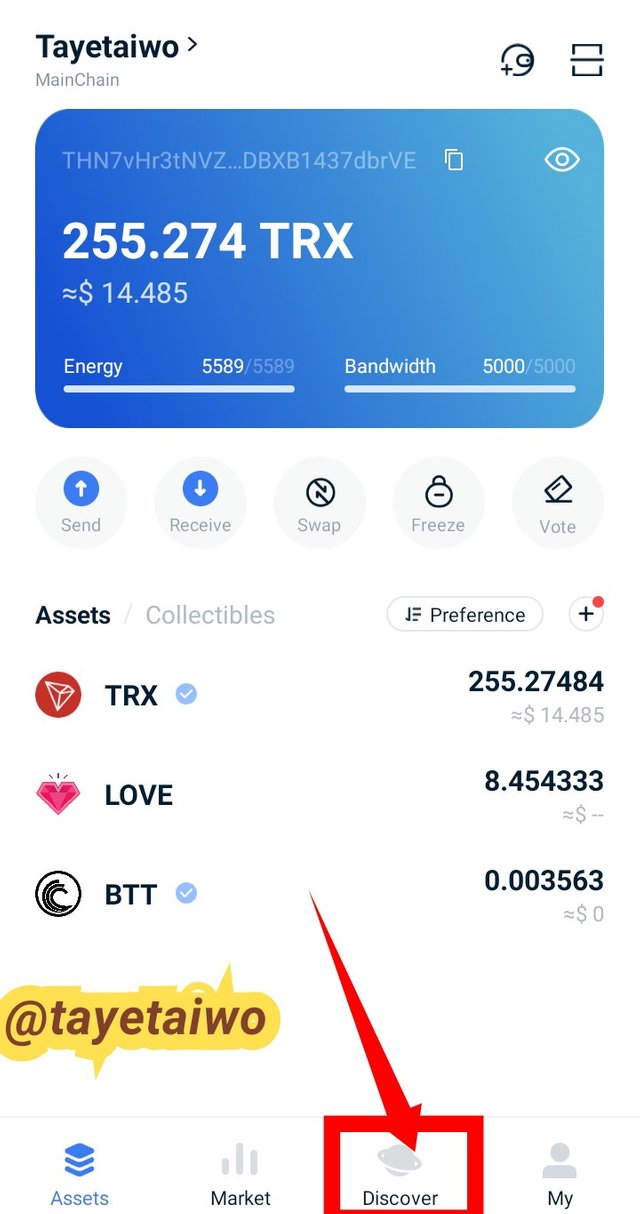

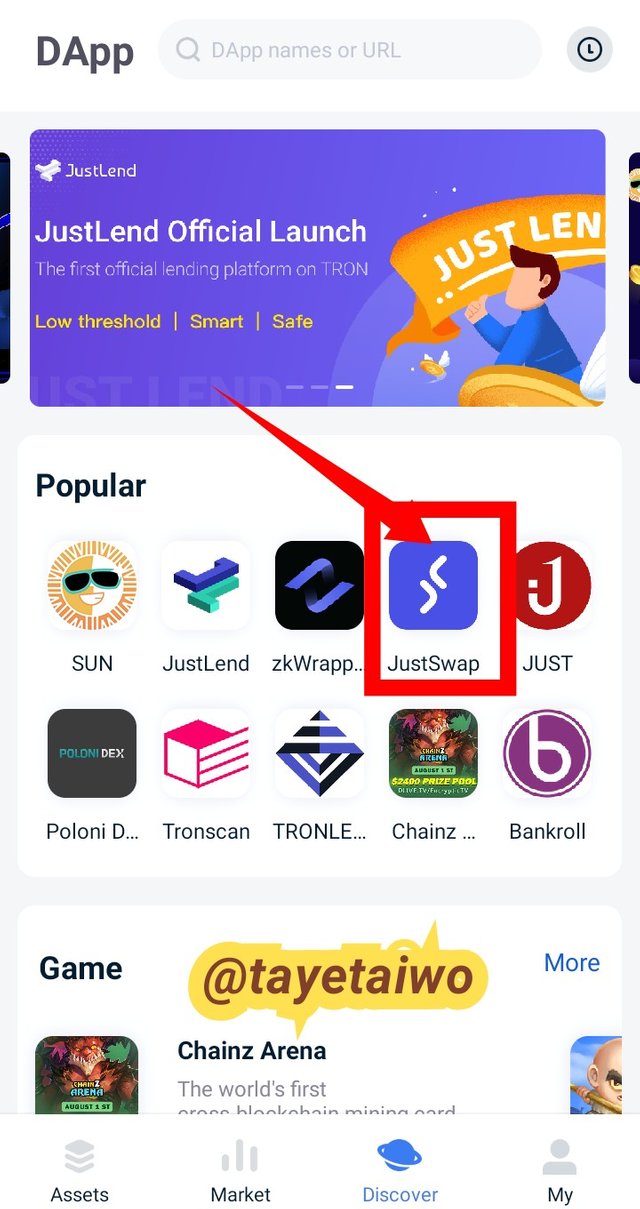

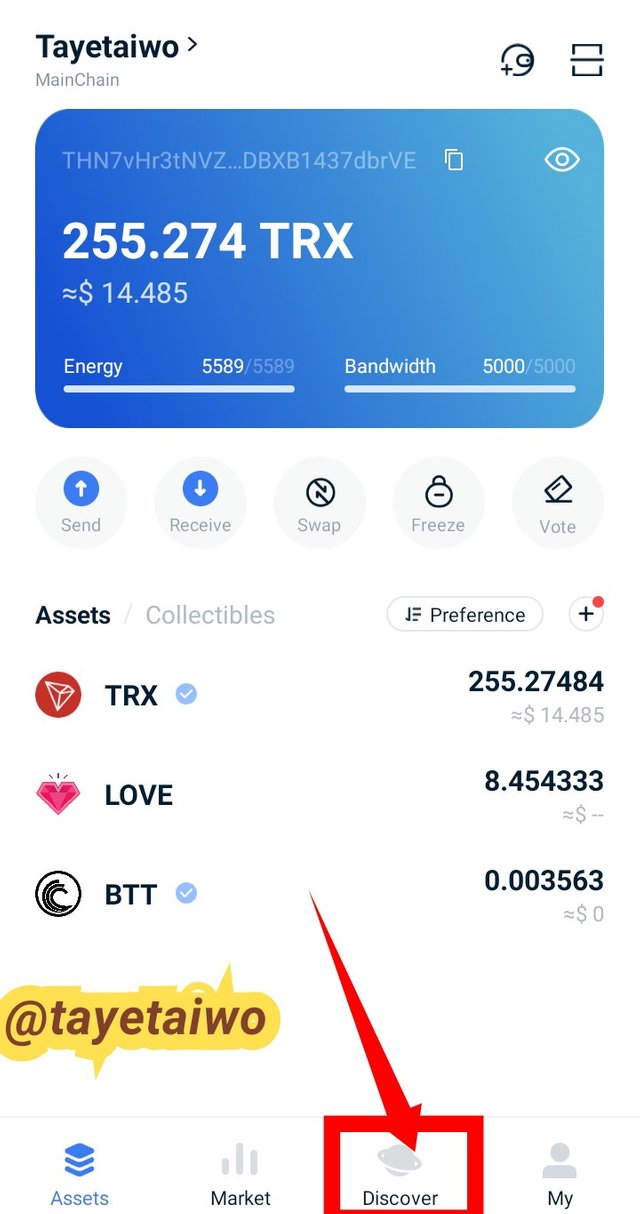

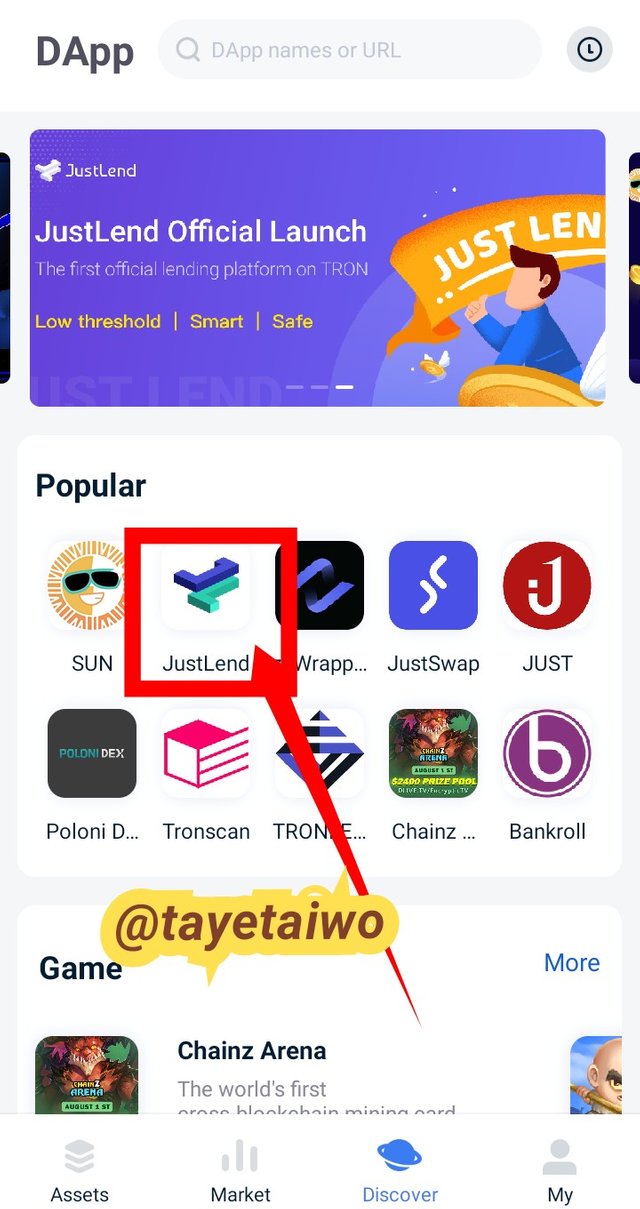

JustSwap is a decentralized exchange based on the Tron blockchain. The platform allow individual to swap, exchange and also supply their tokens to the liquidity pool to earn income without the need for a middle man. A user or individual can easily swap his/her Tron network token for another, to do this a user need to first connect his Tron wallet to JustSwap website. I will illustrate how to do that below;

Note I will illustrate using the Tronlink wallet app on my smartphone.

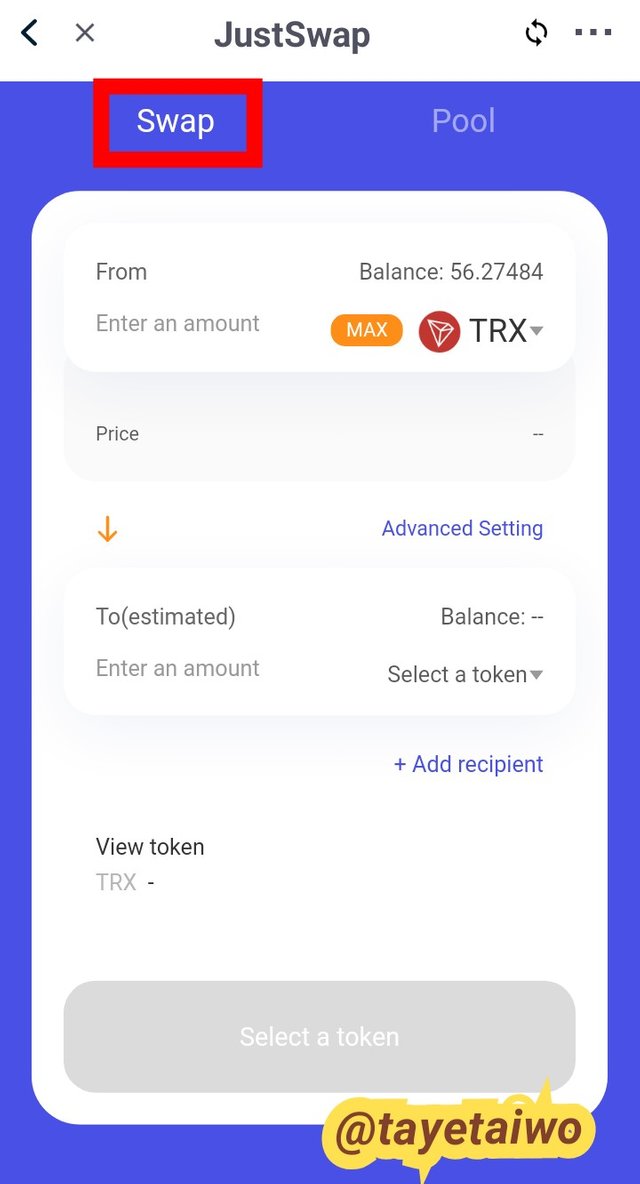

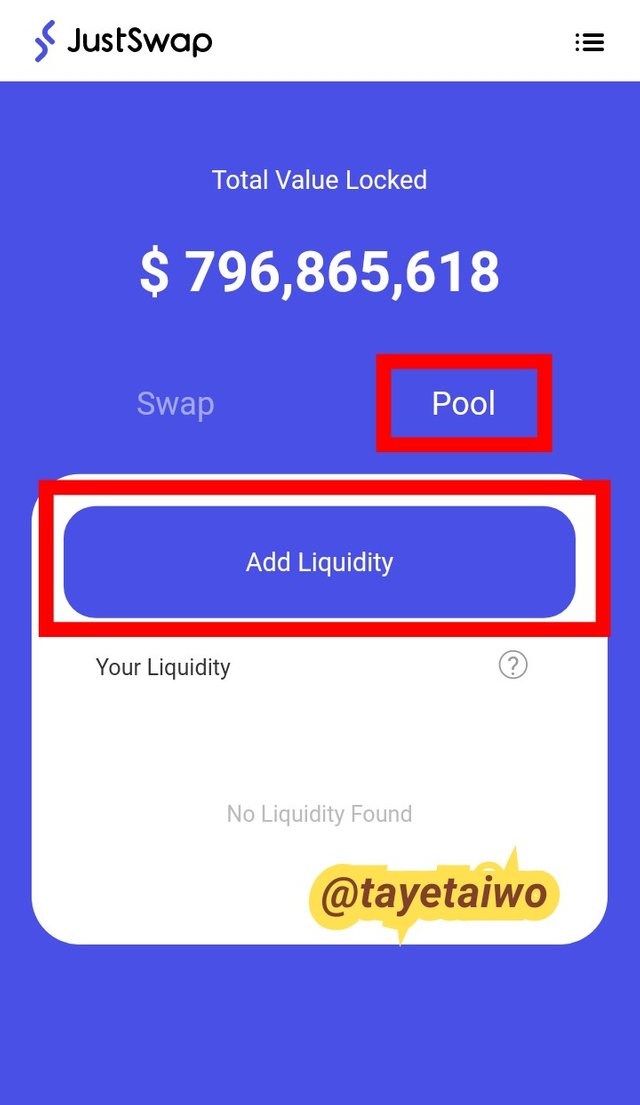

Swap you can easily swap any of your Tron network token to another one.

