Hello friends, my name is Onuh Kingsley Sunday I believe you all are fine? In this post, you will learn more about Binance Leverage tokon.

Introduction.

Leveraged tokens give you leveraged exposure to the price of a cryptocurrency without the risk of liquidation. This way, you can enjoy the enhanced gains that a leveraged product can give you while not having to worry about managing a leveraged position. This means you don’t have to manage collateral, maintain margin requirements, and of course, there’s virtually no risk of liquidation.

The initial design of leveraged tokens was introduced by derivatives exchange FTX. These tokens have been a highly debated topic, especially because they don’t perform as you would expect on a longer-term basis. The Binance Leveraged Tokens (BLVT) propose an alternative design.

What are Binance Leveraged Tokens (BLVT)?

Binance Leveraged Tokens (BLVTs) are tradable assets on the Binance spot market. Each BLVT represents a basket of open positions on the perpetual futures market. So a BLVT is essentially a tokenized version of leveraged futures positions.

The first available BLVTs are BTCUP and BTCDOWN. BTCUP aims to generate leveraged gains when the price of Bitcoin goes up, while BTCDOWN aims to generate leveraged gains when the price of Bitcoin goes down. These leveraged gains amount to between 1.25x and 4x. We’ll discuss why this is the case and how they target this leverage in the next chapter.

Currently, Binance Leveraged Tokens are only listed and tradable directly on Binance, and you won’t be able to withdraw them to your own wallet. Please note that Binance Leveraged Tokens aren’t issued on-chain.

How do Binance Leveraged Tokens work?

One of the main differences between BLVTs and other types of leveraged tokens is that BLVTs don’t try to maintain constant leverage. Instead, they aim for a target range of variable leverage. In the case of BTCUP and BTCDOWN, this is a range between 1.25x and 4x, which acts as a perpetual leverage target for the tokens. The idea is to maximize the potential gains when the price goes up and minimize the risks of liquidation when the price goes down.

This target leverage isn’t constant, and it isn’t publicly visible. Why is that? The main goal is to prevent front-running. If these tokens rebalance at predefined intervals, there could be ways for other traders to take advantage of this known event. Since the target leverage isn’t constant, the tokens aren’t forced to rebalance unless the market conditions deem it necessary. So hiding the target leverage mitigates these strategies because traders can't anticipate the rebalancing events.

Leveraged tokens are traded on the Binance spot market. In addition, they can also be redeemed for the value they represent. In this case, you’ll need to pay a redemption fee. In most cases, though, you’ll be better off exiting your position in the spot market rather than through the redemption process. Exiting through redemption will typically be more expensive than exiting on the spot market unless something like a black swan event occurs. This is why it’s almost always recommended to exit your BLVT position on the spot market.

You’ll see a term on the leveraged token’s page called Net Asset Value (NAV). This refers to the value of your leveraged tokens denominated in USDT. When you redeem your tokens, the USDT you’ll get will be determined by the NAV.

Why use Binance Leveraged Tokens?

One of the main sources of confusion around leveraged tokens is thanks to a concept called volatility drag. In simple terms, volatility drag is the detrimental effect that volatility has over your investment over time. The greater the volatility and larger the time horizon, the more significant the effect of volatility drag is on the performance of leveraged tokens.

Leveraged tokens generally perform as you’d expect when there’s a strong trend, and market momentum is high. However, the same isn’t true in a sideways market. Binance created the variable leverage as a solution to this problem. BLVTs only rebalance during times of extremely high volatility and aren’t forced to periodically rebalance otherwise. While this doesn’t mitigate the problem completely, it greatly reduces the long-term effects of volatility drag on the performance of BLVTs.

What are the fees of using Binance Leveraged Tokens (BLVT)?

When you’re trading BLVTs, you’ll need to keep in mind the fees you’re going to pay.

First, you’ll need to pay trading fees. Since BLVTs are traded on spot markets like any other coins like BTC, ETH, or BNB, the same trading fees apply. You can check your current fee tier here.

You’ll also need to pay management fees. Bear in mind, these tokens represent open positions on the futures market. You’re essentially buying a tokenized version of these positions when you’re buying a leveraged token. So, to keep these positions open, you’ll need to pay a management fee of 0.01% per day. This translates to an annualized rate of 3.5%.

In addition, there are two ways to exit your position if you’re holding a BLVT. One way is to sell the token on the spot market. Easy enough. However, you also have the choice to redeem them for the value they represent. When you redeem your BLVTs through this process, you’ll get the value of your tokens paid in USDT. In this case, you’d have to pay a redemption fee of 0.1% on the value of your tokens.

It’s worth noting, though, that under normal market conditions, you’ll be better off exiting your position in the spot market. This redemption mechanism is there to provide an additional way to exit your positions during extraordinary market conditions.

Something else to consider is the funding. As you know by now, BLVTs represent open futures positions. This means that funding fees apply to those positions. However, you won’t have to worry about them, as those aren’t paid between leveraged token holders, but between traders on the futures market. It’s still worth keeping in mind, though, because the funding fees paid to the futures account are reflected in the value of BLVTs.

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

Table of Contents

TradingEconomicsBinance

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

Home

Articles

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

Intermediate

Published May 25, 2020

Updated Mar 4, 2022

6m

Introduction

Leveraged tokens give you leveraged exposure to the price of a cryptocurrency without the risk of liquidation. This way, you can enjoy the enhanced gains that a leveraged product can give you while not having to worry about managing a leveraged position. This means you don’t have to manage collateral, maintain margin requirements, and of course, there’s virtually no risk of liquidation.

The initial design of leveraged tokens was introduced by derivatives exchange FTX. These tokens have been a highly debated topic, especially because they don’t perform as you would expect on a longer-term basis. The Binance Leveraged Tokens (BLVT) propose an alternative design.

What are Binance Leveraged Tokens (BLVT)?

Binance Leveraged Tokens (BLVTs) are tradable assets on the Binance spot market. Each BLVT represents a basket of open positions on the perpetual futures market. So a BLVT is essentially a tokenized version of leveraged futures positions.

The first available BLVTs are BTCUP and BTCDOWN. BTCUP aims to generate leveraged gains when the price of Bitcoin goes up, while BTCDOWN aims to generate leveraged gains when the price of Bitcoin goes down. These leveraged gains amount to between 1.25x and 4x. We’ll discuss why this is the case and how they target this leverage in the next chapter.

Currently, Binance Leveraged Tokens are only listed and tradable directly on Binance, and you won’t be able to withdraw them to your own wallet. Please note that Binance Leveraged Tokens aren’t issued on-chain.

How do Binance Leveraged Tokens work?

One of the main differences between BLVTs and other types of leveraged tokens is that BLVTs don’t try to maintain constant leverage. Instead, they aim for a target range of variable leverage. In the case of BTCUP and BTCDOWN, this is a range between 1.25x and 4x, which acts as a perpetual leverage target for the tokens. The idea is to maximize the potential gains when the price goes up and minimize the risks of liquidation when the price goes down.

This target leverage isn’t constant, and it isn’t publicly visible. Why is that? The main goal is to prevent front-running. If these tokens rebalance at predefined intervals, there could be ways for other traders to take advantage of this known event. Since the target leverage isn’t constant, the tokens aren’t forced to rebalance unless the market conditions deem it necessary. So hiding the target leverage mitigates these strategies because traders can't anticipate the rebalancing events.

Leveraged tokens are traded on the Binance spot market. In addition, they can also be redeemed for the value they represent. In this case, you’ll need to pay a redemption fee. In most cases, though, you’ll be better off exiting your position in the spot market rather than through the redemption process. Exiting through redemption will typically be more expensive than exiting on the spot market unless something like a black swan event occurs. This is why it’s almost always recommended to exit your BLVT position on the spot market.

You’ll see a term on the leveraged token’s page called Net Asset Value (NAV). This refers to the value of your leveraged tokens denominated in USDT. When you redeem your tokens, the USDT you’ll get will be determined by the NAV.

