---Bitcoin fear and greed index falls to lowest since January

According to CFGI.io, the Bitcoin Fear and Greed index is currently sitting at 19% (Extreme Fear) the lowest number since January 25 when Bitcoin's price was trading below $40k.

The index for Ethereum and Solana is also at a low 20% (Fear). Coinmarketcap's similar index for the whole market is now at 51 (Neutral) which also the lowest point in 3 months.

According to CFGI.io, the Bitcoin Fear and Greed index is currently sitting at 19% (Extreme Fear) the lowest number since January 25 when Bitcoin's price was trading below $40k.

Bitcoin fear and greed index

The index for Ethereum and Solana is also at a low 20% (Fear). Coinmarketcap's similar index for the whole market is now at 51 (Neutral) which also the lowest point in 3 months.

Bitcoin extended its decline falling to $56,550 briefly before climbing back above 57K the last hour.

US stocks closed their worst monthly performance in seven months after data showed a slow in growth and sticky inflation. The Nasdaq declined 2% on Tuesday and closed the month 4.2% lower.

Early futures trading for US stocks show additional declines as markets are preparing for the FED interest rate announcement and speech later during the day.

Index

Change

Bitcoin

-5.48%

S&P 500 futures

-0.43%

Nasdaq futures

-0.77%

S&P 500 ends worst month since September while Bitcoin drops briefly below 57k

Binance former CEO Changpeng Zhao is sentenced to 4 months in prison

The US government sought a sentence of three years for Binance founder Changpeng "CZ" Zhao for violating US banking laws to which he pleaded guilty in November 2023.

Judge Richard Jones of the U.S District Court for the Western District of Washington said he did not agree with a sentencing of three years and said Zhao was never informed of illegal activity, according to the courtroom reporting from CoinDesk.

CZ was ordered to spend 4 months in prison for failures that allowed cybercriminals and terrorist groups to freely trade on the world’s largest cryptocurrency exchange.

Bitcoin falls below 61k monthly support ahead of FED speech

Bitcoin is currently trading below its monthly support level of $61,160 as selling pressure is building up from traders. The drop started during European trading hours when Hong Kong's newly formed ETF numbers were revealed at just $11 million compared to $100 million expected.

The decline extended on US market open after a consumer confidence index produced its weakest reading in almost two years, while employment cost index data showed a 1.2% QoQ rise, up from 0.9% at the end of last year.

The S&P 500 was off 0.92% and the tech heavy Nasdaq Composite down 1,14% by mid-afternoon. Both are down 3.4% this month.

Microstrategy purchased $7.8 million worth of BTC in April

Michael Saylor's firm announced on Monday its Bitcoin holdings revealing an additional purchase of 122 BTC in April. This brings their total holdings to 214,400 bitcoins valued at approximately $7.50 billion.

According to the quarterly report Microstrategy's average price is $35,180 per bitcoin. The Block reports that the firm likely purchased 32 BTC after March 19 when the last number was disclosed.

Entity

Holdings

GBTC

297,120

BlackRock IBIT

274,460

Microstrategy

214,400

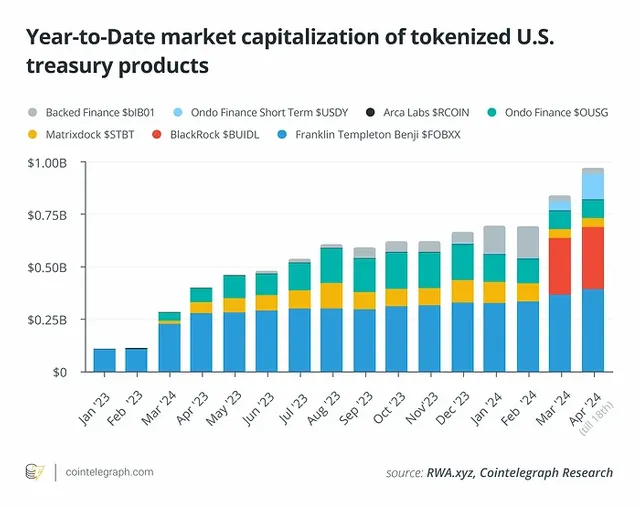

BlackRock's tokenised fund BUIDL becomes No1 overthrowing Franklin Templeton

BlackRock's BUIDL fund, has captured almost 30% of the $1.3 billion tokenised Treasury market in just six weeks.

The fund is backed by US Treasury bills, repo agreements and cash on the Ethereum network. After seeing $70 million inflows last week, BlackRock's fund became the largest with $375 million in AUM.

The increase was largely thanks to Ondo Finance who brought $50 million of inflows to BlackRock's token by leveraging it as reserve asset.

Hong Kong’s crypto ETF begin trading

The Bitcoin and Ethereum ETFs started trading in Hong Kong, as the city pushes ahead with plans to become a virtual assets trading hub despite strict controls in mainland China.

The three asset managers — Bosera, Harvest Global Investment and ChinaAMC — each launched two Bitcoin ETFs and two Eth ETFs, making a total of six funds.

The Bitcoin ETFs each gained about 3% on their debut, while the Ethereum ETFs gained between 0.4% and 1% in early trading.

Solo Bitcoin miner manages to solve block and gets $218k worth in rewards

CKpool developer Con Kolivas reported on X.com that a solo miner managed to solve Bitcoin's 841,286th block and got 3.433 BTC in rewards (approximately $218,544).

A Bitcoin block is solved every 10 minutes and this event has only occurred 282 times in the network's 10 year history. Your chance of solving a block as a solo miner is roughly 0.02%.

EigenLayer set to release native token in 10 days

The restaking protocol announced the launch of its native token EIGEN on May 10th. The token will be released through the independent non-profit Eigen Foundation and have a total supply of 1.67 billion.

The protocol plans to allocate 15% of the token supply to those who staked using the platform. These tokens will be released gradually through multiple seasons. The first season will hand out 5% of total supply.

A whitepaper was also released today describing the structure of the EIGEN token and how it will fit within the EigenLayer ecosystem.

Allocation

Group

45%

Community

29.5%

Investors

25.5%

Early Contributors

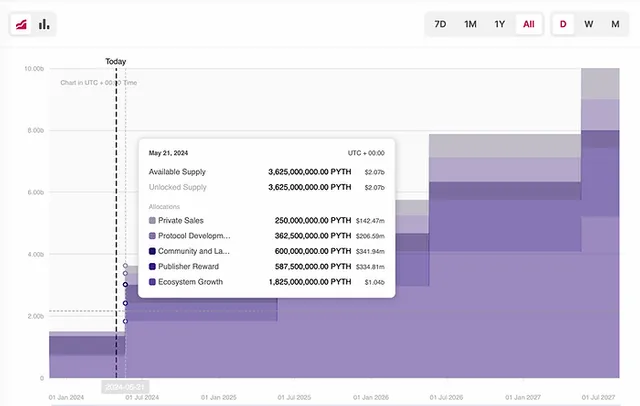

Pyth network first token unlock coming up in 3 weeks

Pyth network's upcoming token unlock on May 20 is the first of 4 scheduled unlocks ending in 2027. The network is set to release 15% of total supply or 2.13 billion tokens.

600 million tokens will be allocated to community rewards through staking and the various DeFi platforms that the network supports. The Pyth token launched on November 20, 2023 and is since up 99% in price.

Markets brief, the week ahead

Tuesday: EU reports GDP growth numbers and inflation rate for April. US Consumers Board reports Consumer Confidence measurements. Paypal, McDonalds and Coca Cola report earnings before market open. Amazon, AMD, Starbucks and Pinterest report earnings after the close.

Wednesday: US Federal Reserve announces interest rate policy decision followed by Chair Jerome Powell's press conference. FED rates expected to remain unchanged at 5.5%. ISM reports data on manufacturing PMI index expected at 50.1.

Thursday: US reports initial jobless claims expected at 212k compared to previous 207k. Apple and Coinbase report earnings after market close.

Friday: US reports Non Farm payrolls expected at 243k and unemployment rate expected to remain unchanged at 3.8%. ISM reports services PMI index expected at 52.

Inflation rises in Spain as food and energy prices tick up

Consumer prices in Spain rose 3.4% YoY in April compared to 3.3% a month earlier. The Spanish statistics agency reported rising gas and food prices and lower prices on leisure and culture costs.

Core inflation (excluding energy & food) index actually slowed from 3.3% to 2.9% in April. The European Central bank is expected to cut rates in June but the latest data from Spain is testing investors' confidence on the matter.

Eurozone inflation numbers are coming out on Tuesday expected at 2.4%. Any overshoot could cause markets to doubt ECB's resolve on cutting rates.

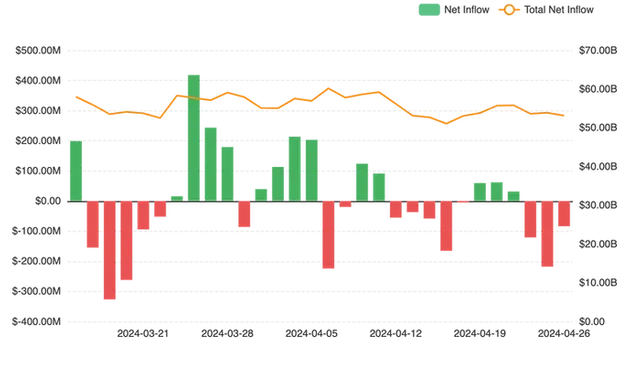

Bitcoin ETFs back to negative weekly flows after halving

Bitcoin ETF weekly flows closed at negative $328 million last week marking the 3rd worst performance since approval. Fund flows started the week positively at $93 million inflows but the last 3 trading sessions saw record outflows of $420 million.

Total weekly volume was the lowest since February indicating low levels of interest from investors post halving. GBTC continued seeing only outflows on its ETF which currently holds 298,000 bitcoins while BlackRock's IBIT is catching up fast with 274,000 bitcoins.

Bitcoin ends week flat as memecoins make a comeback

Bitcoin's closed the week following the halving event basically flat. Data on the health of the US economy came out mixed and resulted in one big sideways movement for Bitcoin.

BONK

Bonk

-23.1%

-10.9%

$ 0.00002

0.00000000

Meanwhile, Solana-based memecoin Bonk closed the week up 58%. The increase came after the approval from the Bonk DAO to burn 278 billion tokens.

PEPE

Pepe

-22.5%

-10.3%

$ 0.00001

0.00000000

Ethereum-based memecoin Pepe posted gains of 36% for the week, following the Coinbase announcement to list Pepe perpetual contracts. The move was seen a first step towards Coinbase making spot Pepe available for trading.