Question (1)

1- Define VuManChu Cipher B Indicator in your own words.

As a new trader people advised me to make use of various charting platforms when I began to analyse trade, but quickly enough I noticed that they requested a paid subscription when a user wants to make use of 3 or more indicators for a particular chart display. This hindered me a lot because I was not able to use multiple indicators at once as I wished, this was the case till I was introduced to the VuManchu Cipher B indicator.

The VuManchu Cipher B is a combination of the relative strength index (RSI) indicator, the Market volume indicator, the money flow indicator, and momentum indicator, etc. This means that the indicator can output data on various signals based on what the trader is looking for, but with these various indications imbibed into one comes complexities which are most notable with its settings or modification.

The indicator is made up of different wavy lines that indicate the amount of volume traded and also the inflow and outflow of money within the asset. Also, the VuManchu Cipher B has some red and green dots that are used to identify when the market is bearish or bullish.

Question (2)

How to customize the VuManChu Cipher B Indicator according to our requirements? (Screenshots required)

Before I begin to show how to customize I would like to illustrate how to set up the indicator on a chart display using screenshots and illustrations.

The first step is to visit a charting platform, and for this Task, I will be using the Trading View

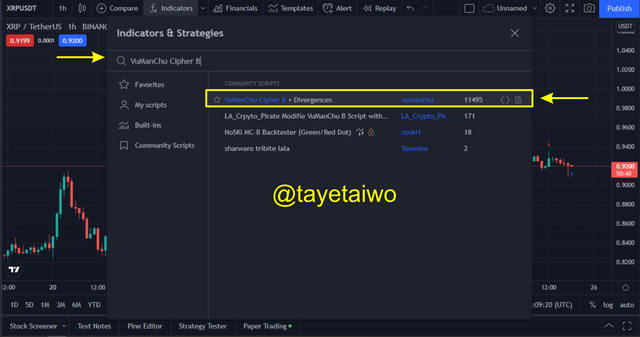

The next step is to open the chart display and click on the Indicator Icon, this will pop up an infobox that contains details of all the indicators in the platform.

- The next step is to search for the VuManChu Cipher B indicator, When I found it I clicked on it, thereby making the indicator appear below the price action display.

- Below is how the VuManChu Cipher B looks like over a chart display.

How to Customizing VuManchu Cipher B indicator

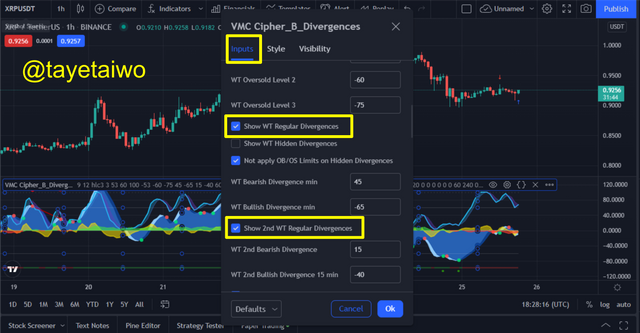

- To customize the VuManchu Cipher B indicator, first click on the settings icon on the down left corner, this will make the indicator configuration tab pop up.

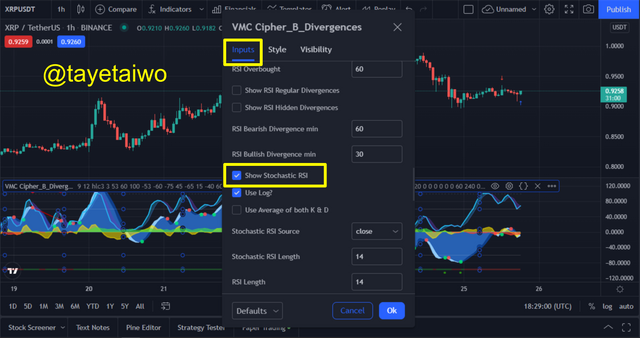

- To customize the indicator to our settings I will be eliminating so indicator options available within the Input interface, they include 2nd WT Regular Divergences, WT Regular Divergences, and Stochastic RSI, to do this I will have to untick these options on the interface.

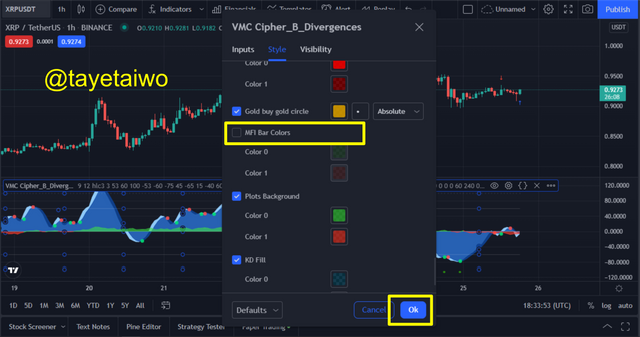

- After eliminating these indicators that are not useful, the next step is to move to the Style interface, this is where the appearance of the indicator can be modified. To modify the indicator further I will be removing the VWAP(volume-weighted average price) indicator by unticking the box.

- The next step is to remove the MFI Bar colour. This Bar colour scheme is of no use to our trading strategy, therefore I will be removing it by unticking its box. After this, I then clicked on the OK tab to validate these changes or modifications.

The image above shows a much observable chart, with a clean data representation due to the modifications carried out, which is a far cry from the initial default settings.

Question (3)

Explain the appearance of the VuManChu Cipher B Indicator through screenshots. (You should Highlight each important part of this indicator by explaining their purpose)

The first thing to highlight here is the Wave trend indicator. This indicator can be identified by two lines which are made of light and Dark blue wavy lines which oscillate above and below the mid or zero line.

These lines can signal a change in trend and can also confirm the emergence of a new trend when they make cross overs, these cross over indications is further verified by either a red or green dot which signifies a Bearish or Bullish trend emergency respectively.

The next indicator to take note of is the Money Flow, this can be identified by the wavy green and red lines. The green wavy line that moves above the zero line indicates the inflow of capital into the asset, while the red wavy line that moves below the zero lone signifies the outflow of capital from the asset. This is very helpful for traders to know when to pull out their investment from a particular asset due to a lack of interest from other investors.

Question (4)

Demonstrate your preparation for the Trading Strategy combining other indicators. (Instead of showing the addition of indicators to the chart, you should explain the purpose of each indicator for this trading strategy.)

For this task, I will be making use of the EMA combination with the VuManChu Cipher B indicator.

Two EMA will be used for the strategy, one will be a 50period while the other will be a 200 period. The crossing of the EMA is said to generate signals for either a Bearish or Bullish Trend.

For a Bearish trend to occur the 50 day period EMA will have to cross below the 200 day period EMA, while for a Bullish trend to be signalled the 50 day period of the EMA has to cross above the 200 day period EMA.

Therefore the merging of these two indicators is to help for trend confirmation because the EMA cross will help filter the noise caused by the red and green dots of the VuManChu Cipher B indicator.

The image above, shows the cross over of the 50 day period of the EMA above the 200 day period, this signifies an emergence of a Bullish trend, this indication was confirmed by the VuManChu Cipher B indicator when the wavy green lines of the MFI started to appear signalling the inflow of cash into the LTC/USD pair, also a green dot appeared during this cross over signalling a bullish movement.

Question (5)

Graphically explain how to use VuManChu Cipher B Indicator for Successful Trading. (Screenshots required)

Buy Entry using the VuManChu Cipher B

To execute a trade using the EMA and the VuManChu Cipher B Indicator, you have to make sure that the EMA cross of the 50 day period above the 200 day period has occurred.

The next step is to verify that the VuManChu Cipher B Indicator has indicated a buy signal by the appearance of a green dot, if this occurs, then the verification of the MFI cash inflow as to occur with the appearance of the green wavy line above the zero line.

If all these procedures are in check then a risk ratio of 1:1 should be used for the Take profit and stop loss as the risk management procedure before executing the trade. The illustration below clearly stipulates the identification of the procedures listed above.

Sell Entry using the VuManChu Cipher B

To execute a trade using the EMA and the VuManChu Cipher B Indicator, you have to make sure that the EMA cross of the 50 day period below the 200 day period has occurred.

The next step is to verify that the VuManChu Cipher B Indicator has indicated a sell signal by the appearance of a red dot, if this occurs, then the verification of the MFI cash outflow has to occur with the appearance of the red wavy line below the zero line.

If all these procedures are in check then a risk ratio of 1:1 should be used for the Take profit and stop loss as the risk management procedure before executing the trade. The illustration below clearly stipulates the identification of the procedures listed above.

Question (6)

Using the knowledge gained from previous lessons, do a better Technical Analysis combining this trading Strategy and make a real buy or sell order in a verified exchange. (You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern)

Hello, professor @reddileep please I am unable to carry out this task due to insufficient funds to carry out the trade, I pledge to do better in acquiring funds in the subsequent Homeworks.

Conclusion

The VuManChu Cipher B is a very good indicator for most users who can comprehend its modifications, it is a very good technical tool that can be used to identify trend emergence. The MFI and the Wave trend are very good inbuilt indicators that are used for the identification of both cash inflow and outflow, also it can be used to identify trend reversal and changes.

The merging of the VuManChu Cipher B indicator and the EMA cross strategy is very ideal for a profitable outcome for any trader.

Thank you professor @reddileep for this insightful course, Merry Christmas.