Why use Binance Leveraged Tokens?

One of the main sources of confusion around leveraged tokens is thanks to a concept called volatility drag. In simple terms, volatility drag is the detrimental effect that volatility has over your investment over time. The greater the volatility and larger the time horizon, the more significant the effect of volatility drag is on the performance of leveraged tokens.

Leveraged tokens generally perform as you’d expect when there’s a strong trend, and market momentum is high. However, the same isn’t true in a sideways market. Binance created the variable leverage as a solution to this problem. BLVTs only rebalance during times of extremely high volatility and aren’t forced to periodically rebalance otherwise. While this doesn’t mitigate the problem completely, it greatly reduces the long-term effects of volatility drag on the performance of BLVTs.

What are the fees of using Binance Leveraged Tokens (BLVT)?

When you’re trading BLVTs, you’ll need to keep in mind the fees you’re going to pay.

First, you’ll need to pay trading fees. Since BLVTs are traded on spot markets like any other coins like BTC, ETH, or BNB, the same trading fees apply. You can check your current fee tier here.

You’ll also need to pay management fees. Bear in mind, these tokens represent open positions on the futures market. You’re essentially buying a tokenized version of these positions when you’re buying a leveraged token. So, to keep these positions open, you’ll need to pay a management fee of 0.01% per day. This translates to an annualized rate of 3.5%.

In addition, there are two ways to exit your position if you’re holding a BLVT. One way is to sell the token on the spot market. Easy enough. However, you also have the choice to redeem them for the value they represent. When you redeem your BLVTs through this process, you’ll get the value of your tokens paid in USDT. In this case, you’d have to pay a redemption fee of 0.1% on the value of your tokens.

It’s worth noting, though, that under normal market conditions, you’ll be better off exiting your position in the spot market. This redemption mechanism is there to provide an additional way to exit your positions during extraordinary market conditions.

Something else to consider is the funding. As you know by now, BLVTs represent open futures positions. This means that funding fees apply to those positions. However, you won’t have to worry about them, as those aren’t paid between leveraged token holders, but between traders on the futures market. It’s still worth keeping in mind, though, because the funding fees paid to the futures account are reflected in the value of BLVTs.

Find out how to buy BTC without being exposed to liquidation risk at Binance.

How to buy and redeem Binance Leveraged Tokens.

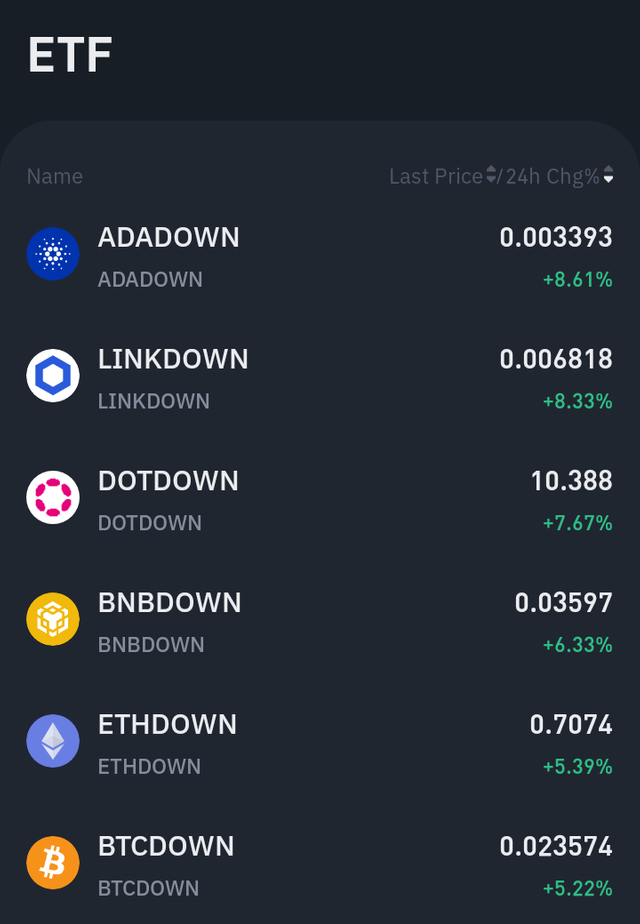

BLVTs are listed on the Binance spot market like other coins and tokens. However, you’ll find them in a different place: under the ETF tab in the Advanced trading interface. This is to avoid confusion and help you differentiate these tokens from other types of tradable assets.

You can also find the Leveraged Tokens page on the Binance home page top bar. The following steps describe how to buy Binance Leveraged Tokens (BLVTs).

Log in to Binance.

Hover over Derivatives on the top bar and select Leveraged Tokens.

Select the trading pair of the BLVT you’d like to trade.

This will take you to the landing page of the BLVT.

Click on Buy, and that’ll take you to the Advanced trading interface.

Before you start, read the Risk Disclaimer. If you are over 18 years old and agree with the statement, check the box and click Confirm to continue.

At this point, you should be able to trade BLVTs similarly to how you trade other coins and tokens.

For example, here’s the page for BTCUP. If you’re already holding BLVTs and wish to redeem them, you can do so on this page (click the Redeem button). You can also check your redemption history from here.

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

Table of Contents

TradingEconomicsBinance

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

Home

Articles

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

A Beginner's Guide to Binance Leveraged Tokens (BLVT)

Intermediate

Published May 25, 2020

Updated Mar 4, 2022

6m

Introduction

Leveraged tokens give you leveraged exposure to the price of a cryptocurrency without the risk of liquidation. This way, you can enjoy the enhanced gains that a leveraged product can give you while not having to worry about managing a leveraged position. This means you don’t have to manage collateral, maintain margin requirements, and of course, there’s virtually no risk of liquidation.

The initial design of leveraged tokens was introduced by derivatives exchange FTX. These tokens have been a highly debated topic, especially because they don’t perform as you would expect on a longer-term basis. The Binance Leveraged Tokens (BLVT) propose an alternative design.

What are Binance Leveraged Tokens (BLVT)?

Binance Leveraged Tokens (BLVTs) are tradable assets on the Binance spot market. Each BLVT represents a basket of open positions on the perpetual futures market. So a BLVT is essentially a tokenized version of leveraged futures positions.

The first available BLVTs are BTCUP and BTCDOWN. BTCUP aims to generate leveraged gains when the price of Bitcoin goes up, while BTCDOWN aims to generate leveraged gains when the price of Bitcoin goes down. These leveraged gains amount to between 1.25x and 4x. We’ll discuss why this is the case and how they target this leverage in the next chapter.

Currently, Binance Leveraged Tokens are only listed and tradable directly on Binance, and you won’t be able to withdraw them to your own wallet. Please note that Binance Leveraged Tokens aren’t issued on-chain.

How do Binance Leveraged Tokens work?

One of the main differences between BLVTs and other types of leveraged tokens is that BLVTs don’t try to maintain constant leverage. Instead, they aim for a target range of variable leverage. In the case of BTCUP and BTCDOWN, this is a range between 1.25x and 4x, which acts as a perpetual leverage target for the tokens. The idea is to maximize the potential gains when the price goes up and minimize the risks of liquidation when the price goes down.

This target leverage isn’t constant, and it isn’t publicly visible. Why is that? The main goal is to prevent front-running. If these tokens rebalance at predefined intervals, there could be ways for other traders to take advantage of this known event. Since the target leverage isn’t constant, the tokens aren’t forced to rebalance unless the market conditions deem it necessary. So hiding the target leverage mitigates these strategies because traders can't anticipate the rebalancing events.

Leveraged tokens are traded on the Binance spot market. In addition, they can also be redeemed for the value they represent. In this case, you’ll need to pay a redemption fee. In most cases, though, you’ll be better off exiting your position in the spot market rather than through the redemption process. Exiting through redemption will typically be more expensive than exiting on the spot market unless something like a black swan event occurs. This is why it’s almost always recommended to exit your BLVT position on the spot market.

You’ll see a term on the leveraged token’s page called Net Asset Value (NAV). This refers to the value of your leveraged tokens denominated in USDT. When you redeem your tokens, the USDT you’ll get will be determined by the NAV.

Why use Binance Leveraged Tokens?

One of the main sources of confusion around leveraged tokens is thanks to a concept called volatility drag. In simple terms, volatility drag is the detrimental effect that volatility has over your investment over time. The greater the volatility and larger the time horizon, the more significant the effect of volatility drag is on the performance of leveraged tokens.

Leveraged tokens generally perform as you’d expect when there’s a strong trend, and market momentum is high. However, the same isn’t true in a sideways market. Binance created the variable leverage as a solution to this problem. BLVTs only rebalance during times of extremely high volatility and aren’t forced to periodically rebalance otherwise. While this doesn’t mitigate the problem completely, it greatly reduces the long-term effects of volatility drag on the performance of BLVTs.

What are the fees of using Binance Leveraged Tokens (BLVT)?

When you’re trading BLVTs, you’ll need to keep in mind the fees you’re going to pay.

First, you’ll need to pay trading fees. Since BLVTs are traded on spot markets like any other coins like BTC, ETH, or BNB, the same trading fees apply. You can check your current fee tier here.

You’ll also need to pay management fees. Bear in mind, these tokens represent open positions on the futures market. You’re essentially buying a tokenized version of these positions when you’re buying a leveraged token. So, to keep these positions open, you’ll need to pay a management fee of 0.01% per day. This translates to an annualized rate of 3.5%.

In addition, there are two ways to exit your position if you’re holding a BLVT. One way is to sell the token on the spot market. Easy enough. However, you also have the choice to redeem them for the value they represent. When you redeem your BLVTs through this process, you’ll get the value of your tokens paid in USDT. In this case, you’d have to pay a redemption fee of 0.1% on the value of your tokens.

It’s worth noting, though, that under normal market conditions, you’ll be better off exiting your position in the spot market. This redemption mechanism is there to provide an additional way to exit your positions during extraordinary market conditions.

Something else to consider is the funding. As you know by now, BLVTs represent open futures positions. This means that funding fees apply to those positions. However, you won’t have to worry about them, as those aren’t paid between leveraged token holders, but between traders on the futures market. It’s still worth keeping in mind, though, because the funding fees paid to the futures account are reflected in the value of BLVTs.

Find out how to buy BTC without being exposed to liquidation risk at Binance.

How to buy and redeem Binance Leveraged Tokens

BLVTs are listed on the Binance spot market like other coins and tokens. However, you’ll find them in a different place: under the ETF tab in the Advanced trading interface. This is to avoid confusion and help you differentiate these tokens from other types of tradable assets.

ETF pairs on Binance

You can also find the Leveraged Tokens page on the Binance home page top bar. The following steps describe how to buy Binance Leveraged Tokens (BLVTs).

Log in to Binance.

Hover over Derivatives on the top bar and select Leveraged Tokens.

Select the trading pair of the BLVT you’d like to trade.

This will take you to the landing page of the BLVT.

Click on Buy, and that’ll take you to the Advanced trading interface.

Before you start, read the Risk Disclaimer. If you are over 18 years old and agree with the statement, check the box and click Confirm to continue.

At this point, you should be able to trade BLVTs similarly to how you trade other coins and tokens.

For example, here’s the page for BTCUP. If you’re already holding BLVTs and wish to redeem them, you can do so on this page (click the Redeem button). You can also check your redemption history from here.

Closing thoughts.

BLVTs give you leveraged exposure to the price of a cryptocurrency without the hassles of managing a leveraged position.

Thanks to the variable target leverage, BLVTs should perform more consistently over the long-term. While holding BLVTs isn’t equivalent to holding a leveraged position, BLVTs can be used to extend your trading toolkit and optimize your trading strategy.

GOOD ARTICLE BROTHER KEEP CONTINUE ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post was upvoted and reshared on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit