Questions

1a) Explain l and why it is a good cryptocurrency investment tool.

b) Explore CoinGecko and explain at least 5 unique features of the platform (Take a screenshot of the page).

2a) Give a brief explanation of Tradingview platform.

b) Explain the steps involved in adding indicators on Tradingview chart. You can add any indicator of your choice except moving average. (Screenshots required)

c) With relevant screenshots, illustrate how to modify the indicator you have added to your chart.

3a) In your own words, explain cryptocurrency Portfolio and Watchlist.

b) Explain the need for Portfolio management.

c) Select 5 cryptocurrency assets you wish to add to your Watchlist and explain your reason for selecting each of them. (Show screenshot of your Watchlist. It can be any platform).

1a.) CoinGecko

CoinGecko, being founded by Bobby Ong and TM Lee in 2014, is one of the world's largest cryptocurrency data collators which provides a lot of necessary information for cryptocurrency traders to digest and have a wonderful know-how on which currencies to invest in.

Why is it a good cryptocurrency investment tool?

CoinGecko is a good investment tool due to the fact that it gives traders information about cryptocurrency and also the quality of information it possesses. The type of information CoinGecko provides includes cryptocurrency and their rank based on trading volume, market cap, 24 hour price changes, etc. These are what helps a trader analyse the currency and pick a position on whether to buy, sell or remain indifferent.

1b.) CoinGecko Features

As mentioned in my answer to question 1, there are some good quality features that CoinGecko possesses that are of good use to the trader. Some of these features are unique and they include:

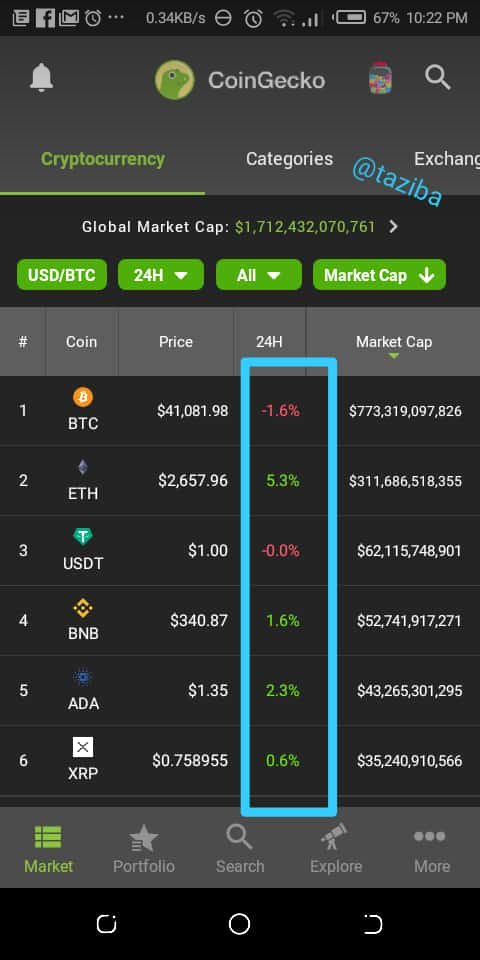

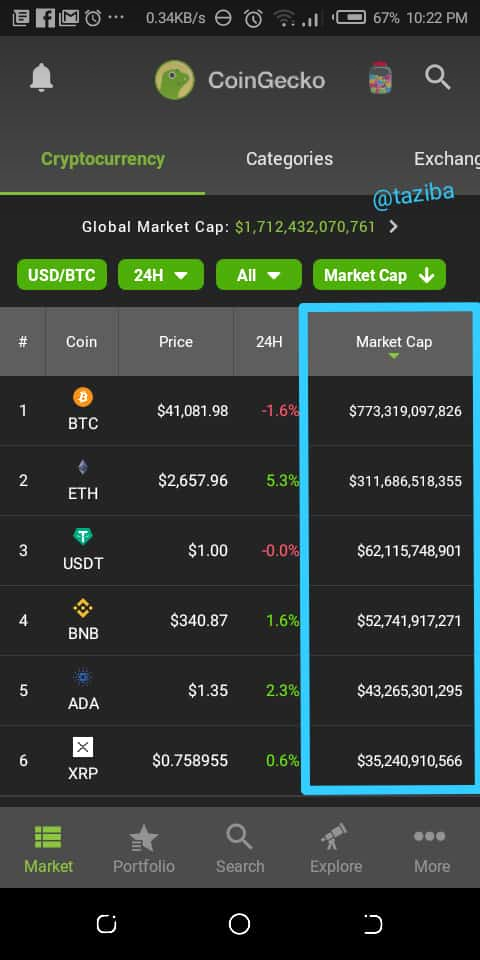

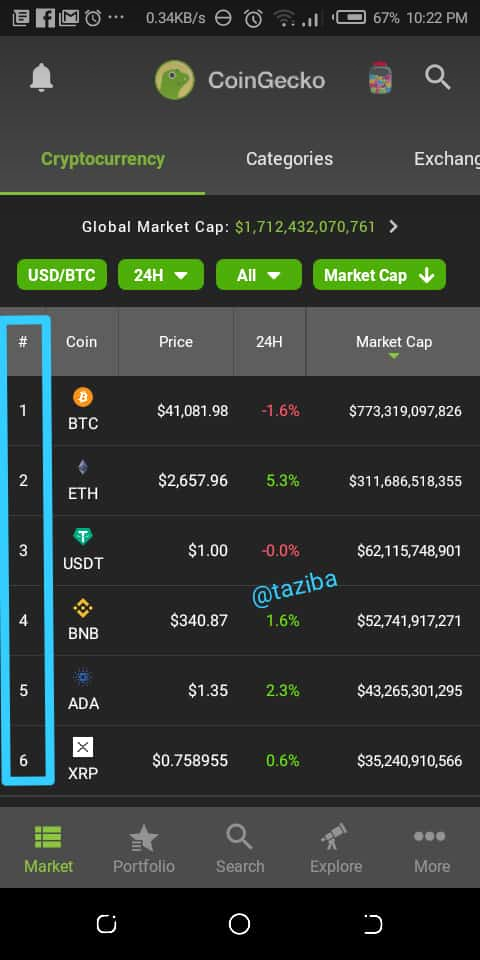

- The 24hr price change indication. CoinGecko is designed to give live prices of the digital coins it watches over and this simply means that any change in price from the closing price of the previous day is being recorded and shown as a moving percentage.

- Market cap: Another amazing piece of information CoinGecko portrays I the matket capitalisation of cryptocurrency. Market cap is simply the stock price of a commodity multiplied by the number of holders of the commodity. This helps an investor know how valued a cryptocurrency is in the market.

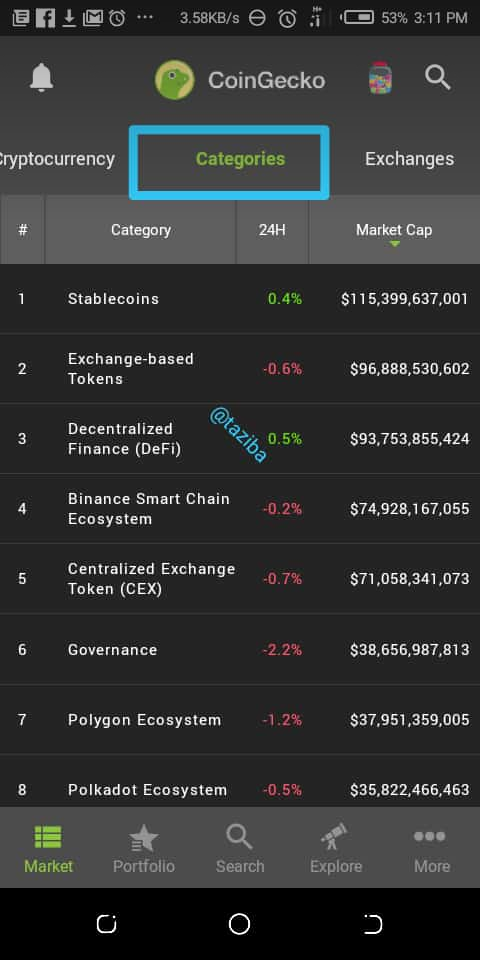

- Categories of cryptocurrency: As we all know, some cryptocurrency are more established than others and also not all are the sane thing. CoinGecko acknowledges this fact and has done well to accurately list cryptocurrency according to their types and classes.

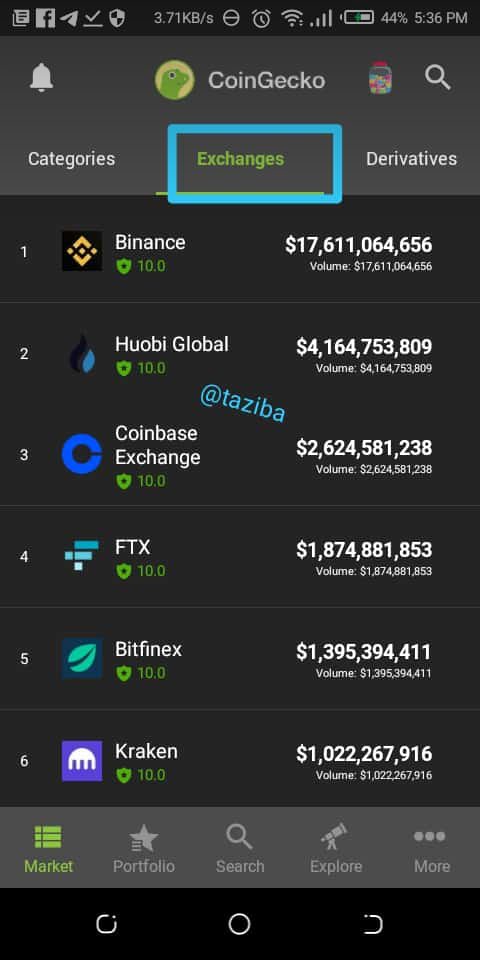

- Exchanges: Another amazing feature of CoinGecko is that it ranks crypto exchanges and gives investors an overview of them and would help them decide which to work with.

- Crypto rank: Based on the other features, CoinGecko gives each coin listed a rank on the market.

2a.) Tradingview

Tradingview is an online charting platform which provides traders and investors access to state of the art technical analysis tools that can be used to carefully analyse market prices and seek opportunity in the markets. It also supports social networking which would help traders from around the world interact with each other and share their different ideologies on different charts.

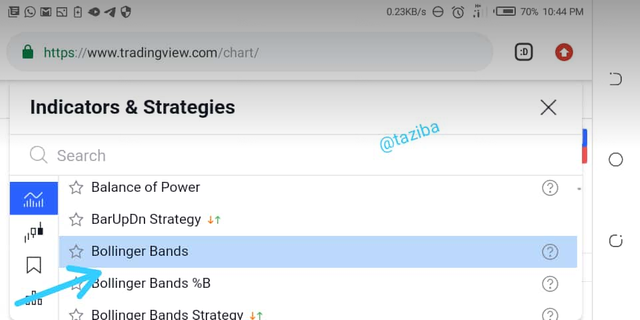

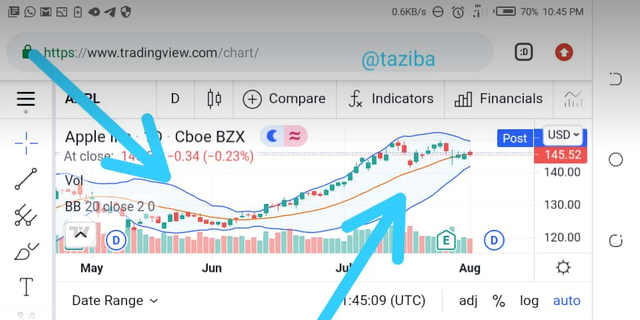

2b.) Adding an Indicator to the Tradingview chart.

The indicator being added is that of the Bollinger bands and I will be working on my android phone;

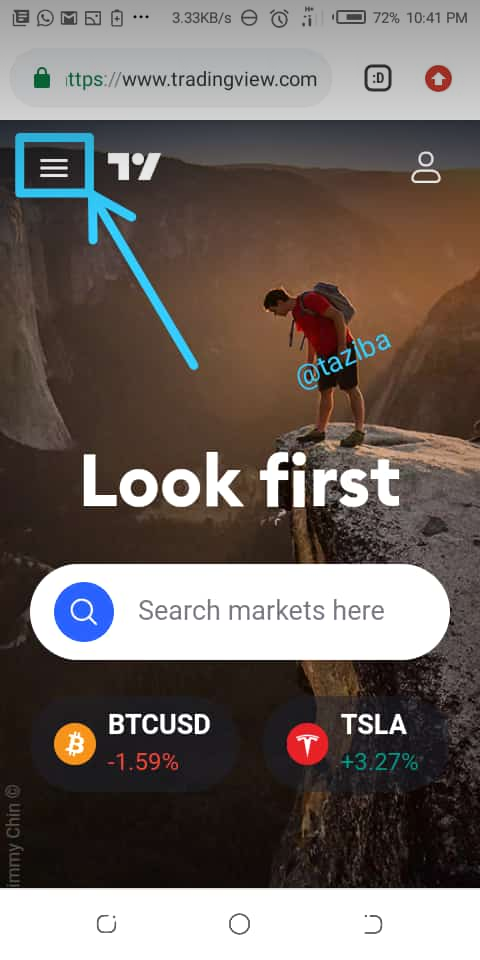

- Go to www.tradingview.com

- On the landing page, go to the top left corner and click on the menu button

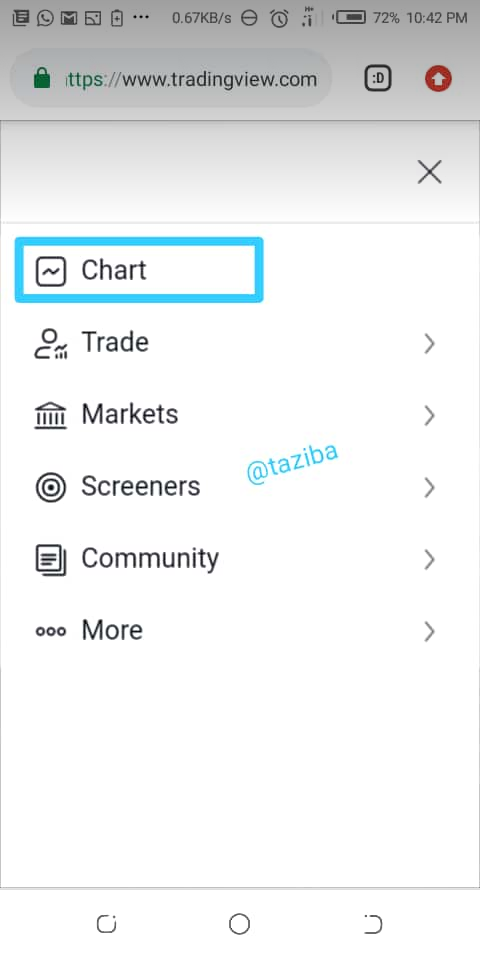

- click on charts

- After this, you would be taken to a default chart

- to insert your indicator, click on the fx indicator icon on the menu bar at the top of your screen.

- Scroll down to find Bollinger bands then click to apply. An alternative to scrolling down is searching for it on the search bar provided.

- Go back to the chart and you will observe that your preferred indicator has been implemented.

3a.) Cryptocurrency Portfolio and Watchlists.

Portfolio

A Crypto portfolio is simply a software that is used to keep record of an investor's crypto inventory, track their prices and in most times cases provide analysis tools for the investor in order for him to use and determine whether to keep or sell his/her asset. Portfolios are often mistakened with wallets by investors and rightly so. The major difference between the two is the extra qualities in which a portfolio possesses.

Watchlist

A crypto watchlist can simply be referred to as an inventory where traders or investors highlight some certain cryptocurrencies for the purpose of monitoring their market performance for potential investment. Watchlists give investors the idea of how the prices of cryptos they want to invest in behave and this helps them in risk management.

3b.) The need for proper Portfolio management.

What is Portfolio management?

Portfolio management is simply the organisation and structuring of an inventory for the maximization of ROI.

Portfolios can be of so much help to investors and consequently, need to be effectively managed by them. Portfolios are made to help investors make good decisions when choosing to invest in as they a record of accurate price changes and analysis tools which a trader uses to make those edgy decisions. When portfolios are mismanaged, the investor looses focus and tends to make horrible decisions in what to invest in and this would lead to loss of money.

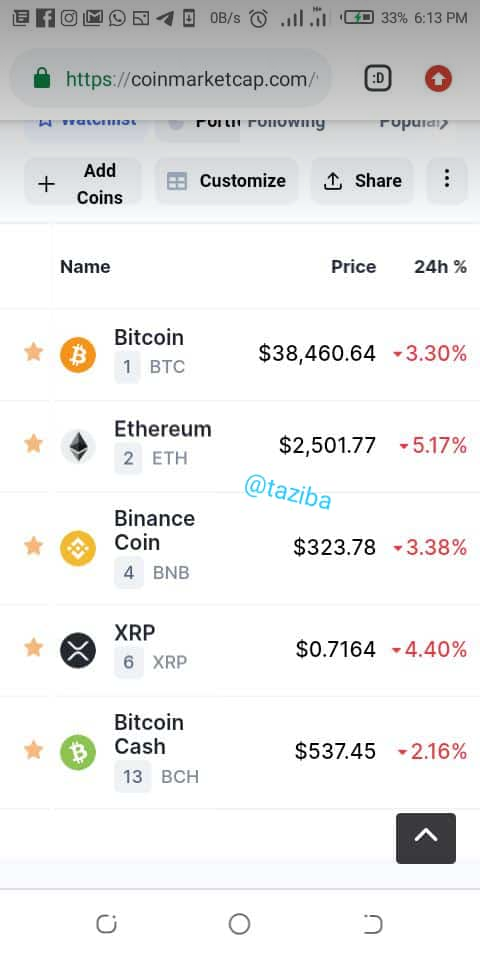

3c.) Assets I wish to add to my Watchlist

The 5 cryptocurrencies added to my Watchlist are:

Bitcoin

Ethereum

Bitcoin Cash

Binance coin

Ripple

Why I added them to my Watchlist

I added all these coins to my Watchlist for the same reason, their trade volume and market capitalisation. The market capitalisation of these currencies are very high and this indicates a high number of investors of the currencies. In these investors, there are whales and these whales have great effects on the prices of the currencies. And this is where trade volume comes in. These currencies on my Watchlist are being bought and sold in large amounts and this is enough to make them more valuable than some others as they are being traded by the whales.

Conclusion

Portfolios and watchlists are wonderful softwares that gives a crypto investor an insight and a view of the larger picture before he/she makes a purchase of any currency. That are helpful but in order to be used effectively, they must be managed properly. Wonderful lesson and really informative too, i hope you like my write up. Thank you.

CC: @reminiscence01

Hello @taziba, I’m glad you participated in the 6th Week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for completing this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit