ETHEREUM CLASSIC

The Ethereum classic which was launched on July 2016 is a hard fork of Ethereum which is aimed at providing smart contract activities and at the same time allow the development of decentralized applications on its network.

The Ethereum classic network operates on Proof-of-Work consensus mechanism and rewards miners with its native token (ETC) on each successful mining.

Unlike the Ethereum (Eth) the ETC has no future plans of migrating to Proof-of-Stake algorithm but are more focused on improving its scalability through other means.

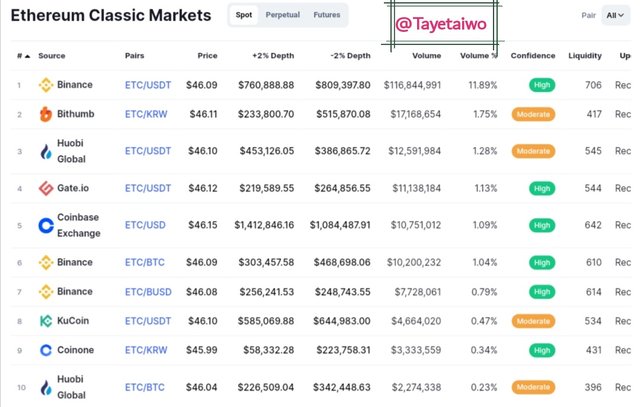

EXCHANGES

Below are some of the exchanges on which the ETC token can be traded.

- Screenshot

TECHNICAL TEAM

Some important information regarding the Ethereum classic project is seen below

- Screenshot

My optimism about the ETC token came as a result of the technical analysis which I carried out on its pair with USD.

The analysis gave out good signals which made me take a position.

My analysis on the ETC|USD pair started on a 1hr time frame where I observed the price to be at just broken support now serving as resistance.

There I also observed the price to just have broken above the EMA which serves as dynamic support and also portrays price direction be trending above the price chart.

- Screenshot

After the above observation on the 1hr timeframe, I switched as usual to a 15mins time frame in other to take a closer look at the pair and if possible find a good entry.

On the 15mins timeframe, I also observed the price to be having a retest on a resistance zone which is a good point to take a sell position.

I didn't rush into making an entry, I moved to observe the position of the stochastic indicator which is serving as a signal filter in other for me to avoid falling for a fakeout or false reversal.

The Stochastic Oscillator Indicator was found to be at an overbought region thus signaling a possible bullish-to-bearish price pullback or reversal.

In addition to the signal provided by the stochastic and the fact that the price is currently at a resistance zone, I observed the change in market structure with the price moving from forming a lower high to forming a lower low which indicates that buyers are getting exhausted and bearish movement is expected.

After the above analysis, I waited for a new candle to form and close below its open (bearish candle) in other to further confirm the expected reversal. As soon as that was spotted, I took a sell position.

- Screenshot

- EXIT

My exit was taken into proper consideration of the support and resistance with my stop-loss set just after the current resistance and my take-profit set at the closest support thus giving a risk to reward ratio of 1:1.

- Result

No, I do not intend to hold for a long time because I am not a swing trader nor did I enter the market for investment purposes.

I only enter as an intraday trader and exit as soon as I scalp profit by obeying my set exit rules as seen in the above question.

I do not recommend it to anyone because the cryptocurrency market is volatile and as such risky.

Therefore, anyone who wants to either invest, buy or sell should carry out their research properly and invest what they can afford to lose.

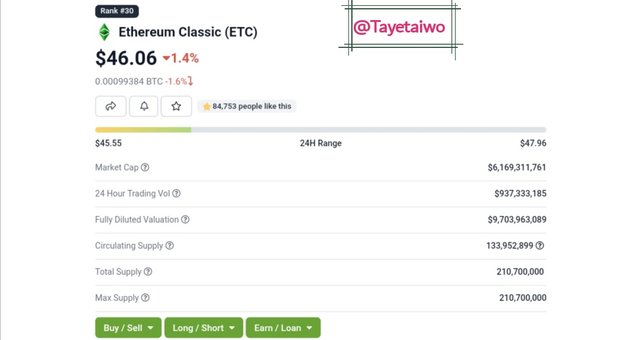

I will be adding some useful information regarding Ethereum classic

| MARKET CAP | $6,182,582,186 |

|---|---|

| CIRCULATING SUPPLY | 133,952,165.02 ETC |

| TOTAL SUPPLY | 210,700,000 |

| CONTRACT ADDRESS | 0x3d6545b08693dae087e957cb1180ee38b9e3c25e |

| CURRENT PRICE | $46.16 |

| COIN MARKETCAP RANK | 29 |

Thanks for reading

CC,

@fredquantum