1. Define the concept of Market Making in your own words.

Market Making activities are required for the cryptocurrency space to continue to function successfully, since they are seen to generate Buy and Sell activity. They are liquidity providers who agitate the whole system's purchase and sell orders. They are seen to Submit Bid and Ask Orders in order to provide liquidity to the Exchange Platforms, and they benefit from the Bid requested from their presence throughout the platforms.

Individuals or groups of persons known as market makers buy assets at the best bid and sell them at the best offer in the current market. They can earn on both sides of the financial markets as a result of this.

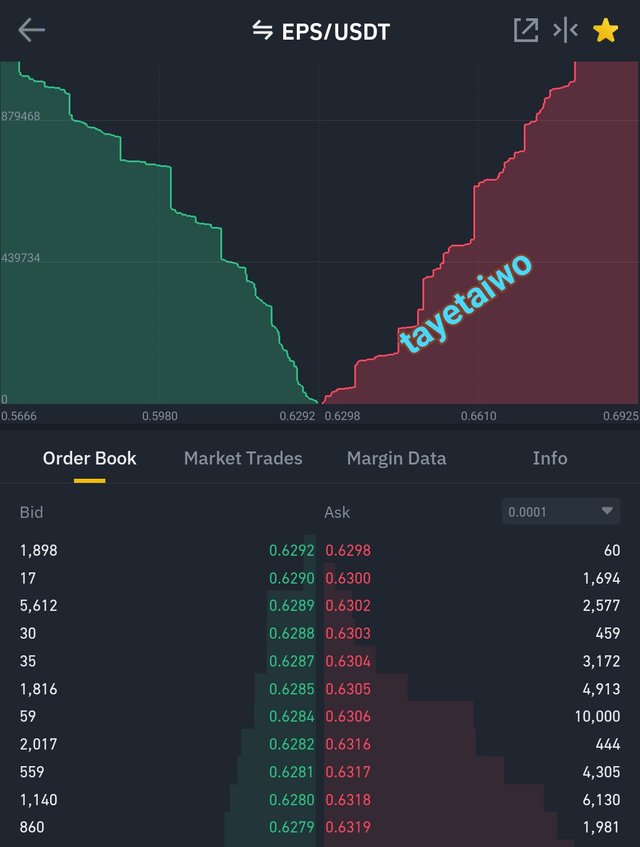

Here's an illustration of how a market maker works. Let's pretend ABC token has a market maker. They may make a bid of $100 $ABC Token for $10.00 and an ask of $200 $ABC Token for $10.05. This indicates they will place a bid (purchase) for 100 shares at $10.00 and will also offer (sell) 200 tokens at $10.05. Other market trader may then purchase (lift the offer) or sell to them (hit the bid) at $10.05 from the Order Book.

The purchase and sales orders that we see in the order book are mostly placed by whales (large investors), who may place a buy and sell order at the same time in order to add liquidity to the asset and therefore start a movement that small investors will quickly follow.

Now, the whales will influence these little investors directly or indirectly, and they will make market orders with prices that are comparable to those that the whales have already begun, so that if the huge investors want anything at a later time, they will be able to get it. If an asset rises in value, they will use all of their methods to make it happen, and all tiny investors will be their followers, ensuring that they achieve their goal.

Small investors often become depressed as a result of the market maker's mentality, which causes them to buy an asset at a price and then sell after a period of low price, forcing them to sell, which is when the whale buys, another asset. Make a purchase when a large volume is observed purchasing an asset in order for it to rise, without realizing that whales will place sales and purchase orders in parallel with price variation to move the asset position according to your interests by manipulating the market and according to their needs.

3. Explain the benefits of Market Maker Concept?

• Constant Pricing Position: Market makers establish a price position that encourages quick trade.

• Relatively Fixed Spread: Traders just have to pay the spread set by market makers; there are no additional costs for buyers or sellers, even during turbulent periods.

• Less Price Manipulation: Market making ensures that asset prices remain relatively stable. Individual traders must work within the boundaries of a market maker's price position.

• Market Dominance: Market making boosts a market's liquidity. It is undeniable, however, that a market with great liquidity would dominate and attract a large number of traders.

4. Explain the disadvantages of Market Maker Concept?

• Unfavorable for High-Volume Traders: The market maker idea favors small traders over big traders since advanced traders suffer larger spread losses than those who deal in smaller amounts.

• Pricing manipulation vulnerability: The market maker idea is extremely sensitive when it comes to price, as market makers are known to manipulate price signals in order to sell liquidity. They will purchase at a cheap price and sell at a greater price in the end.

• Asset Loss: Supply and demand aren't always in sync. This frequently results in an excess of supply relative to demand, and vice versa. In the end, tokens may be lost in any case.

• Wider Bid -Ask Spread: Because of the profits involved, market makers will occasionally widen the spread. Traders will suffer a loss as a result of this.

5. Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

There are several indications that can be employed in the Market Makers idea. For instance;

The Moving Average Indicator

Relative Strength Index RSI

The Moving Average Indicator

The moving average (MA) is a simple tool that can be used in technical analysis to ease out price data by calculating average prices that are updated on a regular basis. This is a critical technical indicator that traders and investors use to smooth out price movements in a market. It aids the trader in filtering out false signals in the market, particularly in short-term market movements.

The average line is calculated over a length of time chosen by the trader, such as 50 days, 200 days, or any other time period.

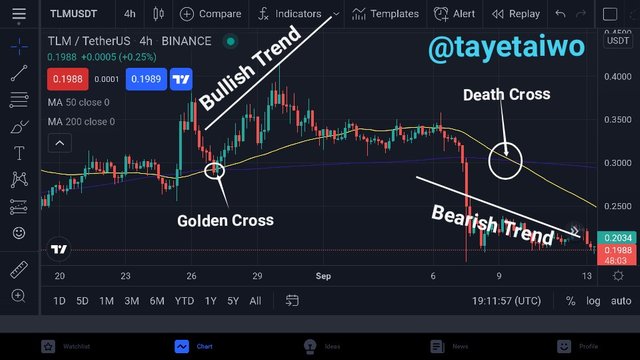

This Indicator consists of two moving line 50-MA the short-term line, and 200-MA the long-term line, the moving average line helps signal Death Cross and Golden Cross. When the long-term line (200-MA) moves across the short-term line (50-MA) then the Death Cross occurs, this usually occurs during an uptrend and signal a trend reversal that is the price of the asset will move from an uptrend to downtrend. While the Golden Cross is said to occur when the short-term line (50-MA) moves across the long-term line (200-MA) thereby the price of the asset will experience a trend reversal from a downtrend to uptrend.

From the screenshoot above, I marked out the Death and Golden Cross. Now let examine the chart, Market Makers may provide more volume into the trade to the point where we see the Golden or Death Cross; this may cause traders to take trading positions as a result of these signals, resulting in an unexpected market reversal trend, resulting in losses for smaller traders.

Relative Strength Index RSI

The Relative Strength Index (RSI) is a leading momentum indicator that identifies possible price trend reversal points. This is based on the rate of change in price, which is displayed on a scale of 0-100. This indicator indicates a shift in the trend's direction; these indications are referred to be overbought and oversold. If the indicator's line is below 30, the market is oversold; this indicates that traders are anticipating a market reversal and are selling aggressively; if the line is beyond 70, the market is overbought; this also Indicate that traders are a anticipating a market reversal and are buying aggressively.

From the Chart above I've also marked the oversold and overbought. Whenever there is an oversold or overbought, the traders or Investors usually anticipate a trend reversal, the Market makers may decided to provide more volume into the trade to the point where we see an overbought or oversold; this may cause traders to take trading positions as a result of these signals, resulting in an unexpected market reversal trend, resulting in losses for smaller traders or Investors.

Conclusion

Market makers are people that are extremely important in the market since they may create markets by providing liquidity and they can also keep asset volatility low. However, there will undoubtedly be losses associated with the Market's offerings, since they will not operate just to fulfill our requests without making a profit.

As traders, we should be well-versed in the mental games used by market makers. The market makers can fix in large sell orders, making the trend appear bearish in the meantime or a large buy order making the market bullish. Traders who don't understand this concept may push all in, only to be disappointed when the trend reverses. Furthermore, having a strong understanding of some of the factors stated above will help you reduce your risks significantly.

I'd like to thank Professor @reddileep for bringing up this fascinating topic; I'm glad to learn something new from him.