Without wasting much of our time, let me quickly proceed with the given tasks.

QUESTION 1

In other to well explain the Support and Resistance zones, I will be taking them one after the other by starting with the Support zone.

The Support zone is an area on the price chart which indicates the strong effect of buyers. This effect keeps the price from going down further and it is repeated severally in a particular area.

The area of repetition is what is regarded as the support area and it is usually identified on different timeframes.

The Support zone also helps traders to identify possible bearish-to-bullish price reversals and when a support zone is broken, it, in turn, turns into a Resistance zone.

- Screenshot

From the above screenshot, it is clear that the support zone is not a straight line but a zone or area that keeps the sellers from taking the price further down.

At the support region, the sellers in the market begin to get exhausted because they expect the price to reverse as it did previously. This mindset (psychology) is what leaves the market in control of buyers who pushes the price upwards.

In addition, when a previous resistance area is broken, it, in turn, becomes a support area for the new price formed.

- Screenshot

The Resistance zone is the same but opposite to the Support zone. This is an area on the price chart which portrays the effect of sellers in preventing the price of an asset from moving further up and this action of sellers is repeated severally at the same region.

This repetition is due to traders' psychology which makes them believe that history tends to repeat itself and this, in turn, makes them sell off once the price approaches an area at which it reversed previously.

This tremendous sell-off leaves the market with more sellers than buyers and this, in turn, leads to a drop in asset value.

- Screenshot

In addition, when major support is broken due to certain factors which could be either fundamental or sentimental. When this happens, the just broken support tends to turn to resistance for the new price.

- Screenshot

QUESTION 2

We have already looked at the basics of Support and Resistance. Now we will be looking at the different types of Support and Resistance and they include;

Horizontal Support and Resistance

Sloping levels of Support and Resistance

Dynamic Support and Resistance

The Horizontal Support and Resistance is the type of Support and Resistance used in explaining support and resistance in question one.

This is the most common type of support and resistance level and it is formed horizontally.

The horizontal support and resistance levels are horizontal zones or areas at which the price of an asset finds it difficult to either move past during an uptrend or downtrend.

These areas are tested repeatedly with the price keep reversing and the more time it is tested, the weaker it gets.

When horizontal support gets broken, it tends to serve as resistance and when the resistance gets broken, it tends to serve as a support.

- Screenshot

This type of support and resistance is usually formed during trending markets be it uptrend or downtrend.

During an up-trending market, the price tends to form a high and when reversed will form support of which the price would retest on but on a higher level. The repetition of this leads to the formation of a higher high with the price maintaining its support level.

- Screenshot

The same thing applies to a down-trending market. The price tends to form low and when reversed will form a resistance of which the price would retest on but on a lower level. The repetition of this leads to the formation of a lower low with the price maintaining its resistance level.

- Screenshot

The Dynamic Support and Resistance is a type of support and resistance which is different from Horizontal and Slopping levels in the sense that it is not identified using trendlines but usually with the use of trend-based technical indicators such as moving average, SuperTrend, etc.

These indicators especially the moving average helps traders to identify these dynamic support and resistance levels by trending close or farther away from the price chart. Let me explain further using the moving average indicator.

The moving average indicator is a trend-based indicator that is used in identifying trend direction by either trending below or above the price chart. When the indicator trends above the price chart, it indicates a downtrend and when it trends below the price chart, it indicates an uptrend.

During either of these trend movements, the indicator tends to serve as dynamic support or resistance by allowing the price to reverse once it bounces above or below it. This allows traders to also take a sell position because a breakout on the indicator serves as a signal for trend reversal.

- Screenshot

QUESTION 3

Breakout is a term used to describe price movement over a resistance zone or below the support area. This resistance area could be in form of a horizontal resistance/support, slopping resistance/support, or dynamic resistance/support.

A breakout helps traders in identifying entries in the market as it shows the strong effect of buyers and sellers on the market. This momentum always tends to carry the price along the breakout direction for a certain period of time before a reversal or pullback is expected.

Nevertheless, not all breakouts are successful as some of them are false usually initiated by strong hands (whales) in the market in other to gain liquidity by trapping the weak hands (retail traders).

- Screenshot

The above screenshots show false breakouts of which price acted as though it is breaking through the support before reversing back to continue its normal trend before an actual breakout which causes trend reversal to take place.

QUESTION 4

In this section, I will be identifying an entry point using the breakout strategy in combination with Volume and RSI Indicator.

Using an ETH|USDT chart on the Tradingview App, I observed that the price is on a bearish movement due to the position of the EMA which is above the price chart.

After identifying the price direction which will aid me not to counter trade (trading against the trend), I added my RSI Indicator and observed a breakout through its middle line from the upside which indicates a strong bearish movement.

I also observed the volume and saw that it's higher at this same point of a bearish breakout through the EMA and RSI middle band. This served as confluence thereby making it a good point for a bearish entry.

- Screenshot

QUESTION 5

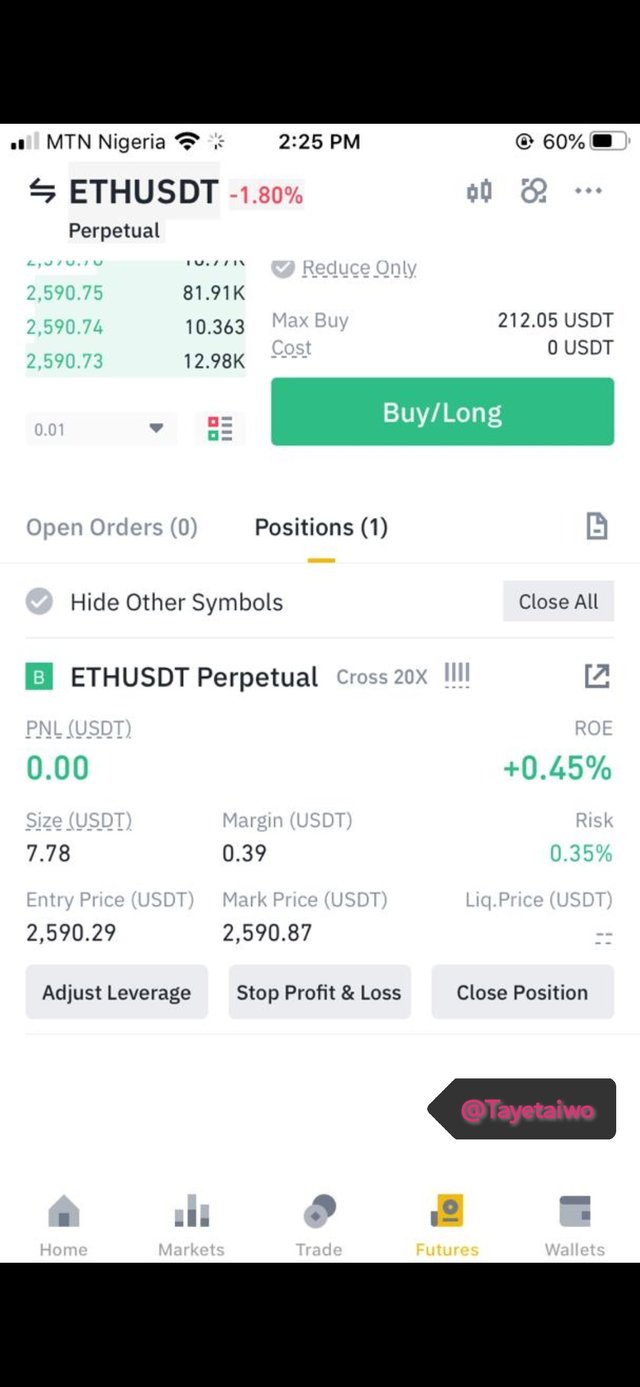

(transaction screenshot required).

In this section, I will be performing a real trade using the breakout strategy on any cryptocurrency pair.

I will be performing the analysis on ETH|USDT pair on a 15m time frame.

I first added a 100 EMA on the price chart. This is to properly identify the trend direction in other to avoid counter trading (trading against the trend).

The EMA just as other trend based indicators also serve to identify the dynamic support and resistance area on the price chart.

When the price breaks below the EMA, it indicates a bearish price movement and when it breaks above the EMA, it indicates a bullish price movement.

I also added the an RSI Indicator which will serve as a signal filter by providing confluence during analysis before I take any position.

- Screenshot

From the above screenshot, we can see that the pride breaks below the EMA indicating a bearish price movement and at the same time, the price breaks below the horizontal support after testing it severally.

Observing the RSI indicator to be below its mid-point which shows a bearish movement, made me a sell position.

- Screenshot

QUESTION 6

The support and resistance technique is the basis for technical analysis and its use in identifying market trend reversals and continuations have been proven effective though not 100 percent efficient because humans ain't perfect and neither will their activities be.

The lack of efficiency of the support and resistance strategy is due to the false breakout which occurs leaving traders in loss after falling for the fake signal it gives.

A false breakout occurs when the price refuses to continue in a new trend immediately after a breakout but reverses and continues in its initial direction. This effect misleads a trader into initiating a buy or sell order in the direction of the false breakout with a mind that an actual breakout has occurred.

- Screenshot

The above screenshot shows a bullish false breakout above the EMA, the midpoint of RSI, and at the same time an increase in bullish volume. This false breakout is a result of the strong hands manipulating the market thereby trapping retailers and liquidating their positions.

Not long after the price falsely breakouts out, it reverses and continues in its actual direction before maybe initiating an actual breakout.

CONCLUSION

The support and resistance strategy is the basis of technical analysis. It allows a trader to know and understand the struggle between buyers and sellers in being in control of the market.

In as much as the support and resistance strategy is highly good, it is always best to combine it with other trading strategies in other to maximize profit and minimize loss.