Pool you can supply your Tokens to the liquidity pool and earn some interest on it at APY or APR depending on the token you supplied.

|  |

|---|

Lending

Lending is another popular DeFi product; the platform operates similarly to our traditional banking system, allowing consumers to invest (stake) their assets and get a return on their investment. Anyone can as well has borrow from the lending pool and will payback with a particular Interest. This can be further explained this way, a user supplied (supplier) his/her to the pool and earn a particular interest rate on it, not to forget on the other hand a user borrow the asset (borrower) from the pool and will repay later with a particular interest, this is done without middle man but through the help of smart contracts.

There are Lending platforms in the Crypto world which includes; JustLend, Aave, Nexo, CoinList, and other DeFi products.

Let me quickly discussed about one the the Lending platform.

JustLend

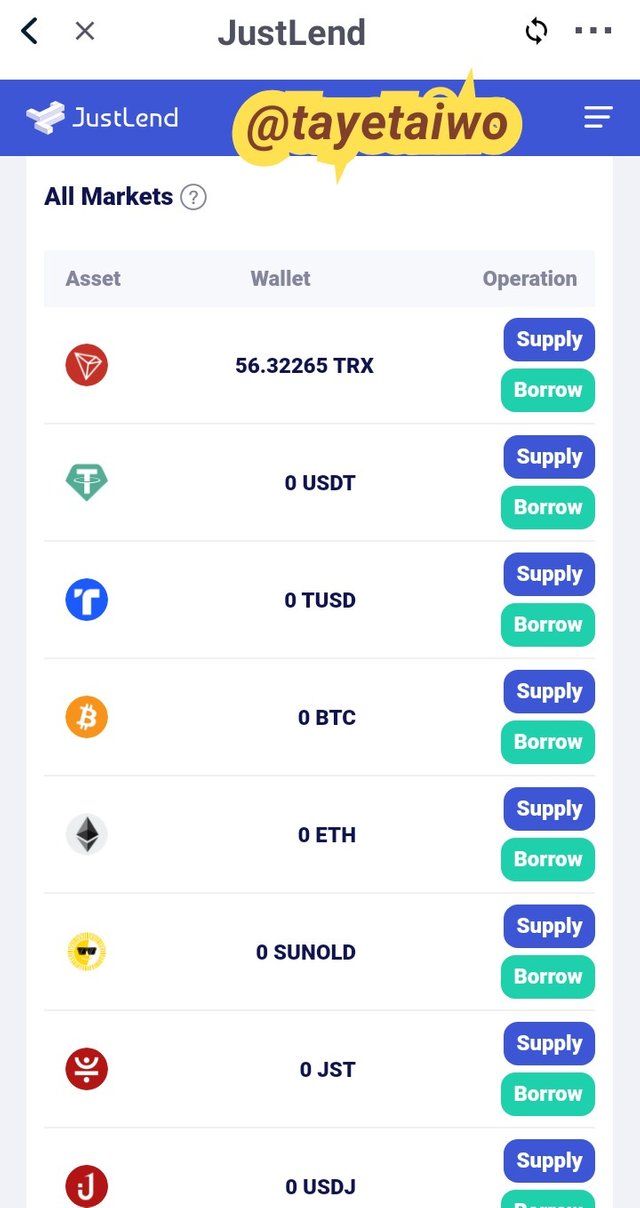

JustLend is yet another Tron based project, the platform is built on the Tron blockchain, it allow users to do two things

This platform can be accessed by visiting the official website and connecting your Tron wallet to it

I will illustrate how to access JustLend on my Tronlink wallet app.

Supply: in this section an individual or group of individuals can supply (stake) their tokens and earn a certain amount of interest at APY and APR, which is paid directly to their wallet.

Borrow: just like the normal lending platform, an individual or group of individuals can easily borrow the Tron network token of their choice and pay back with certain Interest calculated at APY or APR.

Supply and Borrow Section

Supply and Borrow Section

Risk Involved In DeFi

Smart Contract Risk:Knowing fully that DeFi's operations are controlled by smart contracts, and that these smart contracts are based on pre-programmed code. If there was a little flaw in the code, not to mention the fact that the smart contracts are vulnerable to hacking this can make the users could lose their funds.

Liquidity: DeFi platforms are still relatively unknown. As a result, there is a liquidity problem from time to time, and a user who wishes to trade a huge amount of funds may have problems doing so.

Price Volatility: Understanding the fact that we are dealing with cryptocurrency here, price volatility is very common, I have seen a situation of 100% price change in a single day. For instance, you bought a token when the price was very high and you supply it to earn interest then the price decreases massively, and you decided to withdraw your token, then you nke realised that even the interest earned didn't cover up your loss.

Lost of password/key in DeFi there is nothing like reset password has we usaully see in the centralized system whereby a user can reset his/her password if it got lost. But here on DeFi if a user lost his/her password then the funds are lost as well.

High Transaction fees: The Ethereum network has the most DeFi products, despite the fact that the Ethereum network's transaction fees (gas price) are quite high. However, if you choose networks with minimal transaction fees, such as Tron or BSC, you won't have to worry about paying huge transaction fees.

Security risk A centralized system is governed by a central authority, and if a security breach occurs and customer funds are stolen, the funds are always insured, and the consumer can still access them. However, in DeFi, if a security breach occurs and funds are stolen, the customer's funds cannot be returned because there is no central authority.

What is Yield Farming?

Yield farming is another way for DeFi users to supplement their income by locking their assets in the liquidity pool and earn some interest on them for a period of time.

Users that have their assets locked up in the liquidity pool earn passive income from exchange fees based on the APY/APR and the type of asset locked.

The assets locked up in Yield farming are also used for lending to other users, and the suppliers of these assets are rewarded depending on the APY/APR of the pool. Users earn more from their assets through Yield farming, which is superior to letting the asset remain unused in their crypto wallet.

How does Yield Farming Work?

As previously stated, Yield farming begins with a user locking a certain amount of tokens into a pool, also known as liquidity providers, and then receiving a certain amount of income from the pool's borrower of these token's trading fees. The liquidity offered is needed to complete transactions between buyers and sellers on the Decentralized exchange, as well as by the technology used to quote prices on decentralized exchanges, AMM (Automated Market Maker)

In one sentences, a user provide liquidity to the liquidity pool and the LP (liquidity pool token) is then stake at the farm to earn some certain percentage interest from the trading fees at APY/APR depending on the token provided.

For instance, a user provide a liquidity on Binance smart chain using the PancakeSwap, the user will need to supply a Binance smart chain token to the liquidity pool, then he can enable farming on the LP, this will allow the user to earn some certain Interest from farming on PancakeSwap.

What Are the best Yield Farming Platforms and why they are best.

Decentralized application platforms have grown in popularity as a result of the development of decentralized applications. Today, "Yield Farming" can be done on a variety of platforms.

Yield Farming systems provide a variety of opportunities and return rates. Some Yield Farming platforms are better for big investors, while others are better for small investors. I will discuss two platforms that offer Yield farming and why they are the best

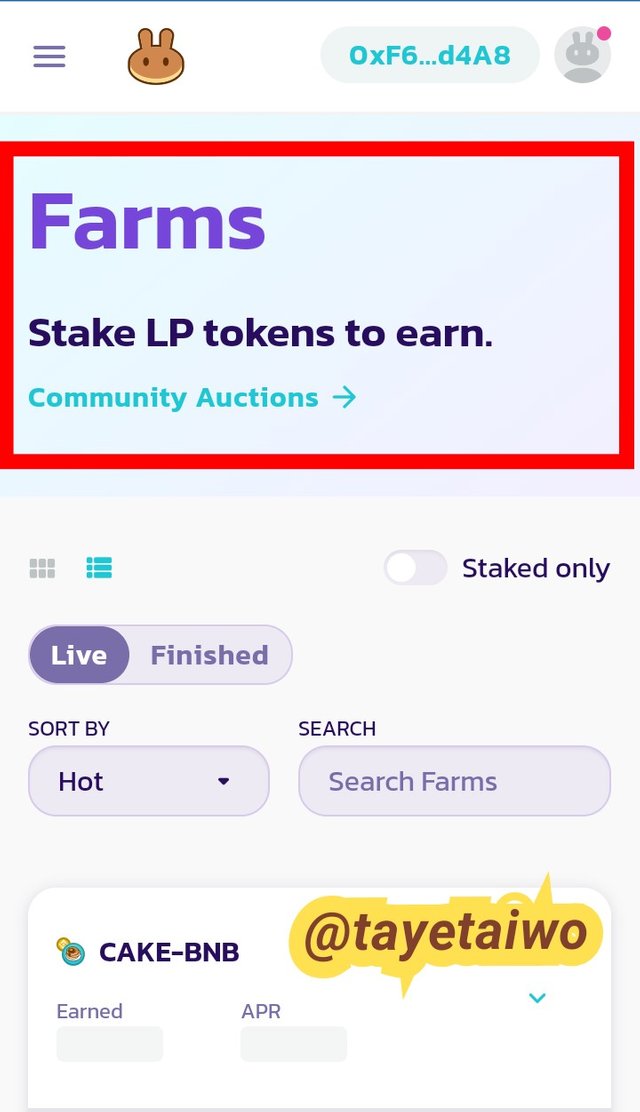

PancakeSwap

PancakeSwap is a decentralized exchange based on the Binance Smart Chain, launched in 2020 and is currently taking the spotlight in the Crypto world. The platform allows users to buy, sell, and swap BSC (BEP-20) token for other BSC (BEP-20). Just like all the decentralized exchange, PancakesSwap uses the Automated Market Maker (AMM) tool, which ensures automated quoting of prices in the liquidity pool and trades done directly with the pool without middlemen.

Furthermore, PancakeSwap allow users to provide liquidity in several pools, and in return the liquidity provider earn passive income at APY or APR.

PancakeSwap's native token is CAKE, is currently valued at $13.95 and ranked #32 in terms of market capitalization at the time of writing this homework task.

Why PancakesSwap is one of the Best

PancakeSwap appears to be a little more reliable in terms of synchronization with other wallets like as Trust-wallets, Binance chain wallets, Metamask wallets and so on. PancakeSwap is well-known for its quick and cost-effective services, which are superior to those offered by other Ethereum-based decentralized exchanges. One of the drawbacks of PancakeSwap is possibility of impermanent loss.

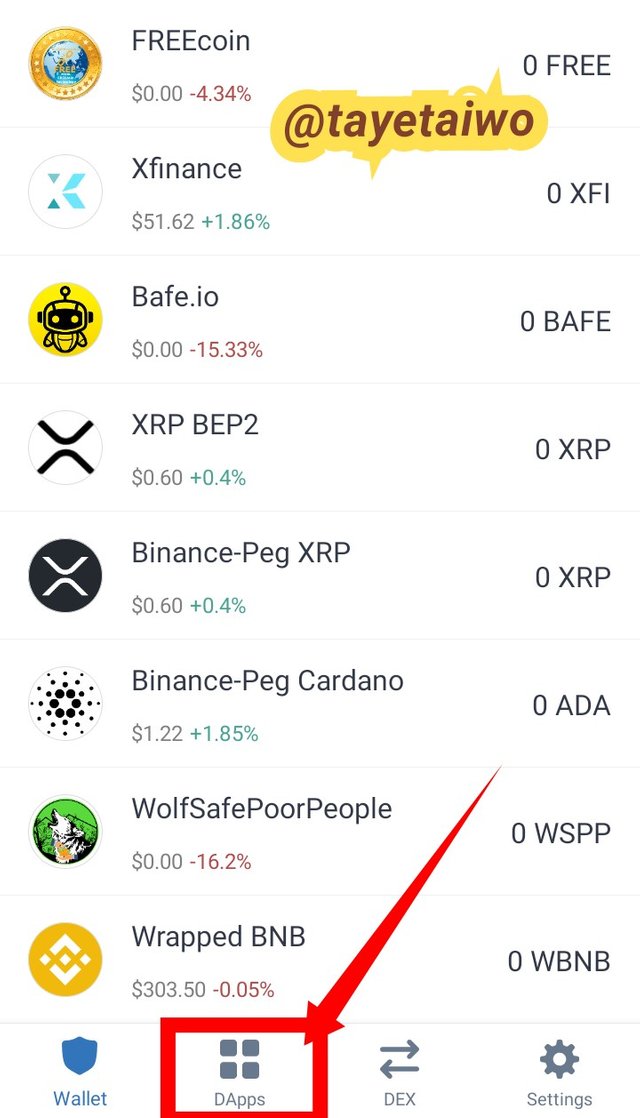

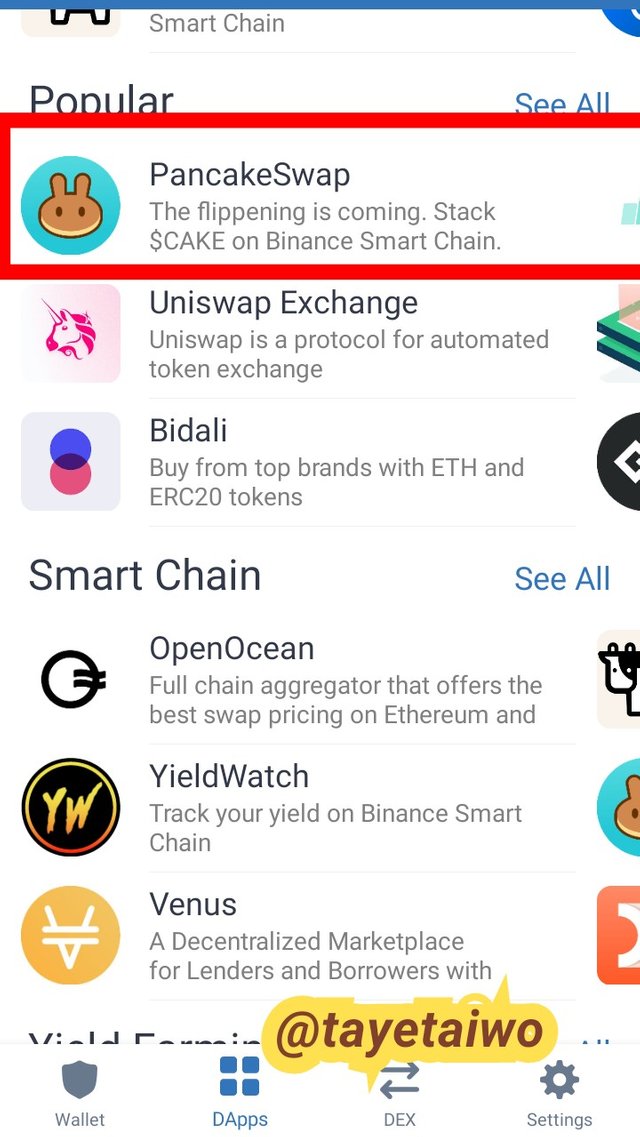

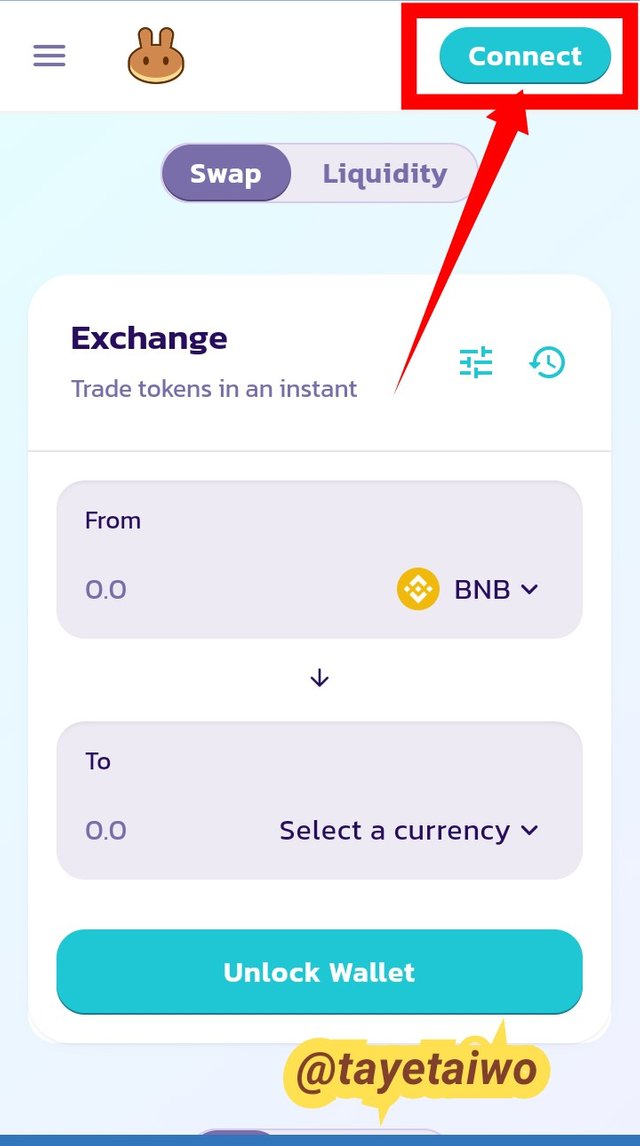

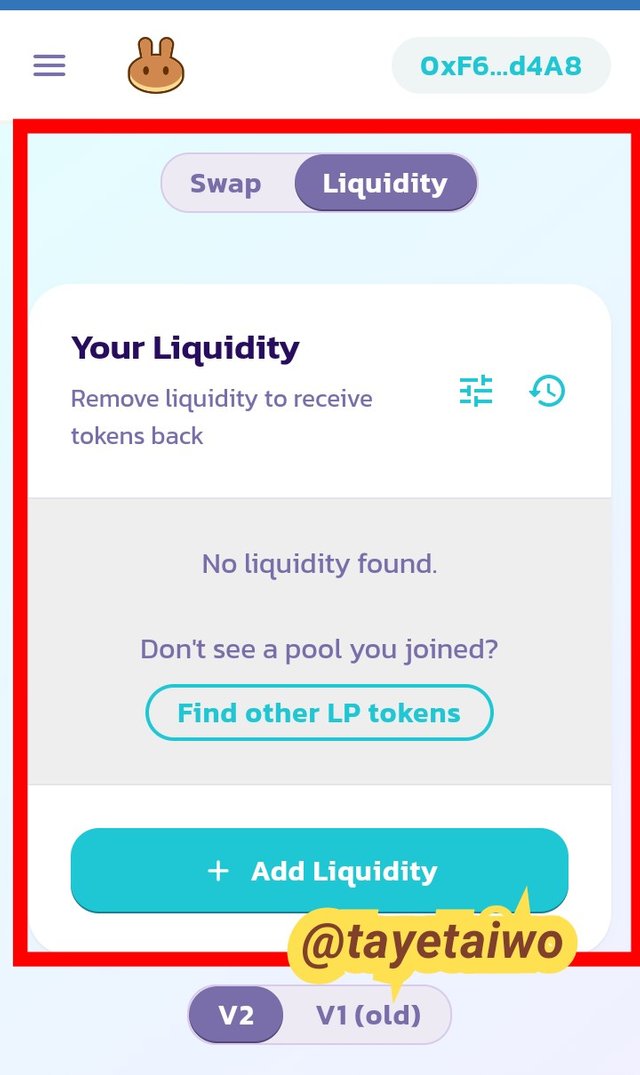

How to Access PancakeSwap

In this illustration I will be making use of my Trust wallet app

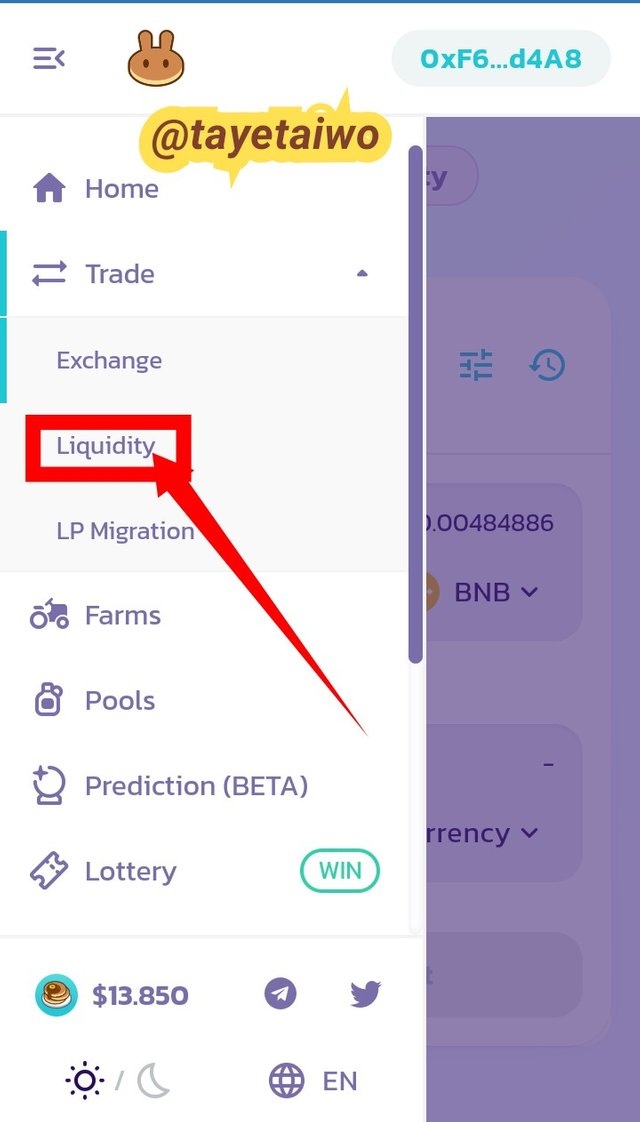

You can supply your token to provide liquidity to the pool as well as enable farming on the PancakeSwap site.

- To provide liquidity, select "Liquidity", click on add liquidity and select the two tokens and enter the amount. Click on Supply to complete the transaction

|  |

|---|

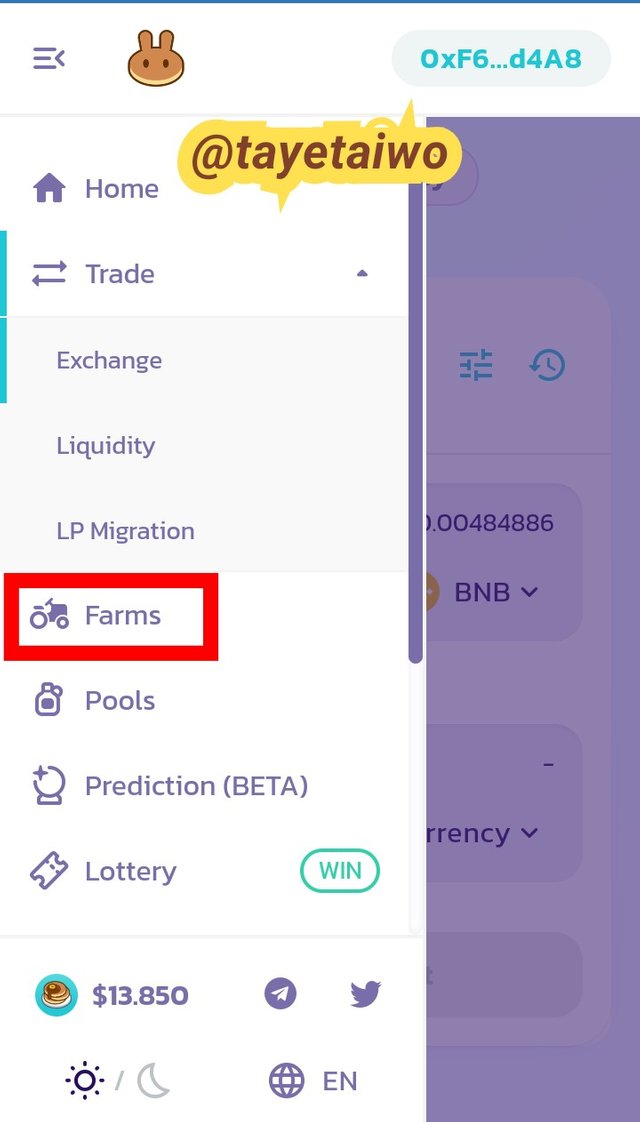

- To Enable farming, click on the "Menu", locate "Farm" then enable it by staking your LP.

UniSwap

UniSwap is an automated market maker (AMM) that was developed in 2018, but has gained traction as a result of the recent decentralized phenomenon and increasing token trading.

UniSwap is a decentralized exchange based on the Ethereum blockchain, the platform allows ERC-20 tokens to be traded. Liquidity providers must deposit the equivalent of two tokens to start a market. Traders can then trade using this pool of liquidity. As an incentive for supplying liquidity, liquidity providers are paid a commission on trades that take place in the pool. UniSwap has become one of the most popular token exchange platforms due to its ease of use. This platform has the potential to be a huge help in terms of yield farming.

UniSwap native token is UNI, currently valued at $18.19 and ranked #11 in term of market capitalization.

Why UniSwap is one of the best

UniSwap is a popular exchange among users since it was one of the first to offer Yield farming, and the market trading volume is relatively high that most of the DEX platforms. Because of its high volume, many users prefer it. When compared to other Yield Farming sites, the APY/APR rates are very great.

Being a part of the Ethereum network instills confidence in its users. Users have taken notice of its support from Ethereum developers. As a result, many users are significantly involved in Yield Farming, as well as staking and exchange operations. It is one of the greatest decentralized exchanges.

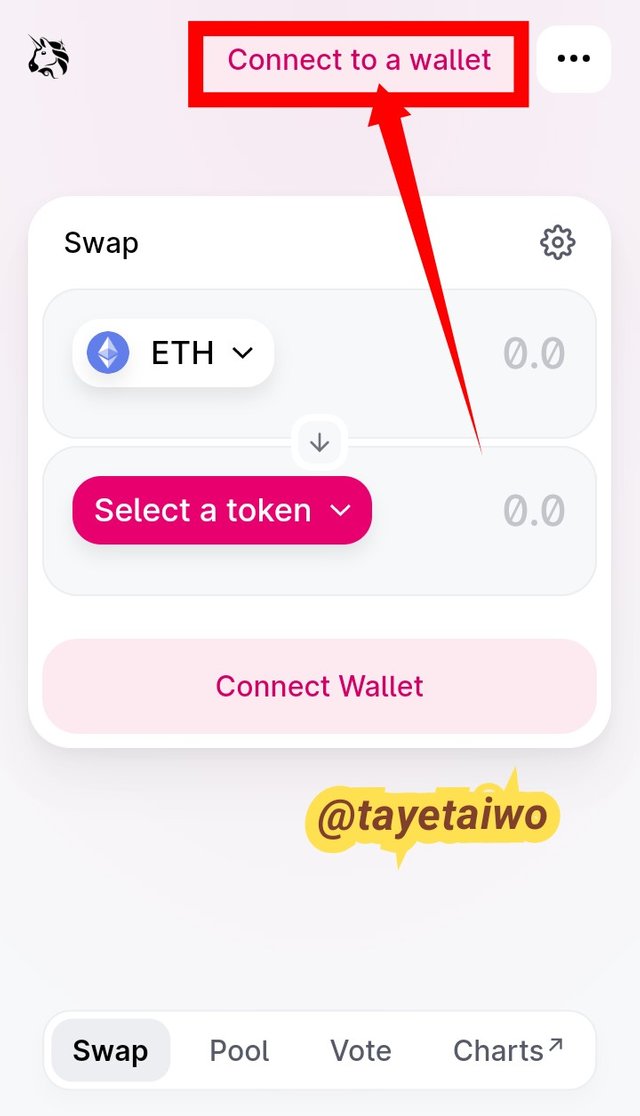

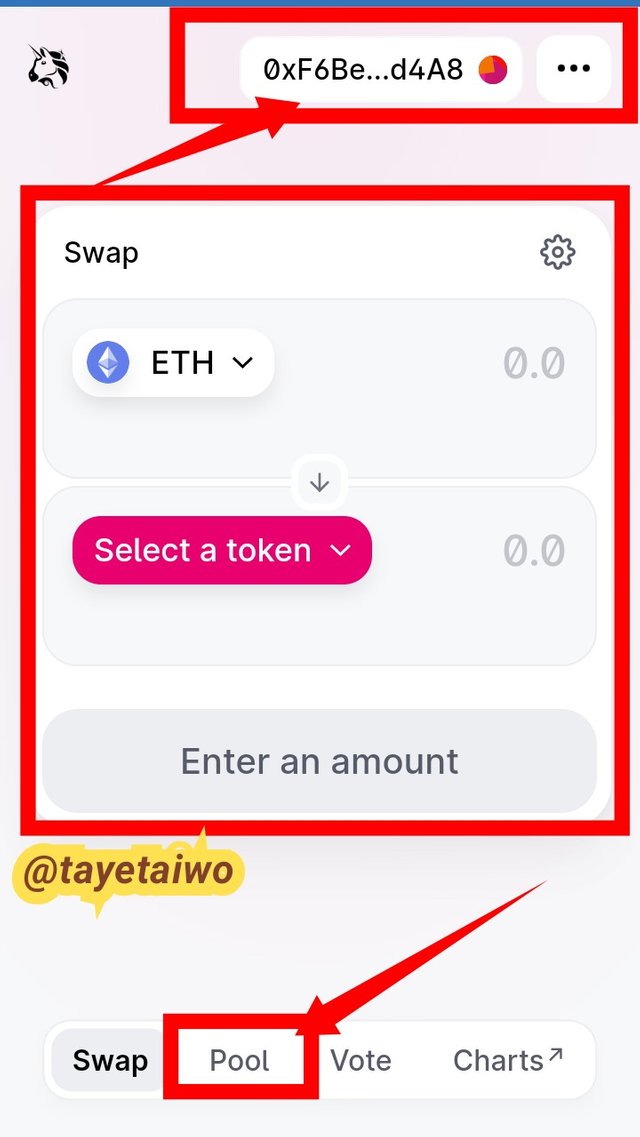

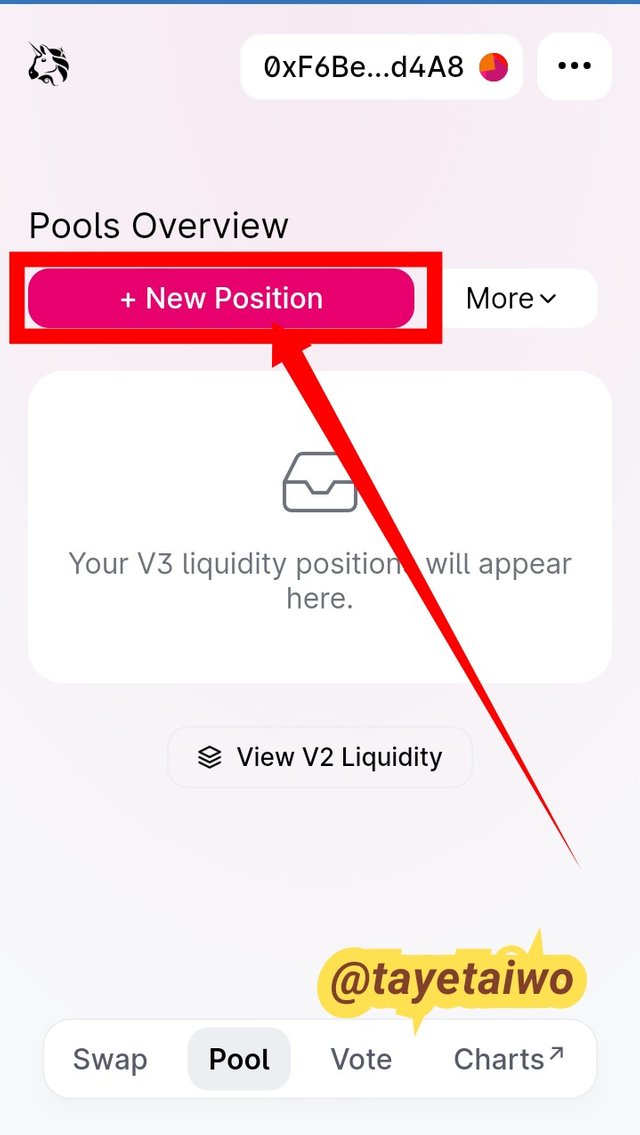

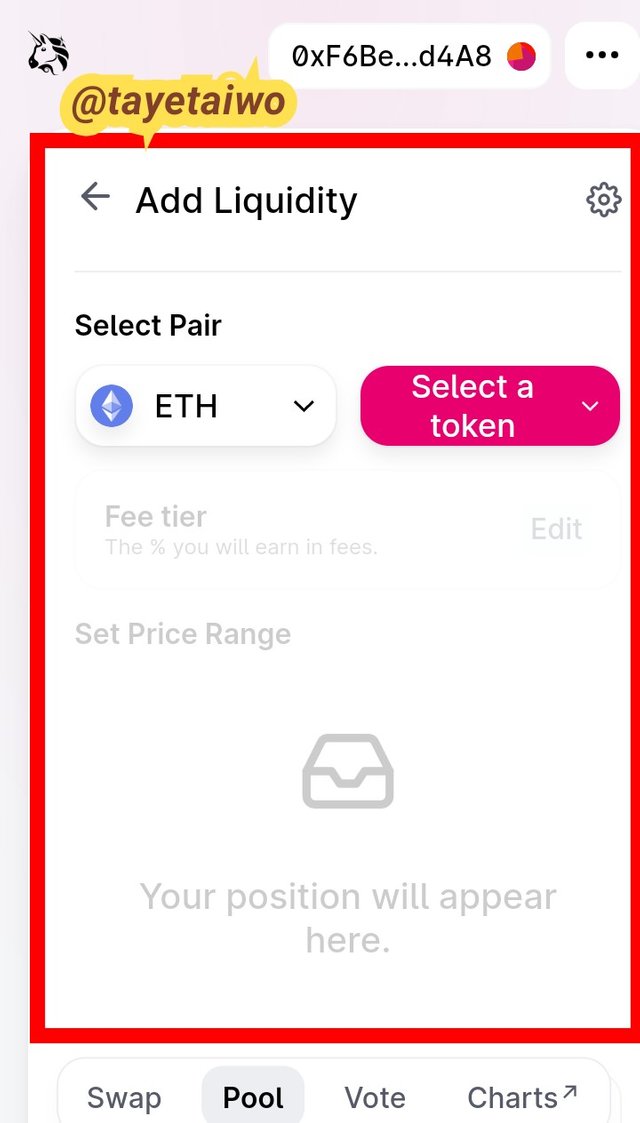

How to Access PancakeSwap

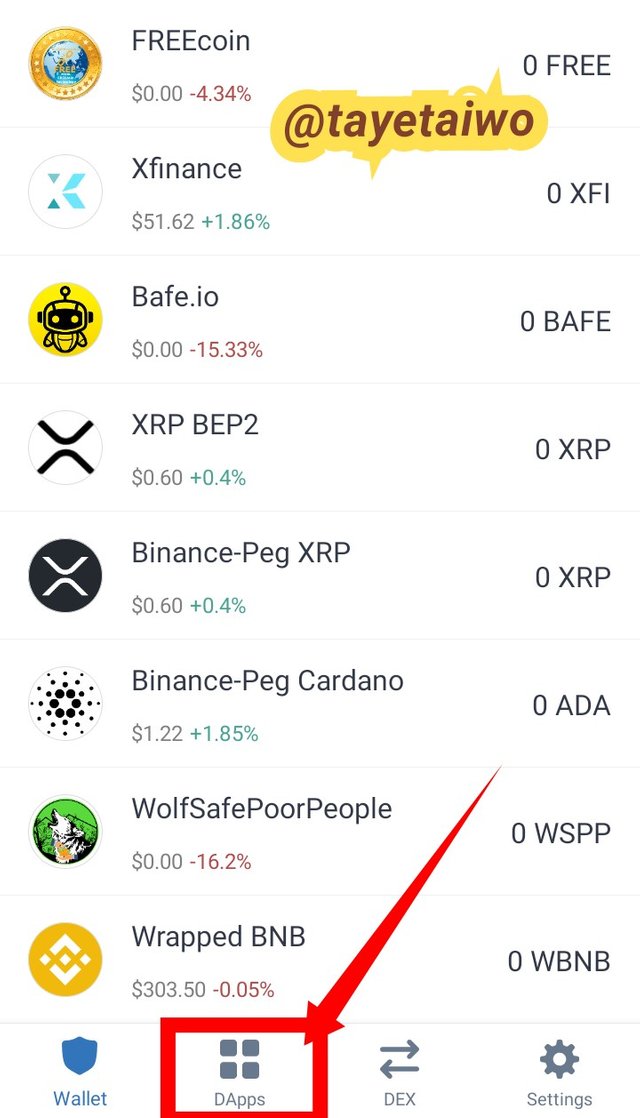

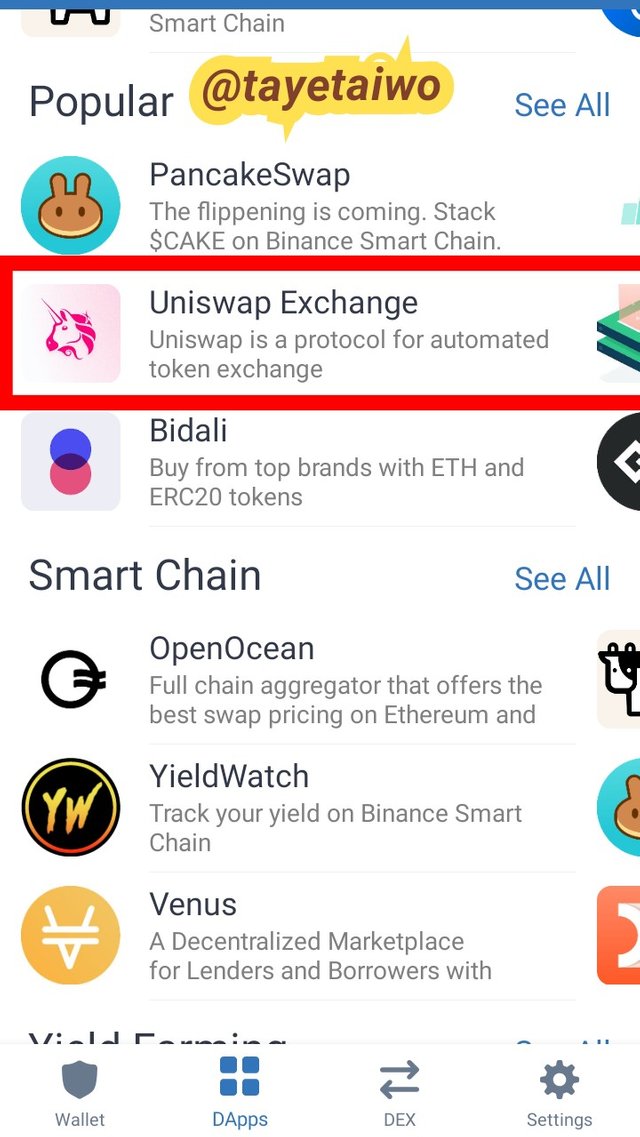

In this illustration I will be making use of my Trust wallet app;

|  |

|---|

The Calculation method in Yield Farming Returns.

There are two methods for calculating yield farming returns.

Annual Percentage Rate (APR)

APR stands for annual percentage rate of return without compounding the interest earned; it is usually imposed on borrowers but paid to supplier based on their investments.

Annual Percentage Rate Calculation

Let take for instance, I staked $100 worth of Cake at a 100% APR.

APR= 100

Initial investment = $100 worth of Cake

100/100 X $100 = $1000

That is my APR is $100...

As a result, my initial investment ($100) plus my APR ($100) will total $200 at the end of the year.

Annual Percentage Yield (APY)

APR stands for the Annual Percentage Yield

this simple means the annual rate of return and this time compounding the interest earned. This is the most big difference between APR and APY.

Annual Percentage Yield Calculation

This is calculated using this formula

Where;

r stands for the interest rate

n stands for the period

Let me make use of the example I used for APR, supposed I staked $100 worth of Cake at 100% APY for 1 year (365 days)

Using the formula for calculating APY = (1 + r/n)n - 1

r will be 100/100 = 1

And n will be 365

Therefore,

(1 + 1/356)365 - 1,

(1 + 0.0027397)365 - 1,

(1.0027397)365 - 1,

(2.7145) - 1 = 1.71454

Therefore, the APY will be 1.7145 X $100 = $171.454

That is my total Investment after a year would be my initial investment ($100) + APY ($171.45)

Advantages & Disadvantages Of Yield Farming.

Farming Yield offers a lot of advantages and as well as disadvantages.

Advantages of Yield farming

The most tangible advantage of Yield Farming is that it generates passive income. Rather than holding the unused token in your wallet, you may use Yield farming to make some income out of the unused tokens.

To access Yield Farming platforms user does not need any KYC verification or any documentation. Users can easily access the platform from anywhere as long as there are internet connection.

- Users have a say in governance on Yield Farming platforms, and holders of liquidity tokens are deemed to have the privilege of engaging in governance and issues relating to any changes or advances in the ecosystem.

Disadvantages of Yield Farming

- One of the main disadvantage of Yield farming is the price fluctuation. If you purchased a token at a high price during the bull run and need to withdraw during the bear run, you are likely to lose some of your investment.

- Knowing that many of the Yield farming Dapps are Ethereum-based and that the transaction fee (gas fee) on the Ethereum blockchain is quite high. You will have to pay some huge amount of transaction fee if you do Yield Farming on sites built on the Ethereum network.

- The yield farming smart contracts are vulnerable to attack, and because the network is decentralized, there is no insurance of funds. Users risk losing their assets if they are attacked.

Conclusion

Decentralized finance (DeFi) has made our crypto world a more pleasant place to transact by eliminating the need for a middleman and, of course, enhancing transaction speed by eliminating the delays that might arise when waiting for permission, as seen in centralized finance. Furthermore, it allows users from all around the world to transact without having to verify their identities. Yield farming, on the other hand, is a new passive income source for DeFi users who want to maximize their earnings by putting their funds in a liquidity pool and earning money from trading fees paid by the liquidity's borrowers.

Thanks to professor @sapwood for this amazing lecture

Cc: @sapwood

Hi @tayetaiwo

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit