Cover Image Created using PosterMaker

Good day, everyone on Steemit and I welcome you to my blog. I'm very excited to be in the academy today to participate in the new contest with the topic "Decentralized Finance (DeFi)", contests in the academy have always been so unique and I will gladly participate in this educational one again. Go with me as I share with you on this topic.

Explain in your own words the DeFi world Why is it important? Let's talk about it.

The traditional financial system that we have known for ages or let me say the ones most of us met when we were born or the ones we have been using in the olden days have always been a centralized financial system. Conventional banks are some of the examples where customers of a financial organization are required to take permission from a central authority before their transactions can be processed.

Technology has evolved and there comes Decentralized Finance (DeFi) which is directly opposite to centralized finance. DeFi is a new financial technology that came into existence some years ago which enables users or investors to perform different financial activities on a platform without taking any permission from a central authority, we can say that it's designed with a peer-to-peer algorithm where anyone can decide on their own at any time.

Furthermore, all activities that are possible with centralized finance are also possible on DeFi, transactions like buying and selling (trading), exchange/swap, lending, and borrowing, adding liquidity, yield farming, and many others can easily be done on DeFi platforms. The use of DeFi doesn't require the KYC (Know Your Customer) that would be requested by a traditional bank before you can transact with them.

There are many things that make DeFi possible or let me call it some features and I will be listing some of them below:

- Decentralization.

- Distributed ledger for transaction recording.

- Smart Contracts Functionality.

- Automated Market Maker (AMM model).

- Consensus algorithm.

Importance of Decentralized Finance

DeFi Vs Centralized Finance. Advantages and disadvantages, let's talk about them

There is nothing that has advantages that don't have its disadvantages, though DeFi sounds very advantageous at the same time, it has some disadvantages, also centralized finance too. I will be writing about these things here.

Advantages of Decentralized Finance

Disadvantages of Decentralized Finance

Advantages of Centralized Finance

Disadvantages of Centralized Finance

Decentralized Finance Vs Centralized Finance

| DeFi | CeFi |

|---|---|

| There is no central authority | Existence of central authority |

| No third party in transactions | There are third parties in transactions |

| Ownership by the user | CeFi authority holds the ownership of accounts |

| No Paperwork required | Documents are required to verify a customer |

| No limit to services | There may be limits according to users' verification level |

Have you used decentralized Exchange? Tell your experience and explain a Decentralized Exchange. Show screenshots

Yes, I have used decentralized exchanges many times through my decentralized applications on my web3.0 wallets (Trust wallet, Tronlink, Metamask, and many others). Now, I will be explaining my knowledge about decentralized exchange also known as DEX.

Decentralized exchange is the type of cryptocurrency exchange that is completely decentralized for crypto transactions in the absence of intermediaries. Unlike the centralized exchange, DEX doesn't have a visible order book it only uses the AMM model to quote prices for cryptocurrency pairs at a point in time to complete a transaction.

Furthermore, the AMM model mentioned above uses the liquidity in the pools to quote the price of a cryptocurrency, and with this, liquidity providers earn money from transaction fees on the DEX. In other words, others are matched by smart contracts on DEX without having the presence of third parties.

For someone to use a DEX, you have to connect a compatible wallet to the platform and then proceed to perform transactions like an exchange, adding liquidity, staking, yield farming, and many others. Examples of decentralized exchanges are SunSwap, Sun.io, PancakeSwap, UniSwap, and many others. SunSwap is my favorite among the aforementioned decentralized exchanges.

My Experience with Decentralized Exchanges

SunSwap

SunSwap has been my favorite of all the DEX I have used so far, SunSwap was launched in the year 2020 and become the first DEX on the Tron blockchain which can be used to swap TRC20 tokens like TRX and others. SunSwap also allows one to add liquidity and others, this ensures that one earns passive income on their assets.

