Cover Image Created using Poster Maker

Hello, dear Steemians. I am very happy to be back in the contest for this week and this will be my first post in the challenge this week. The topic before me today is "My Cryptocurrency Portfolio" and I will be explaining my knowledge of it as asked by the crypto academy.

Explain in your own words what a cryptocurrency portfolio is

Our cryptocurrency assets are stored in wallets on centralized or decentralized exchanges some that we put there for holding purposes or trading purposes, you know just like our purses, the wallets hold our coins for us. The list of cryptocurrencies we hold in our wallets over a period makes up our portfolio.

Cryptocurrency portfolio refers to the collection of the cryptocurrency assets we have in our wallet. The cryptocurrency portfolio is built with the crypto assets we have purchased at a point in time after researching the project and we are confident of holding the product from it or the ones we have bought to trade quickly. So, everything we have available at a period makes up our cryptocurrency portfolio.

Furthermore, some cryptocurrency tools like the Coinmarketcap enable us to simulate a cryptocurrency portfolio where we can include some coins we have and monitor their price behavior. This type helps us to bring our assets from different exchanges into one place and monitor how their prices are moving in the market.

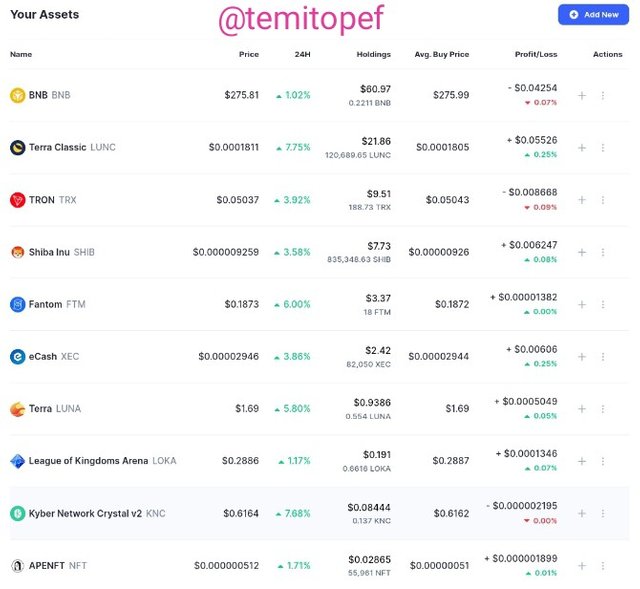

My Portfolio added on Coinmarketcap

That is my portfolio on Coinmarketcap, the list is made up of my cryptocurrency assets from different exchanges. I can now manage all in one place to see how they are behaving, my earnings or losses due to market fluctuations can also be seen there. Also, I can add more coins to it at any time.

Do you prefer a diversified portfolio or a concentrated portfolio? Explain each one

Diversified portfolio is the type of crypto portfolio where one's investment is spread across different types of tokens to ensure you touch different categories of assets in the crypto space. This also helps to manage risk should in case one is failing, the other ones will be there to avoid losing excessively.

Furthermore, our cryptocurrency portfolio can be diversified by the type of the coins, utility purpose, value preservation coin, stablecoin, the popularity of the coins, based on the project team, and many others. Every of these makes our investment safer because we have not entirely placed all the money on one or two tokens only.

Portfolio diversification image taken from Spring water

Also, with this method of portfolio development investors can buy a lot of coins and store them, an example is buying Bitcoin, Ethereum, Tron, Cardano, Trust Wallet Token, Solana, Steem, Aave, Uni, Cake, Fantom and many others. You can see that through this one would have bought coins from different projects including Defi coins and this method makes investment safer.

Concentrated Portfolio is the type of cryptocurrency portfolio where investors put their investments on just a few number of coins rather than diversifying it into many projects. This keeps investors to have easy access and monitor their investment but there is always more risk to that during some period.

Furthermore, a concentrated portfolio always involves trusting the few projects an investor has put money into to believe that their money is safe. The most popular risk of this type of portfolio is the risk of investment when the market of the coins stored enters the bearish phase, it puts the investor in loss without no other coins to compensate for the loss.

I prefer Diversified portfolio over concentrated portfolio because of some reasons that I will give below:

In your portfolio do you have any crypto assets in Hodl? Explain what is Holder in cryptocurrencies

Yes, I have cryptocurrencies that I am holding in my portfolio. Hodl means hold on for dear life which is a language used in the crypto space to explain an investment that is based on holding a crypto asset or many crypto assets for a long time with the trust that there will be more returns later in life. So, come rain come sun, investors hold onto the assets.

Hodl image taken from Flickr

Holders are the types of investors who research a project, believe that it will perform well in the future, and buy it. This type of cryptocurrency investors are long-term traders who does not keep the assets for the purpose of quick trading but leaves them in the wallet for a long period as they wait patiently for when the market of the coin will enter a very bullish phase or hold it to maintain the power of governance.

Furthermore, decentralized crypto wallets can be the best place to hold crypto assets because it's the safer type of wallet and for people that have money for hardware wallets, it's also a good place where it is not connected to the internet all times. We can still hold cryptocurrencies on exchange wallets too, such an investor just has to be disciplined and maintain the target for holding the coins.

The cryptocurrencies that I am holding are BNB, FTM, LUNC, Shiba Inu, and others in my exchange wallet without the aim to sell them any time soon. Also, I hold Steem in the Steemit wallet and I do more than holding with my Steem which I will explain later.

In your portfolio, you have some crypto assets in Staking. Explain what is Staking in cryptocurrencies

The crypto space allows us to make passive income on our cryptocurrencies even when we are sleeping and this ensures that our holdings don't stay idle, staking is one of the ways to earn a passive income in the crypto space. So, my answer to the question asked here is that I have a cryptocurrency that I stake at the moment.

Staking is defined as the process of locking up one's cryptocurrency for some time to gain benefits like governance power, farm tokens, earning passive income, and many others. Staking ensures that the crypto assets an investor was holding is still useful for her during that period to earn passive income without any stress.

Furthermore, to stake cryptocurrencies you must have been holding the cryptos, and what is just left is to stake and earn rewards. An example of how staking works can be seen on the Tron blockchain where investors can stake their TRX to gain Tron Power which can be used to participate in the governance of the Tron network by voting for super representatives. Through this investors earn passive income from the staked asset.

Also, staking on the Binance launchpool to farm new tokens is another way where investors' crypto holdings work for them. On Steemit, I hold Steem power and it gives me a passive reward because I get a proportion from the 15% distribution of new Steem minted per block to SP holders on the Steem blockchain and I can also vote for witnesses on the blockchain.

Which do you prefer Hodl or Staking?

Every day and every time, I will always prefer Staking over Hodl because it has a lot of benefits. Staking allows an investor to earn passive income for just staking and not to any other thing, its rewards keep coming even when one is sleeping and the value of the coin still adds up when its market is bullish.

Hodl on the other hand can only benefit one when the price of the token rises in the market and nothing else. Staking a token means one is holding a coin before, why not use one's holdings to generate more income that's why I choose to stake because its profitability is higher than holding. Also, staking gives one the power to participate in the governance of a blockchain.

Conclusion

Cryptocurrency portfolio refers to the collection of tokens we have stored for holding or trading purposes. It can be diversified when one chooses from a wide range of products to invest into which is good to reduce risk and it can also be a concentrated portfolio where one chooses from just a few products and this may limit profitability and it may also have a high risk of loss if the projects fail.

Furthermore, it is wiser to stake one's crypto holdings than just hold them, staking enables investors to earn from their idle tokens and this makes it more profitable than holding alone. I'm happy that I can participate in this again and thanks to the crypto academy for hosting a good topic like this.

You have explained in a very complete way the benefits of a diversified portfolio, which is the most appropriate for an investor. Thank you for sharing very important information, especially for those of us who have little experience in this world. Blessings

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, I prefer diversified portfolio because it lowers one's risk. Thank you sharing on my post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have many assets, of course you are wrong to be careful in maintaining these assets. Hopefully the value of your assets will increase. With qualified experience, I'm sure you will be successful in managing these assets. I also share posts about portfolios, if you have time please take a look and I'm very happy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing your view. I added each of the assets with good research.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been upvoted through steemcurator08. We support quality posts anywhere and with any tags.

Curated by: @chant

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for supporting my post @chant.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Waooh I can see how good your cryptocurrency portfolio is looking. Portfolio is great for every Investors which you have applied that knowledge. You have written very good post about your portfolio. Best of luck to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, our portfolio is all about the cryptos that we owned at any point in time. Thanks for sharing on my post friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have written well @temitopef on the said topic, you prefer staking according to your publication because it allows investors earn passive income more also, staking allows an individual to participate in the governance of the blockchain since the person is now a share holder. I wish you success in this contest my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are always bent on giving us the very best an I appreciate you for that. I really learnt alot from your article dear friend. When you buy crypto currency, you have the potential to earn even more through staking and interest on that investment. This process consumes very little energy and does not require any special expertise. It is called staking because it requires you to stake your coins as collateral, and will award you with coins if you are deemed reliable

Thanks for sharing friend, and goodluck in this contest. #steem-on.

I will appreciate if you equally engage on Mine

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit