It is common knowledge that "one who fails to plan, plans to fail". With this common knowledge, it is clear that planning is important in everything we do, not necessarily because it guarantees success, but at least, it reduces the chances of failure.

Prof. @Lenonmc21 have detailed much on Trading Plans, how to design one and the need to have one. Let's hop right in for the tasks at hand.

A "Trading Plan" is a decision tool or a guide developed by a trader to serve as a guide in carrying out trading operations. A trading plan must explain how a trader will discover and execute trades, including the conditions under which they will purchase and sell securities, the size of the position they will take, how they will manage positions while they are in them, what securities can be exchanged, and other trading laws. The trading plan helps a trader identify the following:

- When to trade

- Where to trade

- What to trade

- How much to trade

- When to enter/leave a trade

- How much profit and losses he should absorb within a specific period

- When not to trade, among others.

A trading plan must be unique to the trader, it is a "you thing", this means that a trader must design his/her trading plan based on their personal circumstances and their trading aims and goals. In fact, along with what has been mentioned in the Prof's lecture to be included in a trading plan, a trader may choose to include whatever he/she finds useful into a trading plan, there are no hard and fast rules. However, the most important thing with a trading plan is the ability to stick to one's plan.

The development of a trading plan is key to success in trading activities.

Everyone that trades someday must design a trading plan and stick to it. Here are the following reasons why a trading plan is essential:

1. Trading Plan Reduces Risks in Trading

Trading is naturally a risky process as trading assets are always volatile in nature. Delving into the financial/capital market with our natural emotions and mental state increases the amount of risk in the process. A trading plan helps a trader focus and put their thoughts right, as it defines trading expectations and paths. With this guide in place, one major risk to trading, being the "trading psychology" is tamed to an extent.

2. A Trading Plan Makes Trading Easier

It's a lot simpler to get things done when you know what has to be done, this is what a trading plan helps traders to do. Before making any trading decisions, a trading plan lays out all of the criteria that must be met. Regardless of distractions, they will always point you in the right route.

A trading plan forces traders to analyze charts in depth without the pressure of live markets. It enables traders to examine price fluctuations objectively. At the same time, it helps traders know exactly what needs to be done and when, and what to expect from your markets. Trading then becomes a waiting game in which you wait for the price to come to you rather than looking for trades and moving between periods randomly.

3. A Trading Plan Will Help a Trader Monitor His/Her Performance

The capacity to analyze your performance, reflect on results, and adjust your approach to trading is another significant advantage of having a trading plan. A trading plan can be seen as a guideline, it helps a trader identify loopholes during trading as well as troubleshoot faults.

4. Trading Plan Helps a Trader Make Good Decisions

Trading is all about making decisions. Bad judgments will cost you money, while good decisions will make you money. A trading plan guarantees that a trader will make objective judgments at all times, rather than subjective ones motivated by emotions, which can end up costing you a lot of money and putting your trades and cash in danger.

In the end, a trading plan will help a trader cultivate good discipline and avoid unnecessary mistakes.

From the lecture, four fundamental elements of a typical trading plan are:

- Risk management

- Capital management

- Trading psychology

- Planning and control of trading accounts

RISK MANAGEMENT

Risk management is the process of identifying, assessing, and controlling threats to one's trading assets. It is a term used in trading to describe the tactics used to keep losses under control and maintain a good risk/reward ratio.

Risk management involves a lot of activities to be carried out by the trader which includes having a clear understanding of the financial market, developing a risk-reward ratio, keeping emotions in check, etc.

CAPITAL MANAGEMENT

Capital management is simply how a trader intends to manage his/her finances when trading. The aim of capital management is to ensure efficient use of financial resources, i.e. using money in the most profitable way possible and reducing losses to the barest minimum.

Capital management is a method of reducing or raising the size of a position in order to reduce risk while maximizing profit from a trading account. An excellent approach focuses on both your account's risk and reward components. It allows a trader to leverage his/her account while maintaining a risk-adjusted balance. Money management may be employed while trading any market because it is only focused on account performance.

TRADING PSYCHOLOGY

Trading psychology has to do with the trader's mindset Trading psychology refers to the emotions and mental states that influence whether a trader succeeds or fails. The term "trading psychology" refers to the different components of a person's personality and conduct that impact their trading decisions. When it comes to determining trading performance, trading psychology might be just as essential as other factors like knowledge, experience, and competence.

Trading psychology is a crucial aspect when creating a trading strategy since traders are frequently required to think quickly and make quick judgments, which necessitates a certain level of mental presence. They must also be disciplined enough to stick to their trading techniques and recognize when to take profits and losses.

PLANNING AND CONTROL OF TRADING ACCOUNTS

Planning and control and trading accounts are the final steps in developing a trading plan. Here, we map out all plans to guide trading actions on a monthly basis. This structure and guide must be realistic and detailed on how the trading actions will be executed, how much losses can be accommodated, how much profit is expected, how much to be traded, and the trading capitalization.

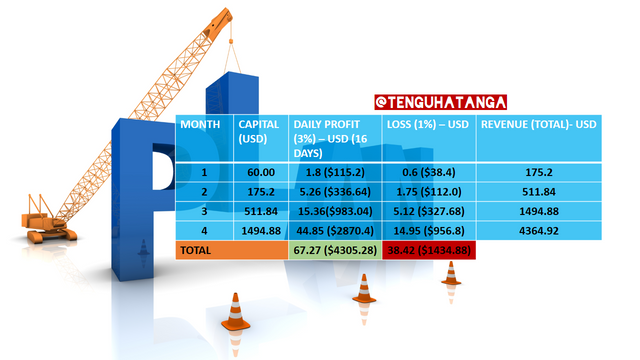

The above is my 4 month trading plan using 60USD as my starting capital. Here, I intend to trade four days weekly. While I will mostly trade with care, this is an amount (starting capital) I can afford to lose, so, it is a safe move.

- Risk management

To keep risks at bay, I intend to carry out detailed fundamental and technical analysis on trading assets before delving into any trade. This may involve (but not limited to) reading extensively about the assets, and applying technical indicators to effectively predict the market.

- Capital management

My approach to capital management as shown above is being realistic with profit plans and losses. I intend to trade at 3% profit to a 1% loss (3:1 margin).

- Trading psychology

To trade effectively, I will avoid trading in a poor psychological/mental state such as when angered, or too happy. Also, during stressful days, such as after a hectic work day, I will generally avoid trading.

I also intend to avoid the pressure to get too excited or too worried about my trade outcome so as not to fall into the trap of greed and/or revenge trading.