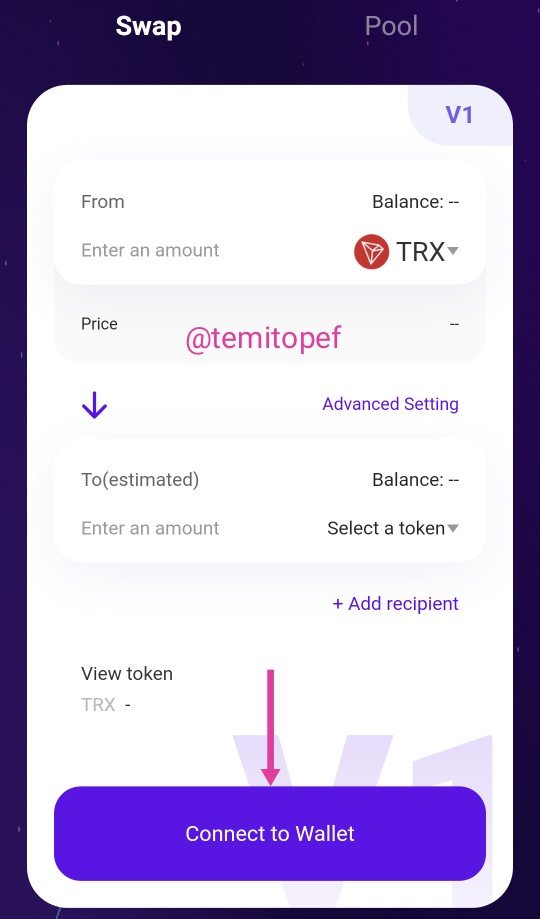

Furthermore, using SunSwap requires connecting a Tron-based wallet to the DEX and performing the transaction of choice. I always use my TronLink wallet to connect to SunSwap DEX whenever I want to swap TRC20 tokens or other transactions. SunSwap was known as JustSwap formerly before it changed its name. I will show you some of the features of SunSwap.

First of all, I will use the DApp on my Tronlink to visit SunSwap.

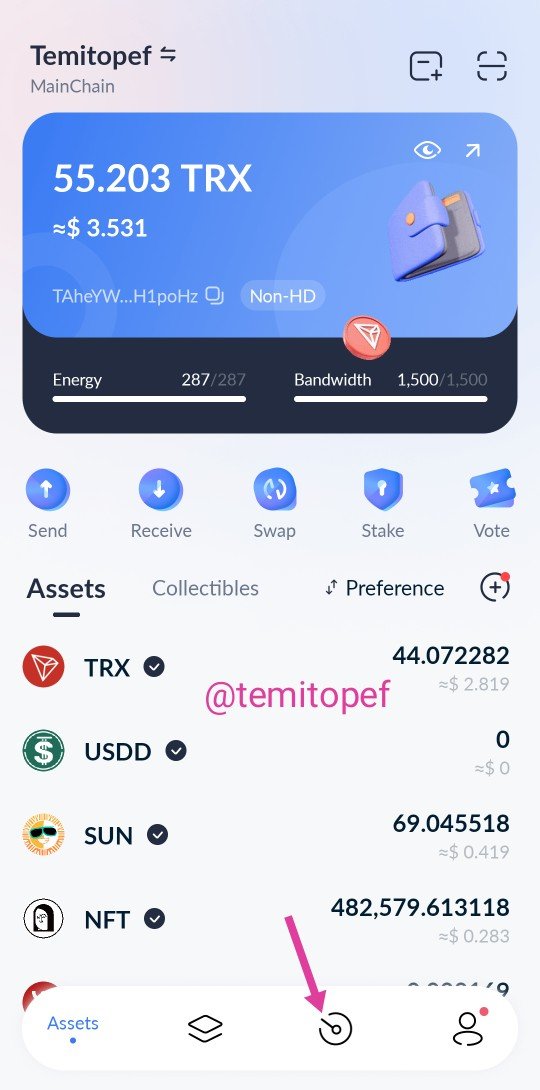

Screenshot from Tronlink wallet

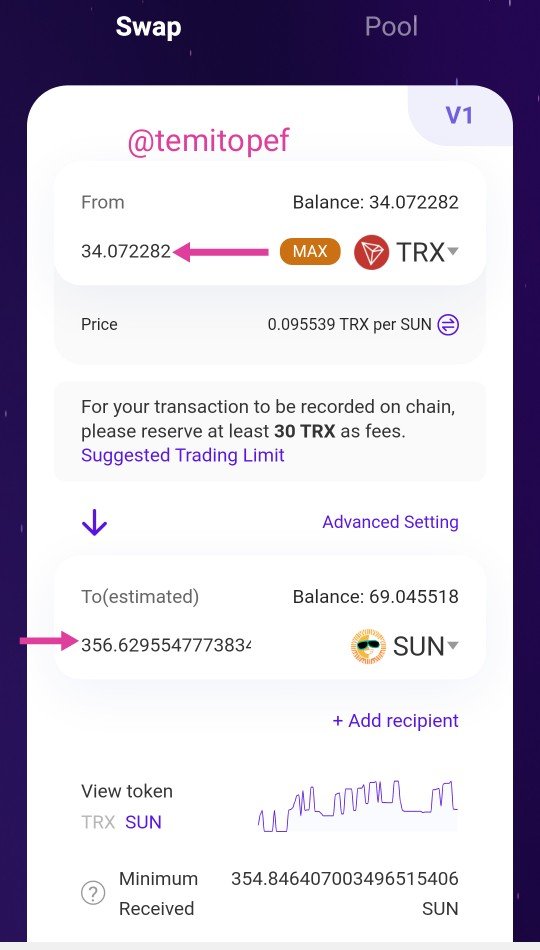

Now, I connected my wallet and I can choose the pairs of TRX I will be willing to swap. For example in this, I chose to swap 34 TRX to SUN (356).

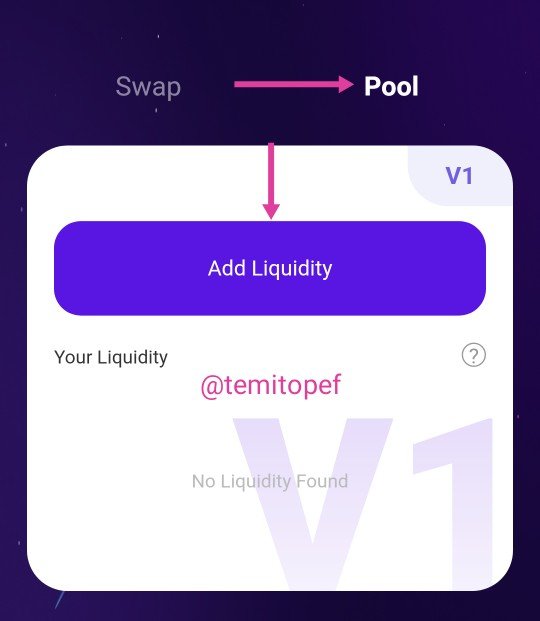

I moved to the pool where one can add liquidity on pairs one chose to.

Pool from SunSwap

My experience with decentralized exchanges has been great so far. I love DEXs.

Give us your opinion about the future of DeFi.

The old financial sector is shifting towards decentralization to make the space trustless, permissionless and transparent, and the only way to achieve this is through Decentralized finance. There are new projects every now and then that are built on top DeFi, this shows us that the future belongs to decentralized finance and more people will adopt it shortly.

Furthermore, as one of the early adopters of DeFi, I strongly believe in its future and I will be adopting more of its products in the crypto space because it provides us with so many ways to earn. The future of finance in DeFi, you can see that the popular exchange Binance has developed its own DEX, this is to show that they are following the trend and wants to retain their potential customers by giving them a DEX that keeps users in total control.

Conclusion

Decentralized finance is gradually replacing the old traditional financial system with the development of many projects recently. Many people have enjoyed how DeFi has given them total control over their financial properties without the need for the submission of any paperwork, and with high flexibility. I believe in the future of DeFi so much, thanks to the @crypto-academy for this beautiful contest topic.

Yes the transactions are almost instantenous owing to scalability of networks involved.

Yes in that sense it is easy to use however it needs technical knowledge.

Yeah scalability is an issue within Defi but if we compare scalability of defii with cefi than defi is far better.

Kindly enlighten about block chains in Cefi.

Good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for commenting on my post my friend. I believe you have asked me a question and I will answer it.

For example on Binance, you can trade cryptocurrencies that are built on top of different blockchain networks, Ethereum, Tron, Algorand, Cardano, Solana, Tezos, Stellar, and many others can be exchanged freely without limitations. This is what I called cross-chain trading of products, one can easily use any supported pair to get it done.

Many DeFi platforms are rigid and only support only some assets built on some blockchain networks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for enlightening me though your wise explanation .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And... your back in full force!!

A great post my friend. I love reading your crypto posts!

Good luck for the contest.

Ps: Thanks for the invite. Let's hope I get the time to make a post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for commenting on my post and I hope to see your entry soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your article has been supported with a 30% upvote by @fredquantum from Team 2 of the community curator program. We encourage you to keep producing quality content on Steem to enjoy more support from us and a likely spot in our weekly top 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for supporting my article, I will continue making quality post.

Thank you once again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

DeFi is the latest breakthrough and opposite CeFi, where DeFi is not controlled by third parties like CeFi. DeFi relates between buyers and sales. The cost of DeFi is cheaper than CeFi.

I also shared a post about DeFi, if you have time please see it and I am very happy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, The elimination of third parties is one of the outstanding features that make DeFi stand out when compared with CeFi. Thank you for reading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, that's right, DeFi and CeFi are different things. Both are financial systems, but the difference is that CeFi can still be controlled by certain institutions while DeFi is between buyers and sellers.

I also await your arrival in my publications friends.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have done a great job in explaining the decentralized finance with such a great knowledge and research work as well. Decentralized finance is the future of the financial world, no doubt.

Here you are very right that the transactions that are proceed through the decentralised finance are much more similar and efficient than those of the transactions that are carried out in centralised finance system.

Thanks a lot for sharing with us and wishing you a very good luck for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend I love how you have details out your work about DeFi. I thinking I also have experience about liquidity pool. Although, I lost some TRX the day I learned it. Thank you for sharing your post with us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good day friend

This is really true and for my analysis I believe it because transactions are made directly, instead of going through a center node.

The second reason is that dex are ran by smart Contact which artificial intelligence unlike cex which I ran by humans, we all know Codes would definitely be Faster than humans.

Thank you very much for sharing

wishing you success

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excelente trabajo, pienso que defi tiene un buen futuro en las finanzas.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit